2020 was a turning point for many entrepreneurs. Decrease in revenue and upcoming abolition of the UTII special regime

Home • Blog • Blog for entrepreneurs • Which tax system to choose for individual entrepreneurs

A situation where a current employee of a company needs to be transferred to the position of General Director may arise in

Which OKVED codes do not fall under the simplified tax system? Some types of activities prescribed in paragraph 3 of Art.

Expenses for business trips according to the Tax Code of the Russian Federation are classified as other expenses. Order to send an employee

5.00 5 Reviews: 0 Views: 10386 Votes: 1 Updated: n/a File type Text document

How does arrears in contributions from the founders of an LLC arise and what are the consequences? Within the deadlines established

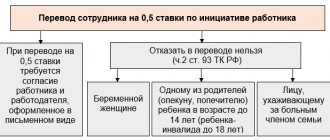

The Labor Code of the Russian Federation on part-time work The terms “rate” or “0.5 rate” in the Labor Code of the Russian Federation

Benefit for registering a pregnant woman 2022 If the expectant mother registers with

Choosing the simplified tax system as a tax system To switch to the simplified tax system, a legal entity or individual entrepreneur