Who is entitled to Putin's payments?

Putin's payments are aimed at supporting low-income families. According to clause 10 of Article 4 of Law 418 of the Federal Law, when calculating benefits, the family includes parents or guardians, their children, as well as the spouses of the parents. But grandparents, aunts, uncles and other relatives are not included here.

The family also does not include relatives:

- those serving sentences in prison;

- deprived of parental rights;

- those under compulsory treatment;

- who are fully supported by the state (for example, in a boarding school).

If the family consists of only a single mother and child or a single father and child, then they are also entitled to payments.

An important point: the benefit is assigned only to the first and second child; families where the third, fourth and subsequent children were born do not fall under the terms of the program, but they can count on payment under special programs for large families.

Putin’s benefit is targeted, that is, it is paid according to the criterion of need only to those families whose income is below the subsistence level.

To understand whether a certain family is suitable for the payment program or not, you need to calculate the average per capita income of its members. We will tell you how to do this further.

However, the average per capita family income is not the only criterion for assigning payments; in addition to it, there are a number of important requirements:

- parents and child must be citizens of the Russian Federation;

- parents must permanently reside in the Russian Federation. Citizens of the Russian Federation living abroad are not entitled to benefits;

- the child must have been born or adopted after January 1, 2018.

By the way, guardians and adoptive parents are also entitled to payment.

As a standard, the benefit is issued to the mother, but if she died or was deprived of parental rights, the father can also receive the payment.

An important point: the benefit is provided only to those families in which the child is considered the first or second for the mother. If, for example, this is the mother’s third child, and for her husband only the first or second, no payments are due.

By the way, if twins were born at once, then Putin’s payments will be paid for both the first and the second child, only you will need to submit documents to different organizations: for the first to social security, for the second to the Pension Fund.

How are child benefits calculated in 2022?

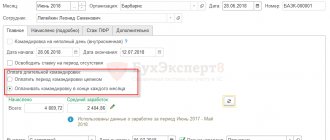

The amount of payments is now calculated taking into account the new billing period (2019 and 2022) and the size of the insurance base - for two years its size amounted to 1,777 million rubles. When calculating the amount of benefits, the minimum wage this year is also taken into account - 12,792 rubles. Since January, all regions that used the offset mechanism to calculate benefits now receive benefits from the Social Insurance Fund. This means that all regions now use the same algorithm for calculating benefits.

How to calculate Putin's allowance

The amount of benefit for the first and second child is the same, only the sources of funding differ. For the first child, funds are allocated from the federal budget, for the second - from maternity capital funds.

To receive benefits, it is necessary to calculate the average per capita family income and compare it with the cost of living in the region for the working population. If the average per capita income is less, then the family is considered low-income and is entitled to Putin’s payments.

Calculation of average per capita family income

To calculate the average per capita family income, you first need to collect all the official income of the family and add them up. Then, the resulting amount is divided by 12 months and by the number of people in the family.

Let's look at an example

The Ivanov family consists of 3 people: mother, father and a minor son (1 year old). The father receives a salary of 33,000 rubles, for the year it turns out to be 396,000 rubles, once he was paid a bonus in the amount of 9,000 rubles. The mother did not work after the birth of the child, but managed to receive benefits for up to 1.5 years per child in the amount of 3,277 rubles for 12 months, which comes out to 39,324 rubles.

We add up all these incomes and then calculate using the formula:

(396000+9000+39324)/12/3=12342 rubles

Next, you need to compare the resulting value with the cost of living in the region; you can see it, for example, on the website of the Pension Fund. Our example family lives in the Murmansk region, where the average per capita income for workers is 17,134 rubles.

The Ivanovs’ income is less, which means they can process the payment.

But if the mother from the Ivanov family had previously worked officially, she would have also received maternity benefits, which would also have been taken into account in the family’s income. Sometimes one such benefit can dramatically increase a family’s income in calculations.

Differences between payments for the first and second child

The main difference between payments for the first and second child is that in the first case the funds come from the federal budget, and in the second - from maternity capital (clauses 10-11 of Article 3 No. 418-FZ).

Since the benefit for the second child is paid from the maternity capital received for this child, to apply for the benefit you must first receive a certificate of maternity capital. If the certificate is not issued, then Putin’s payments do not apply to the second child. It must be remembered that the amount of maternity capital will be reduced by the amount received in the form of benefits.

The amount of payments for the first and second child is the same and is equal to the size of one subsistence minimum for children in the corresponding region of the Russian Federation as of the second quarter of the year preceding the payment.

How to apply for maternity capital in 2022

How to apply for and receive Putin’s allowance: step-by-step instructions

You need to be prepared for the fact that benefits up to 3 years are issued annually. This is done because many coefficients, subsistence minimums and other values that will be needed when calculating benefits change annually.

An important point: you can start applying for benefits at any time, but if you manage to do this before the child turns 6 months old, the money will be paid starting from his birth. If you apply for benefits after he turns 6 months old, then benefits will begin to be paid only from the moment of registration, and money for 6 months will be lost.

Collection of documents

The standard package of documents includes:

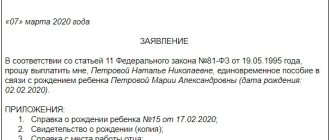

- statement;

- parents' passports;

- birth or adoption certificate of the child;

- Marriage certificate;

- certificates of income for the last 12 months in form 2-NDFL. Individual entrepreneurs need to provide a declaration of income for the year.;

- mother's bank account details;

- copies of parents' work records.

Each case is individual, so additionally you may need:

- certificate of divorce;

- death certificate of the second spouse;

- certificate of alimony assignment.

In any case, before collecting documents, you need to call social security, the Pension Fund or the MFC.

Payment procedure and deadline

Monthly payments are made until the child reaches three years of age. Parents have the right to apply for payment at any time during the three-year period. However, if the application was submitted before the child reached the age of 6 months, then the payment is accrued from the date of birth. If the application was submitted after the child reached the age of 6 months, then the payment of funds begins from the day of application - thus, the right to part of the money is lost.

The application for monthly payment is submitted three times:

- the payment is assigned until the child is 1 year old;

- then, upon application, the payment is extended to 2 years;

- then, upon application, the payment is extended to 3 years.

Consideration times and results

An application for benefits is processed within a month, but sometimes the process takes less time.

After the payment is scheduled, they will either call from social security or the Pension Fund, or notify via SMS immediately that the money has been credited to the card. Benefits are paid monthly no later than the 26th.

Child care allowance up to 1.5 years old

In 2022, citizens caring for a child are guaranteed payment of social benefits in the amount of 40% of their average earnings (Article 15 of the Federal Law of May 19, 1995 No. 81-FZ “On State Benefits for Citizens with Children”). The benefit is paid from the date of granting parental leave until the child reaches the age of one and a half years.

When caring for two or more children, the amount of the benefit is summed up (40% of earnings for each child), but not more than 100% of the average earnings of the insured person. This year, the minimum amount of benefits for caring for the first, second and subsequent children is 7,082 rubles, and the maximum amount is 29,600 rubles.

The benefit is paid to the mother, father, other relatives or guardians who actually care for the child and are on appropriate leave. If several persons are caring for a child at the same time, the right to receive a monthly benefit is granted to one of them.

The right to benefits also remains if the person on parental leave works part-time or at home, as well as if he continues his studies. Persons entitled to both a monthly child care benefit and unemployment benefits are given the right to choose to receive benefits on one of the grounds (Clause 3, Article 13 of Federal Law No. 81-FZ of May 19, 1995).

Persons entitled to receive a monthly child care benefit on several grounds are given the right to choose to receive benefits on one of these grounds.

Since 2022, child care benefits are paid directly from the Social Insurance Fund, but applications for benefits are still submitted through the employer (Part 6, Article 13 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with motherhood").

The application indicates the method of receiving benefits. The benefit can be received both on the Mir card and on any other bank account, as well as through the organization of the federal postal service (clause 11 of the Decree of the Government of the Russian Federation of December 30, 2020 No. 2375).

The initial payment of the monthly child care benefit is made within 10 calendar days from the date of receipt of a set of documents from the employer, and subsequent payments - from the 1st to the 15th of the month following the month for which the benefit is paid (clause 11 of the resolution Government of the Russian Federation dated December 30, 2020 No. 2375).

Table of Putin's benefits by region

| Central Federal District | Amount/rub. |

| Belgorod region | 9 364 |

| Bryansk region | 11 206 |

| Vladimir region | 11 294 |

| Voronezh region | 9 375 |

| Ivanovo region | 10 877 |

| Kaluga region | 11 333 |

| Kostroma region | 10 900 |

| Kursk region | 10 627 |

| Lipetsk region | 10 215 |

| Moscow region | 13 317 |

| Oryol Region | 10 851 |

| Ryazan Oblast | 10 734 |

| Smolensk region | 10 975 |

| Tambov Region | 10 100 |

| Tver region | 11 894 |

| Tula region | 11 032 |

| Yaroslavl region | 10 870 |

| Moscow | 15 450 |

| Northwestern Federal District | |

| Republic of Karelia | 13 713 |

| Komi Republic | 14 492 |

| Arkhangelsk region, including: Nenets Aut. district | 22 884 |

| Arkhangelsk region without a car. districts | 13 744 |

| Vologda Region | 11 732 |

| Kaliningrad region | 11 304 |

| Leningrad region | 10 718 |

| Murmansk region | 17 933 |

| Novgorod region | 11 380 |

| Pskov region | 11 542 |

| Saint Petersburg | 11 336 |

| Southern Federal District | |

| Republic of Adygea | 10 060 |

| Republic of Kalmykia | 10 926 |

| Republic of Crimea | 11 682 |

| Krasnodar region | 11 114 |

| Astrakhan region | 11 722 |

| Volgograd region | 10 414 |

| Rostov region | 11 642 |

| Sevastopol | 12 276 |

| North Caucasus Federal District | |

| The Republic of Dagestan | 10 757 |

| The Republic of Ingushetia | 11 015 |

| Kabardino-Balkarian Republic | 13 815 |

| Karachay-Cherkess Republic | 10 840 |

| Republic of North Ossetia–Alania | 10 470 |

| Chechen Republic | 11 168 |

| Stavropol region | 10 621 |

| Volga Federal District | |

| Republic of Bashkortostan | 10 077 |

| Mari El Republic | 10 415 |

| The Republic of Mordovia | 9 796 |

| Republic of Tatarstan | 9 713 |

| Udmurt republic | 10 518 |

| Chuvash Republic | 9 851 |

| Perm region | 11 124 |

| Kirov region | 10 954 |

| Nizhny Novgorod Region | 11 031 |

| Orenburg region | 10 289 |

| Penza region | 10 002 |

| Samara Region | 11 000 |

| Saratov region | 10 191 |

| Ulyanovsk region | 10 917 |

| Ural federal district | |

| Kurgan region | 11 027 |

| Sverdlovsk region | 11696 |

| Tyumen region, including: Khanty-Mansiysk Autonomous Region. district – Ugra | 16 306 |

| Tyumen region, including: Yamalo-Nenets Aut. district | 16 753 |

| Tyumen region without cars. districts | 11 956 |

| Chelyabinsk region | 11 694 |

| Siberian Federal District | |

| Altai Republic | 10 801 |

| The Republic of Buryatia | 12 968 |

| Tyva Republic | 11 902 |

| The Republic of Khakassia | 12 507 |

| Altai region | 10 611 |

| Krasnoyarsk region | 13 763 |

| Irkutsk region | 12 759 |

| Kemerovo region | 11 254 |

| Novosibirsk region | 12 729 |

| Omsk region | 10 870 |

| Tomsk region | 12 927 |

| Far Eastern Federal District | |

| Republic of Sakha (Yakutia) Trans-Baikal Territory | 18 559 14 199 |

| Kamchatka Krai | 22 693 |

| Primorsky Krai | 15 409 |

| Khabarovsk region | 16 372 |

| Amur region | 13 547 |

| Magadan Region | 21 880 |

| Sakhalin region | 17 300 |

| Jewish Autonomous Region | 16 479 |

| Chukotka Autonomous Okrug | 22 982 |

Benefit for single mother

Single mothers can receive Putin's benefits in the same way as two-parent families, there are no differences. the mother simply provides all the information about her income and then follows the standard instructions.

Women are recognized as single mothers if:

- the paternity of the child has not been established;

- the woman was not married at the time of the baby’s birth;

- a woman adopted a child while unmarried;

- the child's father has died or gone missing;

- the child was born more than 300 days after the dissolution of the marriage between the parents;

- the child's father has been deprived of parental rights.

Usual child benefits in 2018

There are so-called basic “children’s” benefits associated with the birth of a child. From February 1, 2022, they will be indexed by a factor of 1.025 Resolution of the Government of the Russian Federation dated January 26, 2018 No. 74 “On approval of the amount of indexation of payments, benefits and compensation in 2022”). Here is a table with the amounts of child benefits from February 1, 2022.

| Type of benefit | Benefit amount | |

| until February 1, 2022 | from February 1, 2022 | |

| One-time benefit for the birth of a child | 16 350,33 | 16 759,09 |

| Minimum monthly allowance for caring for the first child | 3065.69 (including the minimum wage - 3120) | 3795,60 |

| Minimum monthly allowance for caring for the second and subsequent children | 6131,37 | 6284,65 |

| One-time benefit for registration in the early stages of pregnancy | 613,14 | 628,47 |

The listed types of child benefits are financed from the Social Insurance Fund. However, employees can apply to their employers to appoint them.

Guide for parent-students

Putin's payments are due to student parents even if they are minors.

If the child's mother is over 16 years old, then she is entitled to benefits, but if she is under 16, then her parents or relatives can take custody of the child and receive the payment.

In normal situations, when student parents are adults, they will have to follow the standard scheme for receiving payments.

If students officially work part-time, they will need to confirm their income with a 2-NDFL certificate. You will need to obtain a certificate of scholarships received from the dean's office.

Social Security or the Pension Fund may require an additional certificate stating that the parents are indeed university students.

If students are unemployed, but are registered with an employment center, they will also need to take a certificate from there.

Documents required to receive payments

Regardless of the choice of the authority through which the procedure for registering the right to benefits will be carried out, the applicant will be required to provide the following documents:

1.

A document certifying the birth or adoption of the first child. When receiving money, the guardian needs an extract from the OiP as confirmation of the fact that guardianship has been established.

2.

General civil documents (original + copy) confirming the applicant’s citizenship. The following are accepted for consideration: military ID, passport, birth certificate (for a child).

3.

Income certificates. In this case, the following documents are relevant for applying for Putin’s allowance for the first child:

- certificate in form 2NDFL (from place of work);

- receipt of social payments and benefits for each recipient. Papers for each type of assistance are required to be presented, regardless of what level - federal or regional - the program providing for payments is registered;

- certificates of pension payments or compensation;

- information about scholarships received during the reporting period and other payments due by right of the position held or scientific title;

- documents from the Center for Labor and Social Protection on receipt of payments, if the Putin benefit is issued for the first child born (adopted) by a woman who has official unemployed status. This information is also relevant for men;

- certificate of social benefits (sick leave, temporary disability, etc.).

4.

Bank statement with full details. It is important that the account be personal and opened by the applicant for payments. The provided certificate must contain comprehensive information for the transfer, including: tax identification number, checkpoint, bank account and bank address.

5.

Document from the military registration and enlistment office. If the Putin benefit is issued by a woman who gave birth to her first child during her husband’s military service (fixed-term or contract), this fact must be reflected in the appropriate document.

6.

Certificate of marital status. Social security authorities request the following types of documents of this nature:

- certificate from the registry office on the fact of registration/dissolution of marriage relations;

- “children’s” birth or adoption documents;

- data on family composition reflected in the passport;

- documents confirming the legality of the change of personal data: first name, last name, patronymic.

If a parent or adoptive parent (guardian) raising the first child alone is applying for Putin benefits, the social security authorities must provide papers disclosing the reason for the absence of the second parent (guardian, adoptive parent). Required papers include:

- certificate of death of the second parent or deprivation of his rights to raise a child by a judicial authority;

- certificate of completion of divorce proceedings;

- a document confirming the assignment of the “missing” status to the second parent.

In cases of judicial death or “deceased”, the applicant for Putin’s benefits is required to provide the relevant certificate to the social protection authorities. If the application is submitted through an authorized representative of a woman who gave birth to her first child, then the actual applicant must attach to the package of papers personal documents and a power of attorney for the right to conduct business on behalf of the copyright holder.

When payments stop

As a standard, benefits stop being paid when the child reaches 3 years of age. In addition, money stops being paid if:

- the family has not re-registered its right to receive benefits. when the child is 1 year old or 2 years old;

- the family moved for permanent residence to another region. It will be necessary to re-register the benefit at the local social security or Pension Fund branch;

- the family voluntarily decided to refuse payment and wrote a statement;

- if the child died;

- if the applicant has been deprived of parental rights.

Answers to frequently asked questions

Federal Law No. 418 and Order No. 889n discuss in detail the rules for providing payments for the 1st and 2nd child. In order not to look for answers to frequently asked questions in the texts of documents, we will answer them here.

How to extend presidential benefits after a year?

Benefit payments continue for up to 1 year. In order to continue receiving money, you need to re-assemble the complete package of documentation and take it to the same institution to which the application was sent for the first time: for the 1st child to the Social Security authorities, for the 2nd - to the Pension Fund.

In this case, the documents for the applicant, submitter and child can be the same (copy of the citizen’s main document, copy of the birth certificate, etc.), and information about income can be fresh (for the last 12 months).

When do payments stop?

Payments of presidential subsidies may be stopped.

Reasons for stopping transfers:

- Voluntary refusal of the applicant.

- The child reaches the age of 3 years.

- The child was paid presidential benefits for up to 1 year, but the applicant did not submit a second application to extend the transfers.

- The family's financial situation has improved and exceeded two subsistence limits for each family member (according to information submitted by the applicant).

- The family moves to another region, in this case, payments will be resumed in the new subject of the Russian Federation after submitting an application to its authorities.

- Maternal capital for the 2nd child was fully paid.

- The child has ceased to be supported by the applicant (died, receives full state support, adopted by another person, etc.).

- The applicant has died or is declared dead.

What amount of payments are due to low-income families?

The amounts depend on the place of residence and are equal to the subsistence limit for a child established in the 2nd quarter of the previous year. To receive subsidies in 2022, you must focus on the cost of living for the 2nd quarter of 2022.

How do you know if presidential payments have been approved?

State authorities making decisions on granting subsidies are not required to inform the applicant about a positive decision on the application.

The easiest way to find out about approval is to receive the first transfer to the account specified in the application.

If the money has not been received on the card by the 26th day following the application, you need to check the decision of the government agency.

For this:

- Check the delivery of documents if they were not transferred to Social Security or the Pension Fund in person. This can be checked on the website of the State Service, postal service or MFC, depending on how the papers were sent;

- Call the agency that received your documents. If employees do not provide such information over the phone, contact them in person.

In case of refusal to provide payments, request a written response to the application. This will make it easier to further correct deficiencies or go to court.

Are presidential benefits paid to working pregnant women and the unemployed?

Receipt of the presidential benefit is not affected by the mother's employment status. It is paid to women without work, on maternity leave, expecting the birth of another baby, if other requirements for citizenship, age of the child, income, etc. are met.

Single mothers

A single mother who has given birth to 1 or 2 children has the right to receive presidential money in full. To do this, she needs to submit documents to the relevant government authority on time.

For the 3rd child (large families)

Federal Law No. 418 provides for payments for the birth of the 1st and 2nd child. Other benefits and payments apply to the 3rd and subsequent children.

The video below talks about all the benefits and payments upon the birth of a child:

Remember

- The benefit is paid only for the first or second child born or adopted after January 1, 2022.

- Payments can be made by parents, adoptive parents and guardians.

- The amount of the benefit depends on the region of residence of the family and the level of the cost of living per child in a particular city.

- To receive benefits, the family must be considered low-income and the average per capita income does not exceed 2 times the subsistence minimum for a worker in the region.

- To calculate the average per capita income, you need to add up all family income, including child benefits, pensions and scholarships.

- For the first child, documents on the assignment of benefits are submitted to social security, for the second - to the Pension Fund.

- The benefit can be received by the unemployed, student parents and mothers or single fathers.

Video for dessert: 9 Animals with Incredible Beauty

We arrange maternity capital

Capital is assigned when a second or subsequent child appears on the account. If the capital was not registered for the second child, a family capital certificate is provided at the birth of the third child. Money can be received by both a woman and a man. The second payment is issued if the person is the sole adoptive parent of two or more children. The corresponding decision of the judicial authority must come into force from the beginning of 2007 to December 31, 2022. The size of MK is 453,000.26 rubles.

The money is paid from the Pension Fund. You can receive them either at once or in part. The purposes for which funds are spent are stipulated by Federal Law No. 256 “On additional measures of state support” dated December 29, 2006. Let's look at them in more detail:

- Improving living conditions.

- Payment for the child's education.

- Compensation for the purchase of equipment and services for the social adaptation of a disabled child.

- Creation of a funded part of a woman’s labor pension.

Previously, parents could receive a lump sum payment from the capital. However, this program was closed in 2022. Maternity capital is registered with the Pension Fund. You need to go to the branch at your place of residence. You can contact the authority at any time. To confirm your rights to capital, you must present a personal certificate. Pension Fund employees are presented with the following documents:

- Statement.

- Passport of both father and mother.

- Baby's birth certificate.

IMPORTANT! All payments given in the article must be formalized. They are not automatically provided at the birth of a child. To obtain them you need to collect documents. A birth certificate is required. Parents should also not forget that some benefits require registration within a certain time frame. As a rule, this is 6 months from the date of birth of the baby. If parents do not make it on time, they will not receive any money.