What insurance premiums does the employer pay?

The employer pays four types of social insurance contributions from payments to employees:

- pension;

- medical;

- in case of temporary disability;

- from accidents at work.

For the first three, the procedure and terms for calculating insurance premiums are regulated from 01/01/2017 by Chapter 34 of the Tax Code of the Russian Federation. Previously, the correctness of their payment by payers was monitored by the Pension Fund (OPS and Compulsory Medical Insurance) and the Social Insurance Fund (social contributions for VNiM).

IMPORTANT!

Since 2022, control over payments has been transferred to the Federal Tax Service. To request a reconciliation with the Pension Fund of Russia, you must contact the tax office at the place of registration of the company.

Contributions for injuries are administered by the Social Insurance Fund according to the rules of Federal Law No. 125-FZ of July 24, 1998. To check mutual settlements, you must contact the Social Insurance Fund.

Read more about social contributions paid by employers.

What data does it contain?

To draw up a reconciliation report on insurance payments, the unified form 21-PFR is used.

It was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 511 dated December 22, 2015. What is a sample reconciliation report with the Pension Fund in 2020?

The upper part of the first page of the form contains the document details, namely:

| Name of control body | For payment of insurance premiums |

| Full name of the organization | Or full name entrepreneur (individual) |

| Registration number | At the regulatory authority |

| Legal address of the organization | Or address of permanent residence of an individual entrepreneur or individual |

Next is the title of the document. The date of drawing up the act and its registration number are indicated under the heading.

The following information identifies the parties, in particular:

| Position of the Foundation representative | His full name and contact details |

| Last name, first name and patronymic of the payer | Head of the organization, individual entrepreneur, individual with telephone number |

The following is a description of the procedure. It is indicated that the parties carried out a joint verification of calculations for insurance contributions for compulsory pension insurance in the Pension Fund for the period from ___ to ___ as of ___.

The next stage of filling out is filling out a special table on the second or third pages of the act.

The tabular part consists of several columns, which indicate the amounts in rubles and kopecks received by the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund.

In this case, payments received to:

- insurance pension;

- funded pension;

- contributions at additional rates.

At the same time, during the filling process, arrears, deferred payments, overpaid or collected, debt, debts due to fines, and outstanding payments are displayed.

The table is filled out by an official of the Foundation indicating his signature with a transcript and date.

This is followed by a line indicating the presence or absence of disagreements with the payer. The method for receiving the act is also displayed. Finally, the signature of the payer or his legal representative is affixed.

Reconciliation of settlements with the Pension Fund of Russia

Author of the article Yulia Bakirova 2 minutes to read 2,451 views Contents Reconciliation of settlements with the Pension Fund of the Russian Federation for organizations and entrepreneurs can be a mandatory procedure, or it can also be carried out on the initiative of the latter. Carrying out a reconciliation will reveal the presence of arrears in contributions or, conversely, an overpayment.

Based on the received document confirming the existence of an overpayment, the company will be able to return it or offset it against future payments. In this article we will look at how settlements are reconciled with the Pension Fund of the Russian Federation, how to send a request and how to correctly draw up an application. Important!

Any party can initiate the reconciliation of settlements between the organization and the regulatory authority. Reconciliation is mandatory only if information is prepared for the preparation of annual reporting. The main purposes of reconciliation of calculations include: confirmation of the fact of excessive payment of funds; identification

Pension Fund reconciliation of payments online

Contents Reconciliation begins with the preparation of all necessary documents.

To do this, the employer submits an official request to the Pension Fund for the issuance of a certificate, which will reflect the current state of settlements as of a specific date. You can make such a request in writing or contact the service department via the Internet. Additionally, you will need to obtain information from the regulatory authority about the status of payments made for contributions.

REMEMBER! Information from the certificate will help you figure out whether the final data in the employer’s accounting records and the personal account in the Pension Fund of the Russian Federation coincide. Decryption is needed for a detailed check of all payments made in order to identify the reasons for discrepancies (if they exist). If arrears or overpayments are detected, the business entity must initiate a reconciliation in terms of payments for insurance premiums, penalties and fines.

This is done by submitting a corresponding application to the Pension Fund.

What is needed to reconcile insurance premium payments?

To check mutual settlements, the payer has the right to request the following certificates from the Federal Tax Service, which is responsible for organizing settlements with the Pension Fund of the Russian Federation:

- reconciliation report (KND 1160070, order of the Federal Tax Service dated December 16, 2016 No. ММВ-7-17/);

- certificate on the status of settlements with the budget (KND 1160080, order of the Federal Tax Service dated December 28, 2016 No. ММВ-7-17/);

- statement of transactions for settlements with the budget (KND 1166107, order of the Federal Tax Service dated June 13, 2013 No. ММВ-7-6/).

The procedure for requesting and receiving a response depends on how the information is requested: on paper or electronically. A statement of transactions (a detailed breakdown of charges and payments) can only be obtained in electronic form.

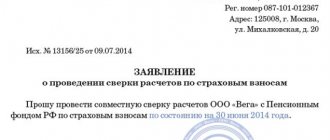

How to submit an application to the Pension Fund for reconciliation of calculations

The procedure for drawing up such a document as an application for reconciliation of settlements with the PRF is not approved by law. Therefore, companies have the right to develop their own forms, but the application must indicate the following:

- recipient's name;

- name, identifying information about the applicant;

- request for reconciliation;

- the date on which payment information is required;

- the manner in which the information should be provided.

As a guide, here is a sample of this statement.

SAMPLE APPLICATION TO THE PFR FOR RECONCILIATION OF CALCULATIONS

Request to reconcile the status of settlements on paper

To obtain information on paper, submit an application to the tax office at the place of registration of the company.

To receive a reconciliation report - on the form recommended by the Federal Tax Service letter dated October 28, 2020 No. AB-4-19:

To obtain a certificate on the status of settlements for insurance premiums and other tax payments - using the KND form 1114237, approved by Order of the Federal Tax Service dated September 3, 2020 No. ED-7-19/:

A taxpayer has the right to submit an appeal on paper:

- by personally visiting the tax office;

- by sending a request by mail;

- by submitting an application through the MFC.

The tax office will generate a response to the request within five working days and issue it to the taxpayer in the manner specified in the application: in person or by mail.

ConsultantPlus experts discussed how organizations can obtain a paper reconciliation report with the Federal Insurance Fund of the Russian Federation for insurance premiums for injuries. Use these instructions for free.

Benefit

Both practitioners and employees of Pension Fund branches strongly advise sometimes reconciling payments with the Pension Fund . What will it give? Here's what:

- you will be calm that information about your company is accurately and correctly reflected in the PF accounting documents;

- you will be sure that your business will not be affected by any underpayments of insurance premiums.

Let us immediately note that accounting legislation requires an inventory to be carried out before the annual financial statements begin to be compiled.

Request for reconciliation via the Internet

To request information in electronic form, submit a request using a single form - KND 1166101 (approved by order of the Federal Tax Service dated June 13, 2013 No. ММВ-7-6/). The payer has the right to send a request:

- via TCS through an electronic reporting operator;

- through the taxpayer’s personal account.

If you request a reconciliation report or an extract for a certain social contribution, fill in the tabular part of the form KBK, the name of the tax (fee) and OKTMO. If you do not fill them out, information will be provided for all types of payments.

The tax office must respond to an electronic request for information no later than 5 working days (clause 97 of the regulations approved by order of the Federal Tax Service dated July 8, 2019 No. ММВ-7-19/373 @). Typically, a response will be received within one to two business days after the request is submitted. The tax office will provide the requested information electronically.

How often do you need to take the SZV-TD?

Data on the SZV-TD form must be submitted every month in 2022. That is, 12 reports per year must be prepared and submitted to the Pension Fund of the Russian Federation for each employer.

After the end of the reporting month, 15 calendar days are given to prepare the report: no later than the 15th day of the month following the reporting month, the SZV-TD must be sent to the fund.

Reporting dates for SZV-TD in 2022, taking into account transfers, are presented below:

| Reporting period 2020 | Deadline for submitting SZV-TD |

| January | 17.02.2020 |

| February | 16.03.2020 |

| March | 15.04.2020 |

| April | 15.05.2020 |

| May | 15.06.2020 |

| June | 15.07.2020 |

| July | 17.08.2020 |

| August | 15.09.2020 |

| September | 15.10.2020 |

| October | 16.11.2020 |

| November | 15.12.2020 |

| December | 15.01.2021 |

From 2022, information on admission and dismissal will need to be submitted to the Pension Fund virtually online: no later than the next working day after the relevant order is issued.

Punishment for SZV-TD

Starting from 2022, legislators plan to provide for administrative liability in the form of a warning for officials who once violated the deadlines for submitting SZV-TD in a calendar year or reflected distorted/incomplete information in it.

If an employer commits a violation twice in a calendar year: he is late with the report, does not submit it at all, or provides false information in it, he will be fined. New edition of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation provides for penalties for such cases of up to 50,000 rubles. for companies and up to 5,000 rubles. for individual entrepreneurs.

If the employee is unable to get a new job on time due to inaccurate data presented in the SZV-TD, the previous employer will have to compensate the employee for the earnings lost in connection with this.

How to submit the report: on paper or electronically

The SZV-TD report can be submitted on paper or electronically. It all depends on the number of employees a given employer has. Legislators did not bother coming up with special criteria by which the employer could navigate the format of the report - they are similar to the SZV-M report.

Namely: the SZV-TD report will be accepted by the Pension Fund on paper or electronically (at the employer’s choice) if the number of employees is less than 25. If the number of employees is 25 or more, the report can only be submitted electronically using the TKS.

We check the contributions for injuries

Settlements with payers of social contributions for insurance against accidents at work are controlled by the Social Insurance Fund. To receive a reconciliation report with the Social Insurance Fund, contact the territorial office of the Fund with an application in any form.

It is possible to submit an application only in paper form. The payer will also receive a response on paper: in person or by mail to the address specified in the application. The form of the reconciliation report with the Social Insurance Fund is established by Order No. 457 of the Social Insurance Fund dated November 17, 2016.

Highlights ↑

In order to carry out a reconciliation with the Pension Fund, the payer of contributions must request from the control authorities one of the following documents:

| Help | Concerning the status of settlements for insurance premiums |

| Information | Regarding the status of payments on a specific date |

By means of a certificate, the applicant is informed about the presence of arrears in insurance payments or excessive overpayment. The certificate is compiled as of a specific date.

The information provided by the Fund provides a breakdown of all payments made by the policyholder in the period shown in the submitted request.

If there is no arrears or overpayments, the reconciliation process is considered completed.

When the information of the Pension Fund and the policyholder differs not in favor of the payer, there is a need for a more thorough reconciliation of payments.

To do this, all calculations regarding insurance premiums, fines and penalties are checked. The consequence of such a check is drawn up in a reconciliation report with the Pension Fund.

Many payers are interested in how to request a settlement balance, but it is not as difficult as it might seem.

What it is

What a reconciliation act is is clear from the name itself; the act displays the results of reconciliation of settlements between the parties.

The reconciliation report with the Pension Fund involves a detailed display of all payments made by the policyholder and amounts received by the Fund.

The payer of insurance premiums has the right to contact the Pension Fund of the Russian Federation with a written request to provide a certificate regarding the status of settlements for paid insurance premiums.

In this case, the Pension Fund is obliged to provide a response, namely the requested document, within five days.

Obtaining complete information from regulatory authorities on issues of calculation and payment of insurance premiums is necessary in order to avoid arrears or overpayments on payments.

Late payment of insurance premiums is fraught with fines and penalties for the policyholder. In case of overpayment of premiums, the policyholder has the right to submit an application to the Pension Fund for offset or return of excessively overpaid amounts.

Arrears, as well as overpayments, must be documented. This task is performed by the act of general reconciliation of paid insurance premiums.

Based on the results of the reconciliation process, the drawn up act is certified by the signatures of the policyholder himself and the authorized representative of the Fund.

What is the role of the document

First of all, the act of reconciling settlements with the Pension Fund plays the role of a supporting document. Before creating financial statements for the year, an organization or individual entrepreneur is required to reconcile calculations with extra-budgetary funds.

Based on the results of the reconciliation, arrears, erroneously accrued penalties, and overpayments are identified. The payer can return these to his current account or count them against future payments.

The basis is precisely the act of reconciliation. In addition, the policyholder may at any time, on his own initiative, request a reconciliation report.

For example, when for some reason there is doubt that the paid insurance premiums have reached their destination or an unscheduled inventory of calculations is carried out.

The Pension Fund is obliged to send the payer a decision, demand or order on the payment of insurance premiums. If the policyholder does not agree with the data specified in the document, he can appeal the Fund’s request.

But first, it is highly advisable to reconcile the calculations. It is quite possible that the paid contributions were simply not received by the Pension Fund or were not received in full.

The legislative framework

The bodies that control the payment of insurance transfers, in particular the Pension Fund of the Russian Federation, as well as the Federal Tax Service, must conduct a joint reconciliation of paid insurance premiums and related payments based on the payer’s application.

This is stated in paragraph 8, part 1, article 18.4 of Federal Law No. 212 of July 24, 2009.

For example, according to clause 1, part 1, article 18.4 of Federal Law No. 212, an organization may need a reconciliation report for calculations in the case when it wants to receive an installment plan or deferred payment.

The application form for joint reconciliation is not fixed, therefore a document is drawn up in free form. Reconciliation can also be carried out at the initiative of the Pension Fund.

As a rule, control authorities initiate this process if an overpayment of contributions is detected. The possibility of carrying out such a reconciliation is stated in Part 9 of Article 19, Part 4 of Article 26 of Federal Law No. 212.

Based on the results of the reconciliation, the company receives the right to submit an application for clarification of payment or an application for a refund or offset of the excess amount. Any reconciliation ends with the execution of a settlement reconciliation report.

The form of the reconciliation report on insurance premiums, penalties and fines with the Pension Fund of the Russian Federation was approved by Resolution of the Pension Fund of the Russian Federation No. 511 of December 22, 2015.

It is noteworthy that Federal Law No. 212 does not regulate the procedure for delivering a reconciliation report to an organization. But based on the form of the act, two methods can be used to transfer a document - personal delivery or transfer by post.

There are no clear deadlines for the execution of the reconciliation report, nor are there strict regulations regarding the reconciliation procedure itself.

Normative base

Order of the Federal Tax Service of Russia dated December 16, 2016 No. MMV-7-17/ “On approval of the form of the act of joint reconciliation of calculations for taxes, fees, insurance premiums, penalties, fines, interest”

Order of the Federal Tax Service of Russia dated December 28, 2016 No. MMV-7-17/ “On approval of forms of certificates on the status of settlements for taxes, fees, insurance premiums, penalties, fines, interest, the procedure for filling them out and formats for providing certificates in electronic form”

Order of the Federal Tax Service of Russia dated June 13, 2013 No. ММВ-7-6/ “On approval of Methodological recommendations for organizing electronic document flow between tax authorities and taxpayers for information services and informing taxpayers in electronic form via telecommunication channels”

Why is it necessary to reconcile settlements with the Pension Fund of Russia?

Important! Any party can initiate the reconciliation of settlements between the organization and the regulatory authority. Reconciliation is mandatory only if information is prepared for the preparation of annual reporting.

The main goals of reconciliation of calculations include:

- confirmation of the fact of overpayment of funds;

- identification of amounts collected by the regulatory authority in inflated amounts;

- search for payments requiring clarification;

- checking the final indicators of obligations to the Pension Fund.

Who should draw up the reconciliation report?

Reconciliation act: who draws up and signs... As a general rule, the reconciliation act must be signed by the director of the company. In order for the chief accountant to sign the act, it is necessary to issue a power of attorney, which would give him the right to sign the act.

Interesting materials:

How to visually expand a room with wallpaper? How to visually enlarge lips? How does RAM frequency affect? How does cardio affect weight loss? How does overclocking a processor affect? How to make changes to the Unified State Register of Legal Entities electronically? How to make changes to the Unified State Register when changing your last name? How to make changes to the types of activities of an individual entrepreneur? How to log into Google account on Qiwi TV? How to enter Safe Mode on Lenovo?

Why do you need a personal account?

To improve the level of work with payers of insurance premiums (ISP) throughout the Russian Federation, the Pension Fund of the Russian Federation introduced a special online service - the payer’s personal account pfr.gov.ru.

Using this program, users will be able to quickly and accurately accrue and pay the required amounts to the regional branches of the Pension Fund. The uninterrupted operation of the service is regulated by the Pension Fund of the Russian Federation, the official personal account of the payer is available to absolutely everyone, the only limitation is the availability of Internet access.

Your personal account performs many important functions:

- improving the procedure for mutual settlements between PSV and the Pension Fund of the Russian Federation;

- minimizing the labor costs of Pension Fund employees;

- reducing errors made in the calculation and payment of contributions;

- advising citizens on any issues arising regarding insurance payments.

The PF personal account of the payer of insurance premiums is intended for the work of PSVs who pay amounts for compulsory medical and pension insurance. Users of the service are legal entities, individual entrepreneurs and individuals engaged in private practices (notaries, lawyers, etc.).

Deadlines, signing of papers

The legislation does not stipulate the time limits for the preparation of the reconciliation report by Pension Fund specialists. When handing over a copy of the final document, the employer's representative must indicate the date of its actual receipt. Additionally, it is recommended to indicate on the form the method in which the act was sent to the enterprise: by mail, or an official of the payer of contributions personally came to the Pension Fund office for documentation. The act must be endorsed by the employer by the head of the company.

If the director does not have the opportunity to receive the document in person, he has the right to delegate such powers to one of his employees (by issuing a power of attorney for him).

The payer of contributions, after reading the act, signs both copies of it. The first remains with the employer, the second must be returned to the Pension Fund specialists. The act is given legal force only after it is signed by all participants in the reconciliation. Based on it, the payer of contributions can issue a refund of the overpayment or initiate an offset of overpaid funds against future obligations.

2 minutes to read5,008 viewsContents

The procedure for organizing electronic information interaction with the Pension Fund of Russia

All employer-insurers are required to submit various documents and reports to the Pension Fund within the established time frame. You can do this in several ways:

- You can independently provide reports directly to the inspector at the Pension Fund branch or send documents by mail. This opportunity is available only to companies whose average number of employees does not exceed 25.

- Through special intermediary companies. Documents are certified by the intermediary's digital signature.

- Via telecommunication channels (TCC), installing the necessary components on your computer.

The third option is becoming increasingly widespread because it saves a lot of time and effort.

The procedure for electronic interaction with the Pension Fund of the Russian Federation is enshrined in the order of the Pension Fund of the Russian Federation “On the introduction of secure electronic document management...” dated October 11, 2007 No. 190r. According to this document, the policyholder should:

- Contact the certification center and conclude an agreement on the purchase of cryptographic protection tools and a software product for organizing electronic document management (EDF).

- Obtain certificates and keys and install the necessary components on your computer.

- Submit an application to connect to the EDF to the Pension Fund of Russia branch.

For a sample application, see the article “Application to the Pension Fund for Connection of Electronic Reporting.”

- Sign an agreement on the exchange of electronic documents with the territorial body of the Pension Fund (see the form in the next section).

- Generate the necessary report form in any special program developed by the Pension Fund for the preparation of personalized information, or in the software used to record salaries and length of service of employees and upload the file.

- Run the received files through a special “checking” program for errors.

- If the test results in a “Success” message, the files should be certified with an electronic digital signature (EDS) and sent to the Pension Fund for verification.

The above programs can be downloaded for free on the official website of the Pension Fund at https://www.pfrf.ru/strahovatelyam/for_employers/programs_for_employers/.

EDS is a detail of an electronic document that is used to protect a file from forgery. The digital signature is generated through cryptographic transformation of information and allows you to identify the person who signed the document. Digital signatures can be open or closed.

Find out what is their difference from the material “What is the difference between the two main types of electronic signatures?”

Within 22 days after sending the files, the policyholder receives a receipt for delivery of the report to the territorial office of the Pension Fund of Russia, and within 4 days - a file control protocol. If the result of the verification is positive, then the subscriber needs to sign the verification protocol with his digital signature and send it to the Pension Fund. If negative, then correct all the indicated shortcomings and send the file again.

Reconciliation result

The results of joint reconciliations with pension authorities are documented in an act in Form 21-PFR. The template of this document is unified. The form was approved by Resolution No. 511p dated December 22, 2015 (author – Pension Fund Board). The structure of the act is represented by the following information blocks:

- Document header. It states the name of the Pension Fund of the Russian Federation, which carried out the reconciliation of contributions jointly with the employer, and provides information about the payer with whom the payments were verified. When designating an employer, its name and the registration number assigned to it in the Pension Fund of the Russian Federation and contact information must be indicated.

- The title of the document with the date of its execution and serial number.

- List of officials who are responsible for implementing the reconciliation of contribution calculations. Representatives of both parties must be present on the lists.

- The time interval for which settlement transactions between the parties were verified is specified.

- A table block with basic information on the results of all procedures.

- Signatures of the parties.

The table block of the document indicates the types of settlement transactions for which transfers and balances are checked. In separate columns, the balances as of the required date are shown, arrears, the amount of funds transferred in excess, and the amount of collections made are displayed. Payments for which information remains unclear and requires more detailed verification are shown separately. All amounts must be reflected in rubles and kopecks. It is necessary to indicate the final balances according to the Pension Fund of Russia and those figures that appear in the employer’s records.

- Set-off or refund of overpayments on insurance premiums

Under the tabular block, the Pension Fund employee who carried out the joint check with the contribution payer endorses the document with his signature. The employer's representative studies the contents of the act and expresses in writing his agreement or disagreement with the reflected results. If the payer believes that the data in the act is reliable, he writes “without disagreement” in the specially designated field. If the policyholder believes that the information shown is not true, then he must express his disagreement with the indicated results with the phrase “with disagreements.”

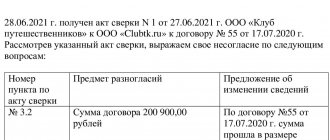

If discrepancies are recorded based on the results of the reconciliation, the responsible employees of the Pension Fund of the Russian Federation, together with representatives of employers, after the date of signing the act, identify the reasons for the discrepancies. To do this, the transcripts of payments are analyzed, the correctness of payment invoices is verified and the amounts are allocated to the appropriate types of contributions.