2-NDFL was abolished from 01/01/2021

As of January 1, 2021, the Federal Tax Service of Russia has abolished form 2-NDFL.

Starting from 2021, tax agents send information about the income and tax amounts of an individual to the Federal Tax Service in the form of an annual application as part of the annual calculation 6-NDFL (due by March 1). Employees are issued a “Certificate of income and tax amounts of an individual.” IMPORTANT!

The format and procedure for filling out the new forms were approved by Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/753.

The requirements and procedure for filling out forms have changed, but the provision of a 2-NDFL certificate by the administration of the employing organization or the Federal Tax Service has not changed.

More information about 2-NDFL: 2-NDFL certificate in 2022: form, codes and procedure for issuing to employees

How long does it take to get a 2-NDFL certificate at work?

According to clause 3 of Article 230 of the Tax Code, the tax agent is obliged to provide employees, upon their applications, with information about income in the prescribed form. But the deadline for issuing the 2-NDFL certificate is not established by the Code. Moreover, in letter No. 03-04-05/50030 dated August 26, 2016, the Ministry of Finance explained that this issue does not relate to the subject of regulation of the Tax Code of the Russian Federation at all, but lies in the sphere of legal relations between the employee and the employer.

It follows from Article 62 of the Labor Code that the employer is obliged to issue a 2-NDFL certificate no later than 3 working days. The same article states that the document is issued upon a written application from the employee. Although in practice in some companies a verbal request is sufficient.

Example 1

Important!

For individual entrepreneurs, a 2-NFDL certificate is issued within the same period and according to the same rules as for legal entities.

Upon termination of an employment relationship, a 2-NDFL certificate is prepared and issued to the employee without fail on the day of his dismissal (Article 84.1 of the Labor Code). In this case, there is no need to write any statements.

Typically, a 2-NDFL certificate is issued for a period of 1 year. That is, if you need to obtain information about income for 3 years (for example, for 3-NDFL declarations), you need to make 3 separate certificates. However, there are no prohibitions on issuing a certificate for a six-month or quarterly period. If an employee needs data for the current year, a 2-NDFL certificate is issued for the past months.

Example 2

If the 2-NDFL certificate takes a long time to complete and the employee believes that his rights have been violated, he can contact the labor inspectorate. For violation of labor legislation, the employer faces a fine under Article 5.27 of the Administrative Code:

- for individual entrepreneurs 1000-5000 rubles;

- for legal entities 30,000-50,000 rub.

Important!

The Tax Code of the Russian Federation does not establish any liability of the tax agent for failure to issue a certificate (for more details, see letter of the Ministry of Finance dated June 21, 2016 No. 03-04-05/36096).

Who issues information about income and withheld tax?

The norms of Article 230 of the Tax Code of the Russian Federation provide that, at the request of an individual taxpayer, information on income and deductions is provided by:

- tax agents;

- Federal Tax Service authorities.

IMPORTANT!

The bodies of the Russian Pension Fund do not have the right and ability to issue certificates of income and withheld tax. The Pension Fund contains information only about the amount of earnings and insurance premiums.

The tax agent for employees is the employer, who withholds taxes from his salary and other payments, transfers them to the budget and issues 2-NDFL from the place of work for past and current periods. But other organizations and individual entrepreneurs where he receives money also have the right to act as a tax agent for an individual.

IMPORTANT!

For military personnel and other security officials, this is the state; the contract for military service is concluded on its behalf. Military personnel receive documents on amounts received and deductions from them at the Unified Settlement Center (SCC) of the Russian Ministry of Defense. The application is submitted at the place of service to the financial unit.

Rules for document execution

The certificate was approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485 “On approval of the form of information on the income of an individual, the procedure for filling it out and the format for its presentation in electronic form,” valid since 2016, but starting with reporting for 2017, that is, changes have been made to it since 2022. According to the order, it is filled out by the tax agent based on the information contained in the tax registers. The filling procedure is regulated by the same orders.

In the 2022 form, new income and deduction codes, new lines have been added, the barcode has been adjusted, and data on the individual’s place of residence has been removed.

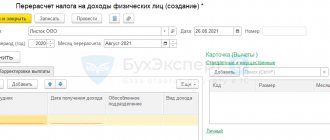

Data correction

No one is immune from an error, so to correct it, corrective data is submitted.

An adjustment is made if:

If an error is found in the submitted report, a new form with clarifying information is submitted. The document serial number cannot be changed. Incorrect information is corrected. And also the column “adjustment number” is changed: instead of “.00”, “.01” is put, if 2-NDFL is subject to change for the first time.

When is information provided to taxpayers?

How long it takes to issue a 2-NDFL certificate depends on the place of application:

- employers are required to produce it within three days at the request of a current or already dismissed employee;

- employers are required to issue it upon dismissal on the last working day, along with the work book and other documents (in accordance with Article 84.1 of the Labor Code of the Russian Federation);

- Federal Tax Service authorities will send information electronically 30 minutes after the request (often faster).

But the tax service allows you to obtain information for past tax periods. This is due to the lack of current data from tax authorities for the current period. Employers annually, before March 1, send tax authorities information about the tax withheld from an individual. Data for last year becomes available no earlier than July. You should contact your employer or other tax agents for current year amounts.

The provisions of Article 230 of the Tax Code of the Russian Federation do not provide for a period for producing a document after the employee’s application. But Article 62 of the Labor Code of the Russian Federation establishes a three-day period for these purposes from the date of receipt of the written application.

More information about the deadlines for providing 2-NDFL when ordering through State Services: instructions: how to order a 2-NDFL certificate through State Services

For what period should a 2-NDFL certificate be issued?

The certificate must be generated for the period for which the employee requests. As a rule, this is a year - after all, it is the tax period for personal income tax (Article 216 of the Tax Code of the Russian Federation). And not necessarily for the last year, but also for past years.

However, it is necessary to take into account the storage period for information about individuals in the organization, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236:

- 5 years - in general;

- 50 years - in the absence of accounts and statements based on information submitted starting from 2003;

- 75 years old - in the absence of accounts and statements based on information submitted before 2003.

Thus, if the storage period for information about individuals in your organization is 5 years, then only during this period can you provide 2-NDFL certificates to an employee upon his application. And for the remaining years, you have the right to refuse him.

What if an employee asks for a 2-NDFL certificate not for the year, but, say, for a quarter or several months of the current year? Such certificates can be made - the Tax Code of the Russian Federation does not prohibit this.

How to write an application for a 2-NDFL certificate

An employee who wants to receive information about wages and deductions from them writes a statement addressed to the head of the organization, in which he indicates:

- Full name of the applicant;

- the period (measured in years) for which a certificate is required;

- date of compilation.

This is what a sample application looks like:

| To the Director of PPT.RU LLC Petrov P.P. from manager Pepetashin P.I. Statement Please provide 2-NDFL (certificate of income and tax amounts of an individual) for 6 months of 2022. | Pepetashin P.I. |

The certificate is issued as many times as necessary upon the employee’s request within a three-year period for which his income is taken into account. It looks like this:

How to fill out the register of information on income for 2-NDFL?

There is no need to create any registers for certificates for 2022 and subsequent periods submitted as part of 6-NDFL.

The register of information on income for 2-NDFL was formed earlier if certificates were submitted to the Federal Tax Service on paper or electronically on a disk or flash drive. If reporting was submitted electronically using the TKS, the register of information on income was formed by the Federal Tax Service.

The form and procedure for submitting the register were approved by order of the Federal Tax Service of the Russian Federation dated October 2, 2018 No. ММВ-7-11/ [email protected] The register was a summary table containing information:

- about the information provided by numbers;

- Full name and date of birth of the person to whom the income was paid for each certificate.

Therefore, the simplest algorithm for creating a registry manually was this:

- prepare certificates for everyone to whom payments were made;

- number the certificates;

- fill out the registry header;

- Enter the necessary data from the certificates into the table in numerical order.

The form and sample register can be found in the publication .

Special situations

Often citizens who want to obtain information about income encounter difficulties. Let's consider several such situations in more detail.

Liquidated employing organization

If at the time of applying for the document the organization is no longer operating or is completely liquidated and information about it is excluded from the Unified State Register of Legal Entities, is it possible to request 2-NDFL from the Federal Tax Service - yes, both the taxpayer himself and the organization or department have the right to do this who needed information.

The taxpayer at any time has the right to independently obtain the necessary information about accrued and paid personal income tax through his personal account on the website of the Federal Tax Service of Russia.

Employer - individual entrepreneur

Many employees believe that if their employer is an individual entrepreneur, they should know how to make a 2-NDFL certificate on their own, or apply for it only to the Federal Tax Service. But in practice, the procedure for issuing a 2-NDFL certificate by an individual entrepreneur is no different from that generally accepted for tax agents-legal entities. When paying remuneration to individuals, individual entrepreneurs withhold tax from it and transfer it to the budget on a general basis. There are no special features.

Delay of salary

Article 226 of the Tax Code of the Russian Federation states that personal income tax accrued from employees’ salaries is not withheld until the salary is paid. And if the salary is accrued but not received, it is not recognized as income. In a letter dated 10/07/2013 No. BS-4-11/ [email protected], Federal Tax Service specialists explained: if income for the previous tax period has not yet been paid at the time of drawing up the certificate, then they should not be reflected in the document along with the tax.

This position differs from the norms of paragraph 2 of Article 223 of the Tax Code of the Russian Federation, according to which the date of actual receipt of income in the form of wages is recognized as the last day of the month for which it was accrued.

Income information for the unemployed

If a person does not work or is retired, he has the right to receive a certificate of income received. But if he is registered as unemployed at the employment center and receives benefits, then it is not subject to personal income tax, and they will not give a certificate for it. If you have other income, the easiest way is to order 2-NDFL on the tax service website.

Where else can I get a certificate?

Students, cadets and contract military personnel can also apply for this document to the accounting department at their place of study or service.

Unemployed citizens who previously had work experience, as well as those who, for one reason or another, were unable to obtain 2-NDFL from their employer (current and past), can rest easy. Provided that the tax agent actually withheld personal income tax from the income, you can obtain similar information:

- by directly contacting the tax office;

- through the taxpayer’s personal account on the official website of the Federal Tax Service of Russia.

An additional feature also became available on April 29, 2014. Information can be found in the section “Tax on personal income” - “Information on certificates in form 2-NDFL”. Moreover, the search for information about income is automatic. There is no need to make a prior request.

According to our information, it is currently possible to obtain information about certificates in Form No. 2-NDFL for the past three years. That is, in 2016, through the tax service website, you have access to a maximum of 2013.

Please note that, taking into account the rules and processing time for information submitted by employers, information for the previous year (tax period) can be obtained no earlier than April-June of the current year.