Forms of financial statements of organizations

The list of reports and their forms was approved by Order of the Ministry of Finance No. 66n “On the forms of financial reporting of organizations.” Also, when preparing financial statements, you should be guided by PBU 4/99.

Order No. 66n approves the forms of accounting statements of non-profit and commercial organizations. The reporting lists of both organizations are almost completely identical, but still have a number of differences.

Reporting forms for non-profit organizations

According to the Law “On Accounting”, the basic accounting statements of non-profit organizations generally include three forms:

- Balance sheet (OKUD 0710001) - it characterizes the financial condition, in it the NPO reflects the structure of its assets and liabilities in thousands of rubles;

- Report on the intended use of funds (OKUD 0710003) - in this report, NPOs show how and on what they spend received contributions and gratuitous receipts, this is important for monitoring their spending;

- Appendices contain explanations of individual balance sheet indicators and reports on the intended use of funds prepared by the NPO accountant.

Most NPOs have the right to conduct accounting and submit financial statements in a simplified form (clause 4, article 6 of the Federal Law of December 6, 2011 No. 402-FZ). That is, they include fewer indicators in the balance sheet and report on the intended use of funds than in standard forms.

Sometimes NPOs additionally submit a report on financial results (OKUD 0710002). This is necessary if during the reporting year the organization was engaged in entrepreneurial activities and received significant income from it, without which it is impossible to assess the financial position and results of the work of the NPO.

Reporting forms for commercial organizations

Commercial organizations have more accounting reports. All their forms are approved by the same order No. 66n:

- Balance sheet (OKUD 0710001) - reflects the structure of the organization’s assets and liabilities;

- Financial results report (OKUD 0710002) - shows what results the organization achieved during the year and what influenced them;

- Statement of changes in capital (OKUD 0710004) - includes data on net assets, capital movements and various adjustments;

- Cash flow report (OKUD 0710005) - shows how much money the organization received or spent as part of investing, financial and current activities;

- Explanations for reporting - explain individual indicators of the listed reports.

Some commercial organizations can also keep records and submit accounting reports in a simplified form. In particular, small businesses and Skolkovo have this right. Exceptions are listed in paragraph 5 of Art. 6 of the Law “On Accounting”.

In a simplified version, only the balance sheet and financial results report are included in the annual reporting. Other reports and explanations need not be prepared if there is no important information that should be reflected in them.

Federal and industry standards may provide for other forms of LLC accounting reporting. Other forms are used by insurance companies and non-state pension funds. For them, order No. 66n is not relevant.

Data from the financial statements of organizations are contained in GIRBO. Any organization on this resource can receive reports, explanations and an audit report for them.

Requirements for financial reporting forms of organizations

The Regulations on the Forms of Accounting Reports of Organizations PBU 4/99 establishes the composition, content and rules for drawing up reports. It should always be referred to when filling out accounting reporting forms.

Standard reporting requirements:

- use only Russian language;

- reflection of all numerical indicators in rubles;

- indicate amounts in thousands of rubles, rounding decimal places;

- put dashes in place of missing data;

- draw up a balance sheet in a net assessment;

- ensure comparability of reporting indicators for the current period with reports of previous periods.

Accounting should help users form a complete and reliable understanding of how things are going in the company: what is its financial position, results of operations. To do this, additional information is reflected in the explanations to the balance sheet or explanatory notes are drawn up.

The explanatory note is not part of the reporting and is not related to the numerical indicators in it. The note may contain development plans for the future, planned financial investments, and the dynamics of important indicators for a certain period.

When preparing reports, it should be emphasized that the explanatory note is not included in its composition. For this (clause 39 of PBU 4/99):

- do not leave references to the information contained in the note in the reporting;

- indicate the data in the note so that the wording does not imply a link to accounting.

Samples of accounting documents

The main document of the company is the accounting policy. It is compiled in the context of accounting and tax accounting and consolidates the primary forms and accounting registers used in the company. An appendix to the policy is the forms of the company’s final reporting to the owners and regulatory authorities.

The block of interim reporting documents includes a balance sheet and a statement of financial results. According to OKUD, these are unified accounting forms 0710001-0710002 OKEY 384. The package of financial reports for the tax period includes additional transcripts (forms 0710003-0710005) on changes in capital, cash flows, explanations and a free-form explanatory note.

Organization tax reporting forms

The composition of tax reporting for commercial and non-profit organizations is the same. It depends on the taxation system, whether the company has taxable objects and on the performance of certain actions.

Let's look at standard reporting forms for taxes and contributions:

| Tax/Contribution | Report form | Where and when to take it |

| Income tax | The declaration was approved by order of the Federal Tax Service dated September 23, 2019 No. ММВ-7-3/475 (as amended on October 5, 2021 No. ED-7-3/ [email protected] ) | Based on the results of the reporting period, the Federal Tax Service |

| Agricultural tax | The Unified Agricultural Tax declaration was approved by order of the Federal Tax Service dated July 28, 2014 No. ММВ-7-3/384 (as amended on December 18, 2020 No. ED-7-3/ [email protected] ) | Based on the results of the reporting year, the Federal Tax Service at the place of registration |

| Single tax according to the simplified tax system | The declaration under the simplified tax system was approved by order of the Federal Tax Service dated December 25, 2020 No. ED-7-3/958 | Based on the results of the reporting year, the Federal Tax Service at the place of registration |

| VAT | The VAT return was approved by order of the Federal Tax Service dated October 29, 2014 No. ММВ-7-3/558 (as amended on March 26, 2021 No. ED-7-3/ [email protected] ) | Every quarter at the Federal Tax Service at the place of registration, electronic form (for almost everyone) |

| Property tax | The declaration was approved by order of the Federal Tax Service dated August 14, 2019 No. SA-7-21/405 | At the end of the year, in the Federal Tax Service at the location of the property in the general case |

| Personal income tax | Calculation of 6-NDFL was approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/753 (as amended on September 28, 2021 No. ED-7-11 / [email protected] ) | Based on the results of the quarter, half a year, 9 months and a year to the tax office at the place of registration |

| Contributions to pension, health and social insurance | The DAM form was approved by order of the Federal Tax Service dated October 6, 2021 No. ED-7-11/ [email protected] (starting with the report for the 1st quarter of 2022) | Based on the results of the quarter, half a year, 9 months and a year to the tax office at the place of registration |

| Contributions for injuries | Calculation 4-FSS approved by Order of the FSS dated September 26, 2016 No. 381 | Based on the results of the quarter, half a year, 9 months and a year in the Social Insurance Fund at the place of registration |

The list of tax returns also depends on the type of activity of the organization:

In addition to the reports indicated in the table, LLCs can submit declarations on gambling tax, water tax, mineral extraction tax, etc.

Balance sheet with line codes - form and filling procedure

Accounting financial statements, the forms of which were approved by Order No. 66n dated July 2, 2010, include, first of all, the company’s balance sheet and the so-called Form 2 - financial results report. The form is provided for the reporting calendar year and contains essential information on items, the importance and detail of which is established by the organization independently.

Important! Small businesses have the right to provide reporting, including Form 1 accounting, in a simplified manner. This implies a lack of detail in articles, combining indicators and filling in aggregated elements.

Read also: Accounting statements of a small enterprise for 2018

The data required to be reflected in Form 1 of the financial statements, the form of which will need to be filled out at the end of the year and submitted to the tax office, is collected by codes and accounts in the table:

| Asset item | Accounts | Line code | Liability item | Accounts | Line code |

| Tangible non-current assets (VA) | The difference between 01 and 02; The difference between 03 and 02; Accounts 07, 08 | 1150 | Capital, reserves | Account 80, 81, 82, 83, 84, 99 | 1310 |

| Financial, intangible, other VA | The difference between 04 and 05; Accounts 09, 08 (minerals), 55.3, 60, 73; The difference between 58 and 59 (in the long-term part) | 1110 | Long-term borrowed funds | Account 67 | 1410 |

| Reserves | Account 10, 11, 20, 23, 21, 29, 41, 43, 44, 46, 45, 16, 15, 97, 19 | 1210 | Other long-term liabilities | Account 60, 62, 73, 75, 76, 96 | 1450 |

| Cash equivalents and funds | Account 50, 51, 52, 55, 57 | 1250 | Short-term borrowed funds | Account 66 | 1510 |

| Financial and other current assets (OA) | Account 55, 58 and 59 (short term), 73, 60, 62, 68, 69, 71, 73, 75, 76, 50, 76, 94 | 1240 | Accounts payable | Account 60,62, 68, 69, 70, 70, 71, 73, 75, 76 | 1520 |

| — | — | — | Other accounts payable | Account 79 (trust management agreements), 96, 98 | 1550 |

| Total balance sheet asset line 1600 | Amounts on line 1150 + 1110 + 1210 + 1250 + 1240 | Total balance sheet liabilities line 1700 | Amounts on line 1310 + 1410 + 1450 + 1510 + 1520 + 1550 | ||

Reporting forms for employees in the Pension Fund of Russia

In addition to reports on the employees indicated in the table (DAM, 6-NDFL and 4-FSS), organizations report on the labor activities of employees to the Pension Fund of the Russian Federation. Reporting includes three forms:

- SZV-M is a monthly report that allows the Pension Fund to keep records of insured persons. Employers submit it before the 15th day of the month following the reporting month, in the form approved by Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103P.

- SZV-TD is a regular report that is submitted for each employee in the event of a personnel event (hiring, dismissal, transfer to another position, choice of work record form, etc.). The form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 25, 2017 No. 730P.

- SZV-STAZH is an annual report on employee experience, which employers submit before March 1. The form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507P.

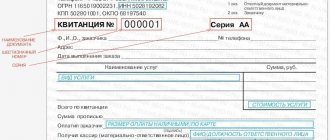

Strict reporting forms

Strict reporting forms (SRF) are not submitted anywhere, but are stored in the organization. They differ in that they are in paper form and are a unit of accounting, but do not relate to monetary documents and cannot be accounted for as liabilities or assets.

An example of BSO can be forms of work books and inserts for them, gift certificates, receipt and check books, vouchers from the Social Insurance Fund, printing BSO. A separate category is BSO documents that replace a cash receipt.

The storage of strict reporting forms in the organization is regulated by the regulations on documents and document flow. The shelf life depends on the type of BSO.

Electronic reporting of organizations

Some categories of taxpayers retain the right to submit reports on paper, but most reports are accepted by regulatory authorities only in electronic form.

For example, only those organizations in which the average number of employees is 10 or less people have the right to submit 6-NDFL and DAM on paper. The 4-FSS report can be submitted on paper if the number of employees does not exceed 25 people, and for reports to the Pension Fund the limit is 24 people. All other employers submit only electronic reporting.

From January 1, 2022, the electronic form is also required for reporting to Rosstat.

Kaluga Astral offers clients several services for submitting electronic reports. “Astral Report 5.0” is a convenient online service, “Astral Report 4.5” is a PC program that has everything for submitting reports online, and “1C-Reporting” can be used in the familiar 1C interface.

Composition of simplified accounting statements for 2021

The current forms of financial statements that must be used to report for 2022 are given in Order of the Ministry of Finance dated July 2, 2010 No. 66n (as amended on April 19, 2019). Further we will refer to it as Order No. 66n.

Forms for simplified financial statements are given in the Order in Appendix No. 5.

Mandatory composition of simplified accounting statements

The set of simplified reporting for 2022 for commercial organizations must include a Balance Sheet and a Statement of Financial Results.

Non-profit companies, as part of their annual simplified financial statements, prepare and submit a Balance Sheet and a Report on the Purposeful Use of Funds.

The remaining forms are filled out and submitted as necessary or as decided by the organization.

Expanded composition of simplified accounting

In some cases, a company may supplement its simplified reporting. Each company decides individually whether or not to include “for large” forms in accounting reports - for example, an Appendix to the balance sheet, a Statement of Changes in Equity or a Statement of Cash Flows.

The reason for such inclusion is always the need to provide important information in additional forms, without knowledge of which it is impossible to correctly assess the financial position of the organization and/or the financial results of its activities.

If a company includes additional forms in its reporting set and at the same time has the right to prepare simplified reporting, it can generate accounting reports in a reduced volume. This means taking the usual forms from the full reporting set, but only in the required composition. For example: Balance sheet + Financial results + Statement of capital flows.

An organization that has the right to prepare simplified reporting can also fill out such forms with simplifications. For example, only for groups of articles without detailed indicators. The only rule is that the reporting must ultimately contain all the necessary information to assess the financial position and results of the organization.

Explanations for simplified financial statements

Explanations for accounting statements are additional information about the indicators included in these statements.

An explanatory note is a document with information not directly related to reporting indicators, which, nevertheless, they want to communicate to users.

In 2022 with financial statements based on the results of 2022:

- There is no need to submit an explanatory note. Whether to do it or not is entirely at the discretion of the organization.

- Explanations to the financial statements must be included in the reporting. Otherwise, accounting records may be considered incomplete (clauses 3 and 4 of Order No. 66n). Moreover, in Order No. 66n, in terms of explanations, there is no division between “general” reporting and simplified reporting. Therefore, we can conclude that those taking the simplified version still need to make some explanations.

But what and to what extent will be included in the explanations to the financial statements for 2022 is also something that the reporting company itself has the right to decide.