February 3, 2022 #Starting a business #Tax optimization

This article was first published in early 2022. But since then, a lot has happened, the patent has become in many ways similar to UTII, and the imputed income itself has sunk into oblivion - so we brought the material into line with new realities. The text is current as of February 3, 2021.

What should an entrepreneur choose if he sews clothes, does cargo transportation, does haircuts, or develops design projects? Patent taxation system. It was introduced not long ago to make accounting easier. The patent system is a taxation regime with a fixed amount of tax for a limited period. Who can use it, how and whether it’s worth it - we’ll look at it in the article.

There is a link to the video below. If you don't like to read, take a look

What are the benefits of tax

- Fixed tax for the entire period of validity of the patent: the entrepreneur pays part of the potential annual income (in most cases 6%). The amount of such income and the rate are determined by regional laws, so the cost of a patent for the same type of activity in two neighboring regions may differ.

It is considered like this:

— if the patent is for 12 months: the potential annual income is multiplied by 6% of the tax rate;

- if less than 12 months: (we divide the tax base by 365 days, multiply by the number of days for which the patent was issued) multiply by 6%.

- Can be combined with other tax regimes. And this combination of regimes allows you to legally save on taxes.

Let's look at an example. In Yekaterinburg, a patent for the development of computer programs without employees costs 13,500 rubles per year. That is, an individual entrepreneur will pay 13,500 rubles for a patent and 36,238 rubles in insurance premiums. Total - 49738 ₽. If an individual entrepreneur’s actual income for the year is 1,000,000 rubles, and the individual entrepreneur applies the simplified tax system of 6%, then in the end he will pay taxes of 60,000 rubles. That is, a patent is 10,262 rubles more profitable.

If you have several taxation regimes, then you need to keep separate records for each. A book of individual entrepreneur’s income is kept for activities on the patent, and a declaration is submitted to the simplified tax system. Separate accounting is when it is necessary to separate income and expenses for different types of activities. For example, you can open a hairdresser - this is a patent. And then decide to sell cosmetics there. Trade in cosmetics is no longer covered by a patent for a hairdresser, so it is necessary to separately take into account income and expenses from services and from trade in cosmetics.

- It's easy to get a patent. If you receive it in the region where you are registered, contact the tax office at your place of registration. If a patent is needed in another region, contact any tax office. Remember that the cost of the same patents differs for different territories.

- A patent replaces several taxes at once: personal income tax, VAT, personal property tax. The rules apply to income from activities covered by the patent and property used in such activities.

- Simplified reporting: there is no tax return, but there is a book of income for individual entrepreneurs. It is highly advisable to keep it, since the tax office may request it for analysis. And you need to monitor your income so as not to exceed it.

- You can obtain patents in different regions for different types of activities. The law does not prohibit multiple patents. There are no restrictions on quantity. Choose as many as you want. To find out what types of activities you can buy a patent for in your region, use the service.

- You can immediately automatically calculate and estimate your future patent costs. The cost, for example, is affected by the number of employees, the area of the sales floor or the number of vehicles.

If you decide to become a hairdresser without employees in Yekaterinburg, and you need a patent for 8 months, then the cost will be 9,000 ₽. Calculation formula: 150,000 ₽ (nominal income) x 6% = 9,000 ₽.

- Paying for a patent is convenient. If it is issued for a period of up to 6 months, the cost is paid until the end of the patent's validity period. If the period is more than 6 months, the patent is paid in two parts: 1/3 within 90 days after the patent begins to be valid, 2/3 before the patent expires.

- Tax holidays are a period during which an individual entrepreneur does not pay tax. They have a zero rate - instead of 6% there will be a 0% rate. He pays other taxes and insurance premiums like everyone else. The zero rate can be applied to registered individual entrepreneurs for the first time within 2 tax periods. The tax period is the validity period of the patent. The conditions for applying tax holidays are determined by the laws of the regions of Russia and may differ, so you should definitely check the “Features of regional legislation” section on the patent system on the tax website.

All about the patent taxation system: how can an individual entrepreneur work with PSN?

Table of contents

Before registering a business and starting work, an entrepreneur must choose a tax regime. How to choose a tax system to pay less taxes? The answer is clear: you need to study all existing regimes, calculate the tax burden for each of them and choose the best option. For some entrepreneurs, this is the patent regime. Let's figure out how it works.

How the patent regime works

The patent system is a preferential special regime that is intended only for individual entrepreneurs. Legal entities cannot apply this regime.

The system works as follows: in order to engage in a certain type of business, an individual entrepreneur buys a special permit - a patent. And its cost is the tax that an entrepreneur pays for the right to work in a specific area. If an individual entrepreneur has several areas of business, he buys a patent for each area of activity.

Regional authorities themselves set a fixed amount of annual income that a businessman can receive. They calculate the patent fee based on this amount. How much an entrepreneur actually earns is not important.

For example, an individual entrepreneur opens a hairdressing salon in Moscow and plans that the income in the first month of work will be about 100 thousand rubles. With a successful combination of circumstances, revenue will grow in the future. A patent for one month costs 5,031 rubles. Even if the individual entrepreneur earns an order of magnitude more in subsequent months, the cost of the patent will remain the same until the end of this year.

A patent, as a preferential special regime, relieves individual entrepreneurs from paying fees and taxes for the type of business for which it was received. An entrepreneur who has acquired a patent does not pay:

- income tax;

- value added tax, with the exception of some special situations, for example, the import of goods from abroad;

- property tax;

- trade fee.

But a businessman is still required to pay insurance premiums both for himself and for his hired staff. He is also obliged to transfer income tax on employee remuneration to the budget and pay local taxes. For example, transport or land.

Types of business that can be transferred to a patent

The list of types of business that can be engaged in under the patent regime is given in paragraph 2 of Article 346.43 of the Tax Code. This list includes 63 types of businesses.

Local authorities may add to the list or limit the number of physical indicators. For example, in St. Petersburg, a patent for catering services is issued if the area of the hall for visitors at each facility is no more than 50 square meters.

To understand whether a particular activity falls under the patent regime, you should read your regional law or contact your local tax office. For example, in Moscow, 80 types of businesses are covered by a patent. The basis is the law of October 31, 2012 No. 53.

Check your local regulations to determine whether the patent regime is right for you. If the potential amount of income from the law is higher than the expected income you plan to receive from your business, it is not profitable to buy a patent.

Restrictions on the use of a patent

The patent regime is intended for start-up entrepreneurs or business owners with modest turnover. Therefore, the Tax Code sets strict limits on the use of a patent depending on the size of the business.

An individual entrepreneur can work on a patent as long as:

- the total number of its employees who are engaged in the patent business will not exceed 15 people;

- his income from the beginning of the year from all types of business on the patent will not exceed 60 million rubles.

In addition, entrepreneurs who sell retail patents are prohibited from selling labeled goods.

For how long can you buy a patent?

A permit can be purchased for any number of months, but within one calendar year.

If the individual entrepreneur decides to close the business before the patent expires, the overpaid money can be returned.

How much will a patent cost?

The basis for calculation is the amount of probable income, which is established by the regional authorities. The patent tax rate is 6%. The exception is Crimea and Sevastopol. These regions have a lower rate - 4%.

In some regions, tax holidays have been established until the end of 2022: aspiring entrepreneurs who plan to open a production facility, work in the scientific or social sphere, can obtain a patent for free. For example, in Moscow, holidays apply to types of businesses that are listed in Part 2 of Article 1 of Law No. 10 of March 18, 2015.

Example. The individual entrepreneur decided to provide services for creating websites, databases and software development in Moscow and purchase a patent for three months: from 04/15/2020 to 07/14/2020.

The possible annual income in this line of activity, according to paragraph 79 of Article 1 of Law No. 53 of October 31, 2012, is five million rubles. This type of business is not subject to tax holidays, which means the tax rate is 6%.

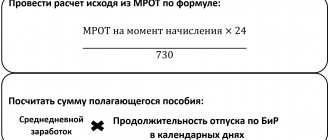

We calculate the patent fee using the formula:

\[Cost\;patent\;=\;\frac{Potential\;possible\;income\;per\;year}{Number\;days\;per\;year}\;\times{Tax\; rate}\times{Duration\;validity\;patent}\]

In our example. Patent cost = 5,000,000 rubles / 366 days * 6% * 91 days = 74,590 rubles.

For the convenience of businessmen, the Federal Tax Service has launched a calculator for calculating patent tax. It is easy to use: the user just needs to specify the initial data and click the “Calculate” button.

Calculation on the Federal Tax Service portal according to our example

Do I need to pay the entire cost of the patent at once?

No no need. If an individual entrepreneur buys a patent for a period of up to six months, he must transfer the money in one payment before the end date of the patent.

For example, an entrepreneur purchased a patent for four months. The patent is valid until 06/30/2020. This means that its cost can be paid on any day during the validity period of the patent, but no later than 06/30/2020.

If an individual entrepreneur has acquired a patent with a validity period of six months to one year, he can split the payment into two parts:

- one third of the amount must be paid within 90 days from the date the patent begins;

- two thirds - until the patent expires.

How to pay for a patent

Inspectors indicate the amount of tax, terms and amounts of payments directly in the patent. Along with the patent, individual entrepreneurs also issue receipts for payment. They already have all the necessary details; you don’t need to search for anything yourself.

You can make a payment in any convenient way. For example, fill out a payment order yourself based on the receipt details in your client bank and send money electronically. Or come with a receipt to any bank and make a payment through an operator.

If the receipt is lost, you can generate a new payment document through the Federal Tax Service service.

Where and how to get a patent

To obtain a patent, you need to submit an application to the tax office in the prescribed form. If an individual entrepreneur plans to conduct several types of business, then to obtain patents for each type of activity, you must fill out a separate application.

An individual who is just registering as an individual entrepreneur and intends to conduct business at his place of residence can attach a patent application to the registration documents.

If an individual entrepreneur has already been registered and then decides to apply the patent regime, he must submit an application no later than ten days before the start of patent activity.

In a situation where an individual entrepreneur opens a business in another region, that is, not at his place of residence, an application for a patent can be submitted to any tax authority of this subject of the Russian Federation. But there is an exception to this rule: if the law of a constituent entity of the Russian Federation establishes different amounts of possible income in different municipalities, then you need to submit an application to the tax office of the entity where the individual entrepreneur will operate.

This exception does not apply to federal cities. If an individual entrepreneur from another region opens a business on a patent in Moscow, Sevastopol or St. Petersburg, he can contact any inspectorate of that city.

There are three ways to submit your application:

- personally or through a representative by notarized power of attorney;

- by post with a description of the contents;

- electronically, if the individual entrepreneur is connected to electronic document management through an operator.

The tax service is obliged to issue a patent within five days from the date of filing the application.

Accounting and reporting

There is no need to submit any declarations under the patent regime to the tax office. But the entrepreneur must fill out an income book in order to notice in time that the limit of 60 million rubles is exceeded.

If an individual entrepreneur attracts hired personnel, he must keep records of wages, contributions, income tax and submit reports for employees.

Combination of tax regimes

The patent system applies only to certain types of activities and can be combined with any other tax regime: general, simplified, imputed, system for agricultural producers. Not all types of activities are transferred to a patent, but only those specified in local law. If the type of activity does not fall under the patent, then it will have to be carried out under a different tax regime. It happens that an individual entrepreneur has the same type of business, but in different regions: in one region this type is transferred to a patent, but in another it is not. Then the combination happens.

Combination with OSNO occurs when one of the types of activities is related to working with legal entities that need VAT deductions. If an individual entrepreneur operates without VAT, it will be unprofitable to sign contracts with him. For example, an individual entrepreneur can transport goods from a factory to wholesale warehouses with VAT and at the same time have a chain of eateries under patent.

Pros and cons of the patent regime

Like any other mode, a patent has its pros and cons.

pros

- No tax reporting. There is no need to prepare declarations or comply with deadlines for submitting them.

- The amount of tax does not depend on the amount of income. If a business grows, then, despite the increase in income, the tax burden remains unchanged.

- Insurance premiums of 1% must be paid on potential income. Individual entrepreneurs whose annual income exceeds 300 thousand rubles must additionally pay insurance pension contributions on the excess amount. If an individual entrepreneur applies a patent, then the potential, rather than actual, income is taken as the basis for calculating the amount of excess.

For example, an individual entrepreneur is engaged in software development in Moscow and earned eight million rubles in a year. The potential annual income from the patent is five million rubles. This means that the individual entrepreneur will count contributions from the excess amount not from eight million rubles, but from five.

(5,000,000 rubles – 300,000 rubles) * 1% = 47,000 rubles

Minuses

- Insurance premiums do not reduce the value of the patent. Individual entrepreneurs who work under other preferential regimes can reduce the tax on the amount of insurance premiums. For the patent regime, such a provision has not yet been adopted, although a corresponding bill already exists.

- The possibility of applying a patent is strictly limited. The number of staff and income are limited. Local authorities may further limit the number of physical indicators. For example, the total area of premises for rent, the number of cars or retail outlets.

- A patent is valid for a certain period. As soon as the period comes to an end, you need to contact the inspectorate again with an application. By default, the tax authorities will not renew the patent.

Results

The patent tax system is suitable for beginning entrepreneurs who find it difficult to calculate the profitability of their business in advance. This mode simplifies your work, as it does not require complex tax accounting and filing a declaration. The cost of a patent does not depend on actual income, but on potential income, the amount of which is approved by the regional authorities. If the expected income is below the level set by the authorities, it is not profitable to buy a patent.

Minuses

- Only individual entrepreneurs can obtain a patent. There is no such tax for companies.

- Insurance premiums must be paid. From 2022, the cost of a patent can be reduced by the amount of insurance premiums paid, similar to the simplified tax system “Income”. Individual entrepreneurs without employees can reduce the cost of a patent by 100% of insurance premiums, and if there are employees, then by half. An important condition: the employees must be engaged in exactly the type of activity for which the patent was issued.

- A patent can be obtained for a period of 1 to 12 calendar months. If you plan to work on a patent for several years, you need to obtain a new patent every year.

- The patent applies to services for the population, cargo transportation, and retail trade with a sales area of up to 150 sq.m. There may be other types of activities, but there is no longer uniformity: regions have the right to introduce a patent taxation system in relation to any types of activities named in OKVED, as well as establish any physical indicators for calculating the cost of a patent.

- A patent is issued only for one type of activity.

- If an entrepreneur is engaged in retail trade and catering, then the trading or service hall cannot be more than 150 sq.m. Not so little, but if it’s even a meter more, they won’t give it.

- A patent will not be granted for activities carried out under a partnership agreement or a property trust agreement. And also to those who are involved

- production, extraction and sale of excisable goods;

- wholesale trade and trade under supply contracts;

- transactions with securities;

- cargo and passenger transportation, if there are more than 20 vehicles.

- Work can be done either on your own or by involving others. But these “others” can only be individuals - under an employment contract or under a GPC agreement (do not forget that there are subtleties). In other words, an individual entrepreneur who has a patent for some type of patent cannot enter into a contract agreement with an LLC or another individual entrepreneur on a patent - otherwise the tax will have to be calculated at the rate of the tax system that is declared as the main one, and this may be where a more significant amount.

Pay by phone

It is also possible to pay for a patent using a mobile phone if the device has a valid Sberbank-Online application. Then the actions will be similar to those in the previous version. You should go to payments, go to the appropriate section, enter all the data in the form and complete the operation.

The main difference is that you can only display a completed receipt from a personal computer. For these purposes, open the transaction history and, having found the one you need, send it to print in the same way as was presented above.

Transition conditions

- Be an individual entrepreneur.

— The legislation of the region allows you to obtain a patent for your chosen type of activity.

— The average number of employees cannot be more than 15 people per tax period.

— Real income should not exceed 60 million rubles per year.

You need to be careful with a patent, because it can easily fall off. What could be the reasons: there were more than 15 employees, income from all patent activities amounted to more than 60 million rubles. in year.

How to get a patent

— Fill out an application for a patent in form No. 26.5-1 and submit it to the tax office.

— Submit an application to the tax office 10 working days before the start of application of the patent tax system.

— Within 5 days, the tax office makes a decision to issue a patent or refuse to issue it. The answer can be received in person or by mail. The date of registration will be the date of commencement of the patent. The application will contain the patent number, validity period, amount of potential annual income, tax payment deadlines and details.

How to pay for a patent in Sberbank Online

Via phone

To pay for a patent using a mobile application, you must follow the following sequence of actions:

- Log in to your personal account, for which you will need to confirm authorization via a message sent to the number;

- Open the “Transfers and Payments” tab in the main menu, select “State” or “Business and Work” from the row that appears, and through this section open the tab with the Federal Tax Service. It is important to remember that payment for a patent is carried out exclusively at a specific regional office, and not through the main inspection center;

- In the window that opens, you need to proceed to pay for the patent. To do this, you need to click on the appropriate line, after which the system will redirect the user to the payment form;

- In the tab with the payment form, the user will need to indicate the inspection authority in the required region and click on the button to continue the procedure;

- Subsequently, personal data is entered. In particular, you will need to indicate your full name, tax identification number and OKTMO;

- In this section with personal data, you must select a bank card from which funds will be debited. It is important to remember that in this case only a debit card is suitable - it will not be possible to pay for the patent using credit and corporate cards;

- Before clicking on the payment confirmation button, the user will be asked to carefully double-check the previously specified data. If all the information has been entered correctly, you should confirm the payment and enter the code that will be sent to your mobile phone within the next two minutes.

Via Computer

If we talk about how to pay for an individual entrepreneur’s patent through Sberbank using a computer, first of all you will need to undergo authorization in the Internet banking system. Clients who have already used this service will only need to provide a password and login, and then confirm login with the password from the message that will be sent to their mobile phone.

If the registration procedure in Sberbank Online has not been carried out previously, then you need to do so. User verification can be done using a bank card number. Next, enter the received password, and also indicate the login and password for your personal account.

Step-by-step instructions for paying via a personal computer:

- On the start page, which contains information for each client product, you need to find the “Transfers and Payments” section and go to it;

- In the section on fines, duties, taxes, budget payments, you need to find the section of the Federal Tax Service. The main thing here is that the region in which the service is searched corresponds to the region in which the citizen works, since payment must be made to the regional office;

- In the tab that appears, you need to select a special section for paying for a patent and start filling out the details;

- After this, the service requiring payment is selected, where in the window that appears, the user will be offered a more precise definition of the recipient’s regional branch. It is important to remember that it must necessarily coincide with the place of stay;

- Next you need to select the bank card from which the payment will be made. It is important to understand that credit cards or savings accounts are not suitable for this payment. Therefore, you will need a Sberbank debit card, since only with its help can payment be made;

- This step will require entering information about the taxpayer. It determines the possibility of payment under a patent for a specific person by a third party indicating the full name.

- At the last stage, the Federal Tax Service client’s data is specified for successful identification. In particular, the TIN will be required. This information can be clarified in advance when contacting the tax service. There you can also get information about OKTMO.

Why can you be denied a patent?

- The application was filled out incorrectly.

- We are late in paying for a valid patent.

- Exceeded the limits on employees and real income.

- You file a patent for a type of activity that does not fall under it.

If an individual entrepreneur has lost the right to apply a patent, then a new patent for the same type of activity can be issued starting from the next calendar year. Therefore, for example, when it is necessary to suddenly move a retail outlet within a year, you should first obtain a patent at the new address, and then abandon the patent at the old address. If you do the opposite, the patent at the new address will be denied.

Responsibility

If an individual entrepreneur loses the right to use a patent, then he is obliged to pay tax according to the general taxation system for the period in which this right was lost. At the same time, penalties are not paid in case of late payment of advance payments of taxes under the general taxation system during the period for which the patent was issued. Also, the amount of personal income tax payable for the tax period in which the entrepreneur lost the right to use the patent is reduced by the amount of tax paid in connection with the use of the patent taxation system.

If initially an individual entrepreneur applied for the use of the simplified tax system or another special regime, then if he loses the right to use the special tax regime, he switches to the special regime that he combined with the patent. And in this case, the tax under the special regime is also reduced by the amount paid under the patent.

When does a foreign citizen need to pay for a work permit?

A foreign citizen who arrived on the territory of the Russian Federation under a visa-free regime for the purpose of further employment is required to submit documents to obtain a migration patent allowing him to work here.

Important! The granting of a patent implies for a foreigner the payment of monthly contributions to the Federal Tax Service in the form of fixed advance payments for personal income tax (personal income tax). This amount is fixed by law, but it is different for each region.

Thus, patent fees must be paid monthly in the amount indicated on the receipt. Payment must be made no later than three days before the expiration of the patent, with the date of issue of the patent indicated on the back of the document being taken as the starting point.

In turn, on the Internet you can find advice that it is necessary to make personal income tax contributions to “patented” employees based on the date of payment for the patent when applying for its issuance. However, this advice is not correct, since many of these advisers themselves took advantage of the contradictory opinion of a friend, relative or stranger, while lawyers unanimously argue that you need to pay for a patent based on the date of issue. One way or another, this confusion with dates is due to the lack of legislative regulation.

When paying, you can also take into account that the contribution may be equal to the amount of contributions for several months. This depends on the person’s desire to pay in advance for a certain period of validity of the patent, for example, two months. In this case, the maximum amount can be a contribution for no more than 12 months.