Overdraft is a type of bank loan. With it, an organization can spend money even if it does not have it in its account. Provided for a short period and at higher interest rates. There is a limit above which you cannot spend money.

A one-time processing fee may apply. Interest is accrued for each day the loan is used.

Let's look at how to account for overdraft transactions in 1C 8.3 Accounting.

Example:

On March 10, VTB Bank provided the organization with an overdraft with a limit of 600,000 rubles. Commission in the amount of 1,000 rubles. Interest rate 18%. The money was used to pay for goods to the supplier. The overdraft was written off on March 28 after receiving money from the buyer.

Overdraft fee

When opening an overdraft, a commission is charged. To do this, we will create a document “Write-off from the current account” with the operation “Other settlements with counterparties”.

We indicate the recipient bank and agreement, and the commission amount. Settlement account 76.09.

We will include the commission in the organization's expenses. To do this, go to the menu “Operations - Accounting - Operations entered manually” and create a document “Operation”.

We enter the entry Dt 91.02 Kt 76.09 for the amount of the commission.

Who is the overdraft suitable for?

Overdraft is convenient for those who have many counterparties and who constantly have to pay from their current account.

Example. On July 8, 2022, I settled with the counterparty under the supply agreement. The amount remaining in the current account is 135,732 rubles. Already on July 15, Success LLC must transfer 413,679 rubles to another supplier. There is not enough money in the account, and its receipt is expected only on July 29 from the buyer.

To cover the cash gap, Success LLC contacts its bank and issues an overdraft with a limit of 500,000 rubles. This amount is enough to pay the supplier. After receiving funds from the wholesale buyer, Success LLC will be able to repay the debt to the bank.

Receipt of overdraft

When an overdraft is received, we will create a document “Receipt to the current account”, the operation “Obtaining a loan from a bank”.

Set the settlement account to 66.01 “Short-term loans”.

Posting a document.

There was a debt to the bank.

What is an overdraft?

1. Overdraft in advance

The bank sets a credit limit at the very beginning of cooperation with a client - immediately upon opening a current account or if it was opened less than six months ago. The loan amount depends on how well the legal entity meets the bank’s requirements.

The overdraft interest rate for new bank clients may be 1.5–2% higher than for regular ones.

2. Standard (classic) overdraft

Such an overdraft can be obtained by regular customers of the bank. For them, based on account turnover for 1–3 months, a fixed cash limit is established.

The interest rate is most often basic, ranging from 14.5–15%.

3. Overdraft for collection

Suitable for companies where 70% or more of their current account turnover comes from collected revenue. The overdraft limit will depend on the regularity of funds being credited, their volumes, and the number of debtors.

4. Unauthorized overdraft

This is a slight excess of the credit limit. This may occur when converting currency, making an auto payment, or writing off a commission that was not provided for.

An unauthorized overdraft can be:

- stipulated - taken into account in the agreement with the bank, but must be repaid as soon as possible established by the same agreement;

- unforeseen - occurs when the agreement establishes a ban on exceeding the credit limit.

An unexpected overdraft is subject to Art. 1107 of the Civil Code of the Russian Federation on unjust enrichment. Interest will be charged on the amount of the unexpected overdraft as on the amount of unjust enrichment.

5. Technical overdraft

It is issued regardless of the client’s financial condition. In this case, the credit limit is secured by a guarantee of receipt of funds to the current account. This could be income from the sale of currency or the return of a deposit.

Interest write-off

We will transfer the interest to the bank and include it in expenses.

We calculate interest as follows: debt amount * interest rate / days per year * loan term in days.

The loan period was from March 10 to March 28 inclusive, that is, 19 days.

It turns out: 600,000 rubles. * 18% / 366 days * 19 days = 5,606.56 rubles.

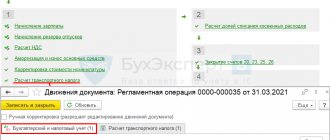

Let's create a document “Write-off from the current account” with the operation “Repayment of loan to the bank”.

Fill out the document:

- We indicate the bank and the agreement.

- Enter the interest amount.

- Type of payment - interest payment.

- Settlement account 66.02 “Interest on short-term loans.”

Posting a document.

For tax purposes, we can classify interest as non-operating expenses, since the transaction is not controlled.

We create a manual operation, enter the posting Dt 91.02 Kt 66.02 for the amount of interest.

How to use overdraft

An overdraft connected to a current account does not increase the amount on it. It is added to the balance of your own funds and is spent only when they run out. It is not necessary to use an overdraft immediately after connecting. This can be done at any time.

Overdraft is a credit product. Therefore, the bank finances clients on the terms of repayment, urgency and payment. This means that you must pay the bank interest for using the overdraft, return the allocated funds and do this within the prescribed period. This determines the key conditions of the overdraft and the features of its use:

1. General term of the agreement

Usually ranges from 6 to 12 months, but can reach 36 months. This is the period during which you can repeatedly go into the red, pay off the debt and again use the credit limit.

2. Period of continuous debt

Usually 30-90 days. During this period, you may be in the red on your account. Then the money must be returned. If you don't make it on time, the bank will charge a commission and a late fee.

3. Interest rate for using an overdraft

The base interest rate is 14–18% per annum. It is calculated individually and depends on the client’s solvency, loan term, and other conditions.

You pay interest on an overdraft only on the amount of the resulting debt. As long as you do not use the overdraft amount, interest does not accrue. They are not charged if you repay the debt on the same day you used the borrowed funds.

In addition to interest, the bank may charge additional fees - one-time or monthly. For example, Alfa Bank charges a one-time fee for issuing an overdraft - 1% of the limit, but not less than 10,000 rubles.

4. Overdraft limit

It can reach 70% of the amounts received into the account for a certain period. This is the amount of the largest “minus” that you can go into by agreement with the bank.

Every 1–3 months the bank reviews the overdraft limit. If the entrepreneur’s turnover decreases, he does not pay taxes, and the debt is covered with a delay, the limit is reduced. And vice versa.

Increased turnover, frequent use of overdraft and timely repayment of funds contribute to an increase in the credit limit. The bank informs you about this via SMS or in your personal account.

5. Overdraft repayment

Repayment of overdraft debt occurs without acceptance. The bank automatically debits funds as they arrive in the current account. Write-offs occur in full until the debt is fully repaid.

Example. At 10:00 on July 20, 2022, Mart LLC used an overdraft in the amount of 4,000,000 rubles. At 14:00 on the same day, the amount of 2,800,000 rubles was received from the counterparty to the current account - it was automatically written off to repay the overdraft. The balance of the debt amounted to 1,200,000 rubles.

Already on July 24, 2022, 1,500,000 rubles were received into the settlement account of Mart LLC. Of these, the bank wrote off the remaining amount of debt - 1,200,000 rubles and interest for using the overdraft. The rest of the money remained in the account.

Overdraft as a special form of credit

Overdraft is a form of short-term lending that banks provide to their clients. An overdraft has a similar yield to other loans, that is, it is issued at an annual interest rate. But there are differences that fundamentally differ from the essence of loans:

- the borrower does not see the transfer of the tranche to the current account;

- does not receive statements to reflect the transaction in accounting;

- To use an overdraft, you do not need to ask the bank to transfer money.

The differences come from the essence of the form of lending. The bank simply agrees to replenish the borrower's current account at the moment when he lacks money. That is, the company is given a certain limit on the terms of immediate debt repayment.

Note from the author! The borrower is not permitted to use an overdraft for loan payments to other lenders.

To open an overdraft, the client pays a certain amount, and subsequently he does not need to take additional actions. Thus, the accounting entries for overdrafts are not of a special nature.

How to use overdraft

In Russia, overdrafts have recently begun to be used. Many are already using “super-planned funds”, but do not know how and how this money differs from a loan.

The difference is obvious. Overdraft is a short-term loan of money. Their bank lends money to its reliable clients who have already proven themselves to be reliable people.

How to use overdraft

The difference from a simple loan is that this loan is issued for a short period. The bank carries out an overdraft, which gives the borrower the opportunity to use additional money. In the future, the borrower will repay the funds borrowed from the bank in a lump sum.

How are overdraft rates reflected in accounting?

The costs that relate to the fulfillment of obligations are called interest, intended to pay the lender-creditor.

How interest is calculated (depending on the purpose of using the funds):

- The use of borrowed money for the purchase or production of an investment asset (it is not recommended to use an overdraft for such needs);

- Accounting for % as part of other expenses;

- Expenses are indicated in the reporting period;

- When receiving a loan for a period of up to 1 year, you need to reflect the overdraft on subaccounts (“Settlements for a short-term loan”);

- % payable should be taken into account as the debit of the account (“Other expenses”);

- Amounts of funds that were not used and the amount to restore them when closing the debt.

When funds are debited from the account, the amount of the limit as it is repaid and the amount of limits that do not apply (in the event of closure of the contract) are reduced.

Salary overdraft

A salary overdraft is a type of overdraft that is tied to a bank card for salary payments.

To receive this loan you must:

- be a regular customer of this bank;

- regularly receive a salary from this bank (i.e. the employer must transfer it regularly).

Please note that if you have a salary card with an overdraft, in the event of dismissal from a permanent place of work, the overdraft is automatically turned off.

As a rule, the overdraft limit on the card is small, and if it goes into negative territory, the overdraft limit is immediately covered by funds from wages arriving in the account. The overdraft amount for this type of loan is determined based on the amount of wages (limit no more than 2 monthly salaries). Interest is 15%-20% per annum.

In this case, interest will be accrued only for the days of using the overdraft and for the specific funds spent.

Accounting for overdraft transactions

And as a result, the bank cancels the balance on the client’s account, they make accounting entries:

- credit 66.

- debit 51;

We recommend reading: Can a private clinic give sick leave?

Interest is calculated on the loan amount received.

Funds that cover the lack of money in the account to carry out financial transactions cannot be reflected separately from such transactions, since they do not appear in any way other than the negative balance in the current account. And it’s not even a fact that this negative balance will be noticed, since the day’s cash receipts can cover this loan without problems.

In practice, this means that when a bank opens an overdraft for a company, little changes for the accountant: as usual, they record current payments with correspondence to account 51 and the accounts of the counterparties to whom these same payments are sent. An overdraft only regulates the balance of the debt on a daily basis, i.e.

Features of tax accounting

Interest on debt of any type is included in non-operating expenses (based on a rate), which is established by agreement of the parties. It takes into account the restrictions specified in the tax code. Interest expenses when used in tax accounting are indicated at the end of the month, on the date of debt repayment.

Technical overdraft

Using the cash method, interest is recognized as an expense on the date it is paid. The cash method generates accounting profit in the reporting period. Payment is made in a different reporting period.

To solve financial difficulties, borrowed funds will not help. It is important to deepen your knowledge in the field of investing, business and cash flow features. An overdraft can be a temporary salvation in a difficult period of life, when there is no way to use other financial sources. But, if you want to gain financial freedom, you need to use your money wisely, invest capital rationally, and close all loans. And if you take out loans, then only for the development and scaling of a successful business.