The production process is a reflection of the transformation of raw materials and materials into a finished product. This is one of the most important elements of accounting in an enterprise, since it reflects costs and expenses for raw materials in comparison with the profit from products sold. The correctness of this accounting ensures timely tracking of the organization’s financial results and allows for effective management.

Question: How are the receipt of materials, the costs of their delivery, as well as the write-off of these materials into production reflected in accounting, if in accounting the materials are reflected at accounting (planned) prices using accounts 15 “Procurement and acquisition of material assets” and 16 “ Deviation in the cost of material assets”, while the actual cost of purchased materials exceeds their book price? View answer

Let's consider what are the features of accounting for the production process at an enterprise.

Production and cost

Production is the main goal of creating any enterprise. Employees, using the necessary tools, during various business operations transform raw materials into goods ready for sale - this is the production process . It also includes activities aimed at performing work and providing services. Products appear during the merger:

- labor resources;

- objects of labor;

- costs of "manpower".

In order to correctly determine the unit cost of each type of product and the entire array as a whole, you need to take into account all the costs invested in its production. Some of the costs will be included in the cost price, some will have to be left “outside the brackets” - accounting will show which ones.

the distribution of administrative (general) expenses in the accounting of a production organization ?

ORGANIZATION OF MANAGEMENT COST ACCOUNTING

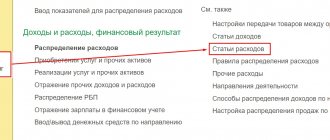

Approaches to organizing cost management accounting may be different. They depend on the type of activity and the adopted management accounting methodology. Therefore, in practice, costs can be grouped according to various accounting criteria:

• cost locations;

• types of products/works/services;

• purpose of costs;

• method of including costs in the cost of products/works/services.

Grouping costs by place of origin

The place where costs arise is understood as a structural unit, workshop, service or separate area where products are produced, work is performed, services are provided using various resources. Grouping by place of origin allows you to plan costs, take into account and control the actual consumption of resources, analyze the dynamics of costs and optimize them.

Using a grouping of cost centers in accounting, an enterprise can correctly calculate the cost of products and monitor the efficiency of departments. In this case, all cost items are reflected in accordance with the directory of departments approved in the enterprise's accounting system.

An example of cost center analytics for this reference book for the “Primary Production” division is shown in Fig. 2.

The management report on production costs for product output will contain analytics on cost items and places of their occurrence (Table 1).

| Table 1. Report on production costs by place of origin, rub. | |||||

| Cost item | Costs, total | Workshop No. 1 | Workshop No. 2 | ||

| site No. 1 | site No. 2 | site No. 3 | site No. 4 | ||

| Raw materials | 2 000 000 | 800 000 | 400 000 | 450 000 | 350 000 |

| Salary and deductions | 400 000 | 125 000 | 140 000 | 85 000 | 50 000 |

| Energy resources | 700 000 | 160 000 | 120 000 | 200 000 | 220 000 |

| OS repair and maintenance | 250 000 | 80 000 | 50 000 | 90 000 | 30 000 |

| Marriage and loss | 60 000 | 25 000 | 10 000 | 15 000 | 10 000 |

| Household expenses | 40 000 | 15 000 | 8000 | 7000 | 10 000 |

| Depreciation of fixed assets | 100 000 | 35 000 | 15 000 | 20 000 | 30 000 |

| other expenses | 50 000 | 20 000 | 5000 | 10 000 | 15 000 |

| Total | 3 600 000 | 1 260 000 | 748 000 | 877 000 | 715 000 |

Grouping costs by product type

Costs by type of product/work/service are grouped based on the calculation of their cost by cost item. As a result, you can see what resources and in what amount were spent on the manufacture of each type of product.

In this grouping, the management report on production costs for product output will contain analytics on cost items and types/range of products (Table 2).

| Table 2. Report on production costs by type of product, rub. | ||||

| Cost item | Costs, total | Costs by product type | ||

| A | IN | WITH | ||

| Raw materials | 2 000 000 | 900 000 | 450 000 | 650 000 |

| Salary and deductions | 400 000 | 200 000 | 80 000 | 120 000 |

| Energy resources | 700 000 | 300 000 | 180 000 | 220 000 |

| OS repair and maintenance | 250 000 | 50 000 | 80 000 | 120 000 |

| Marriage and loss | 60 000 | 30 000 | 10 000 | 20 000 |

| Household expenses | 40 000 | 12 000 | 20 000 | 8000 |

| Depreciation of fixed assets | 100 000 | 60 000 | 20 000 | 20 000 |

| other expenses | 50 000 | 25 000 | 15 000 | 10 000 |

| Total | 3 600 000 | 1 577 000 | 855 000 | 1 168 000 |

| Product output, units | 1800 | 1000 | 300 | 500 |

| Unit cost, rub. | 2000 | 1577 | 2850 | 2336 |

Grouping costs by purpose

The grouping of costs by purpose is based on the fact that all costs are direct or overhead. In this case, direct costs are recognized as those directly associated with finished products ( GP ), and overhead costs are considered to be the costs of ensuring and organizing the production of products.

Overheads also include the costs of auxiliary production, general business expenses and costs of selling products.

With this approach to grouping costs, in addition to types of products and cost items, the indicator of basic and overhead costs will be added to the analytics. This allows you to evaluate what resources the company spends on production, and what resources are needed for the organization and functioning of the service and auxiliary processes of the production enterprise.

What is reflected in production accounting

To record the dynamics of the production process, the accountant should take into account:

- expenses arising in the process of manufacturing the finished product;

- funds spent on finished products and on those goods whose production has not yet been completed;

- the sum of all resources for creating products;

- fluctuations in cost, factors of its growth and reduction possibilities.

How to reflect in the accounting of a contracting organization the production of excisable products on a toll basis and their transfer to the customer?

Forms of production costs

Production costs are those costs incurred by an enterprise during the transformation of raw materials into products. All manifestations of these costs are taken into account:

- material;

- financial;

- resource.

Question: How to reflect in the accounting and financial statements of an organization (LLC) the correction of a significant error made in 2019, which was identified in December 2022? In November 2022, the organization produced products and sold them in the same month. The actual cost of raw materials used in production in accounting (amounts to 600,000 rubles, equal to the cost of its acquisition in tax accounting), due to the fault of the organization's accountant, was erroneously not written off as production costs and cost of sales, and was also not taken into account for profit tax purposes. View answer

In fact, these costs represent one or both options for the movement of monetary (sometimes non-monetary) funds:

- payment to third parties;

- increase in obligations to counterparties.

Classification of production costs

The division of costs is due to a different approach to their accounting:

- Fixed (overhead) and variable costs - characterize the relationship of costs to the production process. The first ones are related to the organization of the production process; they do not change, even if the volume of goods grows. The second group ensures the production process itself - the purchase of raw materials and payment of labor, so this part of the costs is subject to dynamics.

- Direct and indirect costs are associated with the attribution of expenses to cost. The former are included directly in it, reflecting the connection with the production of each individual unit (for example, the cost of materials). The latter are distributed across several types of products at once; they must be included in the cost within the framework of the methodology adopted by the enterprise.

What is included in production costs

We list the main items of the enterprise’s expenses for creating products, which must be reflected in accounting:

- wages for personnel – workers, maintenance, management;

- the cost of objects of labor that were spent on production and household needs;

- depreciation of equipment, as well as premises, household equipment, etc.

NOTE! In these expenses, part is included in the cost directly (direct costs), and part is distributed indirectly.

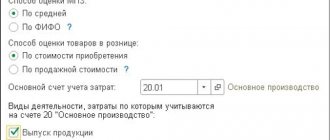

Accounts for accounting of production process

To maintain production records, an accountant will need several separate accounts:

- Account 20 “Main production”. During the reporting period, it accumulates the costs of manufacturing products included in the cost price, namely:

- cost of materials, raw materials;

- remuneration for the labor of workers participating in production;

- payments to various social funds;

- resource costs (water, electricity, etc.).

- Account 23 “Auxiliary production” collects the costs of those production structures that are not directly involved in the production of products, but provide and maintain the functioning of the main purpose. For example, these are the costs of maintaining your own boiler house, power plant, water pumping facilities, etc.

- Account 25 “General production expenses” associated with the use of equipment, machines and mechanisms. It reflects:

- funds for fuel and lubricants;

- depreciation of mechanisms, buildings, structures;

- maintenance costs;

- salaries for repairmen and adjusters;

- equipment testing;

- other similar costs.

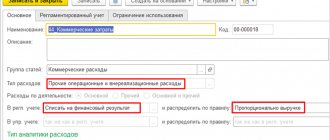

- Account 26 “General business expenses” records the areas of expenses that are designed to support the work of the entire enterprise, including management functions and implementation. These include the following types of costs:

- salaries and other payments to management employees;

- business trips;

- funds for equipping and repairing office premises;

- payment for stationery;

- communication and Internet services, etc.

- Account 28 “Manufacturing defects” is the “saddest” of the expense accounts, but, unfortunately, necessary. The cost of all substandard products, if subject to write-off, will be reflected in the debit of this account. If it is nevertheless sold, albeit at a discount, these funds will be used against the loan.

- Account 29 “Servicing industries and farms” shows the share of costs for maintaining activities not directly related to production:

- expenses for operating subsidiary workshops (sewing, repair, etc.);

- payment for internal canteens, buffets;

- costs for auxiliary facilities (baths, laundries, dormitories, etc.);

- departmental kindergartens, sanatoriums.

- Account 96 “Reserves for future expenses” accumulates expenses for the coming periods, including:

- vacation pay for workers;

- long-service benefits for production personnel;

- funds for repairs;

- money for preparatory measures to launch a new line or change seasonal production.

- Account 97 “Future expenses” – used when costs have already been incurred, but will have to be taken into account later. In the production process it reflects:

- exploration costs;

- prepayment for advertising, etc.;

- funds for the expansion of technological lines, new equipment, product range, etc.;

- licensing, certification.

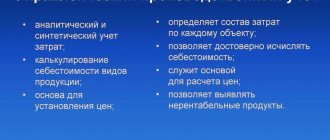

Consolidated production cost accounting

Consolidated accounting of production costs is a set of accounting and other operations for grouping the costs of manufacturing products according to expense items across the entire organization and its individual divisions, as well as the distribution of costs between unfinished and completed production.

Consolidated accounting and control of production costs is carried out on the basis of received and summarized information and data from primary documentation. Information from consolidated accounting forms the basis for calculating the cost of products. The accounting methodology is determined based on industry characteristics, production scale and technology.

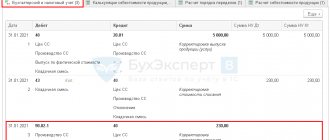

Direct costs are reflected on Dt account 20, indirect costs are reflected on collection and distribution accounts:

- Dt 25 “General production expenses”;

- Dt 26 “General business expenses.”

The costs of auxiliary production are included in account 23. Damage caused by defective products and all costs of correcting the defect during the warranty period are charged to account 28 and at the end of the reporting period are written off to account 20. At the end of the month, indirect costs are written off to 20, 23 or 29 accounts.

Based on the accounting methodology enshrined in the organization’s accounting policy, the cost of fully manufactured products is written off from the account. 20 to debit 43, 40 or 90 accounts. If there is unfinished production, a balance is formed on these accounts, which will reflect the number of unfinished objects at the end of the period.

Consolidated accounting of the costs of the production process is organized either using non-semi-finished or semi-finished methods.

The non-semi-finished method reflects cost accounting for each division or workshop, within which the costs of manufacturing products are calculated item by item, without grouping them into a separate item. The accounting department fully controls the movement of semi-finished products across departments and maintains proper operational accounting in kind.

The semi-finished method involves identifying the cost of semi-finished products, their value and movement through each department or workshop.

Principles of production cost accounting

- When reflecting cost data in accounting, you need to correlate their actual indicator with the planned one.

- When documenting costs that coincide with the planned ones and those incurred with deviations, they are reflected separately.

- The cost includes all costs of producing goods in the accounting period.

- Various accounting accounts combine expenses for certain objects and cost items.

- Cost accounting objects must clearly coincide with the calculation objects to correctly reflect the cost.

Automation of production accounting

Today there are many programs that allow you to automate production accounting. Thanks to a set of software tools, it becomes possible to record the parameters and state of economic objects, manage them, collect and accumulate data about processes and production objects.

To choose a production accounting automation program, you need to consider several nuances:

- Economic feasibility for a specific enterprise. To do this, you need to analyze many facts and parameters, so it is better to involve professionals.

- Analysis of the investment opportunities of the enterprise. To do this, one should proceed from a calculation of the cost-effectiveness of automation, as well as the profitability of implementing such a solution.

Automation of production accounting, depending on the selected program, allows you to:

- Maintain complete internal records of raw materials, partially finished and finished products in the warehouse. This item presupposes the availability of a detailed directory of materials and raw materials with classification, information about them at any period and moment, and the receipt of specific reporting (for example, on materials and raw materials, production, etc.).

- Create costing cards for each operation of the production process. This includes entering information on production operations into the database and storing it, the ability to set standard indicators (consumption of materials and raw materials, permissible deviations from the norm, production of finished products), accounting for additional costs, storing the entire history of making any changes to each technological map.

- Plan production, namely receive an automatic calculation of planned costs, take into account planned indicators, calculate the planned cost of manufactured products, plan purchases, plan any production processes for any period (short-, medium- and long-term).

- Keep actual records of production processes. This includes recording actual indicators, writing off materials and raw materials (carried out in accordance with data from technological maps), automatically filling in information on material consumption with the ability to adjust values, calculating the actual cost of production, comparing actual indicators with planned ones (this takes into account permissible deviations).

So, automation of production accounting allows you to perform many tasks. With her help:

- production of products is planned depending on the sales plan;

- the wages of company employees are calculated based on the number of shifts, accrued bonuses, output and other parameters;

- stocks of raw materials, materials and products in warehouses are optimized;

- production of product blanks is planned depending on the existing production plan for finished products;

- necessary materials and raw materials are purchased in a timely manner, etc.

A modern accounting automation system connects all elements of the production process into a single whole. Thanks to it, you don’t have to worry about the timing of product production, spend a lot of time on creating a purchase schedule, monitoring warehouse balances, distributing costs, accounting for labor costs and other processes. Everything is available in one interface.

Financial result of the production process

If you reduce the revenue received from the sale of goods by cost, the result will be a gross profit, which clearly reflects the efficiency of the enterprise.

Account 90 “Sales” reflects this result: if the credit is greater than the debit, we have a profit, the debit exceeds the credit, there are losses. The balance is displayed as follows:

- Reflection on the loan of the amount of proceeds from the sale of goods (with or without VAT - what methodology is adopted in the organization). This will require wiring:

- debit 62, credit 90.3 – cost accounting without VAT;

- debit 90.3, credit 68 – with value added tax.

- Calculating the cost of goods and writing it off from the appropriate accounts. Postings:

- debit 90.2, credit 20;

- debit 90.2, credit 23.

- The conclusion of the resulting balance on account 90 and 91 to account 99 “Profits and losses” is the final entry of the year, which will be reflected in the annual balance sheet.

IMPORTANT! If account 99 has a loan balance, it means the result is positive and the company has retained earnings at its disposal. When there is a debit balance, it is necessary to review the production and sales management policy.

Thus, accounting data becomes the basis for making vital decisions for the enterprise.