If employee data does not need to be adjusted

In this case, the report includes only data on the organization with the adjustment number on the title page. There is no need to include employee data in the report. To remove employees from the report, uncheck them in Section 3.

If Section 1 is in automatic calculation mode, be sure to update the list of employees. For example, Kontur.Extern calculates amounts for all employees in the list, regardless of whether they are selected or unchecked. Check the box only for those employees who should be included in the adjustment report.

Also, in some systems, for example in Externa, amounts for employees and for the organization are reconciled only in the original report. To check the adjustment, use the following algorithm.

Algorithm for checking a corrective report

- Remove the correction number from the title page, if it is there.

- Update the list of employees in Section 3.

- Set the fields in Section 1 applications to automatic mode.

- Check the relevance of the data in previous periods if the calculation is not for the first quarter.

- If the data is not up to date, download the reports in pre-import mode into the service.

- Run the scan. Correct errors if any.

- Put the correction number on the title page.

- Generate and send a report.

If you report through Kontur.Extern, the task is simpler. The system will warn you if you try to send a report with the details of a previously sent report. Here are some tips:

- If the Federal Tax Service has accepted the initial report and you want to send an adjustment, the system will tell you which number you need to indicate.

- If the initial report has not yet been accepted, Extern will inform you that it is too early to send an adjustment and advise you to wait for a response from the Federal Tax Service.

- If the initial report is rejected, Extern will warn you that before sending the correction you must submit the primary report with number = 0.

Fill out, check and submit the RSV for free via the Internet

Try it

Responsibility for violation of the deadline and method of submitting Calculation of insurance premiums

Penalties are provided for violation of the deadline and method for submitting calculations for insurance premiums. Violation of the deadline for submitting the calculation entails the following consequences:

- a fine in the amount of 5% of the unpaid (underpaid) amount of contributions specified in the calculation for each full and partial month of delay, but not more than 30% of this amount and not less than 1,000 rubles. (Article 119 of the Tax Code of the Russian Federation);

- a fine of 1,000 rubles, if at the time of submitting the calculation, insurance premiums have been paid in full;

- warning or administrative fine in the amount of 300 to 500 rubles. — for officials of the organization (Article 15.5 of the Code of Administrative Offenses of the Russian Federation);

- blocking of an account due to late payment of contributions and suspension of electronic money transfers. Consequences will occur if the calculation is not submitted within 10 working days after the deadline for its submission (clause 6 of article 6.1, clause 3.2 of article 76 of the Tax Code of the Russian Federation).

The fine must be calculated separately for each type of compulsory social insurance (letter from the Federal Tax Service of Russia dated 06/30/2017 N BS-4-11/ [email protected] , dated 05/05/2017 N PA-4-11/8641).

A fine of 1,000 rubles. distributed to the budgets of state extra-budgetary funds in the same proportion as the rate of insurance contributions of 30% for certain types of compulsory social insurance (Article 425 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated June 30, 2017 N BS-4-11 / [email protected] ) .

For example, for organizations that pay income to individuals, the distribution of the fine looks like this:

- 22%, that is, 22 / 30 × 1,000 = 733.33 rubles. - on the OPS;

- 5.1%, that is, 5.1 / 30 × 1,000 = 170 rubles. - on compulsory medical insurance;

- 2.9%, that is, 2.9 / 30 × 1,000 = 96.67 rubles. - at VNiM.

The fine must be transferred in three different payments to the appropriate KBK.

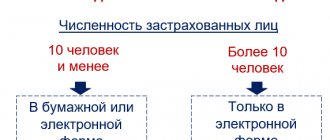

For violation of the method of submitting a payment, namely submission on paper, if the payer is required to submit it in electronic form, a fine of 200 rubles is provided. (Article 119.1 of the Tax Code of the Russian Federation).

If you need to adjust data on employees in Section 3 (except for full name and SNILS)

On the title page, indicate the correction number (for example, “1—,” “2—,” and so on). According to the filling procedure, include in the form only those employees for whom you need to correct the data.

In section 3 of the employee’s card, you just need to correct the necessary data (except for full name and SNILS).

Please note that the TIN, date of birth and passport must be adjusted in this way, and not through cancellation.

If you need to adjust the amounts for an employee, then do not forget to make changes to the appendices of section 1. If the amounts remain the same, section 1 with all appendices is included in the report without changes.

Please note: checks in the service work for all employees only if the title has an adjustment number = 0. To check the report, use the above algorithm.

Please indicate the correction number on the title page. For example, “1—”, “2—”, etc. Include two sections 3 with the same full name of the employee in the calculation and send them in one calculation:

- With an incorrect SNILS with zero (removed) Subsection 3.2 and a sign of cancellation of information about the insured person in line 010.

- With the correct SNILS number with the correct amounts in Subsection 3.2, without a sign of cancellation of information about the insured person in line 010.

If, in addition to the full name and SNILS, it is necessary to adjust the amounts for the employee, then do not forget to make changes to section 1. If the amounts remain the same, section 1 with appendices is included in the report without changes.

Example 1: SNILS is not the same, but real

In the original report, instead of Ivanov Ivan Ivanovich working in the organization with SNILS 001-001-002 13, Ivanov Ivan Ivanovich with SNILS 001-001-001 12 was indicated. Both SNILS numbers exist, so the information was loaded into the Federal Tax Service database.

To make the adjustment, we include two employee cards in the report. The first one contains an error that needs to be corrected (removed from the Federal Tax Service database), the second one contains data that should be in the Federal Tax Service database.

In the first card in Section 3 of Ivan Ivanovich Ivanov with SNILS number 001-001-001 12, put a tick in the line “Cancel employee card.” Delete subsection 3.2.

In the second card in Section 3 of Ivan Ivanovich Ivanov with SNILS number 001-001-002 13, do not check the “Cancel employee card” checkbox and fill out subsection 3.2 with the correct amounts.

Example 2: non-existent SNILS

In the original report, instead of Ivanov Ivan Ivanovich working in the organization with SNILS 001-001-001 12, Ivanov Ivan was indicated, Ivanovich with SNILS 001-001-002 18.

Such SNILS should not pass the check for the control ratio, and the full name should not be checked according to the scheme. The Federal Tax Service should not have accepted such a report. If this happens, contact the inspector for clarification.

When is a clarification submitted on the RSV?

When to submit updated calculations is written in Article 81 of the Tax Code.

The payer of insurance premiums is obliged to make the necessary changes and submit an updated calculation:

- if the provided DAM reveals the fact that information is not reflected or is incompletely reflected;

- if an error was discovered in the provided DAM, which led to an underestimation of the amount of insurance premiums payable.

The updated calculation must include sections and appendices to them that were previously submitted by the payer to the tax authority, taking into account all changes made to them.

Let us remind you that the Federal Tax Service of Russia, by order of September 18, 2022 No. ММВ-7-11 / [email protected] , approved a new form for calculating insurance premiums, the procedure for filling it out, as well as the format for submitting it in electronic form. For the first time, the new form requires reporting for the first quarter of 2020.

If you forgot to include an employee in the original report

Include the forgotten employee in the adjustment form with the adjustment number in the employee card = 0. The amounts in Section 1 and Appendices 1 and 2 to Section 1 change taking into account this employee and are indicated as they should be throughout the organization).

Please note that each time you send a new correction, you must put a new number on the title page.

Report for employees through Kontur.Extern. Loading data into RSV from SZV-M. Zero RSV in no time.

Register

Filling out the updated calculation

The adjusted DAM differs from the primary one in that an adjustment note is made in certain fields. In the initial calculation, the adjustment number is marked “0” on the title page, and the submission of an amendment is reflected by the serial number of the amended report - 1,2,3, etc. For example, the corrective DAM number “1” means that the change is being made for the first time. Line 010 of the third section of the report is filled in similarly.

The clarifying calculation is completed taking into account the following provisions:

- all sheets of the DAM that were presented in the primary report are filled out, except for section 3, taking into account changes;

- Personalized accounting data (section 3) is filled out only for individuals for whom the data is being adjusted;

- Only new indicators are indicated (not the amounts by which the data in the primary report decreased or increased, but new ones).

If you included one employee instead of another

Both employees should be included in the corrective report:

- Unnecessary - with zero (removed) Subsection 3.2 and a sign of cancellation of information about the insured person in line 010.

- Required - with correct data, correct amounts in Subsections 3.2.1 and 3.2.2 and without a sign of cancellation of information about the insured person in line 010.

Section 1 with Subsections 1 and 2 needs to be adjusted: subtract the amounts of the erroneously added employee from the total amounts of the organization and add the amounts for the employee who was forgotten to be included.

General questions

How to make sure that an employee does not get counted? Can it be removed from the list?

In order for the calculation to be generated without taking into account a specific person, it is enough to uncheck the box next to his full name in the list of employees:

If an employee no longer works and all payments have already been made to him, then he can be removed from the list completely. This will not affect the calculations.

How to transfer data from the previous period to the reporting period?

You need to enter Section 3 in the “Actions” menu, select “Download data on employees”, and then “Download data for the previous period to calculate amounts”. Now you need to choose one of the options:

- Load from file.

- Load from the report for the previous period. When you select this item, data from the previous report (if it was made or uploaded to the service) will be loaded into the current period.

You can upload a list of employees if it is empty. To do this, use the “Load employees from the previous reporting period” link.

You need to delete the subsection that was created by mistake. How to do it?

You should go to the page of this subsection and use the “Actions with subsection” button - it is located in the upper right corner. When clicked, a menu will appear in which you need to select “Delete subsection”.

Questions about Section 1

What are the features of filling out Section 1 if the region participates in the Direct Payments project?

In this case, the features are as follows:

- in Appendix 2 to Section 1, feature “1” must be indicated;

- Social insurance costs are not reflected in Appendix 2 on line 070;

- Appendices 3 and 4 to Section 1 are not completed.

Is it necessary to indicate in Appendix 3 of Section 1 the amounts for the 2nd-4th quarter on an accrual basis? How to correct if the amount is indicated only for the quarter?

Since the billing period is a year, the amounts must be indicated on an accrual basis. If the DAM has already been submitted, then you need to send a corrective calculation.

The employee did not work during the reporting period and there were no accruals. Should it be taken into account when filling out Appendix 1 Subsection 1.1 on line 020? Can terms 010 and 020 in the corresponding columns not coincide?

Since no payments were made to the employee, there is no need to reflect it in line 020. This line takes into account individuals from whose payments insurance premiums were accrued for the last three months of the billing period. The values of lines 010 and 020 may not be the same, but the inequality must be satisfied: line 010 > line 020.

An individual is hired under GPC, but payments are made irregularly. In certain months they may not be available. Should this employee be taken into account on line 010 of Subsection 1.1 for those months when payments are not made to him?

According to Part 1 of Article 7 of Law No. 167-FZ, a citizen working under the GPC is insured for the entire duration of the contract. Therefore, throughout the entire period of validity of the contract, it must be taken into account when filling out line 010 of Subsection 1.1. But on line 020 it is taken into account only in those months when payments are made to it.

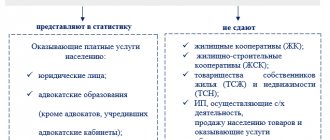

Questions about individual entrepreneurs and heads of peasant farms

Individual entrepreneur on a patent provides services to the public. Which payer tariff should he choose?

In accordance with subparagraph 9 of paragraph 1 of Article 427 of the Tax Code of the Russian Federation, individual entrepreneurs with a patent can count on the use of reduced insurance premium rates. This is possible if the entrepreneur is not engaged in leasing real estate, retail trade or providing catering services.

If an individual entrepreneur applies a preferential tariff, then in Appendix 1 to Section 1 he must indicate the tariff code “12”.

An individual entrepreneur combines the simplified tax system and UTII; there are employees in both systems. Should he fill out one RSV?

The calculation must be completed alone. However, since different tariff codes are used (02 and 03), it may be necessary to fill out 2 options of Appendix 1 to Section 1. We recommend that you check with your inspectorate whether it is necessary to separate tax systems in this case, taking into account the fact that contributions are paid at the same tariff.

What is the frequency of submitting accounts to the head of the peasant farm?

Heads of peasant farms submit accounts once a year if they do not have employees. If there are employees, the calculation is submitted quarterly.