When to pay salaries for December 2021

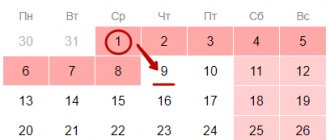

Days from December 31, 2022 to January 9, 2022 are holidays and weekends according to the production calendar. Therefore, if the December salary payment deadline falls during this period, it must be paid the day before, December 30, 2021 .

This procedure is established in Art. 136 Labor Code of the Russian Federation:

“...If the payment day coincides with a day off or a non-working holiday, wages are paid on the eve of this day”

If the salary payment deadline in the organization is set on the 10th day or later, then the salary for December 2022 must be paid after the New Year holidays in January 2022.

Various business situations that arise when paying wages

Salaries can be paid in installments in the following cases:

- to comply with the conditions set out in Part 6 of Art. 136 of the Labor Code of the Russian Federation regarding payment for the performance of labor duties once every half month;

- when the enterprise does not have enough money to pay out the earnings and the employer is forced to pay off debts on wages to employees in parts.

Such situations may raise questions among accountants regarding the correct entry into 6-NDFL of data relating to both basic income and advance payments. Considerable difficulties are possible when reflecting fractional salaries.

Using regulatory materials, below we will describe the basic rules for creating the 6-NDFL calculation, and then indicate how to include the payment of wages in it when situations arise related to debt to employees and when transferring money directly to the bank to repay the loan. It is these 2 situations, as it seems to us, that are most often encountered in modern economic conditions and can cause difficulties in reporting.

How to take into account the salary payment date in ZUP 3.1

In ZUP 3.1, salary payments are registered with the documents Statement (Payments - All statements for salary payments). The salary payment date is determined in the program using two details:

- date document.

- Payment date – opens when you click on the link Payment of salaries and transfer of personal income tax.

The payment date is filled by default with the Date . If you adjust the Payment Date the Statement , when determining the actual date of salary payment, ZUP 3.1 will focus on this field, and not on Date .

Nuances of calculating personal income tax from an advance

An advance is a component of an employee’s salary. Therefore, the same rules apply to an advance as to a regular salary.

Personal income tax must be calculated on the date of actual receipt of income (clause 3 of Article 226 of the Tax Code of the Russian Federation). The Tax Code of the Russian Federation recognizes the date of receipt of income in the form of wages as the last day of the month (clause 2 of Article 223 of the Tax Code of the Russian Federation).

The accountant is required to withhold tax on the day the main part of the salary is issued. Tax is not withheld from the advance payment (letter of the Federal Tax Service of Russia dated March 24, 2016 No. BS-4-11/4999).

You can transfer personal income tax on the day the salary is paid or the next day.

Reflection of salary payments for December 2021 in 6-NDFL

The procedure for reflecting wages for December 2022 in 6-NDFL will depend on when it was actually paid: in December 2021 or January 2022.

If salary is paid in December

When paying wages for December on December 30, 2021, the personal income tax withheld from it will go to Section 1 of the 6-NDFL report for 2022. In this case, the deadline for transferring the tax will be set as the next working day according to the production calendar - 01/10/2022.

Section 1 of form 6-NDFL is filled out according to the tax withholding date, in our example this is the date of salary payment. Because the salary was paid in December 2022, then the withholding date also refers to December and the payment of the December salary is taken into account in Section 1 of the report for 2022.

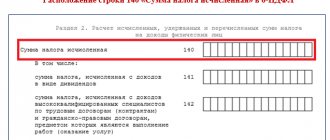

In Section 2 6-NDFL, the December salary and personal income tax from it will also be included in the lines of the report for 2022:

- salary amount in pages 110 and 112

- calculated personal income tax on page 140

- withheld personal income tax on page 160

If salary is paid in January

If the salary for December was paid on January 10, 2022 and later, then the personal income tax withheld from it will fall into Section 1 of the 6-NDFL report for the 1st quarter of 2022. The tax payment deadline will be set as the next working day according to the production calendar. For example, if the salary for December was paid on 01/10/2022, the deadline for transferring personal income tax will be completed on 01/11/2022.

In Section 2 of the report, the December salary and personal income tax on it will be included according to the following principle:

- amount of income (pp. 110-112) and calculated tax (page 140) – in 6-NDFL for 2022;

- withholding tax (page 160) – in 6-NDFL for the 1st quarter of 2022.

Results

In practice, circumstances quite often arise when an enterprise is forced to issue wages in parts with varying dates. In such situations, in 6-NDFL, tax actions should also be recorded in parts - how the payment was actually made.

Sources:

Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Transfer of personal income tax from salary for December 2021

The deadline for transferring personal income tax on salary income is the next business day. Therefore, if the salary for December is paid on December 30, 2021, the personal income tax must be transferred no later than January 10, 2022. If the salary is paid in January, for example, on January 10, 2022, the tax must be paid no later than January 11, 2022.

In ZUP 3.1, you can reflect the transfer of personal income tax from wages in two ways:

- IN Vedomosti via checkbox The tax is transferred along with the salary. Here you will also need to indicate the details of the payment order for the transfer of personal income tax. The tax payment date will be considered the date of salary payment.

- Separate document Transfer of personal income tax to the budget (Taxes and contributions - All documents transferring to the personal income tax budget) - the tax payment date is entered manually. Therefore, if in fact the personal income tax was transferred not on the day of salary payment, but on the next one, then it would be more correct to reflect the payment of tax in the document Transfer of personal income tax to the budget.

The date of tax transfer in ZUP 3.1 appears only in the Tax Accounting Register for Personal Income Tax (Taxes and Contributions - Reports on Taxes and Contributions) in the Tax Transferred .

The actual date of tax payment does not affect the completion of 6-NDFL.

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C:ZUP, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Salary for December 2022 - how to reflect it in 6-NDFL? From the reporting for the 1st quarter of 2022, the calculation of 6-NDFL is filled out...

- The Ministry of Labor explained whether it is possible to pay a part-time worker a full salary and how the period of his downtime is paid. The employer contacted the Ministry of Labor with the question: is it possible to assign a salary to a part-time worker...

- Should I pay an annual bonus to a resigned employee: the position of judges and officials The Supreme Court of the Republic of Karelia considered the case of recovery from the company...

- Is an employer obligated to pay an annual bonus to a resigning employee? A controversial situation arose between a former employee of the company and his employer:...

Example No. 4. One category of income in one document (amounts under GPC agreements) and their payment in installments

A GPC agreement was concluded with employee Kiparisov for January-February 2022 for a total amount of 6,000 rubles. according to certificates of completed work:

In February 2022, two Acceptance Certificates for completed work in the amount of 5,000 rubles. and 1,000 rub. with planned payment dates of March 1 and March 5, 2022, respectively:

Accruals of amounts under contracts and personal income tax are made in the document Accrual of salaries and contributions in the context of planned payment dates:

Amounts under GPC agreements belong to the Income Category – Other income from employment . The date of receipt of income corresponds to the date of payment of income.

It is planned to pay 5,000 rubles on March 1, 2022. (including personal income tax) for the first act and on March 5, make a payment for the second act - 1,000 rubles. (including personal income tax).

The general scheme looks like this:

When filling out the Statement... March 1, 2022 with the payment method - Remuneration to employees under GPC agreements, the total amount payable under two acts is loaded - 5,220 rubles. and general personal income tax – 780 rubles:

Since you need to pay the amount under the first act, you need to open the explanation of the To be paid and adjust the amount to be paid by 4,350 rubles:

Next, you should click the Update personal income tax so that when partial income is paid, partial personal income tax is withheld. An amount equal to 650 rubles will be automatically loaded:

In the breakdown of the personal income tax withholding , you can see that personal income tax for the Income Category - Other income from labor activity is reflected in one line:

Since there is a payment of income with the Income Category - Other income from labor activity , then when posting the document Statement... in the accumulation register of Taxpayers' calculations with the budget for personal income tax, the calculated personal income tax is transferred from the planned payment dates to the actual ones in the context of two planned payment dates under GPC agreements. However, since both incomes have one basis document (document Calculation of salaries and contributions ) and belong to the same Category of income - Other income from work , then only one line appears for the withheld personal income tax and the corresponding paid income:

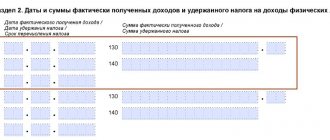

In the 6-NDFL in Section 2 , the amount of income paid will be reflected correctly in one block: in line 130 - 5,000 rubles, withheld personal income tax in line 140 - 650 rubles.

On March 5, 2022, when paying the final debt under GPC agreements, you can see a similar picture in the accumulation register. Calculations of taxpayers with the budget for personal income tax for the amount of withheld personal income tax in the amount of 130 rubles. and the corresponding amount of paid income - 1,000 rubles:

In the 6-NDFL in Section 2 , the amount of income paid will be reflected correctly in one block: in line 130 - 1,000 rubles, withheld personal income tax in line 140 - 130 rubles.

Thus, if one basis document calculates income with the Income Category - Other income from labor activity with different planned payment dates, then with partial payment of such income according to this basis document, the calculated personal income tax is “transferred” from the planned date to the actual date, and withholding of personal income tax and the corresponding paid income is made in one line on the date of payment. And this information is reflected in the 6-NDFL in Section 2 in one block.

General procedure for filling out form 6-NDFL

The calculation of 6-NDFL is made on an accrual basis for the first quarter, for six months, for nine months and for the year. The data is taken from tax registers (clause 1, article 230 of the Tax Code of the Russian Federation, clause 1.1 of the Procedure).

You need to report:

- for the first quarter – no later than April 30;

- for half a year - no later than July 31;

- for nine months - no later than October 31;

- for the year - no later than April 1 of the year following the reporting year.

The calculation consists of sections, each of which is required to be completed:

- Title page;

- Section 1 “Generalized indicators”;

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

How should tax be reported?

Income tax is not allowed to be transferred until the end of the month of its deduction. This payment will be regarded as payment at the expense of the business entity. This is enshrined in the Tax Code, Art. 226 clause 9. Calculation of income tax should be performed no later than the working day following the day of payment of earnings, from which the actual deduction will occur (TC Article 226 clause 6 and Article 6.1 clauses 6-7).

Despite the fact that the law does not allow advance calculation of personal income tax, tax authorities do not apply sanctions to organizations if payments arrive to the treasury in the current month ahead of schedule.