A company may look prosperous on the outside, have a beautiful office and a polite sales department, but inside there are huge debts, courts and the director is on the run.

And if you deduct VAT, the tax office may give you years taken out just because the counterparty seems to be somehow unreliable.

Therefore, counterparties must be checked. Here's how to do it.

Let me make a reservation right away: there are 16 ways to check a counterparty using different databases, sites and services, and if you use them all, it will cost time. On the other hand, a counterparty that has completed all 16 steps is gold. If you started checking, and the first five stages turned out to be a failure, you can immediately refuse this counterparty - it is unlikely that you will find something good further.

Why check counterparties?

Unscrupulous companies are very good at feigning trustworthiness. You can’t trust abundant advertising on the Internet, generous discounts, or expensive suits. That's why you need to check your counterparties based on documents.

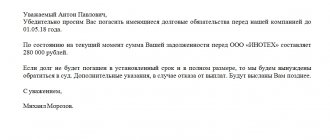

Identify those who will not fulfill their obligations. My clients often talk about the dishonesty of their partners. The beauty salon was poorly renovated and disappeared - the losses amounted to a third of the original repair amount. The customer did not pay the builders for the work performed for three years - they had to sue, but the customer went bankrupt.

It often happens that the buyer accepts the goods and does not pay. Or vice versa: the supplier receives an advance and does not ship the goods. The check will help you decide whether it is worth cooperating with the counterparty, or whether there is a risk that he will not fulfill his obligations.

Do not work with one-dayers. The counterparty may turn out to be a shell company that was created a week ago specifically to take advances from customers and disappear. In this case, you will only lose money, but this is also unpleasant.

It may turn out that the company does not exist at all. There is a website, there is a name and an account for transferring money, but there is no legal entity, and behind the website there are deceivers.

Identify scammers. Your counterparty may be committing financial crimes, such as cashing out or racking up illegal loans. In this case, law enforcement agencies will check not only the counterparty, but also you as his partner.

Avoid working with a bankrupt. You can contact a company that is in bankruptcy. If you transfer money to such a company, you will not see it soon, if at all.

Creditors have the right to challenge any transaction with a bankrupt, including yours, in court. To get money back, you need to be included in the register of creditors and wait for the end of the bankruptcy procedure, which can last several years.

No problems with the tax authorities. If the tax office considers that you have not sufficiently checked the integrity of a potential counterparty, you may be denied a tax benefit. That is, you will not be able to pay less taxes - receive a tax deduction or apply a lower tax rate.

A case from one's life.

After a tax audit, one company was assessed additional income tax and VAT in the amount of 10 million rubles. The fine and penalties amounted to another 4 million.

The reason for this was one supply contract. The tax office said that the company did not exercise due diligence when concluding the agreement: the counterparty could not conduct real business activities, did not pay taxes and generally existed only on paper.

We went to court, but he sided with the inspectorate. It turned out that the counterparty was completely excluded from the register of legal entities.

During the audit, the tax office found out that the passport of the person who signed the agreement on behalf of the counterparty does not exist, and the signatures are forged. Then the police got involved and the real fun began. The police were looking for the undelivered goods, the general director, and raised awareness of all the partners of the dishonest contractor, including our unfortunate company, which eventually had to pay additional taxes and a fine.

Since 2022, a new article of the Tax Code 54.1 has been in force. It directly prohibits reducing the tax base or the amount of taxes if the organization has distorted the facts of its activities. But if the facts are displayed correctly, the purpose of the transaction is not tax benefit and the agreement was actually executed, then the organization has the right to reduce the tax base or the amount of taxes. This article will apply to on-site tax audits that were scheduled after August 19, 2017. Judicial practice on the application of Art. 54.1 of the Tax Code of the Russian Federation has already appeared in disputes with the tax authorities.

A case from one's life. The tax inspectorate became interested in several supply contracts for one organization. And after the inspection, the company was assessed additional taxes, fines and penalties of 39.5 million rubles. Disagreeing with the tax authorities' decision, the organization filed a lawsuit.

The first instance sided with the tax authorities, and the second one agreed with the organization. The third instance said that tax rights and taxes would have to be paid extra.

The reason for this was that the reality of contracts with counterparties was refuted by the tax authorities.

The tax office referred to this. The counterparties were absent from their legal addresses, the documents of the counterparties were not signed by the directors, and the directors themselves denied their leadership of the companies. The tax authorities also found that the problematic counterparties have the same IP addresses.

The tax court agreed and the organization had to pay a significant amount.

Documents that need to be requested from a foreign organization

If the counterparty is a foreign organization (non-resident), then when requesting documents from this counterparty and checking them, the following features must be taken into account.

Firstly, documents confirming the legal status of a foreign organization (charter, constituent agreement, certificate of incorporation, etc.) must be translated into Russian and legalized in the prescribed manner, unless the law provides for a simplified procedure for their confirmation by affixing an apostille .

The list of documents for which an apostille is required is specified in Article 1 of the Hague Convention Abolishing the Requirement for Legalization of Foreign Official Documents, to which Russia is a party (concluded in The Hague on October 5, 1961, entered into force for Russia on May 31, 1992). If the country of origin of the counterparty is not a party to this convention, then all its official documents must be legalized in the prescribed manner.

Similar requirements apply not only to the constituent documents, but also to the power of attorney of the person who will sign the agreement, as well as to all other official documents.

It is necessary to keep in mind that the counterparty - a foreign organization - may refuse to provide apostilled or legalized documents, citing the complexity of the procedure, high cost, etc. In this case, you can accept copies of documents from him without the necessary certification. However, in this case, the risks when concluding an agreement with this counterparty will increase many times over.

Secondly, before concluding an agreement, it is advisable to request an extract from the trade register of its country from a foreign organization. This extract must indicate the status of the foreign company, and the company must be listed as “active”. If the counterparty does not provide such an extract or the current status is indicated in the extract, it is not recommended to conclude an agreement with this organization. In the event of a legal dispute, you will not be able to protect your rights and recover losses from an organization that has already ceased its activities.

At the same time, a number of foreign countries do not provide for the maintenance of trade registers (for example, in the UK). In these cases, instead of an extract from the commercial register, it is recommended to request a certificate confirming the good standing of the company.

Here's how to check the counterparty yourself.

Step 1: Request a set of live documents

Request copies of key documents from your potential counterparty. For companies, this is a charter, a tax registration certificate (TIN), a certificate of assignment of the main state registration number (OGRN), as well as a decision or protocol on the appointment of the general director. For individual entrepreneurs - a certificate of assignment of the main state number of an individual entrepreneur (OGRNIP).

If an organization or individual entrepreneur is registered in 2022 or later, then instead of registration certificates they only have sheets for recording information in registers. This is fine.

Willingness to provide documents at your request is a good sign. This means that the counterparty is serious and ready to work in good faith. And in the event of a court case or claims against you from the tax authorities, requesting constituent and registration documents from your partner is a plus in your favor to confirm the fact that you checked the counterparty.

If you are planning to enter into a transaction for a large amount, the counterparty's charter will show how it can conclude such a transaction and whether it can do so at all. To do this, you need to study the rules for approving a major transaction and check the competence of the manager.

For example, for an LLC, by law, a major transaction is a transaction or chain of transactions worth more than 25% of the value of the company’s assets. Sometimes business owners limit large transactions to a specific number. For example, a transaction worth more than 500 thousand rubles is considered large. In this case, the director cannot sign the agreement if it is not approved by the decision of the owners of the organization.

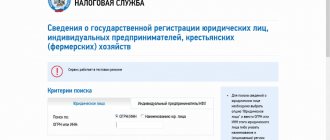

Step.2 Get a current extract from the register

Check the basic data of the organization with which you are going to enter into an agreement. To do this, take a free extract from the Unified State Register of Legal Entities, in which you look at the general data: registration date, address, authorized capital, telephone numbers, full names or names of managers and founders, types of activities of the organization.

Extracts are publicly available on the tax website; you can check the counterparty by TIN, OGRN or name.

Check that all this matches your expectations and common sense. It will be strange if you enter into an agreement for the supply of fittings with a company that deals with children's parties.

An alarming sign is the large number of very different types of activities of the company, from selling baby food to oil refining. This may be a sign of a garbage company that is being used to siphon money. And the absence of the necessary type of activity to conclude a transaction, according to tax inspectors, is one of the signs of a fly-by-night company.

The supply agreement that the company from the previous example entered into was related to petroleum products. But for some reason, the company bought petroleum products from a company that, according to documents, sells paints and varnishes, sheet glass, sanitary equipment and other construction materials. The IRS didn't like it.

But that's another matter. The company was brought to justice, among other things, because it entered into agreements for the repair of equipment with contractors who, according to the Unified State Register of Legal Entities, do not engage in this type of activity. The main activity of one counterparty is general construction work. Another is forestry and services in this area. It shouldn't be this way.

Also, look to see if there is a note in the statement about the unreliability of information about the general director or address. This should be alarming. Inaccurate address information means that the organization does not receive correspondence at the address specified in the Unified State Register of Legal Entities or is not located there at all. And the unreliability of information about the general director indicates that the director indicated in the Unified State Register of Legal Entities does not fulfill his functions. Perhaps it was a nominal director who left long ago.

Pay attention to the size of the authorized capital if your potential partner is an LLC. The minimum amount of 10 thousand rubles for a serious organization, together with other alarming factors, is also a reason to think about it.

This is what a mark indicating the unreliability of information about the general director looks like. This means that the director is listed incorrectly in the statement.

This is what a mark indicating that the address is invalid looks like. According to the tax authorities, the organization is not located at this address

Step.3 Check the counterparty's address

Check the counterparty's address to see if it is a mass address. A bulk address is the address of the location of a large number of organizations that simply buy it on the Internet for registration. Thousands of different companies can be located at one address.

This may mean that the counterparty is not located at the stated address. It will be difficult to find in case of conflict. A mass address purchased for registration may not in itself indicate the unreliability of the counterparty, but in the overall picture of the audit it should raise red flags.

Step.4 Check if the director is disqualified

Look for the head of the counterparty in the register of disqualified persons. Also, check information about persons who, through the court, refused to manage a potential partner.

A disqualified director does not have the right to manage the company and enter into contracts. He cannot do anything at all on behalf of the organization, unless by proxy. For amateur activities, such a director faces administrative liability.

Step.5 Clarify what kind of business the counterparty is conducting: small or medium

Check the register of small and medium-sized businesses to determine what type of counterparty it is: micro-enterprise, small or medium-sized enterprise. This will show the level of turnover of the company and the number of employees in the organization.

Small businesses can have up to 100 employees, while medium-sized ones can have between 101 and 250 people, according to official data. A fly-by-night company or fraudulent organization will not employ such a number of people.

Step.6 Check if the counterparty is bankrupt

Check the federal bankruptcy registry to see if your counterparty is about to go bankrupt or is in receivership.

If bankruptcy proceedings are introduced against a counterparty, its activities are suspended: it cannot enter into transactions at all. You cannot work with such a company.

If bankruptcy has just begun, you should wait: the financial situation may stabilize. If the future partner himself filed for bankruptcy, most likely he is cunning and has no money - it is better not to mess with such a person.

Step.7 See if the counterparty is excluded from the Unified State Register of Legal Entities

Look in the State Registration Bulletin for messages about the upcoming exclusion of an organization from the Unified State Register of Legal Entities as inactive.

If there is such a message, it looks like a scam - be careful. You may be the scammer's latest attempt to illegally enrich himself.

For example, you really need to install new desks in your office, you enter into an agreement with a counterparty, give an advance, and then find out that he has already been excluded from existing legal entities. Unpleasant.

Step.8 Search for the counterparty in the bailiff database

You can check the organization for the presence of debts and enforcement proceedings for their collection on the website of the Federal Bailiff Service.

Enforcement proceedings begin after cases are won in court. This suggests that the potential partner not only sues and loses, but also continues to not pay his bills.

On the same resource you can view tax debts; they are also collected through bailiffs.

Check results on the FSSP website. There are too many enforcement proceedings.

Step.9 Check the counterparty in the file of arbitration cases

The file of arbitration cases will tell you in what legal proceedings the counterparty is involved, what obligations it does not fulfill, with whom it is in conflict and why. Or maybe, on the contrary, your future partner is always on the side of good and justice.

If a supplier has several lawsuits with customers in a row, a contractor is suing a customer over the quality of work, or an organization regularly forgets to pay for electricity - this is a reason to think about it. Or you can ask your future counterparty about this question directly.

Checking the counterparty in the Arbitration Case File. It’s better to search by INN or OGRN; you can go straight to those cases where the counterparty is the defendant.

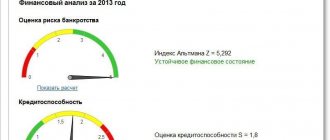

Step 10 Find out if the counterparty has a profitable business

Review and show your accountant the counterparty's accounting data. In them you will see what happened to the company’s finances over previous years: how much they earned, how much they lost, went into negative territory or became positive.

Data on the reporting of LLCs, PJSCs, JSCs and even non-profit organizations can be found on the websites of the Center for Corporate Information Disclosure and the Federal State Statistics Service. A profitable accounting past is a good sign.

In the Corporate Information Disclosure Center you can see a lot more interesting things: persons associated with the company, decisions of participants and even issue documents.

Balance sheet of Mosenergo. Everything is fine here financially.

Step.11 Check the passport for validity

Another useful service is the list of invalid Russian passports on the website of the Ministry of Internal Affairs.

It will be unpleasant to find out that the general director, representative by proxy or individual entrepreneur has an invalid passport. This fact clearly indicates that you need to be careful with such a counterparty. Maybe there was a glitch in the passport data accounting program, or maybe the passport was used by scammers who stole it.

Step.12 Check whether the power of attorney has expired

If a person with a notarized power of attorney is going to sign the contract on the part of the counterparty, it is better to play it safe and check the power of attorney using the details on the website of the Federal Notary Chamber.

If there is no power of attorney on the website or it has been revoked, the agreement cannot be signed - such a transaction may be declared invalid. First you need to contact the head of the counterparty, obtain evidence of approval of the transaction and request a new power of attorney.

Step.13 Check the validity of the license

If your counterparty must have a license to carry out activities, it is better to check its validity - you never know. Without a license, he simply does not have the right to enter into transactions.

The presence of a license can be viewed in an extract from the Unified State Register of Legal Entities on the tax website, and its validity can be checked directly.

For example, you can check a license for the sale of alcohol in the register of licenses of the Federal Service for Regulation of the Alcohol Market, and for educational activities - in the register of licenses of the Federal Service for Supervision of Education and Science.

On the Fedresurs service you can check construction organizations: in which self-regulatory organizations (SROs) they participate. No licenses are needed for construction, but membership in an SRO and permits are required.

Step.14 See if it is a nominee director

See if the director manages several organizations at once. This can be done on the website of the Federal Tax Service.

It happens that fraudulent companies simply pay some person to be a director in 5, 10 or even 15 companies. This is a clear sign of a shell company or a company that illegally transfers money abroad.

This director runs ten organizations - it looks like these are shell companies.

Step.15 Check changes in the Unified State Register of Legal Entities

You can also find out whether the director or owner of the organization is changing on the Federal Tax Service website. Perhaps the director with whom you are negotiating the deal has already written a letter of resignation.

Making any changes to the Unified State Register of Legal Entities is a reason for a potential partner.

This is what information looks like when an organization is changing its CEO.

Step.16 Conscientious supplier

Many construction organizations and suppliers participate in government tenders for government procurement. When they do not fulfill their obligations, they are included in the register of unscrupulous suppliers. You can check whether the counterparty is included in such a register on the procurement website.

Inclusion in the register of unscrupulous suppliers does not immediately characterize the organization as unreliable. But together with other verification methods it will create an overall picture of the counterparty.

What to pay special attention to when checking a counterparty

The following points can serve as special signals of a counterparty’s unreliability:

- the company refuses to provide copies of legally significant documentation, for example, the charter, TIN or OGRN;

- OKVED codes indicated in the extract from the Unified State Register of Legal Entities do not correspond to the actual activities of the counterparty;

- the number of OKVED codes exceeds a reasonable number, and at the same time they are quite diverse and relate to completely different areas of activity;

- there is information about the unreliability of the legal address or information about the director;

- the organization has no employees;

- the counterparty is often involved in legal proceedings;

- operations are carried out that are atypical for the activities of the enterprise;

- the company submits zero or loss-making reports;

- the counterparty has a serious debt on taxes and fees.

Important! If already at the initial stage there are serious doubts about the reliability of the counterparty, it makes sense to refuse to cooperate with him, even if he offers good conditions and prospects.

Regulations so as not to get confused and forget anything

On August 1, the tax office published more information about the companies in the public domain. But this information is not so easy to find, so I have prepared the Counterparty Verification Regulations, which can be printed and attached to transactions. This way you will show the tax authorities or the court that you have checked your partner in as much detail as possible.

The regulations will also help you decide whether it makes sense to work with a potential counterparty. We suggest downloading the Contractor Verification Regulations.

I recommend considering all verification steps together. If a potential counterparty does not pass the verification in one or two steps, you can clarify the reasons with him and then decide to conclude an agreement. If you see that the counterparty has not passed the verification process for most of the steps, you should not take risks - look for a more reliable partner.