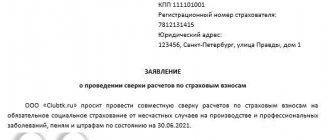

What insurance contributions does the employer pay? The employer pays four types of contributions from payments to employees:

Overdraft is a type of bank loan. With it, an organization can spend money, even

The concept of factoring First of all, let's give a definition of factoring. Modern economic dictionary (Raizberg B. A., Lozovsky

Why and who needs it? Every manager wants to know whether he is spending money in vain.

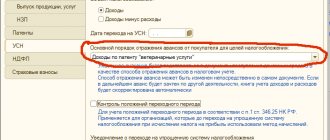

Changing the tax regime is very popular: work on OSNO is complex and time-consuming, and control

Primary: NU According to Article 265 of the Tax Code, expenses must be documented. Under documented

How to calculate the simplified tax system “income” To calculate the simplified tax system tax, the taxpayer who has selected the object “income” should

How inventory is carried out First, let's look at the question of how companies inventory fixed assets and

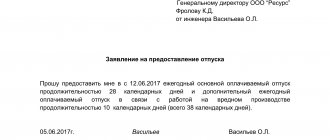

When to write a vacation application A vacation application must be written in the following cases:

When sending an employee on a business trip, the company must provide him with money to cover the necessary expenses. TO