Factoring concept

First of all, let's give a definition of factoring.

The modern economic dictionary (Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B.) gives the following interpretation of factoring operations - this is a method of financing trade operations based on advance payment of invoices by commission banks, which represents a unique form of lending to trade capital. Under a financing agreement for the assignment of a monetary claim, one party (financial agent) transfers or undertakes to transfer to the other party (client) funds to offset the client’s (creditor) monetary claim against a third party (debtor), arising from the client’s provision of goods, performance of work or provision of services to a third party, and the client assigns or undertakes to assign this monetary claim to the financial agent (Article 824 of the Civil Code of the Russian Federation).

Thus, factoring is the operation of the selling organization selling receivables from its customers to a third party - a factoring company. The factoring company receives from the selling organization the right to claim the clients' debt and transfers funds in the amount of the debt to the selling organization, while retaining its commission. As a rule, the factoring company transfers 70-80% of the purchased debt immediately after assignment of the monetary claim and the remaining part after receiving payment from the client.

This scheme is used, as a rule, by organizations that work with their clients on long-term deferred payment terms. This method of mutual settlements allows them to increase cash flow and avoid cash gaps.

Factoring: accounting of transactions for tax purposes

Income tax Grounds: Articles 265, 269 of the Tax Code of the Russian Federation.

When concluding a factoring agreement, as a rule, the “Factor” is paid:

— document processing fee,

- commission for payment of financing,

— commission for factoring services,

— in case of late payment by the debtor – insurance against the risk of late payment.

The cost of a financial agent's services can be expressed in absolute terms or as a percentage.

If the “Factor’s” remuneration is set at a fixed amount, then in tax accounting it can be fully reflected as part of other expenses (based on subclause 25, clause 1, article 264 of the Tax Code of the Russian Federation) if the receivables arose from operations related to the sale products. This commission is recognized as a non-operating expense (based on subclause 15, clause 1, Article 265 of the Tax Code of the Russian Federation) if the receivables arose from non-operating operations.

With regard to commission fees established as a percentage of the amount of the assigned monetary claim or the amount of financing, the Tax Code does not establish standards for accounting for expenses.

In this regard, in practice, there are two positions on the issue of accounting for such expenses:

1. According to sub. 25 clause 1 art. 264 of the Tax Code of the Russian Federation as part of other expenses associated with production and sales (non-standardized expenses).

2. According to sub. 2 p. 1 art. 265 of the Tax Code of the Russian Federation as non-operating expenses, as part of expenses in the form of interest on debt obligations of any type, taking into account the features provided for in Article 269 of the Tax Code of the Russian Federation (standardized expenses).

Value added tax

2.1. Tax base Basis: articles 154, 155 of the Tax Code of the Russian Federation.

The tax base for value added tax for sales of goods and services, the monetary claims for which are ceded by the client to the Factor, is determined in the generally established manner, i.e., as the cost of these goods, calculated on the basis of prices determined in accordance with Article 40 of the Tax Code of the Russian Federation, taking into account excise taxes (for excisable goods) and without including value added tax.

2.2. Moment of determining the tax base Reason: Article 167 of the Tax Code of the Russian Federation.

The moment of determining the tax base for value added tax is the earliest of the following dates:

1. Day of shipment (transfer) of goods (work, services), property rights.

2. The day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

The fact that the client uses factoring does not entail changes in the moment of determining the tax base for VAT, while the client receives the funds necessary to pay the tax to the budget on goods shipped but not yet paid for by buyers.

2.3. Tax deductions Reason: Articles 171, 172 of the NKRF.

The amount of value added tax on the Factor's commission is subject to deduction by the client based on the invoice issued by the Factor in the generally established manner.

Example data

Our organization provided services to the client “Favorite” in the amount of 500,000 rubles, incl. VAT 76,271.19. The client undertakes to pay for the services provided within 30 working days. Our organization entered into an agreement with a factoring company, under the terms of which the factor transfers 80% of the delivery amount within one day after transfer of the right to claim the debt, and the remaining 20% - within 2 days after payment by the client. The factor's commission is 0.5% of the delivery amount.

In accounting, we must create the following entries:

| № | Dt | CT | Sum | Content |

| 1 | 62 | 90 | 500 000 | Accounts receivable reflected |

| 2 | 90 | 68 | 76 271,19 | VAT charged on services provided |

| 3 | 76 | 91.1 | 500 000 | Transfer of debt to factor reflected |

| 4 | 91.2 | 62 | 500 000 | The debt transferred to the factor is written off |

| 5 | 51 | 76 | 400 000 | The factor transferred 80% of the amount under the contract |

| 6 | 91.2 | 76 | 2 118,64 | Factor commission reflected |

| 7 | 19 | 76 | 381,36 | VAT is reflected on the commission amount |

| 8 | 51 | 76 | 97 500 | The factor transferred the remaining amount under the contract |

...and from the seller

Recognition of the financial result of an organization assigning a monetary claim is associated with certain features. If financing is received in the amount of “receivables,” then no difficulties arise: in this case, only taking into account the remuneration of the financial agent. But when the buyer’s debt, as usually happens, is sold at a loss, then two accounting options are possible. The discrepancy concerns the actual state of affairs, namely: whether the payment deadline has arrived before the assignment of the right of claim or not yet.

Thus, if a seller of goods (work, services) who calculates income (expenses) using the accrual method assigns the right to claim the debt to a third party before the payment deadline stipulated in the contract for the sale of goods (work, services), then the negative difference between the income from the sale of the right to claim the debt and the cost of goods (work, services) is recognized as his loss. In this case, the amount of loss for tax purposes cannot exceed the amount of interest that the taxpayer would have paid taking into account the requirements of Art. 269 of the Tax Code of the Russian Federation for a debt obligation equal to income from the assignment of the right of claim, for the period from the date of assignment to the date of payment stipulated by the contract for the sale of goods (works, services). Let us remind you that Art. 269 of the Tax Code of the Russian Federation establishes that the maximum amount of interest recognized as an expense on debt obligations issued in rubles is taken equal to the refinancing rate of the Central Bank of the Russian Federation, increased by 1.5 times (in the absence of debt obligations to Russian organizations issued in the same quarter on comparable terms ). Let us explain the above with an example.

Example 2 continued: Assume that the accounts receivable are assigned at a 10 percent discount to the due date, which is 45 days later. Obviously, in this case, the client incurs a loss of 354,000 rubles. (RUB 3,186,000 - RUB 3,540,000), which is recognized in the amount of RUB 68,084. (RUB 3,186,000 x 19.5% / 365 x 45). Here 19.5% is the refinancing rate of the Central Bank of the Russian Federation of 13%, increased by 1.5 times.

In this case, a permanent difference arises in accounting, which, in accordance with PBU 18/02 “Accounting for calculations of corporate income tax”, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n, is accounted for as a debit to account 99 “Profits and losses” and a credit Account 68 “Calculations for taxes and fees.”

The procedure for accounting for the remuneration of a financial agent also has its own subtleties. If the factor's commission is set in a fixed amount, then it is included in other expenses at a time, but if it is a percentage of the amount of receivables, it is normalized in the same manner as interest on credit funds.

In the case where the seller, calculating income (expenses) using the accrual method, assigns the right to claim the debt to a third party after the payment deadline stipulated in the contract for the sale of goods (work, services), there is a negative difference between the income from the sale of the right to claim the debt and the cost of goods sold ( works, services) is recognized as a loss under the transaction of assignment of the right of claim. The seller includes this amount as non-operating expenses. In this case, the loss is accepted for tax purposes in the following order:

- 50% of the amount of the loss is taken into account as part of non-operating expenses on the date of assignment of the right of claim;

- 50% is included in non-operating expenses after 45 calendar days from the date of assignment of the right of claim.

Judicial and arbitration practice. With regard to factoring operations, officials quite clearly adhere to the main line of behavior, namely: expenses that reduce taxable income must not only be documented, but also, most importantly, economically justified. The referees also support them in this. For example, in the Resolution of the Federal Antimonopoly Service of the Moscow District dated 05/07/2007, 05/11/2007 N KA-A41/3646-07 in case No. A41-K2-6838/05, the judges indicated that if the expenses did not lead to profit, then such expenses cannot be considered economically justified. In the case under consideration, the question arose about the legality of the company including expenses under a factoring agreement as expenses that reduce the taxable base. The fact is that the company’s profit on the transaction financed by the factor was 240 times less than the cost of its factoring services (RUB 22,400 versus RUB 5,435,000). The company's appeal was unsuccessful, since the deal obviously did not make economic sense.

D. Vasiliev

Chief Accountant

JSC "Kun"

Directory settings in 1C:ERP

In 1C:ERP, accounting for settlements through a factoring company is not automated. However, the specified scheme can still be reflected using standard system documents.

To begin with, we will need to set up expense and income items to generate transactions for accounts 91.01 and 91.02:

- Setting up an income item for transferring debt to a factor:

- Setting up an expense item for writing off a client's debt transferred to a factor:

- Setting up an expense item for factor commission:

It will also be necessary to correctly configure the contract with the counterparty factor. We will use an agreement with the type of mutual settlements “With a supplier” - this option will allow us to avoid a long chain of documents to reflect the factor’s commission:

On the “Calculations” tab, we indicate the option for detailing calculations – “according to contracts”:

And a very important point - on the “Accounting Information” tab in the “Finance Group” field. accounting of settlements" we will indicate the group of financial accounting of settlements with counterparties, in which accounts for accounting of settlements for factoring are configured for account 76:

So, all the basic settings have been entered, you can start reflecting factoring operations.

1C:ERP documents for reflecting factoring operations

What is factoring

The word “factoring” most likely means nothing to the average person. And not every specialist knows what it is and has not used this service.

Meanwhile, this is an excellent way to improve the company's balance sheet.

Let's imagine a supplier company that sold a product or provided a postpaid service. In Russian realities, this payment is often delayed, and money is needed to launch a new production cycle, pay salaries to employees, etc. There seems to be money, they should be paid, but in fact there is none.

So, factoring is a way to turn debt into real money. The factor (this is a specialized company or bank) buys it.

Types of factoring

Factoring comes in several varieties:

- With regression. The factor buys the right to all payments to the debtor. However, if these amounts cannot be recovered, the client returns the money to the factor company.

- No recourse. The factor assumes the entire risk of non-payment of the debt by the debtor. If he fails to get the money, he suffers losses.

All information about non-current and current assets.

What is BDR, you can find out here.

Reasons for factoring: laws, agreement, work scheme

There is no term “factoring” in domestic legislation; it is borrowed from Western practice. In our country, the concept itself appeared in 1996 with the entry into force of Part II of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation).

It is described in Article 824 as financing against the assignment of a monetary claim. Thus, a factoring agreement is called a financing agreement for the assignment of monetary claims. It is concluded upon provision of statutory documents, accounting. reporting, copies of the company’s agreements with debtors.

The supplier company transfers documentation to the Factor confirming the shipment of goods or provision of services (invoices, delivery notes), and the Factor pays part of their cost. After receiving money from the debtor, he gives the remaining amount minus the commission.

Accounting entries for factoring services

There are no strict regulations for the provision of factoring services.

You can do it as follows:

- The financing amount is posted on the day of the bank statement as a debit to 51 accounts, a credit to 76 (by order we introduce the sub-item “Settlements with the financial agent” - in the future, when we mention account 76, we will mean it).

- Income from the assignment of the right of claim is included in the category “Other income”: posting the amount of payment from the Factor (this is 60-90% of receivables) is recorded as a debit to account 76 - credit to 91/1 by the date of payment of financing.

- The assigned right of claim is written off on the same date: debit for the amount of payment by the Factor on account 91/2 - credit on 62.

- The payment of remuneration to the Factor is recorded on the basis of the invoice: the amount of the commission excluding VAT is entered on the date of the bank statement as a debit to account 76/Settlements with a financial agent - credit to 51.

- The costs of paying commissions are recognized: on the basis of the received act and invoice from the financial agent, an entry is made for the amount of this commission without VAT by debit to account 91/2 - credit to 76.

- VAT is recorded on the commission: by the date of the act and invoice, the VAT amount is debited to account 19 - credit 76.

- The right of claim for the remaining part of the debt is written off: debit for 76 - credit for 62 by the date of the bank statement.

- The transfer by the Factor of the remaining part of the assigned monetary claim is recorded: debit for 51 - credit for 76 by the date of the bank statement.

- The VAT paid to the Factor from the commission is accepted for offset in the budget: debit 68 - credit 19.

A cash flow budget, or cash flow budget, is one of the most effective financial management tools.

You can find out how to obtain an extract from the Unified State Register of Legal Entities here.

At: https://helpacc.ru/buhgalteria/personal/kak-rasschitat-bolnichnyjj.html you can find out how sick leave is calculated from January 2013.

Advantages of factoring

Thanks to factoring, the company’s funds are not frozen in the form of deferred payments, but are constantly working. You can increase sales without fear that the money will not come back and there will be nothing to start a new production cycle. The liquidity of a product or service increases. This allows you to increase assets at a high rate.

When using factoring services, a company can develop solely at the expense of its own resources, without resorting to loans, which require collateral.

A young company with large accounts receivable will most likely not receive a development loan from a bank. But she can get money from Factor.

In addition, the burden of managing accounts receivable is removed from the shoulders of the company's employees and transferred entirely to the Factor.

At the same time, its balance sheet structure and balance sheet indicators are significantly improved.

1. Sales to the client

On September 05, services were provided to the client “Lubimy” in the amount of 500,000 rubles. Our company works with this client on deferred payment terms, and then the payment deadline under the contract is 17.10.

After being reflected in regulated accounting, the document generates entries for recording accounts receivable on account 62:

Factoring entries in accounting

The article from the magazine "MAIN BOOK" is relevant as of May 8, 2015,

magazine No. 10 for 2015.

According to the Association of Factoring Companies, in 2014, over 5,200 small and medium-sized companies and the IP website of the Association of Factoring Companies used factoring services.

Let's consider this situation. Your company is engaged in the resale of goods. And now you have a difficulty with working capital to pay for the purchased goods and you need a deferred payment.

But the supplier does not want to provide it or you are unable to agree on a deferment period (let’s say the seller agrees for a maximum of 30 days, but you would like 3-4 times more). Or the supplier has charged too much for a commercial loan and the product will cost you too much as a result.

And for some reason you can’t borrow money from the bank. But a way out can be found from any difficult situation. Reverse (purchase, or reverse) factoring will help you solve the issue of financing.

2. Transfer of receivables to a factoring company

Our company has entered into an agreement with the factor company, according to which we transfer to it the right to claim the debt from the client “Lubimy” and it transfers to us 80% of the sales amount within a day after such transfer.

This operation is reflected in the system by the document “Write-off of debt” by the type of operation “Write-off of accounts payable” and by the type of settlements with the counterparty “Settlements with suppliers”.

As the settlement object, we select the agreement with the counterparty for which we have set up mutual settlements for factoring:

On the “Income” tab, indicate the item of income from the transfer of debt:

When reflected in regulated accounting, the document generates transactions for account 76 in correspondence with account 91.01:

Factoring operations in BP 3.0

In modern economic conditions, new financial instruments are increasingly being used, the use of which allows enterprises to efficiently manage their activities and maximize profits. One of these tools is factoring - a range of financial services for enterprises conducting trading activities on deferred payment terms.

Let's look at an example of a factoring operation with a supplier of goods and services; let's formalize the operation in 1C: Enterprise Accounting 3.0.

We are a supplier and sell goods to the buyer with a delay of 3 months. In order not to wait for the transfer of money, we enter into a factoring agreement with a bank, which actually buys the buyer’s debt from our organization for a fee

The bank immediately transfers the money to us. And the buyer subsequently repays the debt to the bank.

There are three parties involved in a factoring operation:

- factor - bank/factoring company;

- supplier - client of a bank/factoring company;

- buyer - debtor of the supplier whose debt was purchased by the factor.

Functionality.

First, let's check the functionality of the program and enable the necessary settings.

Go to the section Main menu - Settings - Functionality (Fig. 1).

Figure 1 - Setting up the program functionality.

Go to the Calculations tab and check the Factoring operations checkbox (Fig. 2).

Figure 2 - Enabling functionality for factoring operations.

Accounting for factoring from a supplier of goods and services.

- First of all, we will sell the goods to the buyer by drawing up a document for the sale of goods and services (Fig. 3). We will indicate the payment deadline.

- To transfer debt to factoring, go to the section Sales - Settlements with counterparties - Transfer of debt to factoring (Fig. 5).

Figure 3 - Buyer's debt to the supplier.

Accounts receivable are formed (Fig. 4). Debit 62.01 Credit 90.01.1 - the total amount of revenue from the sale of goods including VAT; Debit 90.02.1 Credit 41.01 - cost of goods sold; Debit 90.03 Credit 68.02 - the amount of VAT on the sale of goods.

Figure 4 — Postings for the sale of goods and services

Figure 5 - Go to the document Transfer of debt to factoring

Let's create a new document. We indicate in the header:

- date of transfer;

- buyer - the counterparty for whom the sale of goods and services was registered;

- agreement with the buyer (for the sale of goods and services);

- factoring company to which we transfer the buyer’s debt (bank);

- select a factoring agreement or create a new one (Fig. 6) (between the supplier and the factoring company).

Figure 6 - Creation of an agreement with a factoring company.

In the document Transfer of goods for factoring, fill out the tabular section. It is convenient to use the “Fill” button (Fig. 7). Pull up all documents for settlements with the buyer under the specified agreement. We leave only those settlement documents that interest us. We carry out the document.

Figure 7 — Creating a document transfer for factoring

We check the movement of the document transfer to factoring (Fig. 8).

Debit 76.13 Credit 91.01 - the amount of debt transferred to the factoring company;

Debit 91.02 Credit 62.01 - the amount of the buyer’s debt written off from accounting.

Figure 8 — Posting the document transfer to factoring

- Receipts of money from the factoring company are reflected in the document Receipt to the current account with the transaction type “Payment from the factoring company” (Fig. 9).

The amount of factoring transfer depends on the terms of the agreement and can range from 80% to 90% of the buyer’s debt. - To reflect the remuneration to the bank/factoring company for services under the factoring agreement, go to the Purchases section (Fig. 11) and create a Receipt document (acts, invoice) with the type of operation “Factoring Services” (Fig. 11.1).

Figure 9 — Receipt of funds to the current account under a factoring agreement.

We check the movement of the document for receipt of money from the factoring company (Fig. 10). According to Kt 76.13, the bank's debt was repaid.

Figure 10 — Posting a document for receipt of money from a factoring company.

Figure 11 — Creation of a receipt document (acts, invoice) with the type of operation “Factoring services”

Figure 11.1 — Creating a receipt document (acts, invoice) with the type of operation “Factoring services”

Checking the wiring.

Debit 91.02 Credit 76.13 - cost of factoring services excluding VAT;

Debit 19.03 Credit 76.13 - for the amount of VAT on factoring services.

Figure 12 — Posting a receipt document (acts, invoice) with the type of operation “Factoring services”.

Accounting for factoring from the buyer.

We draw up a document for the receipt of goods and services, it can also be a document Acquisition of services and other assets (Fig. 13).

Figure 13 — Receipt of goods

In the field of assignment of the right of debt to the factor, the supplier notifies the buyer that funds must be transferred to the factor. The buyer reflects this operation in the document Adjustment of debt with the type of operation “Transfer of debt” (Fig. 14). The tabular part can be filled in automatically by clicking the Fill - Fill in mutual settlement balances button. We carry out the document.

Figure 14 - Debt adjustment

We check the wiring (Fig. 15).

Transfer of accounts payable from one supplier to another. Debit 60.01 Credit 60.01 for the amount of debt including VAT.

Figure 15 — Posting the debt adjustment document.

Repayment of accounts payable to a bank/factoring company is reflected in the document Write-off from current account with the transaction type Payment to supplier (Fig. 16).

Figure 16 - Debiting from a current account with the transaction type Payment to supplier.

Postings of the document for repaying the debt to the factoring company in cash: Debit 60.01 Credit 51 for the amount of the existing debt, including VAT (Fig. 17).

Figure 17 — Postings of the document Write-off from the current account with the transaction type Payment to supplier.

3.Write off the client’s receivables

We notify the client about the assignment of the debt to a third party and write off his debt as expenses.

This operation is reflected in the system by the document “Write-off of debt” by the type of operation “Write-off of accounts receivable” and by the type of settlements with the counterparty “Settlements with clients”. As the object of calculations, we select the document for the sale of services to the client:

On the “Expenses and Assets” tab, indicate the item of expenses from debt write-off:

When reflected in regulated accounting, the document generates transactions for writing off debt from account 62 to the debit of account 91.02:

Advantages and disadvantages

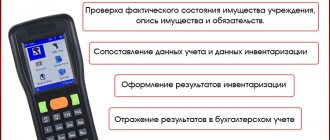

Factoring, being a modern financial tool for managing the receivables of organizations, in practice has both advantages and disadvantages.

Factoring has the following positive characteristics:

- Control over accounts receivable; Tax legislation directly states that companies are required to conduct an inventory of accounts receivable not only before preparing annual reports. Factoring allows you to track your outstanding debt and quickly take action to eliminate it.

- The risks of paying off the debt are transferred to the factor company;

- The ability to effectively use funds issued by the factor for the development of the company;

- Increasing attractiveness in the eyes of partners and creating trusting relationships with counterparties in the form of providing various credit programs;

- Financial resources are not withdrawn from circulation in connection with the conclusion of a factoring agreement.

Financing carried out under the assignment of receivables is called factoring. There are three parties involved in the operation: the factoring company (bank), the lender (supplier), and the borrower (buyer).

The lender transfers his factoring company and receives 80-90% of the funds for the goods delivered to the borrower. After the borrower repays his obligations to the bank, the supplier will receive the rest of the money, and the bank will receive a commission.

4. Payment by the factor 80% of the debt amount

The day after the debt is transferred, the factor company transfers funds in the amount of 80% of the debt amount.

In the system, this operation can be registered with the document “Receipt of non-cash funds” with the type of operation “Return from supplier”.

By selecting this operation, on the “Payment Decoding” tab, we can specify the agreement with the factor as the basis for the payment:

When reflected in regulated accounting, the document will generate transactions for mutual settlements with factor 76:

Factoring scheme

The factoring agreement provides for the following algorithm of interactions between the parties to the agreement:

Stage-1. Signing a contract for the supply of goods

The first stage of the relationship between the parties is the conclusion of an agreement for the supply of goods (rendering services) between the seller (creditor) and the buyer (debtor). The contract confirms the terms of delivery of goods and the procedure for payment.

As a rule, at the stage of concluding a supply agreement, the parties rarely plan to subsequently conclude a factoring agreement, since it is assumed that the buyer will pay for the goods in full and on time.

Stage-2. Conclusion of a factoring agreement

Unlike a supply agreement, the signatories of a factoring agreement are three parties - the buyer, the seller and the intermediary. The terms of the agreement regulate the area of responsibility of each party, as well as the amount and procedure for paying remuneration to the intermediary (factor).

Stage-3. Shipment of goods by the supplier and partial payment by the buyer

In accordance with the terms specified in the contract, the seller ships the goods to the buyer. Along with the goods, the supplier transfers to the customer:

- invoice for the total cost of shipment;

- an invoice for the amount of partial payment for the supply (in accordance with the terms of the factoring agreement).

Having received the goods and documents, the buyer makes a partial payment for the goods in the established amount (usually no more than 10-15% of the total delivery amount).

Stage-4. Debt control by intermediary

After the buyer has made partial payment for the goods, the factor (intermediary) transfers the balance of the debt to the supplier. Further control over debt collection in accordance with the terms established by the contract is the responsibility of the intermediary.

The factor has the right to notify the buyer of the need to repay the debt both in writing, by sending the relevant requirements, and orally, by telephone calls. The parties can also reconcile mutual settlements and confirm the amount of debt by signing the relevant act.

Stage-5. Repayment of debt by the debtor

In accordance with the terms established in the contracts, the buyer is obliged to repay the balance of the debt on the goods (services) received. Since the supplier received full payment for the goods at the initial stage (partly from the buyer, partly from the factor), the buyer pays the remainder of the debt to the factor’s account, based on the invoice issued by the latter.

Stage-6. Payment of remuneration to the intermediary

Having received full payment of the debt from the debtor, the factor has the right to present the amount of remuneration to the supplier for payment. Typically, the intermediary submits the following documents to the lender:

- an invoice for payment of remuneration in the amount specified in accordance with the agreement;

- act of completion of work for the provision of intermediary services;

- an act of mutual settlement confirming full repayment of the debt by the debtor.

5.Reflection of the commission factor

05.10 the client paid the debt for services to the factor and we reflect the costs of the factor’s commission. The system uses the document “Receipt of services and other assets” for this purpose.

On the “Expenses and other assets” tab, indicate the expense item for the factor commission:

After being reflected in regulated accounting, the document will generate transactions for mutual settlements with the factor on account 76:

Kinds

There are several types of factoring depending on the relationship between the seller, the factor company and the buyer, such as factoring with recourse and factoring without recourse.

Factoring with recourse is a type of factoring in which the debt seller is obliged to return the funds received from the factor in the event of the debtor's insolvency and his lack of financial ability to fully repay the debt.

Of course, this type of factoring is not very beneficial for companies, due to the fact that, ultimately, it can suffer serious losses, but, nevertheless, such factoring costs much less and allows the creditor company not to withdraw monetary resources from circulation.

As the concept puts it, non-recourse factoring is a type of factoring in which the factoring company completely transfers to itself all the risks caused by changes in the financial stability of the debtor.

For domestic practice, the most popular is factoring with recourse.

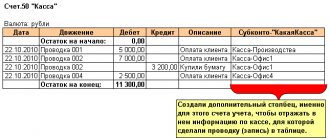

Reporting

After reflecting all transactions in regulated accounting in the balance sheet for accounting:

In the “Statement of settlements with suppliers” report, you can monitor the balance of the supplier’s debt:

The difference between a factoring agreement and an assignment agreement

Many entrepreneurs and business entities confuse the legal relations that arise within the framework of a factoring agreement with an assignment agreement.

Let us recall that in accordance with the assignment agreement, the creditor transfers to the intermediary not only the right to claim the debt, but also the debt itself. In other words, the seller, who shipped the goods but did not receive payment from the buyer on time and recognized the debt as overdue, transfers the rights to collect the debt and receive funds to the intermediary in exchange for the established fee. Problematic receivables to collection firms work in a similar format.

According to the factoring agreement, the factor does not receive ownership of the debt, but only has the right to control and optimize it, while the right to collect the debt remains with the supplier of goods (services).

Types of factoring

In international legal practice, two types of factoring are used - factoring with recourse and factoring without recourse. In the first case, the factor, receiving from the creditor the right to control the debt, if it is impossible, receives compensation from the client in the established amount. Under this scheme, an intermediary who has paid a debt to a creditor, but has not collected it from the debtor, has the right to repay losses by receiving payment from the creditor.

Legal relations under a non-recourse factoring agreement provide that if the debtor does not repay the amount of the debt, these losses are attributed to the factor and are not subject to compensation from the creditor.

In addition, factoring agreements are classified as open and closed. Open factoring is a tripartite agreement concluded between the debtor, creditor and factor. With closed factoring, the agreement is concluded only between the creditor and the factor, while the debtor is not notified of the assignment of the right to claim the debt.

Factoring as security

According to the Civil Code of the Russian Federation, a monetary claim against a debtor may be assigned by a client to a financial agent also in order to ensure the fulfillment of the client’s obligation to the financial agent. Factoring as security is a special form of factoring. The main difference from “regular” factoring is that there is a primary obligation, for example, on a loan, and the assignment of the right of claim to the factor is secondary to the main obligation. In this case, the tax consequences for the supplier and the factor will be determined based on the tax rules applicable to the main obligation.