Choosing the simplified tax system as a taxation system

To switch to the simplified tax system, a legal entity or individual entrepreneur submits to the Federal Tax Service inspection at the place of registration a message about the application of the simplified tax system according to the form No. 26.2-1 recommended by the order of the Federal Tax Service of Russia dated November 2, 2012 No. MMV-7-3 / [email protected] . The order also contains instructions on how to fill out the notification. He is directed by:

- when switching to a simplified system from the date of registration;

- when the tax system changes in the next tax period.

In the first case, the filing deadline is 30 calendar days from the date of registration (clause 2 of article 6.1 of the Tax Code of the Russian Federation, clause 2 of article 346.13 of the Tax Code of the Russian Federation). In the second, you need to do it before December 31 of the year that precedes the year in which the changes apply.

IMPORTANT!

The transition to the simplified tax system during the calendar year is not provided for existing legal entities and individual entrepreneurs.

To select a simplification, you must meet a number of criteria, which are slightly different for entrepreneurs and organizations. An individual entrepreneur has the right to switch to this special regime if:

- it employs less than 100 people;

- income less than 150 million rubles.

Legal entities have the right to apply the simplified tax system in 2022 if:

- number of employees - less than 100;

- income for 9 months of 2022 did not exceed 112.5 million rubles when working on the simplified tax system (clause 2 of article 346.12 of the Tax Code of the Russian Federation);

- residual value of fixed assets - less than 150 million rubles;

- the share of other companies in the authorized capital is less than 25%;

- the company has no branches;

- activity does not relate to the financial sector (banks, insurers);

- earnings for last year amounted to less than 150 million rubles (clause 4 of article 346.13 of the Tax Code of the Russian Federation).

Use free instructions from ConsultantPlus experts to switch to the simplified tax system from another tax system.

When can you change the object of taxation?

The change of object is carried out from the beginning of the tax period (calendar year).

It is prohibited to change the object during the year (clause 2 of Article 346.14 of the Tax Code of the Russian Federation). Example

Gedeon LLC applies the simplified tax system from 01/01/2021. The company's management thought about changing the object of taxation in March 2022. However, it is impossible to change the object of the simplified tax system during the year (clause 2 of article 346.14 of the Tax Code of the Russian Federation). It can only be changed from January 1 of the next year, that is, from 01/01/2022.

At the same time, according to the clarifications of the Ministry of Finance from letter No. 03-11-11/58878 dated October 14, 2015, the taxpayer has the right, before the end of the official deadline for submitting a notice of a change of object, to change his decision and re-submit the notification if he made a mistake with the object in the first one. The same should be done if the taxpayer made a mistake when filling out the “Object of taxation” column when submitting a notice of transition to the simplified tax system. He has the right to correct the error and change the object if he manages to submit a new notification before December 31 of the current year (letter of the Ministry of Finance dated January 16, 2015 No. 03-11-06/2/813).

How to send a notification to the Federal Tax Service

The notification nature is a distinctive feature of the transition to the simplified tax system. But this does not mean that you should receive a notification from the tax service. Quite the opposite: it is provided for filling out a notice of transition to the simplified tax system (form 26.2-1) for an LLC or individual entrepreneur and sending it to the Federal Tax Service at the place of registration. Previously, there was a separate form of notification about the possibility of applying a simplified taxation system from tax authorities; this form served as a response to the taxpayer’s application. But it lost force back in 2002 by order of the Federal Tax Service of Russia No. ММВ-7-3/ [email protected] Now there is no need to wait for permission from the tax authorities to use the simplified form. After sending the notification, it is allowed to apply the simplification from the date specified in the application.

There is also no need to confirm the right to use this regime. If you do not meet the conditions, this will become clear after the first report, and only then will you have to be financially responsible for the deception. The tax service has no reason to prohibit or allow the transition to a simplified system; its use is the taxpayer’s decision. In addition, the notification about the transition to the simplified tax system of form 26.2-1 has the nature of a recommendation. It is allowed to notify the Federal Tax Service of your intention to use the special regime in any form, but it is more convenient to use a ready-made one.

Deadlines for submitting information about changes in the object of taxation

Submission of information about a change in the object of taxation according to the simplified tax system is carried out before December 31 of the current year by notifying the tax authorities in form 26.2-6, approved by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3 / [email protected] You can download the form for free by clicking on picture below:

Such notification to the head of the company or individual entrepreneur should be brought to the tax office in person, sent through a representative by proxy, or sent by mail in a valuable letter with a list of the attachments.

In addition, notification can be submitted electronically via telecommunication channels. The electronic data submission format was approved by order of the Federal Tax Service of Russia dated November 16, 2012 No. ММВ-7-6/ [email protected]

You can find a line-by-line algorithm for filling out a notification and a completed sample in ConsultantPlus. A free trial of full access to the legal system is available.

In the picture below, see the optimal procedure for changing the object of taxation.

To make the right decision, read the article “Which object is more profitable under the simplified tax system – “income” or “income minus expenses”?”

You will find tips on accounting for income and expenses after changing the object of taxation in ConsultantPlus. Sign up for a trial access to K+ for free and go to the Ready-made solution.

Step-by-step instructions for filling out form No. 26.2-1

The recommended form was introduced by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] “On approval of document forms for the application of the simplified taxation system.” Newly created companies and individual entrepreneurs submit a notification using the same form. They have the right to inform the Federal Tax Service about the application of the simplified tax system within 30 days from the time they register.

Let's look at line by line how to fill out a notice of transition to a simplified taxation system for legal entities and individual entrepreneurs. Let us point out the differences that are important to take into account when entering data about organizations and individual entrepreneurs.

Step 1. TIN and checkpoint

Enter the TIN in the line - the number is assigned when registering a company or individual entrepreneur. Entrepreneurs do not enter the checkpoint - the code for the reason for registration, since they simply do not receive it during registration. In this case, dashes are placed in the cells.

If the notification is submitted by an organization, the checkpoint must be included in the application.

Step 2. Tax authority code

Each Federal Tax Service Inspectorate is assigned a code, which is indicated when submitting applications, reports, declarations and other papers. Firms and individual entrepreneurs submit forms to the inspectorate at the place of registration. If you are sure that the code is correct, look it up on the Federal Tax Service website. An example is the code of the Interdistrict Inspectorate of the Federal Tax Service No. 16 for St. Petersburg.

Step 3. Taxpayer attribute code

At the bottom of the sheet is a list of numbers indicating the organization code in the application for the simplified tax system - a sign of a taxpayer:

- 1 is placed when submitting a notification by a newly created entity along with documents for registration;

- 2 - if a person is registered again after liquidation or closure;

- 3 - if an existing legal entity or individual entrepreneur switches to the simplified tax system from another regime.

Step 4. Company name or full name. IP

For individual entrepreneurs, the main identifier is the last name, first name and patronymic. Include them in the application for transition to the simplified tax system. Empty cells of the form are filled with dashes.

If you are the head of a company, then enter the full name of the organization. Fill in the remaining cells with dashes.

Step 5. The number in the line “switches to simplified mode” and the date of transition

Specify one of three values. Each number is deciphered below:

- 1 - for those who switch to the simplified tax system from other taxation regimes from the beginning of the calendar year. Don't forget to enter the year of transition;

- 2 - for those who register for the first time as an individual entrepreneur or legal entity;

- 3 - for those who stopped using UTII and switched to the simplified tax system not from the beginning of the year. Does not apply to all UTII payers. To switch from UTII to simplified taxation in the middle of the year, you need reasons. For example, stop activities that were subject to UTII and start running a different business.

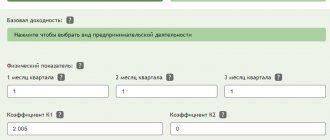

Step 6. Object of taxation and year of notification

To follow the instructions on how to correctly fill out the notice of transition to the simplified tax system, enter the value corresponding to the selected taxation object:

- The simplified tax system “Income” is taxed at a rate of 6% - expenses cannot be deducted from the tax base. Regions have the right to lower interest rates since 2016. If you chose this type of object, put 1;

- The simplified tax system “Income minus expenses” has a rate of 15%, which regions have the right to reduce to 5%. Expenses incurred are deducted from income. If you chose “Income minus expenses”, put 2.

Be sure to indicate the year in which you are submitting the notice.

Step 7. Income for 9 months

Enter the amount of income if you are switching to the simplified tax system from another system. For 9 months, income must not exceed 112,500,000 rubles for the right to apply the simplified system in the future period. This restriction does not apply to individual entrepreneurs.

Step 8. Residual value of fixed assets

The residual value of the organization's fixed assets as of October 1, 2020 does not exceed 150,000,000 rubles. There are no restrictions for individual entrepreneurs.

Step 9. Full name company manager or representative

In the final part, indicate your full name. the head of the company or his representative, who has the right to sign papers by proxy. Don't forget to indicate by number who signs the form:

- 1 - the leader himself;

- 2 - trusted representative.

The entrepreneur does not need to write his last name in this line; put dashes.

Step 10. Phone number, date, signature

Please provide a contact number and the date the notification was submitted. The form is signed by the entrepreneur, head of the company or representative of the taxpayer.

The rest of the form is filled out by the tax authority employee. Form No. 26-2.1 is drawn up in two copies. One is returned to the taxpayer with the signature and seal of the Federal Tax Service. This is confirmation that you have informed the tax authority of your intention to switch to a simplified tax system starting next year.

Procedure for filling out form 26.2-6

according to the KND form 1150016 in PDF format, please follow the link

It is important to pay attention to filling out the fields:

- When filling out the form, legal entities must indicate the TIN and KPP and the name of the organization. Individual entrepreneurs indicate their full last name, first name and patronymic;

- tax office code;

- the year from which the taxpayer makes a change to the object of taxation of the simplified tax system;

- code number - indicates the desired version of the object of taxation of the simplified tax system;

- At the bottom of the form, you must indicate “1” if the notification is submitted personally by the manager or entrepreneur, and “2” is indicated if the notification is submitted by a representative on the basis of a power of attorney issued by the manager or individual entrepreneur personally.

Rules for changing a simplified tax system object

If you want to start applying the simplified tax system, abandon this system, or change the object of taxation, then please note: the timing of the implementation of each of these procedures is affected by the tax period established for the simplified tax system, which is equal to a year (clause 1 of article 346.19 of the Tax Code of the Russian Federation). This means that it is impossible to change the simplified tax system object during a given period of time.

That is why the Tax Code of the Russian Federation states that the opportunity to apply the simplified tax system for an already functioning taxpayer occurs only at the beginning of the next year (Clause 1 of Article 346.13), and there is also a direct ban on the transition before the end of the year:

- to a different tax system with simplified taxation (clause 3 of article 346.13);

- on another object of taxation with a simplified tax (clause 2 of Article 346.14).

However, the simplified tax system object can change annually. For the change to take effect, it is enough to notify the tax authority about it before the end of the year preceding the onset of the next tax period (clause 2 of Article 346.14 of the Tax Code of the Russian Federation).

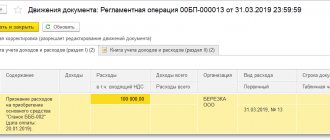

If the notification is submitted on time, then from the coming year the procedure for determining the base for calculating the simplified tax will change. In this case, the value of the new object “income” can no longer be reduced by any current or previously incurred expenses.

In turn, when calculating the base for a new “income minus expenses” object, it will not be possible to include in expenses any expenses incurred previously when using the “income” object. In particular, it is impossible to take into account the amount of damage incurred during the period of operation of the “income” object (Letter of the Ministry of Finance dated April 15, 2016 No. 03-11-11/22058).