Kontur.Accounting - 14 days free!

Automated calculation of vacation pay in a few clicks.

Save your time. Try for free

Each employee working under an employment contract has the right to paid leave of 28 days annually. Payroll accountants and employees themselves are interested in correctly calculating the amount of vacation pay. We will provide the rules for calculating vacation pay in 2022 and tell you how to do this using an online calculator.

Online vacation pay calculator in 2022

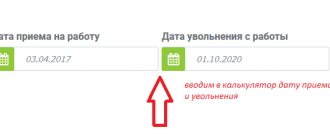

The vacation pay calculator from the Kontur.Accounting service will help you calculate the amount of payments for various types of vacations, taking into account sick leave, time off, and changes in salary. The calculator is available free of charge and without registration; its calculations meet all legal requirements. It's very easy to use:

- In the “Initial data” tab, indicate the vacation period, its type and the boundaries of the billing period. Indicate exclusion periods and salary increases, if any.

- In the “Pivot Table” tab, enter data on monthly accruals to the employee for the billing period.

- In the “Results” tab, you will see the amount of vacation pay and the approximate amount of personal income tax to be withheld (to accurately calculate personal income tax, you need to take into account deductions, taxes and charges).

The calculation will take a couple of minutes. If you work under an employment contract, add our calculator to your “Bookmarks” and you can always find out the amount of your vacation pay. If you are an accountant for a company, you will appreciate the ease of working with the calculator. Kontur.Accounting has many other tools for accounting and payroll.

Free calculators for sick leave, maternity leave, and vacation pay are our open access widgets. If you want to quickly and easily calculate salaries, keep records and send reports via the Internet, register in the online service Kontur.Accounting. The first 14 days of work for each new user are free.

Instructions for using the vacation pay calculator

To quickly calculate your vacation pay, use our free calculator. The principle of its operation is based on three operations:

1. First, specify the rest period in the format “day.month.year”. Then select the type of vacation and specify the billing period.

Please note the auxiliary fields:

- The “There are exclusion periods” field is checked if there were exclusion periods in the billing period (illness, business trips, etc.).

- The field “If there was a salary increase in the billing period...” is marked if there was a salary increase throughout the company. This is done so that the calculator automatically indexes the employee’s earnings for the months preceding the increase.

2. Next, the employee’s income is indicated to calculate the average daily earnings, excluding the amounts of sick leave, etc. (see question mark in the calculator).

3. Receive a full calculation of vacation pay, highlighting the approximate amount of personal income tax and vacation pay to be issued.

Submit reports for employees. Extern gives you 14 days for free!

Try for free

When can an employee take vacation?

Vacation pay is a cash payment to an employee before a vacation; it represents the employee’s average salary for days of rest. The rules for granting vacations are prescribed in Chapter 19 of the Labor Code of the Russian Federation. In a calendar year, an employee can take 28 days of vacation - break this period into parts or use it entirely. By law, you can take your first vacation after 6 months of continuous work in one place. But by agreement with management, vacation can be taken earlier. If an employee has been working for more than a year, leave can be taken at any time.

When an employee goes on vacation, the accounting department accrues vacation pay to him. Another case when this needs to be done is the dismissal of an employee: then he receives monetary compensation for unused vacation days. If an employee does not go on paid leave for more than two years, this is a gross violation of labor organization rules, even if the employee agrees to receive vacation pay instead of the vacation itself.

What payments are included in average earnings when calculating vacation?

In accordance with paragraph 2 of Resolution No. 922 and part 2 of Art. 139 of the Labor Code of the Russian Federation, the average earnings for calculating vacation pay include all payments that are provided for by the company’s remuneration system for the billing period.

If during the billing period the employee did not have wages or working days, then the average earnings are calculated for the 12 months that preceded the billing period. This situation may arise, for example, if the employee was on maternity or child care leave.

To calculate vacation pay for 2022, you can use a calculation note about granting vacation to the employee. This form combines both the vacation order and the calculation itself. The form of this calculation note can be downloaded for free here:

NOTE-CALCULATION ON PROVIDING LEAVE TO AN EMPLOYEE

The form of the order for the provision of leave or its calculation is not approved . The company has the right to develop it independently . Also, no one prohibits the use of unified forms.

In any case, the forms of accepted documents must be approved by order and included in the accounting policy.

The accountant calculates vacation days after signing the vacation order.

You can read about the preparation of this order in our article “Sample order for vacation in 2022.”

An employee can go on vacation according to the planned vacation schedule or in agreement with management.

For information about the schedule, see the article “How to draw up and approve a vacation schedule for 2020 ” (relevant in 2022).

Additional leave

The employees listed in Art. 116 Labor Code of the Russian Federation:

- employed in hazardous and hazardous industries;

- with irregular working hours;

- working in the regions of the Far North, territories equivalent to them, and in other regions of the North, where the Republic of Kazakhstan and percentage increases in wages are established;

- performing work of a special nature and others.

At the discretion of the employer, additional paid leave is also provided to employees who do not have to be provided with it, but then the procedure must be prescribed in a collective agreement or local regulation. Unlike regular vacations, non-working holidays are excluded from the calendar days of additional paid vacation.

Results

An employer can use several coefficients to calculate vacation pay. They are used for different purposes: calculating the average number of days in a month when calculating average earnings, increasing average earnings based on an increase in salary. Regional or “northern” coefficients directly determine the amount of salary on the basis of which vacation pay is calculated.

You can learn more about the features of vacation registration for employees in the articles:

- “Are health workers entitled to additional leave?”;

- “Part-time leave and main place of work”.

Sources:

- Labor Code of the Russian Federation

- Decree of the Government of Russia dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deadlines for payment of vacation pay, personal income tax and contributions

The general rule for paying vacation pay is no later than three days before the start of the vacation (Article 136 of the Labor Code of the Russian Federation). If an employee goes on vacation on Monday, Rostrud considers Friday to be the deadline for payment (letter of the Ministry of Labor dated July 30, 2014 No. 1693-6-1).

There is a question: is personal income tax withheld from vacation pay and are insurance premiums paid? The law says yes. Contributions must be calculated in the same month in which vacation pay was accrued and paid no later than the 15th day of the following month. And we withhold personal income tax when paying vacation pay and transfer it to the budget no later than the last day of the month.

Special calculation of vacation pay in working days

Before this, we counted vacation pay in calendar days. Employers accrue vacation in working days in two cases:

- seasonal workers,

- if a person works under an employment contract that is valid for up to two months.

Formulas:

Amount of vacation pay in working days = Average daily earnings × Number of working days of vacation

Average daily earnings = Actual accrued wages / Number of working days according to the calendar of a 6-day working week

Actually accrued wages are payment for the work that the employee received from the first day of work until the start of vacation.

Example 4. Calculation of vacation pay for a seasonal worker

The employee goes on vacation for 12 working days. The actual accrued wages amounted to 600,000 rubles. The number of working days according to the calendar of a 6-day working week for six months is 111 days.

Average daily earnings: 600,000 rubles / 111 days = 5,405.41 rubles

Vacation pay: 5,405.41 rubles * 12 days = 64,864.92 rubles.

How to calculate vacation pay

First of all, the accounting department designates the billing period for which vacation is due and calculates the employee’s total earnings for this time. Total earnings include: wages, bonuses, allowances and additional payments, payments for special working conditions, income in kind. Total earnings do not include: financial assistance, sick leave, maternity leave, business trips, reimbursement of food expenses.

After this, you need to calculate your average daily earnings. If an employee has worked for the previous 12 months without excluded periods (sick leave, time off), then the average daily earnings are calculated according to the formula approved in Government Resolution No. 922:

Average daily earnings = Total earnings / 12 × 29.3 (average monthly number of calendar days).

If the employee worked for less than a year and/or there were excluded periods in the work, then the average daily earnings are calculated differently. First, we find out the number of days in months worked completely:

Number of days in fully worked months = number of months × 29.3 (average monthly number of calendar days).

Then we find out the number of days in each month that are not fully worked out.

Number of days worked in a month = (Number of calendar days of the month - Days of excluded periods) × 29.3 / Number of calendar days of the month.

After this, we sum up all the found values and obtain the number of days in the billing period. After this we can calculate the average daily earnings:

Average daily earnings = Amount of payments in the billing period / Number of calendar days taken into account when calculating total earnings.

Example of vacation pay calculation No. 1

Employee Ogurtsov works at Krasny Kon LLC; in 2022 he earned 480,000 rubles, receiving 40,000 rubles every month. For January–March 2022, Ogurtsov received 135,000 rubles. He takes a vacation from April 9 to April 22, 2022 - for 14 days.

The billing period is from April 1, 2022 to March 31, 2022. During the billing period, Ogurtsov was not sick and did not take time off.

Total earnings = 40,000 × 9 + 135,000 = 495,000 rubles.

Average daily earnings = 495,000 / (12 × 29.3) = 1,407 rubles 85 kopecks.

Vacation pay = 1,407.85 × 14 = 19,709.90 rubles.

Personal income tax was withheld from vacation pay at 13% = 2,562 rubles.

Ogurtsov received 19,709.90 – 2,562 = 17,147.90 rubles.

Example of vacation pay calculation No. 2

Employee Ershova worked for the individual entrepreneur Creep for a pay period of 7.5 months - from August 19, 2022 to March 31, 2022. During this period, she earned 320,000 rubles and plans to take a vacation for 5 days - from April 15 to April 19, 2022. At the same time, in January she took sick leave for 8 days.

Creep's accountant calculates the total number of days in months worked entirely: 29.3 × 6 = 175.8 days.

Then calculates the number of days in months partially worked:

(30 – 17) × 29.3 / 31 = 12.3 days;

(31 – × 29.3 / 31 = 21.7 days.

Adds up the amounts and gets the total number of days worked: 175.8 + 12.3 + 21.7 = 209.8 days.

Average daily earnings = 320,000 / 209.8 = 1,525.26 rubles.

Vacation pay = 1,526.26 × 5 = 7,626.3 rubles.

Personal income tax is withheld in the amount of 991 rubles, and Ershova receives 6,635.3 rubles.

Special procedure for accounting for bonuses when calculating vacation pay

There are different types of bonuses: based on the results of work for the year, monthly, one-time for anniversaries and holidays, and others. When calculating vacation pay, they are taken into account in a special manner (clause 15 of Resolution No. 922).

If the time falling within the billing period was not fully worked or there were excluded periods (according to clause 5 of Resolution No. 922), bonuses are taken into account when determining average earnings in proportion to the time worked in the billing period. Exception: bonuses accrued for time actually worked in the billing period (monthly, quarterly, etc.).

Bonuses are taken into account based on the amounts actually accrued, if the employee worked part-time for which bonuses are accrued, and they were accrued in proportion to the time worked.

For example, bonuses for an anniversary or holiday. They can be taken into account when calculating vacation pay if two conditions are met simultaneously:

- the bonus is provided for by the remuneration system;

- the premium is accrued in the billing period.

Such bonuses are taken into account in full when calculating vacation pay (clause 15 of Resolution No. 922, Letter of the Ministry of Labor dated 03.08.2016 No. 14-1 / OOG-7105).

How to calculate vacation pay for holidays

When calculating vacation pay, holidays are excluded. If an employee takes leave for the May holidays, then they are not included in the number of vacation days and, accordingly, are not paid (Article 120 of the Labor Code of the Russian Federation). But the employee will be able to rest a day longer. In this case, weekends and holidays postponed by the Government of the Russian Federation to other dates are included in vacation and paid (Article 112 of the Labor Code of the Russian Federation).

Example of calculating vacation pay No. 3

Employee Tsvetkov has been working at Mart LLC for 7.5 months, during the billing period he earned 360,000 rubles (Total earnings). He takes leave from April 29 to May 13, 2022.

Tsvetkov will rest for 15 days, but will receive vacation pay only for 13 days, since May 1 and May 9 are not included in the calculation and are not paid. At the same time, the remaining days off - May 3 and May 10 - will be paid.

During the billing period, Tsvetkov was not sick and did not take time off.

Average daily earnings = 360,000 / (12 × 29.3) = 1,023 rubles 89 kopecks.

Vacation pay = 1,023.89 × 13 = 13,310.57 rubles.

Personal income tax was withheld from vacation pay at 13% = 1,730 rubles.

Tsvetkov will receive 13,310.57 – 1,730 = 11,580.57 rubles.

Fixed ratio of the number of days in a full month

The indicator in question is used as part of the formula for calculating vacation pay:

VO = TD / KD × DO,

Where:

VO - amount of vacation pay;

TD - all accounted labor income of the employee for the billing period (12 months before the vacation);

KD - the conditional number of days worked by a person in the billing period;

TO - duration of vacation.

The coefficient in question is used when calculating the CD indicator as part of the formula:

CD = 29.3 × MES + RAB / DNM × 29.3 × KNM,

Where:

MES - the number of full months worked in the billing period;

RN - the number of calendar days in partial months falling within the worked period;

DNM - the number of calendar days in partial months;

KNM - number of partial months.

ConsultantPlus experts told us how to take non-working weekends into account when calculating vacation.

Explore expert insights with a free trial.

You can learn more about the specifics of calculating vacation pay in this article.

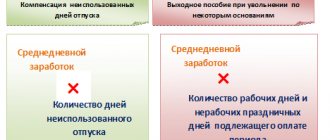

Compensation for unused vacation

A resigning employee receives not only wages for days worked, but also monetary compensation for unused vacation. The calculation for this compensation is the same as when calculating vacation pay for a partially worked period. First, we find out the average daily earnings, then multiply this amount by the days of unused vacation. The Labor Code teaches that for each month worked in full, an employee is entitled to 2.33 days of vacation. That is, we must multiply the number of full months worked by 2.33 and round to the nearest whole number in favor of the employee. There is one nuance in calculating compensation: if you are dismissed after the 15th, the current month is considered a full month. If you leave before the 15th day, the month is not taken into account at all.

An example of calculating compensation for unused vacation

Employee Kotov worked for 9 months and resigned on April 20, 2022. The number of vacation days will be 10 × 2.33 = 23.3 days, rounded to 24 days.

Kotov’s average daily earnings was 1,700 rubles, which means compensation for unused vacation will be 1,700 × 24 = 40,800 rubles. Minus personal income tax (40,800 × 13% = 5,304 rubles), Kotov will receive 35,496 rubles in compensation for unused vacation.

Let's sum it up

- To calculate vacation pay, the number of vacation days is multiplied by the average daily earnings.

- The base for calculating vacation pay includes wages for days worked and other payments provided for by the wage system. Bonuses and salary increases are taken into account in a special manner, and sick leave, financial assistance and other payments for unworked days are not included in the calculation of vacation pay.

- The calculation period for vacation is 12 calendar months preceding the month the vacation begins.

- Paid non-working days due to coronavirus and payments for them are not taken into account when calculating the “vacation” average earnings if the employee did not work on these days.

- Paid vacation pay must be recalculated and the missing amount must be paid to the employee if its amount turned out to be underestimated as a result of a calculation error or other events (changes in salaries, payment of an annual bonus, etc.).