KUDIR is a book of income and expenses that must be maintained by all organizations and individual entrepreneurs using the simplified tax system (Article 346.24 of the Tax Code of the Russian Federation). There is no need to certify the book with the tax office, however, in case of any questions regarding the annual declaration, tax authorities can request the accounting book for a more thorough check. Errors in KUDIR or its absence are grounds for a fine of at least 10 thousand rubles (Article 120 of the Tax Code of the Russian Federation and Article 15.11 of the Administrative Code).

KUDIR is maintained in a form approved by order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n. The last time changes were made to the accounting book was by order of the Ministry of Finance dated December 7, 2016 No. 227n. This was caused by the introduction of a trade tax, which is currently only paid by retail outlets in Moscow. To reflect the amounts of the trade fee, Section V was added to KUDIR.

KUDIR for individual entrepreneurs using the simplified tax system is the main tax accounting document. Simplified organizations, in addition to tax accounting in KUDIR, also maintain mandatory accounting. Taxpayers determine their tax base for the simplified tax on the basis of KUDIR, so if you combine several tax regimes, then you need to keep records of income and expenses under the simplified tax system separately from the other tax regime.

The general rules for registering and filling out KUDIR are as follows:

- for each tax period (that is, calendar year) - a new KUDIR;

- entries in the book are kept cumulatively in chronological order;

- KUDIR is filled out using the cash method, that is, only the actual movement of money in the cash register or in the current account is taken into account. If you have only shipped the goods to the buyer, but have not received payment, this is not yet recognized as income for the cash method of accounting. Similar rules apply for expenses;

- KUDIR is maintained on a computer, in a special accounting program or by hand;

- amounts are entered into the book in rubles and kopecks;

- The electronic KUDIR is printed at the end of the tax period;

- a printed electronic KUDIR or a handwritten paper one must be numbered, laced, sealed with the signature of the manager or the individual entrepreneur himself and a seal (if any);

- in a handwritten KUDIR, errors are corrected as follows: the incorrect entry is crossed out, the correct wording is written next to it, certified by the position, full name and signature of the person responsible, and the date the correction was made is recorded.

KUDIR consists of 5 sections plus a title page. In section I of the book, the taxpayer indicates income and expenses, in section II - expenses for the purchase of fixed assets and intangible assets, section III includes losses from previous years, by which the current tax can be reduced, section IV is devoted to expenses that reduce the amount of tax.

Sections II-III should be filled out only for the simplified taxation system Income minus expenses, and section IV is intended only for the simplified taxation system Income. Section V is completed by trade tax payers.

Let's take a closer look at how to conduct KUDIR with the simplified tax system of 15% and 6%.

Free accounting services from 1C

Filling out KUDIR under the simplified tax system Income

Since the taxpayer uses the simplified tax system for income only to take into account his own income, then in section I of KUDIR he will reflect only receipts to the current account or to the cash desk. At the same time, not any money received is taken into account as income for determining the tax base. According to Art. 346.15 of the Tax Code of the Russian Federation, the simplifier takes into account as income his revenue and non-operating income - rental of property and other income from Art. 250 Tax Code of the Russian Federation. The list of income that cannot be taken into account on the simplified tax system is given in articles 224, 251, 284 of the Tax Code of the Russian Federation.

This list is long, most of the income is very specific. Let us point out the most typical for the daily activities of most businessmen: money received from the Social Insurance Fund to reimburse the costs of child benefits and sick leave for employees, the return of advances or any overpaid amounts, the amount of loans received, or the return of a loan issued by the organization itself cannot be considered income.

Individual entrepreneurs have even more nuances when accounting for taxes on income received under the simplified system. The entrepreneur does not take into account in the KUDIR according to the simplified tax system his income as wages for hire, replenishment of the cash register of his own enterprise. The sale of property not used in business activities (for example, a car or apartment) is also not included in income when calculating the tax base.

How to conduct KUDIR with the simplified tax system of 6%? Income receipts are reflected by registering the PKO, payment order or bank statement. If you need to reflect the return of money to the buyer in KUDIR, then this amount must be entered in the “income” column with a minus sign.

Another nuance of filling out KUDIR according to the simplified tax system for income is filling out section IV. Since the taxpayer can reduce the amount of tax on insurance premiums using the simplified tax system for income, the amount of these contributions should be reflected in section IV of the KUDIR. The book contains information about the payment document, the period for payment of contributions, the category of contributions and their amount. Entrepreneurs in this section indicate not only contributions for employees, but also their own pension and health insurance. Based on the results of each quarter, as well as half a year, 9 months and a calendar year, results are summed up.

Why in 1C 8.3 expenses are not included in the book of income and expenses

Let's figure out how expenses are filled out in KUDiR using the example of costs for purchasing goods.

In order for expenses to be reflected in KUDiR, you must formalize:

- receipt of goods;

- payment of goods to the supplier;

- sale of goods.

There is no need to formalize receiving payment from the buyer, because This condition is not specified in the settings.

All these stages are reflected in the accumulation register Expenses of the simplified tax system , and only after the goods have gone all the way, movements will be made in the register Book of Income and Expenses (Section I) . Learn more about completing each stage.

Let's look at the last stage using the example of selling goods for which payment has already been transferred to the supplier.

We will draw up the document Sales of goods (act, invoice) .

Postings

Because all conditions for recognizing expenses have been met, a corresponding entry is made in KUDiR.

If the amount in the Expenses is not filled in or there are no movements in this register, check the movements in the Expenses register under the simplified tax system.

Pay attention to the fields:

- Status of payment of expenses of the simplified tax system - if there is a receipt according to this register, it means that some of the conditions have not been met. For example, in this case there would be the following movements for unpaid goods:

- Reflection in NU Accepted must be selected . This information is established when goods arrive, but can be changed as they move.

Not every document generates postings to this register. View a list of all documents that generate movements automatically. PDF

If the document with which you formalized the business transaction is not included in this list, make an entry in this register yourself with the document Entry of the book of income and expenses of the simplified tax system in the section Operations - simplified tax system - Entry of the book of income and expenses of the simplified tax system.

Example of filling out KUDIR on the simplified tax system Income 6%

Individual entrepreneur I.M. Kuznetsov bought raw materials for the production of buns for 230,000 rubles on January 11, 2022 and sold 100 buns at a price of 20 rubles per piece. The buyer returned one bun to the entrepreneur due to broken packaging. In addition, IP Kuznetsov received an advance from the buyer in the amount of 10,000 rubles. Kuznetsov has one pastry chef whose salary is 30,000 rubles. For January 2022, Kuznetsov paid insurance premiums for the employee - 9,000 rubles.

Here is what a sample of filling out KUDIR for individual entrepreneurs on the simplified tax system of 6% looks like in this example.

Filling out KUDIR under the simplified tax system Income minus expenses

Income in KUDIR is reflected in the same way, regardless of the selected simplified tax system option. But expenses are reflected in section I only under the simplified tax system: Income minus expenses. The list of expenses that can be taken into account in KUDIR is in Appendix 2 to the order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n and in Art. 346.16 Tax Code of the Russian Federation. Since expenses reduce the tax base under the simplified tax system, tax authorities carefully check the company’s expenses and regularly issue letters and explanations: which expenses can be taken into account and which cannot. The general principle is that expenses can be accepted only if they are economically justified, documented and will generate income for the taxpayer.

When calculating the single tax, the payer of the simplified tax system can take into account material costs, labor costs and compulsory social insurance of employees and some other expenses. Each listed category of costs has its own characteristics, for example, costs for the purchase of goods fall into KUDIR only after they directly entered the warehouse, were paid to the supplier and sold to the buyer. Insurance premiums for employees under the simplified tax system. Income minus expenses do not reduce the calculated tax itself, but are included in the tax base as expenses in full.

Please note that personal expenses of an individual entrepreneur on the simplified tax system. Income minus expenses not directly related to making a profit cannot be entered into KUDIR.

Manual adjustment of KUDiR records

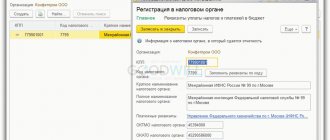

Sometimes an accountant is faced with the need to adjust KUDiR records. For this purpose, 1C 8.3 provides the document Entries in the Book of Income and Expenses (USN). It’s not difficult to find it: Operations – simplified tax system – entries in the book of income and expenses (USN):

By clicking on the link, we will go to the Journal Entries of the Book of Income and Expenses (USN). The document is created by clicking the Create button:

The form that opens asks you to fill out the following document:

- Organization – select from the list of the Organization directory the desired one that applies the simplified tax system (if there are several of them);

- Date – current date by default;

- Number – will be filled in automatically when posting the document:

Next, we see that the document contains 3 tabs that correspond to sections:

- Income and expenses - data is entered to adjust section 1 of KUDiR;

- Calculation of expenses for the acquisition of fixed assets - data on the fixed assets is entered to adjust section 2 of KUDiR;

- Calculation of expenses for the acquisition of intangible assets - data on intangible assets is entered to adjust section 2 of KUDiR:

After completing the document, the data will be included in KUDiR in the appropriate sections:

Example of filling out KUDIR under the simplified tax system Income minus expenses

Let's look at an example of how to fill out KUDIR for individual entrepreneurs on the simplified tax system of 15%. Data on income and expenses of individual entrepreneur I.M. Kuznetsova Let's take from the previous example. Plus, Kuznetsov paid in advance the rent for the bakery premises in January - 100,000 rubles for February-March 2022. The rent advance in KUDIR is included not on the date of transfer of money, but on the date of fulfillment of the counter-obligation, that is, the signing of an act on the provision of rental services on the last day of March 2022.

In this example, a sample of filling out KUDIR for an individual entrepreneur on the simplified tax system of 15% will look like this.

In the sample documents on our website you can KUDIR according to the simplified tax system. If you have questions about how to fill out the KUDIR according to the simplified tax system, we recommend that you seek a free consultation from 1C:BO specialists.

How to make sure that expenses are included in the KUDiR in a timely manner for purchased goods?

- home

- About the franchisee

- Articles

- How to make sure that expenses are included in the KUDiR in a timely manner for purchased goods?

December 9, 2020

The procedure for recognizing expenses can be checked in the Taxes and reports for the organization section in the simplified tax system

—

Procedure for recognizing expenses

.

In Expenses for the purchase of goods, it is necessary to note: Receipt of goods, Payment of goods to the supplier and Sales of goods. Additionally, you can set the conditions for receiving income (payment from the buyer), that is, the data will go to KUDiR at the time of receiving payment from the buyer.

When applying the simplified tax system, always in the Accounting Policies

The organization uses the FIFO method for assessing inventories.

Checkout in the Purchases

new arrival, purchase of goods. In document movements, a posting is generated in the form of 41 accounts, since batch accounting will always have three sub-accounts: goods, warehouse and batch (receipt document). The batch is also an analytics on account 60 (settlements with suppliers), where the fact of payment is tracked in the context of the receipt document.

At the time of receipt, records of income and expenses are not generated. The formation procedure can be checked in the Book of Income and Expenses

in the

simplified tax system

.

In the Sales

—

Implementation

, go to the desired document. The implementation date must be after the receipt date. Carry out a sale, in the movements you will see that on the credit of 41 accounts, a write-off of goods by batch has been formed. But at the same time, no new entries appeared in the Book of Income and Expenses, since the goods were not paid for.

Based on the Receipt, generate a Write-off from the current account, indicating a date later than the sale. Run the count.

In the document movements, you will see analytics on receipts, closing the debt on invoice 60 to the supplier and generating expenses for part of the goods sold, since this was the last sale. Pay attention to the wording:

Check the Book of Income and Expenses; it should contain an entry for the cost of the goods.

In the case of a different sequence of documents, the wording of the KUDiR record will change.

Cancel the debit from your current account, then pay for the goods and complete the sale. In the book of income and expenses, an entry will be generated only for the cost of goods. The wording of the entry is different:

The record is generated according to the last operation for only part of the cost.

If all goods are sold, the full cost price will be displayed in the income and expenses ledger.

What mistakes can be made?

If you have in the Administration

—

Documentation

includes the possibility of writing off inventories in the absence of balances according to accounting data, that is, you can carry out sales in the absence of goods.

In this case, the amount and batch for the product will not be displayed in document movements. Accordingly, this entry will not be included in the book of income and expenses, since there is no receipt. If you create such records, then check the availability in the account, warehouse and by item.

If the product is in stock, but the record is not generated or is generated incorrectly

, then you need to check whether there is any debt to the supplier for the previous period. In this case, the debt will be closed chronologically.

If it is not possible to adjust the debt, you can indicate in the payment document that this payment pays off the debt under a specific document.

We recommend checking the Turnover Balance Sheets for account 41 to avoid errors.

In the settings for them, always fully disclose analytics for all possible subaccounts.

Check that there are no negative balances for positions and batches.

Similarly with account 60 for accounts payable.

Work with pleasure!

To get a consultation

How to find out about useful materials on time?

Join our monthly newsletter and stay up to date.