The rules for making a decision based on the results of an inspection are established by Art. 101 Tax Code of the Russian Federation. In its essence, such an audit is an audit conducted at the location of the taxpayer’s base. Based on the results of its implementation, an act is formed, and if the person being inspected has objections, they are attached to it.

Various circumstances confirming the version of the tax service employees are also documented and added to all final documentation. As a result, a package of documents is formed, which is submitted to the head of the tax service department for consideration.

What is this type of check?

A tax audit is a set of measures aimed at identifying possible violations of an economic entity. Such inspections may have different criteria for dividing them into types, but the most important of them remains the division of desk and field inspections.

In both cases, the work of tax inspectors ends with the drawing up of a report listing all violations. At the same time, the employees who carried out the inspection do not immediately make any decisions themselves. This happens on the basis of a legitimate procedure, and as a result, a definite decision of the commission appears.

A taxpayer who has been inspected by inspectors will receive a written notification and a copy of the report. He will have 10 days to prepare to speak orally before the commission or submit written requests to it.

He can protest the conclusions of the commission, present his arguments, relying on the articles of any codes and federal laws that are only related to the issues of taxation of entrepreneurs based on the results of their economic activities.

The most unpleasant type of inspection is its on-site type. It lasts a long time, and the period can be extended. All this time, the entrepreneur faces significant difficulties in conducting business. For example, tax inspectors may begin taking inventory at its warehouses, and this will require a temporary suspension of work - full or partial.

Thus, within a few months, an inspection can lead to complete bankruptcy. Especially if the identified violations, obvious or imaginary, entail the introduction of some restrictive measures. The taxpayer being audited can seek protection from the courts, but this only gives rise to a court process drawn out over time.

The on-site inspection is carried out on the basis of the provisions of Art. 89 of the Tax Code of the Russian Federation and can last two months. This period can be increased by the head of the Federal Tax Service department up to 6 months.

Inspectors begin the inspection with a specific plan, and it preliminarily describes the violations charged to the taxpayer, as well as the approximate amount of arrears. Most often the test is to identify what is in this plane. In official documentation it is called a conclusion.

The report that appears as a result of the inspection contains information about how closely the preliminary conclusion corresponds to reality.

What are the deadlines for a desk audit of a tax return?

Speaking about the timing of a desk tax audit, it should be noted that (clause 2 of Article 88 of the Tax Code of the Russian Federation):

- the beginning of the desk audit coincides with the moment the taxpayer submits a tax return (calculation);

- The deadline for conducting a desk tax audit for Russian companies and individual entrepreneurs is 3 months, with the exception of the VAT return (6 months from the date of submission of the VAT return by a foreign company registered with the tax authority in accordance with clause 4.6 of Article 83 of the Tax Code of the Russian Federation) .

- Inspectors have 2 months to check the VAT return.

Read more about the VAT audit in the section Desk audit for VAT in 2022 - 2022, as well as in the material “Desk tax audit for VAT: deadlines and changes.”

So, the Tax Code (clause 2 of Article 88) establishes a period for a desk audit, which is 3 months (or 2 months for a VAT return) from the date of submission of the declaration or calculation. The day of submission directly depends on the method of submitting the tax return:

- Personally to the tax authority. The day of submission is considered to be the day the reporting is submitted. In this case, the tax authority, according to paragraph. 2 clause 4 art. 80 of the Tax Code of the Russian Federation, must make a note about the acceptance of the declaration on its title page.

- By mail. The day of submission is the date of dispatch. Although tax officials consider this to be incorrect, since the inspector cannot begin a desk audit without appropriate reporting. This position is also supported by court decisions (resolution of the Federal Antimonopoly Service of the North-Western District dated September 19, 2012 No. A66-376/2012).

- Via telecommunication channels. The day of submission is considered to be the day of dispatch (clause 4 of Article 80 of the Tax Code of the Russian Federation).

At the same time, tax authorities are not obliged to begin control measures strictly on the day they receive the declaration. Therefore, the date in the cameral’s act may differ from the date of submission of the declaration. But the tax authorities are obliged to complete the audit on time. See details here.

Do not forget that taxpayers have the right to submit a VAT return only according to the TKS (paragraph 1, clause 5, article 174 of the Tax Code of the Russian Federation).

The materials in the section “VAT Declaration in 2020-2021 - Form and Sample” will help you prepare a VAT return without errors.

Review of materials

Within 10 days from the expiration of the period established by Art. 100 of the Tax Code of the Russian Federation, the manager must make an informed decision. There is a possibility of a one-time extension of the review period by one month. At the time of receipt of documents, the manager must notify the taxpayer in respect of whom the audit was carried out about the time and place of consideration of the received materials.

From this moment on, he has the right to take part in the consideration. In this case, the absence of such a person is not considered as an obstacle to consideration. However, the manager may decide that the participation of the taxpayer or his representative is mandatory.

In practice, tax authorities always aim to get the maximum from each economic entity subject to audits. As a result, many entrepreneurs go bankrupt.

Before the start of the consideration of materials, the head must announce the person who will consider the case, establish the presence of persons invited to participate in the consideration, and announce the decision on the possibility of consideration without those invited to participate if they did not appear.

His responsibility also includes checking the authority of the taxpayer’s representative, if he acts through him, to explain to all participants their rights and obligations, or to make a decision to postpone the consideration if there is no person whose presence the manager considers necessary.

During the review, the act, other materials, as well as written objections of the taxpayer may be read out. According to the rules of the article in question, the taxpayer may not provide written objections, but the right to personal presence and statement of objections orally is still retained in this case.

During the review procedure, it is possible to make a decision that it is necessary to involve an expert or specialist.

Results

A desk audit of a tax return lasts 3 months (2 months for a VAT return) from the moment it is submitted by the taxpayer to the tax authority (6 months from the date of submission by a foreign company registered with the tax authority in accordance with clause 4.6 of Article 83 of the Tax Code of the Russian Federation , VAT returns). As part of the pilot project, the VAT return for refund is checked for 1 month.

If during the desk audit the taxpayer submitted an update, the desk audit of the primary declaration is terminated and a new desk audit of the already updated declaration begins, which also lasts 3 months.

Tax legislation does not provide for the possibility of extending or suspending such an audit.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Responsibilities of the manager when reviewing materials

The terms of reference of the manager regarding the results of inspections are also determined by the article in question. These include the establishment of violations of tax laws and the presence of elements of an offense in them, grounds for bringing a person to justice. Circumstances are also identified that can exclude guilt, mitigate it, or aggravate responsibility.

This article also introduces the legal regime for additional events. They may be related to the need to obtain additional evidence of violations or the absence thereof.

The head of the tax authorities has the right to make a decision on carrying out additional measures within a period not exceeding one month. In this case, the period and specific form of additional activities are indicated. These include requesting documents, conducting examinations, and obtaining testimony.

The main ones are the manager’s decisions to hold people accountable for committing an offense or to refuse to hold them accountable.

Demand for payment of tax, penalty or fine

Based on the decision that has entered into force, the person in respect of whom it was made is sent, in accordance with Art. 69 of the Tax Code of the Russian Federation requires the payment of a tax (fee), corresponding penalties, as well as a fine if this person is brought to justice for a tax offense (clause 3 of Article 101.3 of the Tax Code of the Russian Federation).

The specified requirement is sent to the tax agent within 20 days from the date of entry into force of the relevant decision of the tax authority (clauses 2, 4 of Article 70 of the Tax Code of the Russian Federation).

Clause 6 of Art. 69 of the Tax Code of the Russian Federation provides for the following options for submitting a claim: – personally against signature to the head of the organization (its legal or authorized representative) or an individual (his legal or authorized representative); – by registered mail; – in electronic form via telecommunication channels (TCS) or through the taxpayer’s personal account.

At the same time, the Tax Code of the Russian Federation does not establish any priority in the use by the tax authority of methods for submitting a claim for payment of tax, penalties, or fines (letter of the Ministry of Finance of Russia dated March 3, 2011 No. 03-02-08/21). Thus, the demand can be sent in any of the provided ways.

If the specified request is sent by registered mail, it is considered received after six days from the date of sending the registered letter.

That is, the corresponding tax procedure is recognized as being complied with regardless of the fact that the tax agent (his representative) has actually received a request for payment of tax sent by registered mail (clause 53 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57, determination of the Constitutional Court of the Russian Federation dated April 8, 2010 No. 468 -O-O, letter of the Ministry of Finance of Russia dated December 6, 2013 No. 03-02-08/53311).

What decisions are made based on the results

The analyzed article establishes the requirements for decisions that are made based on the results of inspections. If the person in question is held accountable, the circumstances of the offense he committed must be set out, with reference to documents confirming the circumstances of the offense.

The taxpayer’s arguments put forward in his defense, the results of verification of this information and arguments, and the decision to hold the taxpayer accountable are added. The amount of arrears and corresponding penalties, as well as the fine imposed on the person, are indicated.

If a decision is made to refuse to prosecute for committing an offense, the circumstances that became the basis for this are listed. The arrears and the amount of the corresponding penalties may also be indicated.

Desk audit of Calculation 6-NDFL

Article 123 of the Tax Code of the Russian Federation establishes liability for unlawful non-withholding and (or) non-transfer (incomplete withholding and (or) transfer) within the period established by the Tax Code of the Russian Federation of tax amounts subject to withholding and transfer by the tax agent.

Based on the provisions of Art. 100.1 of the Tax Code of the Russian Federation, making a decision on bringing to responsibility under Art. 123 of the Tax Code of the Russian Federation is possible only based on the results of consideration of tax audit materials (letter of the Federal Tax Service of Russia dated January 20, 2017 No. BS-4-11/864).

The calculation of personal income tax amounts calculated and withheld by the tax agent according to Form 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] (hereinafter referred to as Calculation 6-NDFL), is a document containing a generalized tax agent information in general on all individuals who received income from a tax agent (a separate division of a tax agent), on the amounts of income accrued and paid to them, tax deductions provided, on calculated and withheld amounts of tax, as well as other data serving as the basis for calculating tax (clause 1 of article 80 of the Tax Code of the Russian Federation).

By virtue of the provisions of paragraphs. 1, 2 tbsp. 88 of the Tax Code of the Russian Federation, the data specified in Calculation 6-NDFL are subject to desk verification.

Making decisions based on the results of inspections and the position of the high court

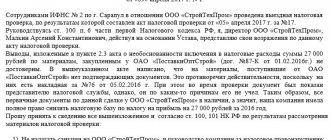

An example of the application of the provisions of the article in the course of judicial resolution of disputes can be found in the ruling of the Supreme Court of the Russian Federation in case No. 307-KG16-6928 dated June 7, 2016. From the judicial acts it becomes clear that, based on the results of an inspection of the company by the inspectorate, a decision was made to hold it accountable for committing offense, additional income tax in the amount of RUB 1,718,703. and VAT in the amount of 1,546,833 rubles, as well as an accrual of 732,521 rubles. penalties and fines for non-payment of income tax in the amount of RUB 343,740.

The basis was the conclusion that the basis was understated due to the fictitious registration of a transaction with an interdependent organization. The inspection concluded that the company deliberately sold the goods at a price below the market price.

The courts of first and appellate instances declared the decision invalid and proceeded from the fact that, in violation of the requirements of paragraph 8 of Art. 101 of the Tax Code of the Russian Federation, the inspection decision does not contain circumstances or references to evidence confirming the deviation of the selling price of goods under the transaction.

The cassation court indicated that the Federal Tax Service presented all the necessary evidence in the case to substantiate the conclusion that the company was dishonest when making transactions. The Supreme Court found that the district court correctly applied the rules of substantive law. The judges of the Supreme Court upheld his decision, and at the same time the decision of the Federal Tax Service department that the violations discovered during the inspection are subject to such severe qualifications, and the society must pay a large tax and, on top of that, pay a fine.

As we can see, the consideration of the company's case in his favor by the initial courts did not help him, since the state system is aimed at obtaining maximum returns and seeks to take as much from the business as it can.