Labor Code of the Russian Federation on part-time work

The terms “rate” or “0.5 rate” do not appear in the Labor Code of the Russian Federation. In practice, the rate is usually called the normal working time - no more than 40 hours per week (Part 2 of Article 91 of the Labor Code of the Russian Federation).

Everything that is less than the specified norm (including work at 0.5 times the rate) is designated in the Labor Code of the Russian Federation as part-time work (ILO Convention No. 175 of June 24, 1994 “On Part-Time Work”, Art. 93 Labor Code of the Russian Federation, letters of Rostrud dated 06/08/2007 No. 1619-6, dated 06/24/2009 No. 1819-6-1).

When can you transfer an employee to 0.5 rates?

Such a transfer is acceptable upon entry to work or at any time during the period of employment. When transferring to 0.5 rates, not everything depends on the employer and employee - labor legislation imposes certain restrictions:

- establishes categories of employees for whom the employer cannot refuse a request for transfer to part-time (Part 2 of Article 93 of the Labor Code of the Russian Federation);

- stipulates the conditions and circumstances of the legal transfer of employees to part-time work at the initiative of the employer (Article 74 of the Labor Code of the Russian Federation).

According to labor legislation, transferring an employee to part-time work is possible:

- At the initiative of the employee

In addition, the employer does not have the right to refuse to change the essential terms of the employment contract to an employee who submits a medical report and an application for light work in connection with pregnancy (Part 1 of Article 254 of the Labor Code of the Russian Federation).

- At the initiative of the employer

If one of the conditions is not met, unilaterally transferring employees to part-time status (without their written consent) will be illegal.

The criteria for mass layoffs are determined in industry and (or) territorial tariff agreements or according to Government Decree No. 99 of 02/05/1993 (based on the number of workers laid off due to the liquidation of enterprises or a reduction in the number or staff of employees for a certain calendar period).

Instructions for filling out an order for transfer to full time in 2022

As already noted, the order to transfer a subordinate to a full-time position does not have an approved template. It can be compiled in any style on a standard A4 sheet of paper or on company letterhead.

When creating such an administrative document, you will need to display the following information in it:

1) The full name of the enterprise with the designation of its details (TIN, OGRN, legal address of registration). If the order is filled out on company letterhead, this item can be skipped, since it already displays the company details.

2) The name of the form is “Order”, with a number assigned to it.

3) Place and date of formation of the order.

4) The subject of the order, in this version: “On transfer to …”.

5) The administrative part of the form begins with the word “I order” and then the following data is required to be displayed:

- Date of transfer of the specialist to labor relations.

- FULL NAME. and the position of the subordinate who is being transferred.

- Daily routine under new mutual cooperation.

- Salary amount for new cooperation.

- Link to the staffing table of the enterprise on the basis of which the transfer is carried out.

6) In the next paragraph of the order, the position and full name are noted. official who is entrusted with control over the execution of the order. As a rule, this is assigned to Ch. company accountant.

7) Next, the order must indicate the basis that served for the publication of such an order. This may be a statement from the employee or a notification to management followed by the consent of the subordinate.

Then the document is signed by the director of the company, after which the persons noted in the order must sign the order to familiarize themselves with the administrative document.

After the order is published, the specialist begins to perform new duties from the date indicated in the order.

Sample order for transfer to full time in 2022

and sample

- Form, doc

- Sample, doc

For how long can a part-time transfer be possible?

Here it all depends on who initiated the transfer of the employee to 0.5 rates:

- The initiator of the transfer is the employee himself

The period of work in this mode can be any, including indefinite (part 1 of article 93 of the Labor Code of the Russian Federation).

There is one exception in relation to employees transferred at a personal request to 0.5 rates and belonging to the category of employees who cannot be denied this. The period of their work in part-time mode is limited to the period of preferential circumstances (Part 2 of Article 93 of the Labor Code of the Russian Federation).

The employer may agree to such employees a longer period of part-time work, although it is not obligated to do so. Such employees have the right to abandon the established regime ahead of schedule, and the employer cannot prevent them from doing so - since according to the Labor Code of the Russian Federation, the employer’s consent to the establishment of a special regime is not required, it means that it is not necessary to cancel it (Part 2 of Article 57, Art. 72, part 1 of article 93 of the Labor Code of the Russian Federation).

- The initiator of the transfer is the employer

If the employer unilaterally transferred workers to part-time to prevent mass layoffs, the period of work in this mode cannot exceed 6 months (Part 5 of Article 74 of the Labor Code of the Russian Federation).

Within this six-month period, a specific length of working time (week, day, shift) must be established. After this period, employees must be transferred to the previous regime. Cancellation of the part-time work regime before the expiration of the period for which it was established is carried out taking into account the opinion of the trade union.

Salary and vacation under the new work schedule

Part-time work does not limit the employee’s rights. He can still count (Part 4 of Article 93 of the Labor Code of the Russian Federation, Letter of the Ministry of Labor dated October 25, 2018 No. 14-2/OOG-8519):

- for annual paid leave, the duration of which does not change due to a decrease in hours worked;

- calculation of length of service in the usual manner and full compliance with other labor rights.

The salary for part-time work is calculated in proportion to the time worked or depending on the amount of work performed (Part 3 of Article 93 of the Labor Code of the Russian Federation). The salary in such a situation is calculated according to the rule - if an employee works part-time, then it is assumed that he works half the normal working time.

Example. The salary of the accountant of Progress LLC Tomilina N. E. is 32,000 rubles. From July 2022, at her personal request, expressed in the application, the employee was transferred to part-time work at 0.5 times the rate.

From now on, her monthly salary will be:

32,000 rub. x 4 hours /8 o'clock = 16,000 rub.

or

32,000 rub. x 0.5 bet = 16,000 rub.

The introduction of a part-time working regime does not entail changes in the staffing table in terms of the initially established salaries.

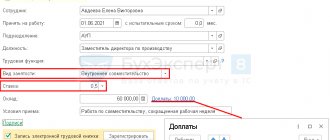

We arrange a transfer of 0.5 rates at the request of the employee

For personnel records management, transferring an employee to part-time work is a change in the terms of the employment contract previously determined by the parties.

How to formalize such a personnel event depends on who initiated the transfer. If an employee makes such a request to the employer, the following documents are usually needed to document the transfer:

- Written statement from the employee.

The law does not require a written form of the application, but if something happens it will confirm the fact of the employee’s personal request for a transfer to 0.5 rates and the absence of coercion on the part of the employer.

- Additional agreement to the employment contract according to the provisions of Art. 72 Labor Code of the Russian Federation.

Draw it up in two copies in any form indicating the working hours (at 0.5 times the rate), the period for which part-time working hours are introduced, the procedure for remuneration and the date of entry into force of the changes.

For what to write in the text of the agreement, see the example:

Since the employee transferred to part-time will work no more than 4 hours a day, he may not be provided with a lunch break (Part 2 of Article 57, Part 1 of Article 100, Part 1 of Article 108 of the Labor Code of the Russian Federation).

- An order to transfer an employee to 0.5 rates (it is advisable to issue, but not necessary).

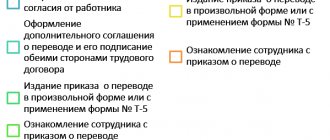

How to arrange a transfer at the request of an employee

Both the employee and the employer have the right to initiate the transition of an employee to full-time work. The instructions depend on this. Here's how to transfer an employee to full-time if the initiator is the employee:

Step 1. An official application is submitted to the employer with a request to transfer to full time.

Step 2. If the employer accepts the offer, he draws up:

- agreement to change the terms of the employment contract;

- order to change the rate.

Additional entries are not made in the work book, because the employee remains in his previous position.

After the order is issued, the employee goes out for a full day.

What documents should I prepare if the initiator of the transfer is the employer?

Let us recall that the part-time regime can be introduced by the employer solely under the circumstances provided for in Art. 74 Labor Code of the Russian Federation.

The package of documents will be as follows:

- Employees should be given written notices no later than 2 months before the introduction of the new regime (Part 2 of Article 74 of the Labor Code of the Russian Federation).

- If the employee agrees, enter into an additional agreement with him or her to the employment contract. In case of disagreement, the employment contract is terminated after 2 months due to a reduction in the number or staff (part 6 of article 74, clause 2 of part 1 of article 81 of the Labor Code of the Russian Federation).

- Issue an order on the introduction of part-time working hours, in which you specify from what date and for what period the regime will be introduced, for which employees, as well as other nuances that will help HR officers to correctly formalize the change in labor relations, and the accounting department to pay employees.

Don’t forget to also send a notification to the employment service (we’ll talk about this later).

Order form

The existing legislation of the Russian Federation does not provide for a unified form of order to transfer an employee to full-time mode. This form is filled out in a free style, in compliance with generally accepted rules in office work.

The main condition when generating such an order is to display the following information:

- Name of the enterprise.

- Order number.

- Place and date of its compilation.

- The name of the form, in this case: “Order for transfer ...”.

- The start date of the subordinate's transition to new working conditions.

- FULL NAME. transferred person.

- Working hours.

- The position to which the employee is transferred.

- FULL NAME. and the position of the person entrusted with monitoring the execution of the order.

- Signature of the director of the company.

- Signature of the employee for whom the transfer was made.

Transfer procedure

The transfer of a subordinate to a full-time position must be carried out in accordance with the requirements of the Labor Code of the Russian Federation, as well as approved internal departmental regulations.

If the initiator of the transfer is management, then it is obliged to notify the employee in writing and obtain his consent. Notification must be sent no later than 2 months before the transfer of the specialist. At the same time, if there is a trusting relationship between the director of the company and the specialist, then such a formality can be ignored. Oral consent for the transfer will be sufficient, without written notification.

Thus, based on the legislative norms of the Russian Federation, the procedure for transferring a subordinate to full-time work consists of the following stages:

- Sending a letter to a specialist about transfer to full-time, at the initiative of the employer.

- Obtain the written consent of the employee or submit an application if the employee himself takes the initiative.

- Signing additional agreements with the TD, where it is necessary to specify new working conditions, reflecting his new responsibilities, date of transfer, salary, working hours and other requirements.

- Publication of the order.

- Written familiarization of the employee with the order.

Note : The listed steps do not require breaking the previous AP. The additional conclusion is sufficient. agreements. At the same time, if a specialist insists on a new TD, then the employer is obliged to satisfy the specialist’s desire.

Employment service notification

The employer is obliged to notify the employment service in writing about the introduction of a part-time working regime, including when transferring employees to 0.5 wages, within 3 working days after the decision is made to carry out the relevant measures (Clause 2 of Article 25 of the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On employment in the Russian Federation”).

Such information is mandatory if the transfer of employees to 0.5 rates is established at the initiative of the employer - in accordance with Art. 74 Labor Code of the Russian Federation.

The form of notification for such situations is not officially established, that is, it is arbitrary. The main thing is that the notification makes it clear who submitted it and when the decision was made to introduce part-time working hours.

If the employee himself asked the employer for a part-time transfer and received his consent, there is no need to notify the employment service (Rostrud Letter No. 1329-6-1 dated May 17, 2011).

Documenting

First of all, an additional agreement is drawn up on the establishment of part-time work to the contract previously concluded between the parties to the labor relationship. It must specify new working conditions - duration of working hours, work schedule, rest time.

All labor rights of an employee transferred to a share of the rate are retained in full. That is, he has the right to count on full vacation, accrual of seniority , and so on. A provision regarding this is also included in the additional agreement.

It would be advisable to state in the document that all other provisions of the employment contract remain unchanged, as well as the date from which the additional agreement is valid.

Next, an order is issued to establish part-time work . It reflects the new working conditions. In addition, you need to indicate the basis for the order - this is an additional agreement to the employment contract, which is mentioned above. Also in the order it is necessary to give instructions to responsible persons related to the transfer of the employee to part-time work. Typically, the accountant is tasked with recalculating wages based on part-time work, and the personnel officer is tasked with bringing the order to the attention of the employee and obtaining his signature.

An example order form is presented below:

» data-medium-file=»https://kontursverka.ru/wp-content/uploads/2018/09/prikaz-1-300×216.jpg» data-large-file=»https://kontursverka.ru /wp-content/uploads/2018/09/prikaz-1.jpg" loading="lazy" class="wp-image-7511 size-full" title="Sample order" src="https://kontursverka.ru /wp-content/uploads/2018/09/prikaz-1.jpg" alt="Order to transfer to a share of the rate" width="751″ height="540″ srcset="https://kontursverka.ru/wp- content/uploads/2018/09/prikaz-1.jpg 751w, https://kontursverka.ru/wp-content/uploads/2018/09/prikaz-1-300×216.jpg 300w" sizes="(max- width: 751px) 100vw, 751px" /> Sample order for transfer to a share of the rate

Note to the employer

Transferring an employee to 0.5 rate may raise many questions. We answered some of them in our material. We will briefly discuss other possible nuances below:

Personnel and organizational issues

| Question | Answer | Rationale |

| Is it necessary to make an entry in the work book about transferring an employee to 0.5 rates? | No | Such an entry is not provided for by the rules for maintaining a work book (Part 4 of Article 66 of the Labor Code of the Russian Federation, clause 4 of the Rules for maintaining and storing work books, approved by Government Resolution No. 225 of April 16, 2003) |

| Is the transfer of a part-time employee reflected in SZV-TD ? | No | Such a personnel event as transferring an employee to part-time work is not included in the list of events reflected in the SZV-TD (Procedure for filling out the SZV-TD, approved by Resolution of the Board of the Pension Fund of December 25, 2019 No. 730p) |

| When transferring employees to 0.5 rates, is it necessary to make changes to the working hours in the PVTR ? | Yes | If you change the working hours for the organization as a whole or for a structural unit (Part 1 of Article 100 of the Labor Code of the Russian Federation) |

| No | If the changes are caused by the personal request of individual employees and are introduced temporarily | |

| Can an employer introduce part-time work due to difficult financial situation ? | No | Such a translation will be illegal, as it contradicts Art. 74 Labor Code of the Russian Federation. Payment to employees for the time when they were deprived of the opportunity to work should be made as for downtime due to the fault of the employer, and paid in the amount of at least 2/3 of the average salary of the employee (Article 72.2 of the Labor Code of the Russian Federation) |

Salary nuances

| Question | Answer and link to the normative act |

| How to calculate insurance premiums at reduced rates if an employee transferred to part-time work is 0.5 times less than the minimum wage? | In order to apply the reduced rates of insurance premiums established by Law No. 102-FZ dated April 1, 2020, the total amount of payments to the employee for the month is taken into account, which exceeds the minimum wage, regardless of the rate at which the employee works |

| How to calculate the average salary for an employee transferred to 0.5 rates? | Average earnings are calculated according to the general rule - the average daily earnings are used, calculated by dividing the amount of wages actually accrued for days worked in the billing period (including bonuses and remunerations) by the number of days actually worked during this period. The average earnings of an employee are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to (clause 9 of the Regulations, approved by Government Decree No. 922 of December 24, 2007) |

| How to pay an employee transferred to 0.5 rates beyond the duration of his working day ? | For an employee transferred to 0.5 rates, such work will be considered overtime, which must be paid at one and a half or double times (Article 152 of the Labor Code of the Russian Federation) |