Restoration of VAT previously accepted for deduction - what is it?

When purchasing goods (works, services), the buyer-taxpayer takes the VAT presented as a deduction.

However, input VAT must be reinstated under certain conditions. What is VAT recovery? Restoration of VAT previously accepted for deduction is an operation in which VAT previously accepted for deduction must be restored, that is, paid to the budget.

Note that cases in which VAT restoration is necessary are regulated by law (clause 3 of Article 170 of the Tax Code of the Russian Federation).

For details, see the material “When to restore VAT” .

See also “The list of grounds for VAT restoration has been adjusted .

Restoration of VAT in case of shortage: postings

Typically, shortages of valuables are identified during an inventory. After approval of its results, the shortage is reflected in accounting on the day the inventory is completed.

This means that on the date the goods are written off, the following entries will appear in the company’s accounting:

| Operations | D/t | K/t |

| Shortage taken into account: | ||

| — OS (at residual value), — accrued wear and tear of the OS is written off | 94 02 | 01 01 |

| — intangible assets at residual value, — depreciation on the intangible asset is written off | 94 05 | 04 04 |

| - materials, goods | 94 | 10, 41 |

| The shortage within the limits of natural loss norms (NL) is written off to production | 20, 44 | 94 |

| Shortages in excess of NEU are written off to the perpetrators or other expenses if the perpetrators are not identified. | 73, 76, 91 | 94 |

| Reinstatement of VAT when writing off shortages during inventory (using the tax rate in effect at the time of purchase of the goods) | 19 | 68 |

| Write-off of VAT on other expenses | 91 | 19 |

It is logical to assume that VAT should be restored only for that part of the shortfall that relates to excess loss. However, the Department of Finance does not comment on this issue in any way and does not distinguish between losses within and above the NEU. Therefore, in practice, input VAT is restored from the full amount of losses incurred.

And one more nuance. Since the restored tax must be paid to the budget, the company needs to register an invoice (IF) in the sales book for the amount of the restored tax, reflecting the incoming SF, on the basis of which VAT was deducted, with the adjusted amount of tax to be restored.

Restoration of VAT on goods (works, services, property rights) when their value decreases

If after the acquisition of goods (work, services, property rights) there is a decrease in value, quantity, tariff, then the VAT previously accepted for deduction for this transaction must be restored (clause 4, clause 3, article 170 of the Tax Code of the Russian Federation). Restoration must be made to the earliest date:

- the date of receipt of the adjustment invoice for the reduction in the cost of goods (work, services, property rights);

For details, see the material “What is an adjustment invoice and when is it needed?”

- the date of receipt of primary documents confirming the decrease in the value of goods (work, services, property rights).

In this case, the difference between the VAT amounts before and after the change in value is restored (paragraph 2, paragraph 4, paragraph 3, Article 170 of the Tax Code of the Russian Federation).

Inventory of goods

<< Home

Reflection in accounting of the write-off of identified shortages and losses of goods in the commodity warehouse(s) (in the seller's section) in wholesale and retail trade in the event of identification of the guilty parties. There are no loss norms for goods.

| № | Debit | Credit | Contents of operation |

| Accounting entries when writing off shortages (damage) of goods accounted for at acquisition cost | |||

| 1 | 94 | 41-1 | The identified loss of goods is reflected at the actual (purchase) cost of inventories |

| Accounting entries when writing off shortages (damage) of goods accounted for at sales price | |||

| 1 | 94 | 41-2 | The identified loss of goods is reflected at the sales value of inventories |

| 2 | 94 | 42 subaccount “Trade margin: discount, cape” | The trade margin on missing or damaged goods has been written off (reversed) or |

| 42 subaccount “Trade margin: discount, cape” | 94 | The trade margin on missing or damaged goods has been written off | |

| Accounting entries when goods are reimbursed at the expense of the guilty parties | |||

| 1 | 73-2, 76 | 94 | The shortage (damage) of valuables is repaid at the expense of the guilty persons or |

| 70 | 94 | The shortage (damage) of valuables from the wages of the guilty persons was compensated | |

| Accounting entries when restoring the amount of VAT on missing goods | |||

| 1 | 94 | 68 subaccount “VAT calculations” | The amount of VAT on goods written off due to shortage or damage has been restored. The amount of VAT on missing or damaged goods is reflected in the account of shortages and losses from damage to valuables or |

| 19-3 | 68 subaccount “VAT calculations” | The amount of VAT on goods written off due to shortage or damage has been restored | |

| 94 | 19-3 | The amount of VAT on missing or damaged goods is reflected in the account of shortages and losses from damage to valuables | |

| Accounting entries for VAT refunds at the expense of the guilty parties | |||

| 1 | 73-2, 76 | 94 | The amount of VAT on missing or damaged goods is repaid at the expense of the guilty persons or |

| 70 | 94 | The amount of VAT on missing or damaged goods was reimbursed from the wages of the guilty persons | |

Reflection in accounting of the write-off of identified shortages and losses of goods in the commodity warehouse(s) (in the seller's section) in wholesale and retail trade if the perpetrators are not identified. There are no loss norms for goods.

| № | Debit | Credit | Contents of operation |

| Accounting entries when writing off shortages (damage) of goods accounted for at acquisition cost | |||

| 1 | 94 | 41-1 | The identified loss of goods is reflected at the actual (purchase) cost of inventories |

| Accounting entries when writing off shortages (damage) of goods accounted for at sales price | |||

| 1 | 94 | 41-2 | The identified loss of goods is reflected at the sales value of inventories |

| 2 | 94 | 42 subaccount “Trade margin: discount, cape” | The trade margin on missing or damaged goods has been written off (reversed) |

| 42 subaccount “Trade margin: discount, cape” | 94 | or The trade margin for missing or damaged goods has been written off | |

| Accounting entries when refunding goods if the perpetrators are not identified | |||

| 1 | 91-2 | 94 | The shortage (damage) of valuables is repaid at the expense of other expenses of the organization |

| Accounting entries when restoring the amount of VAT on missing goods | |||

| 1 | 94 | 68 subaccount “VAT calculations” | The amount of VAT on goods written off due to shortage or damage has been restored. The amount of VAT on missing or damaged goods is reflected in the account of shortages and losses from damage to valuables or |

| 19-3 | 68 subaccount “VAT calculations” | The amount of VAT on goods written off due to shortage or damage has been restored | |

| 94 | 19-3 | The amount of VAT on missing or damaged goods is reflected in the account of shortages and losses from damage to valuables | |

| Accounting entries for VAT refunds if the perpetrators are not identified | |||

| 1 | 91-2 | 94 | The amount of VAT on missing or damaged goods is repaid at the expense of other expenses of the organization |

Reflection in accounting of waste generated during the preparation of goods for sale, if the waste can be sold to the public and (or) other organizations.

| № | Debit | Credit | Contents of operation |

| 1 | 94 | 41-1 | The actual cost of waste generated during the preparation of goods for sale has been written off |

| 2 | 41-1 | 94 | The amount allocated to account 94 “Shortages and losses from damage to valuables” was reduced by the amount of waste that can be sold to the public and (or) other organizations. |

| 3 | 91-2 | 94 | The balance of the amount attributed to account 94 “Shortages and losses from damage to valuables” is repaid from other expenses of the organization |

Reflection in the accounting records of the organization's return of lost (stolen) goods found during investigative and search activities.

| № | Debit | Credit | Contents of operation |

| Accounting entries if goods are returned before their value is written off as losses | |||

| 1 | 94 | 41-1 | The actual (purchase) cost of the disposed goods or |

| 41-1 | 94 | The actual (purchase) cost of the disposed goods, previously written off to the account of shortages and losses from damage to valuables, was restored by reverse entry. | |

| Accounting entries if goods are returned before their value is written off as losses in a significantly worse condition than before they were lost | |||

| 1 | 41-1 | 94 | The amount of shortages and losses from damage to valuables has been reduced by the amount of the value of the returned goods at the price of its possible use |

| 2 | 91-2 | 94 | The difference between the accounting and estimated value of the goods is written off as other expenses of the organization |

| Accounting entries if goods are returned after their value is written off as a loss | |||

| 1 | 91-2 | 94 | The written-off shortage (damage) of valuables was reversed from other expenses of the organization |

| 2 | 94 | 41-1 | The actual (purchase) cost of the disposed goods was reversed from the account of shortages and losses from damage to valuables |

Reflection in accounting of damage to goods, as a result of which it is not subject to further sale. The financially responsible person refused to plead guilty to damage to the goods. As a result of the trial, the court did not find the employee of the organization guilty of damaging the goods. There are no loss rates defined for the product. Goods are accounted for at cost of acquisition.

| № | Debit | Credit | Contents of operation |

| Accounting entries when reflecting loss of goods | |||

| 1 | 94 | 41-1 | The identified loss of goods from the financially responsible person is reflected |

| 2 | 94 | 68 subaccount “VAT calculations” | The amount of VAT on goods written off due to damage has been restored. The amount of VAT on damaged goods is reflected in the account of shortages and losses from damage to valuables |

| 3 | 73-2 | 94 | Damage to goods and the amount of VAT on damaged goods are attributed to the person at fault |

| Accounting entries when a claim against a financially responsible person is rejected | |||

| 1 | 94 | 73-2 | The amount for losses from damage to goods was restored, if the claim against the financially responsible person was unfounded |

| Accounting entries for reimbursement of goods and VAT in the event of failure to identify the perpetrators | |||

| 1 | 91-2 | 94 | Damage to goods and the amount of VAT on damaged goods are repaid from other expenses of the organization |

Reflection in accounting of the write-off of identified shortages and losses of goods in the commodity warehouse(s) (in the seller's section) in wholesale and retail trade due to emergency circumstances. Loss rates have been determined for goods.

| № | Debit | Credit | Contents of operation |

| Accounting entries when writing off shortages (damage) of goods due to emergency circumstances, if goods are accounted for at acquisition cost | |||

| 1 | 91-2 | 41-1 | The identified loss of goods is reflected at the actual (purchase) cost of inventories as other expenses |

| Accounting entries when writing off shortages (damage) of goods due to emergency circumstances, if goods are accounted for at their sales value | |||

| 1 | 91-2 | 41-2 | The identified loss of goods is reflected at the sales value of inventories as other expenses |

| 2 | 91-2 | 42 subaccount “Trade margin: discount, cape” | The trade margin on missing or damaged goods has been written off (reversed). Other expenses of the organization were reduced by the amount of the reversed trade margin |

| Accounting entries for compensation of identified loss of goods due to emergency circumstances within the limits of the loss rate | |||

| 1 | 44 subaccount “Distribution costs” | 91-1 | The loss of valuables was capitalized (reimbursed) - shrinkage, shrinkage, dispersion, etc. within the limits of the norms for distribution costs. The loss of valuables according to the norms is reflected in other income of the organization |

| Accounting entries when restoring VAT on written-off goods in case of shortage, damage or damage due to emergency circumstances, if loss rates are determined for the goods | |||

| 1 | 91-2 | 68 subaccount “VAT calculations” | The amount of VAT on goods written off due to shortage or damage in excess of the norms of natural loss has been restored. The amount of VAT on missing or damaged goods in excess of the norms of natural loss is reflected as other expenses or |

| 19-3 | 68 subaccount “VAT calculations” | The amount of VAT on goods written off due to shortages or damage in excess of the norms of natural loss has been restored | |

| 91-2 | 19-3 | The amount of VAT on missing or damaged goods in excess of the norms of natural loss is reflected as other expenses | |

Reflection in accounting of the write-off of identified shortages and losses of goods in the commodity warehouse(s) (in the seller's section) in wholesale and retail trade due to emergency circumstances. There are no loss norms for goods.

| № | Debit | Credit | Contents of operation |

| Accounting entries when writing off shortages (damage) of goods due to emergency circumstances, if goods are accounted for at acquisition cost | |||

| 1 | 91-2 | 41-1 | The identified loss of goods is reflected at the actual (purchase) cost of inventories as other expenses |

| Accounting entries when writing off shortages (damage) of goods due to emergency circumstances, if goods are accounted for at their sales value | |||

| 1 | 91-2 | 41-2 | The identified loss of goods is reflected at the sales value of inventories as other expenses |

| 2 | 91-2 | 42 subaccount “Trade margin: discount, cape” | The trade margin on missing or damaged goods has been written off (reversed). Other expenses of the organization were reduced by the amount of the reversed trade margin |

| Accounting entries when restoring VAT on written-off goods in case of shortage, damage or damage due to emergency circumstances, if loss rates have not been determined for the goods | |||

| 1 | 91-2 | 68 subaccount “VAT calculations” | The amount of VAT on goods written off due to shortage or damage has been restored. The amount of VAT on missing or damaged goods is reflected as other expenses or |

| 19-3 | 68 subaccount “VAT calculations” | The amount of VAT on goods written off due to shortage or damage has been restored | |

| 91-2 | 19-3 | The amount of VAT on missing or damaged goods is reflected as other expenses | |

Restoration of VAT on goods (works, services) used in transactions taxed at a rate of 0%

From 01/01/2015, the norm was excluded from the Tax Code of the Russian Federation, according to which previously, when using goods, works, services, fixed assets and intangible assets in transactions subject to VAT at a rate of 0%, tax restoration was required (clause 3 of Article 170 of the Tax Code of the Russian Federation) .

At the same time, input tax on goods, works, services and property rights that are involved in the production of a new product, taxed at a zero tax rate, must be deducted according to special rules. The deduction occurs at the time the tax base is determined in accordance with Art. 167 of the Tax Code of the Russian Federation, subject to the conditions of paragraph 3 of Art. 172 of the Tax Code of the Russian Federation.

If, when purchasing goods (works, services, property rights) involved in transactions taxed at a zero rate, VAT was accepted for deduction, then such tax, according to officials, will have to be restored and accepted for deduction later (letter from the Ministry of Finance of Russia dated February 13, 2015 No. 03-07-08/6693). The restored VAT must be accepted for deduction at the time of determining the tax base in accordance with Art. 167 Tax Code of the Russian Federation.

The logic of the Federal Tax Service on the issue of VAT restoration

In answering the question about the need to restore VAT on written-off goods, the Federal Tax Service and the Ministry of Finance have long assumed that write-off, regardless of the reason for which it occurs (shortage, damage, obsolescence), is not an operation subject to this tax. Accordingly, according to the text of paragraph 2 of Art. 170 in such a transaction, the tax must be included in the cost of the product being written off. That is, if VAT was deducted upon receipt of goods from the supplier, then at the time of write-off it must be restored and included in expenses.

This position is confirmed by repeated letters from the Russian Ministry of Finance:

- dated January 21, 2016 No. 03-03-06/1/1997 - VAT on goods written off must be restored and taken into account according to the rules of Art. 170 Tax Code of the Russian Federation;

- dated 03/19/2015 No. 03-07-11/15015 - since disposal due to damage is not subject to VAT, a deduction for the written-off product is impossible;

- dated 07/05/2011 No. 03-03-06/1/397 - the procedure for writing off goods is not subject to VAT, and therefore the tax on such goods should be restored;

- dated 04/24/2008 No. 03-07-11/161 - write-off of goods in excess of the norms of natural loss requires the restoration of VAT in the part of its value corresponding to the excess of the norms.

But by now we can say that the position of officials has changed. And the reason for this is numerous judicial practices not in favor of tax authorities, which the financial and tax departments order to be followed (letters of the Ministry of Finance of Russia dated November 7, 2013 No. 03-01-13/01/47571, Federal Tax Service of Russia dated November 26, 2013 No. GD-4-3 / [email protected] ).

So, first, the Federal Tax Service, in a letter dated June 17, 2015 No. GD-4-3 / [email protected] , said that there is no need to restore the tax in the event of loss of property as a result of an emergency. And already in 2022, the Ministry of Finance indicated that there was no obligation to restore VAT upon disposal of property as a result of a fire (letter dated 03/02/2018 No. 03-03-06/1/13389). Both departments referred to the decision of the Supreme Arbitration Court of the Russian Federation dated October 23, 2006 No. 10652/06.

Restoration of VAT on property contributed as a contribution or contribution

In transactions with property used as a deposit or contribution, VAT is restored:

- When using property, intangible assets to contribute to the authorized capital of business companies, partnerships or contributions to mutual funds of cooperatives. The exceptions are contributions of property to mutual investment funds (letter of the Ministry of Finance of Russia dated January 15, 2008 No. 03-07-11/09) and contributions under a simple partnership agreement (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 22, 2010 No. 2196/10).

- When using property and intangible assets for contributions under an investment partnership agreement.

- When using property to replenish the target capital of a non-profit organization in accordance with Federal Law dated December 30, 2006 No. 275-FZ “On the procedure for the formation and use of target capital of non-profit organizations.”

VAT is restored in the period that corresponds to the date of the document on the transfer of property in full.

Fixed assets and intangible assets are an exception to this rule: for this type of property, restoration occurs in a part proportional to the residual value without revaluation (paragraph 2, paragraph 1, paragraph 3, article 170 of the Tax Code of the Russian Federation). At the same time, Chapter 21 of the Tax Code of the Russian Federation does not establish rules for determining the residual value of fixed assets. The Ministry of Finance of Russia believes that it is necessary to form the residual value in accounting by reducing the residual value by the amount of the revaluation, adjusted to take into account depreciation (letter of the Ministry of Finance of Russia dated 02.08.2011 No. 03-07-11/208).

The restored VAT must be indicated in documents on the transfer of property (property rights) and intangible assets. These documents are the basis for accepting an object for accounting and VAT amounts for deduction if the object is used in transactions subject to VAT (paragraph 3, paragraph 1, paragraph 3, Article 170, paragraph 11, Article 171, paragraph 8 Article 172 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated November 21, 2011 No. 03-07-11/317 and November 11, 2009 No. 03-07-11/294). The seller of the property cannot take into account the amount of restored VAT in income tax expenses (letter of the Ministry of Finance of Russia dated 02.08.2011 No. 03-07-11/208).

The seller does not issue an invoice for the transferred property, so it is not required to deduct VAT (Clause 3, Article 169, Clause 1, Clause 2, Article 146, Clause 4, Clause 3, Article 39, Clause 1, Art. 172, paragraph 1, paragraph 3, article 170 of the Tax Code of the Russian Federation). However, this does not relieve the obligation to register in the purchase book the documents on the basis of which the transfer is made.

Basic rules for deducting and recovering VAT

In terms of goods received by the VAT payer (as well as for other values), the Tax Code of the Russian Federation establishes the right to a tax deduction for this tax (clause 1 of Article 171). The deduction will not raise questions if the following conditions are simultaneously met in relation to the goods:

- subsequent transactions with it are supposed to be carried out with VAT (clauses 1, 2 of Article 171 of the Tax Code of the Russian Federation);

- goods are reflected in accounting (clause 1 of article 172 of the Tax Code of the Russian Federation);

- there is an invoice issued by the supplier (clause 1 of Article 169 of the Tax Code of the Russian Federation), or a document (customs declaration) confirming the fact of payment of tax upon import into the Russian Federation (clause 1 of Article 172 of the Tax Code of the Russian Federation).

The Tax Code of the Russian Federation obliges the restoration of a tax previously accepted for deduction in quite unambiguous situations (clause 3 of Article 170), including when the product with which the tax is associated:

- contributed to the management company or mutual fund (subclause 1, clause 3, article 170);

- is involved in operations not subject to VAT (subclause 2, clause 2, article 170);

- changes its value downward (subclause 4, clause 3, article 170);

- subsidized by the budget (subclause 6, clause 3, article 170).

For more information about which transactions are classified as non-VAT taxable, see the article “Transactions not subject to VAT taxation: types and features.”

Is it necessary to restore VAT when writing off a defect? Find out the answer to this question in the ConsultantPlus ready-made solution. If you don't have access yet, get a free trial online.

Recovering VAT from advances received

The prepaid payment system involves receiving an advance payment and paying VAT on these amounts by the seller. The buyer has the right to accept these amounts for deduction (clause 1 of Article 154, clause 12 of Article 171, clause 9 of Article 172 of the Tax Code of the Russian Federation).

From 01.10.2014, the procedure for VAT restoration has been changed: the amount of VAT previously claimed for deduction on the basis of an advance invoice received from the seller is restored by the buyer in full if the shipment is equal to or exceeds the amount of the advance, and is restored in accordance with the invoice for shipment, if it is less than the advance payment.

You will find all the nuances of recovering VAT from an advance payment in the article “When and how can a buyer recover VAT from a transferred advance payment? ”

Support and assistance

Receive articles by email

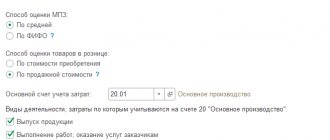

In the 1C: Enterprise Accounting program version 3.0, there are two ways to write off VAT. The choice of method depends on how the goods or materials were purchased.

Method 1

If the goods were purchased by an accountable person, then when filling out the advance report, VAT will be written off automatically.

Let's go to “Bank and cash desk” - “Advance reports” (see Fig. 1).

Rice. 1. Advance reports

When filling out the “Advance report” document, you must indicate the VAT highlighted in the documents in the “VAT” column (rate and amount) (see Fig. 2). In the column “Invoice” (invoice) we do not check the box.

Rice. 2. Indication of VAT

We check the transactions made by the document using the “DT/CT” button. The written-off VAT is reflected in account 91.02. The article “Write off allocated VAT for other expenses” is set automatically.

In addition, the written-off VAT accumulates in the off-balance sheet account HE.01.9 during the calendar year (see Fig. 3).

Of course, there is a constant difference, but it is calculated automatically.

Rice. 3. Document movements: expense report

You can check the correctness of the reflection of this operation by generating a balance sheet for account 19.03 (see Fig. 4).

Rice. 4. Balance sheet

Method 2

The second option for writing off VAT is not automated in the 1C: Enterprise Accounting program ed. 3.0 and requires the execution of an additional special document.

In this case, the receipt of goods or materials is documented using the document “Receipt of Goods”. You can find it by going to “Purchases” - “Receipts (acts, invoices, UPD)” (see Fig. 1).

Rice. 1. Document “Receipt of goods”

When filling out the “Receipt of Goods” document, indicate the VAT highlighted in the supplier’s documents in the “VAT” column (see Fig. 2). We do not register the invoice.

Rice. 2. Filling out the document “Receipt of goods”

We check the transactions made by the document using the “DT/CT” button (see Fig. 3). We see that VAT was not automatically written off.

Rice. 3. Document movements: Receipt

To write off VAT in the 1C: Enterprise Accounting program version 3.0, a document “Write off VAT” is provided.

The easiest way to write off VAT based on the “Receipt of Goods” document is to generate the “Write off VAT” document using the “Create based on” button (see Fig. 4).

Rice. 4. Formation of the document “Write-off of VAT”

The “Purchased Assets” tab will be filled in automatically (see Fig. 5).

Rice. 5. Tab “Purchased Values”

On the “Write-off account” tab, you can specify the account and also select the required analytics (see Fig. 6).

Rice. 6. Tab “Write-off account”

We check the transactions made by the document using the “DT/CT” button. The written off VAT was reflected in account 91.02.

Also, the written-off VAT is accounted for in the off-balance sheet account HE.01.9 (see Fig. 7).

Rice. 7. Reflection of written off VAT

Having generated the balance sheet for account HE.01.9, we can analyze how much VAT was written off during the reporting period.

It is important not to forget to check the “NU” checkbox in the report settings. To do this, select “Show settings” - “Indicators” - “NU” (see Fig. 8-9).

Rice. 8. Report settings

Rice. 9. Balance sheet

In this way, VAT is written off in the 1C: Enterprise Accounting program, edition 3.0, depending on the methods of purchasing goods or materials.

Accounting entries for VAT restoration

During VAT recovery operations, transactions are generated as follows:

Dt 19 Kt 68 - restoration of VAT on goods, work and services;

Dt 912 Kt 19 - inclusion of the restored VAT amount in other expenses.

Example:

In February, Ladoga LLC purchased from the supplier Kenon LLC a batch of materials worth 219,000 rubles, including VAT - 36,500 rubles. The tax was accepted for deduction based on the invoice of Kenon LLC and reflected in the VAT return for the first quarter.

In April, there was a change in the price of the supplied material, and Kenon LLC decided to provide a discount of 5% of the total cost. An adjustment invoice was submitted for this fact.

The adjusted cost of the consignment amounted to 203,300 rubles, including VAT - 33,883 rubles.

According to tax legislation, Ladoga LLC must restore the difference in VAT amounts:

36,500 - 33,883 = 2,617 rubles.

This amount must be included in the declaration in the second quarter.

The accounting entries for VAT restoration are as follows:

In the 1st quarter:

Dt 60 Kt 51 - 219,000 rub. (batch of materials paid);

Dt 10 Kt 60 - 182,500 rub. (a batch of materials was received from Kenon LLC);

Dt 19 Kt 60 - 36,500 rub. (input VAT on purchased materials is reflected);

Dt 68 Kt 19 - 36,500 rub. (input VAT is accepted for deduction);

In the 2nd quarter:

Dt 10 Kt 6 — 2,617 rub. reversal (the cost of materials received is reduced in accordance with the supplier’s notification of the discount provided and the adjustment invoice);

Dt 19 Kt 60 — 2,617 rub. reversal (reduced input VAT on purchased materials in accordance with the supplier’s notification of the discount provided and the adjustment invoice);

Dt 19 Kt 68 — 2,617 rub. (the VAT amount on the adjustment invoice was restored).

If VAT is restored on property transferred as a deposit or contribution, then the transferring party takes the restored tax into account as part of financial investments (debit Dt 58).

The receiving party, according to the recommendations of officials (letters of the Ministry of Finance of Russia dated October 30, 2006 No. 07-05-06/262 and the Federal Tax Service of Russia for Moscow dated July 4, 2007 No. 19-11/063175), should reflect the amount of the restored tax with the entry “Dt 19 Kt 83".

These recommendations were made on the basis of the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n, and the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n.

“Input” VAT: the position of officials and judges

The problem of deducting VAT on lost property arose a long time ago. After all, as a rule, companies acquire valuables in order to use them in taxable transactions (Clause 2 of Article 171 of the Tax Code of the Russian Federation). And accordingly they present VAT for offset. But if the property is lost, what about the tax?

Officials have always insisted that only the VAT that relates to property used in transactions that are subject to taxation can be deducted (clause 2 of Article 171 of the Tax Code of the Russian Federation). If the valuables are lost, then there is no question of such operations. This means that tax cannot be deducted. Therefore, it must be restored in the period when the missing values are written off from the register (letter of the Ministry of Finance of Russia dated July 31, 2006 No. 03-04-11/132). The reason doesn't matter,

by which the property is disposed of. This could be theft, damage, loss, emergency circumstances. In any case, VAT must be restored. The only relief that the Ministry of Finance provides to entrepreneurs is the opportunity to take into account the amount of restored VAT as part of non-operating tax expenses on valuables lost as a result of a fire (letter of the Ministry of Finance of Russia dated May 6, 2006 No. 03-03-04/1/421). But provided that the facts of fire and loss are documented.

And even more so, it is necessary to restore the tax if the property loses its marketable appearance after the expiration of the storage period (letter of the Ministry of Finance of Russia dated April 21, 2006 No. 03-03-04/1/369). The same applies to stolen property (letter of the Ministry of Finance of Russia dated August 14, 2007 No. 03-07-15/120).

Tax inspectors, of course, share this point of view. The arguments are the same: since the property is lost, it does not participate in production activities and is not registered. This means that the assets are not used for taxable transactions. Consequently, tax amounts previously legally accepted for deduction are subject to restoration and payment to the budget.

Firms did not always agree with this opinion of officials and tried to defend their rights using the judicial system. Indeed, why is it necessary to restore VAT if it was once accepted for deduction on completely legal grounds?

It should be noted that very contradictory arbitration practice has emerged on this issue. Thus, some judges sided with entrepreneurs (resolutions of the Federal Antimonopoly Service of the North-Western District dated March 1, 2006 No. A26-4963/2005-29, dated February 9, 2006

No. A56-9808/2005, dated January 17, 2005 No. A05-6493/04-12).

And others supported the controllers (resolutions of the FAS Moscow District dated March 3, 2005 No. KA-A41/839-05, FAS North Caucasus District dated April 28, 2006 No. F08-1521/06-644A).

In particular, the Federal Antimonopoly Service of the North Caucasus District (resolution No. Ф08-1521/06-644А dated April 28, 2006) stated that the disposal of a fixed asset as a result of theft is not a transaction subject to VAT, since fixed assets are not used in business activities . Therefore, the amount of VAT on a stolen object, previously accepted for deduction, is subject to restoration in an amount proportional to the residual book value of this object.

It is difficult to agree with this approach. After all, Chapter 21 of the Tax Code of the Russian Federation contains a closed list of cases when it is necessary to restore VAT (clause 3 of Article 170 of the Tax Code of the Russian Federation). Grounds such as shortage of property, damage or theft are not mentioned here. Therefore, there is no need to restore the tax on lost property.

The same arguments are given by the Supreme Arbitration Court of the Russian Federation in decision No. 10652/06 of October 23, 2006. The senior judges specifically indicated that it is impossible to impose on taxpayers the obligation not provided for by the code to contribute to the budget the amounts of VAT previously accepted for deduction. A shortage of goods discovered during an inventory or theft of property are not among the situations when the code requires reinstatement of the tax. This means, the judges conclude, by imposing on firms an additional obligation not provided for by the code, controllers are violating tax laws.

However, officials could not come to terms with such a decision. After all, the budget is deprived of a certain share of revenue, since the write-off of property by companies due to its shortage is not such a rarity. Therefore, financiers continue to insist on the restoration of VAT. They issued another letter, dated November 1, 2007, No. 03-07-15/175, in which they once again confirmed their point of view. The Federal Tax Service of Russia brought it to the attention of the inspectorates, which means that this is the position that local inspectors will adhere to.

Results

VAT must be restored if the assets on which VAT was claimed for refund began to be used for non-taxable transactions. All cases when it is necessary to restore VAT are named in Art. 170 Tax Code of the Russian Federation.

Sources:

- Tax Code of the Russian Federation

- PBU 19/02, approved. by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n

- PBU 6/01, approved. by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.