Which OKVED codes do not fall under the simplified tax system?

Some types of activities prescribed in paragraph 3 of Art.

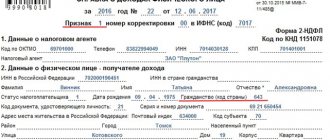

346.12 of the Tax Code of the Russian Federation is one of the grounds limiting the use of the simplified tax system. All types of activities have a digital code (OKVED), given in the corresponding classifier. Today, the classifier OKVED 2 OK 029-2014 (NACE rev. 2) is used, approved by order of Rosstandart dated January 31, 2014 No. 14-st. But for some taxpayers, the old OK 029-2001 (NACE rev. 1), approved by Decree of the State Standard of the Russian Federation dated November 6, 2001 No. 454-st, is still relevant. Despite the fact that it has not been in effect since the beginning of 2022, many documents (for example, an information letter from the State Statistics Committee or an extract from the Unified State Register of Legal Entities (if there was no need to obtain a fresh one) still contain the codes of the old classifier. From July 11, 2016, registration of legal entities and IP was carried out with the assignment of codes from the new directory, and before this date - old codes (letter of the Federal Tax Service of Russia dated June 24, 2016 No. GD-4-14 / [email protected] ). The correspondence between the new and old codes must be looked for on the website of the Ministry of Economic Development of Russia at address https://economy.gov.ru/minec/activity/sections/classificators/.

Advisor to the State Civil Service of the Russian Federation, 1st class, S. N. Shalyaev explained in relation to which OKVED codes it is legal to use the simplified tax system. Find out the official's answer in ConsultantPlus. And if you don’t have access to the K+ system, get a trial demo access for free.

According to the provisions of paragraph 3 of Chapter. 26.2 of the Tax Code of the Russian Federation, payers do not have the opportunity to use the special regime of the simplified tax system for the following OKVED codes:

| Old classifier | New classifier | Decoding the code |

| 65.21; 65.22; 65.23 | 64.91; 64.92; 64.99 | Codes related to banking activities |

| 66.01–66.03 | 65.11; 65.30; 65.12 | Insurance activities (except for insurance brokers and agents) and non-state pension provision |

| 67.12 | 66.12 | Transactions with securities |

| 64.30 | 64.30 | Investment activities |

| 65.22.6 | 64.92.6 | Carrying out pawnshop activities |

| 92.71 | 92.1 | Gambling business |

When selling excisable goods and minerals, OKVED is determined depending on the type of product. There are restrictions for privately practicing notaries and lawyers, as well as for agricultural enterprises, but they rather relate not to the OKVED codes themselves, but to the nature of the activities of such companies.

Thus, the question “Which OKVEDs fall under the simplified tax system?” can be answered this way: if the type of activity is not listed in clause 3 of Art. 346.12 of the Tax Code of the Russian Federation, which means that this special regime applies to him.

Our special service will help you choose the right OKVED codes.

You just need to type the keyword for the type of activity and click on the magnifying glass, the system will give you a list of the most suitable OKVED 2 codes.

By going to the next tab, you can use a ready-made set of codes and select the most suitable one.

For information on how to correctly indicate the OKVED code, see the material “Nuances of the procedure for drawing up and submitting an income tax return .

OKVED codes that allow you to conduct activities on the simplified tax system

As mentioned earlier, when registering an LLC, JSC or individual entrepreneur, codes from the OKVED classifier are indicated in the application. They allow you to have a clear picture of the organization's activities. However, they can also be indicated in any “fire” case. Therefore, it is necessary to know which OKVED codes fall under the simplified tax system.

Let's understand the legislation.

The application of the simplified taxation system is regulated by the Tax Code of the Russian Federation, namely its Chapter 26.2. However, it does not list the OKVED codes for which the simplified tax system is allowed to be used.

Important ! There is no restriction on the use of the simplified tax system specifically according to OKVED as such. The only legislative act limiting the application of the simplified tax system by type of activity is Article 346.12 of the Tax Code of Russia.

Since the above article provides a small but exclusive list of organizations whose activities are prohibited by the use of the simplified tax system, it is easier to name the OKVED codes under which this list fits.

Under which OKVED do insurance premium benefits apply to payers on the simplified tax system?

Reduced insurance premium rates of 20% for compulsory health insurance and 0% for compulsory medical insurance and compulsory social insurance in 2021-2022 can be applied by non-profit and charitable organizations using the simplified tax system.

If a taxpayer using the simplified tax system is a small business, he has the right to apply reduced insurance contribution rates in the amount of 15% of employee salaries exceeding the minimum wage. Read more about the reduced tariffs and the procedure for filling out the ERSV with such contributions here.

All other simplifiers pay insurance premiums according to the general rules.

Let us recall, taking into account the provisions of sub-clause. 5 p. 1 art. 427 of the Tax Code of the Russian Federation until the end of 2018, individual entrepreneurs and enterprises could make calculations at preferential rates of insurance premiums according to the following, for example, OKVED:

| Old classifier | New classifier | Decoding |

| 15.1–15.8 | 10.1–10.8 | Food manufacturing activities |

| 24 | 20 | Chemical production |

| 73 | 72 | R&D activities |

| 80 | 85 | Educational activities |

| 85 | 86-88 | Activities in the field of social security and health care |

| 45 | 41 | Construction |

| 15.98 | 11.07 | Production of mineral waters and other non-alcoholic drinks |

| 17, 18 | 13, 14 | Textile and clothing production |

| 19 | 15 | Manufacturing of leather, leather products and footwear |

| 20 | 16 | Wood processing and production of wood products |

| 25 | 22 | Manufacturing of rubber and plastic products |

| 26 | 23 | Manufacture of other non-metallic mineral products |

| 28 | 25 | Manufacturing of finished metal products |

| 29 | 28 | Manufacturing of machinery and equipment |

| 30-33 | 28.23; 26.2; 27; 26; 32 | Manufacturing of electrical equipment, electronic and optical equipment |

| 34, 35 | 29 | Manufacturing of vehicles and equipment |

| 36.1 | 30 | Furniture making |

| 36.4 | 32.3 | Manufacturing of sporting goods |

| 36.5 | 32.4 | Making games and toys |

| 37 | 38 | Processing of recyclable materials |

| 60-64.0 | 49-53 | Activities in the field of transport services and communications |

| 92.61 | 93.11 | Activities of sports facilities |

| 92.62 | 93.19 | Other sports activities |

| 52.31-52.32 | 47.73; 47.74 | Retail trade in pharmaceutical and medical goods, orthopedic products |

| 50.2 | 45.2 | Vehicle maintenance and repair |

| 90 | 37 | Removal of waste water, waste, other similar activities |

| 93 | 96 | Providing personal services |

| 21 | 17 | Production of cellulose, wood pulp, paper, cardboard and products made from them |

| 36.3 | 32.2 | Making musical instruments |

| 36.6 | 32.9 | Other activities |

A complete list of activities “preferential” in terms of insurance premiums is contained in subparagraph. 5 p. 1 art. 427 Tax Code of the Russian Federation.

In 2022, for preferential activities, contributions to compulsory health insurance were accrued at a rate of 20%, but compulsory medical insurance and VNiM insurance were not paid. But since 2019, this benefit has ended, and simplified workers (with a few exceptions) must pay contributions at general rates.

Read more about the amounts of reduced insurance premiums here.

Read about general insurance premium rates in this material.

Benefits for the simplified tax system according to certain OKVED

When registering an organization, determining the main type of activity and indicating additional ones, according to the OKVED directory, is very important. The whole point is that this or that activity can contribute to the establishment for the organization of both higher tax rates and benefits for certain types of taxes.

As for the simplified tax system, the correct definition of types of activities according to OKVED is also necessary here, since in different regions of the country there are more lenient tax conditions. For example, for construction companies in some areas there is a tax rate under the simplified tax system Income minus expenses equal to 5%, which is a significant argument in favor of developing a construction business and applying this tax.

Preferential conditions for insurance premiums under the simplified tax system also depend on the applied OKVED codes. For example, the following organizations on the simplified tax system can apply insurance benefits:

- Manufacturers of food products (OKVED codes: 10.01 – 10.08);

- Educational institutions (OKVED code – 85);

- Construction organizations (OKVED code – 41);

- Representatives of the chemical industry (OKVED code – 20)

- Processors of recyclable materials (OKVED code – 38);

- Sports organizations (OKVED codes: 93.11 and 93.19).

Only part of the OKVED preferential codes for insurance is listed above. A complete list of them is provided in the Tax Code of the Russian Federation, namely in subparagraph 5 of paragraph 1 of Article 427.

Results

We looked at OKVED codes that you need to pay attention to if an individual entrepreneur or organization plans to switch to the simplified tax system. In addition, charitable organizations and NPOs need to calculate the share of income for certain types of activities in order to take advantage of the benefits provided for by current legislation.

Sources:

- Tax Code of the Russian Federation

- Order of Rosstandart dated January 31, 2014 No. 14-st

- Letter of the Federal Tax Service of Russia dated June 24, 2016 No. GD-4-14/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The published letter from the Russian Ministry of Finance is devoted to the moment from which the simplified tax system can be applied. It varies depending on the time of creation of the organization and registration of the individual entrepreneur.

If the company is newly created

So, for a newly created company or a newly registered individual entrepreneur, this moment is the day of registration with the tax service.

The fact is that the persons mentioned are recognized as taxpayers of the simplified tax system from the date on which they registered for tax purposes. This date is reflected in the corresponding certificate. Of course, if a newly created company or a newly registered individual entrepreneur has notified the tax service about the transition to the simplified tax system. And they did this no later than 30 calendar days. The countdown is also carried out from the date of registration with the Federal Tax Service. These are the provisions of paragraph 2 of Article 346.13 of the Tax Code of the Russian Federation.

Here it should be borne in mind that when a company of one type is transformed into a company of another type (for example, when the organizational and legal form is changed, for example, from JSC to LLC), a new legal entity arises. It has the right, within 30 calendar days, to declare a transition to the simplified tax system, which will take place from the moment it is registered with the Federal Tax Service (letter of the Ministry of Finance of Russia dated February 24, 2014 No. 03-11-06/2/7608).

If the company has been around for a long time

Let's say the company has been around for a long time. Then she can begin to apply the simplified tax system only from January 1 of the calendar year following the year of the decision to switch to the said special regime. It should notify the tax service of such a change in the taxation regime no later than December 31 of the calendar year in which the desire to apply the simplified tax system arose. This also applies to individual entrepreneurs who have been operating for several years. These are the provisions of paragraph 1 of Article 346.13 of the Tax Code of the Russian Federation.

In the published letter, the Russian Ministry of Finance also drew attention to the fact that it is impossible to make the transition to the simplified tax system within a year due to the emergence of new types of business activities. After all, the provisions of Chapter 26.2 of the Tax Code of the Russian Federation do not establish such a possibility. Thus, firms and individual entrepreneurs who have begun to engage in new types of activities can switch to the simplified tax system only from the beginning of the next calendar year.

If the company has ceased to be a UTII taxpayer

Let us note that according to paragraph 2 of paragraph 2 of Article 346.13 of the Tax Code of the Russian Federation, firms and individual entrepreneurs who have ceased to be UTII taxpayers have the right, on the basis of a notification, to switch to the simplified tax system from the beginning of the month in which their obligation to pay the single tax on imputed income was terminated .

According to the explanations of the Federal Tax Service of Russia in letter No. ED-3-3/ [email protected] , this is possible in the following cases:

- the regulatory legal act of the representative bodies of municipal districts and city districts, the laws of the federal cities of Moscow and St. Petersburg on the taxation system in the form of a single tax on imputed income abolished UTII in relation to the type of business activity in which the taxpayer is engaged;

- the taxpayer stopped conducting activities subject to UTII taxation during the calendar year and began to carry out any other type of activity, whether or not subject to UTII taxation.

If a company paying UTII has changed its physical indicator

Let’s say a company has ceased to be a UTII taxpayer due to a change in a physical indicator (for example, an increase in the area of the sales floor). Then it should switch to a common taxation system. The transition to the simplified tax system is possible for her only from the beginning of the new calendar year.

The situation is different when a company is engaged in several types of activities and combines UTII with the simplified tax system. After all, then, if during a quarter the right to apply a special regime in the form of UTII in relation to certain types of activities is lost in connection with exceeding the limits of physical indicators, she can apply the simplified tax system in relation to this activity from the month in which such a violation occurred. Of course, subject to the restrictions established by Chapter 26.2 of the Tax Code of the Russian Federation. Similar explanations are given in letters of the Ministry of Finance of Russia dated 08.08.2013 No. 03-11-06/2/32078, dated 10.06.2013 No. 03-11-09/44.