3-NDFL: Who should file

All income of individuals is subject to tax in Russia. Citizens who work for hire receive wages reduced by its amount. In this case, the calculation, deduction and transfer to the budget is carried out by the employer, who is the tax agent for personal income tax of his employees.

But it happens that an individual receives income independently. There is no tax agent for such income, so the responsibility for calculating and paying personal income tax falls on the citizen himself . For example, these are cases when an individual who does not carry out entrepreneurial activities:

- sold the property belonging to him;

- received income from its rental;

- received income under other civil law contracts (if the person who paid this income is not a tax agent for personal income tax);

- received expensive property as a gift from someone other than a close relative;

- otherwise independently received income subject to personal income tax.

A separate category of citizens are tax residents of the Russian Federation who received income outside the country in the reporting year. Please note that tax residents are persons who have lived in Russia for at least 183 days a year, while their sources of income are located abroad.

In all these cases, the citizen (tax resident) must independently pay tax on his income and report to the Federal Tax Service in Form 3-NDFL.

So, the first group of persons who submit the form in question are individuals (not individual entrepreneurs) who received income without a tax agent.

The second group are persons who are engaged in entrepreneurial activities , namely:

- individual entrepreneurs who apply the general taxation system;

- lawyers, notaries and some other persons engaged in private practice;

- heads of peasant farms.

The purpose of the 3-NDFL declaration is to inform the Federal Tax Service about the income of an individual. This is necessary to:

- tax authorities monitored the correctness of their personal income tax payment;

- a citizen could receive a tax deduction.

Submission rules

Declaration form

Form 3-NDFL is a multi-page form that consists of a title page, two sections and application sheets. Moreover, the annexes make up the majority of the declaration. They must be filled out depending on the availability of information. But all taxpayers must fill out the Title Page, Section 1 and Section 2.

We fill out the new form 3-NDFL for 2022 for submission in 2022 as follows:

- title page - indicate the tax period and reporting year, inspection code, TIN and information about the taxpayer. We enter the number of completed sheets and applications to 3-NDFL for 2022. We sign the report and set a date for completion;

- section 1 - we provide information about income tax that needs to be paid or returned from the budget; appendix to section 1 - fill out an application for offset/refund of overpayment for personal income tax, if such an overpayment has arisen at the end of the year;

- section 2 - we calculate the tax base and the amount of income tax by type of income;

- Appendix 1 - reflect income from sources in Russia;

- Appendix 2 - indicate income from sources outside the Russian Federation;

- Appendix 3 - we record income from business activities, law and private practice;

- Appendix 4 - we calculate the amount of income not subject to personal income tax;

- Appendix 5 - we calculate standard, social and investment tax deductions;

- Appendix 6 - we calculate property tax deductions from the sale of property;

- Appendix 7 - we calculate property tax deductions for expenses on new construction;

- Appendix 8 - we calculate expenses and deductions for transactions with securities;

- fill out the calculations - to Appendix 1 (calculation of income from the sale of real estate), to Appendix 5 (calculation of social and investment tax deductions).

Reporting deadlines

In general, 3-NDFL is submitted no later than April 30 of the year following the expired tax period, unless otherwise provided by Article 227.1 of this Code.

That is, for income received by an individual in 2022, you should report until 05/04/2022, because April 30 is Saturday, followed by May holidays. The first working day after their end is May 4.

This deadline for submitting 3-NDFL is valid for:

- individual entrepreneurs, private practitioners;

- foreign citizens working in the Russian Federation under a patent;

- citizens who received income:

- from tax agents who did not withhold tax upon payment;

- entrepreneurial activity;

- rental of property;

- sale of property owned for up to 3 years, securities, shares in the authorized capital;

- donations;

- remuneration of copyright heirs.

Where and how to submit 3-NDFL

The form is submitted to the tax authority at the place of registration of the taxpayer , that is, at the place of residence of the individual. Standard delivery methods:

- to the territorial body of the Federal Tax Service in person;

- through a representative under a notarized power of attorney;

- by mail;

- in electronic form through the Federal Tax Service website or using online services.

Responsibility

Failure to pay personal income tax is punishable by a fine of 5% of the unpaid amount for each month of delay. Delay is counted from the day after the deadline for paying the tax. In this case, both full and partial months are considered.

If 3-NDFL is not filed , then the penalty depends on whether there is tax payable in it or not:

- if there is no tax, a fine of 1 thousand rubles will follow;

- If there is personal income tax to be paid, then the fine will be 30% of the tax amount .

Are additional documents required when re-submitting the 3-NDFL declaration?

In tax legislation, the concept of repeated declaration is not used. One taxpayer may submit several declarations (primary and subsequent) when receiving a property deduction related to the purchase of an apartment. Repeated forms are required to obtain the remaining unused deduction for subsequent periods of income.

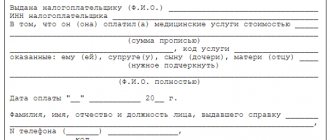

The information about the taxpayer and the acquired object for which the right to deduct has arisen will be the same, but information about income received at the place of work and personal income tax withheld will change. And every year you will need to confirm them with a 2-NDFL certificate . You can receive a refund of the deduction by filling out a return for the tax period and submitting an application .

Copies of the purchase and sale agreement and other documents confirming the purchase must be attached to the initial declaration. They are not required to be provided subsequently.

Procedure for filling out 3-NDFL

General rules

The declaration form can be filled out:

- Manually . You must use blue or black ink. The fields are filled in from left to right from the outermost cell. Information must be indicated in printed characters according to the model from the Tax Service website. Dashes are placed in empty cells. Completely empty fields must also have a dash in each cell.

- On the computer . Text in form fields should be right aligned. The recommended font is Courier New, size 16-18.

Regardless of the filling method, you must adhere to the following rules:

- if there are not enough pages in a section, you need to use additional ones;

- all amounts, except tax, are indicated in kopecks;

- the tax amount is rounded according to standard rules (up to 50 kopecks is discarded, 50 kopecks and more are rounded to the nearest ruble);

- if the declaration reflects income received in foreign currency, it should be converted into rubles at the exchange rate of the Central Bank of the Russian Federation on the date of receipt;

- pages of the form should be numbered in a special “Page” field, with the number “001” assigned to the title page;

- it is necessary to attach documents (copies) confirming the information reflected in the declaration (they can also be listed in a separate list in any form);

- the title page indicates the number of sheets of the declaration and the number of additional (supporting) documents.

Filling out the title page

The topmost line of the title page, as well as all other sheets in the declaration, is intended for the TIN. Next is the page number. The following line is filled in:

- Correction number . When submitting the initial declaration, a “0” is entered; when submitting a second declaration, the serial number of the adjustment is indicated.

- Taxable period . The tax period code “34” corresponding to the year is indicated. Codes for other periods: 21 - I quarter, 31 - half a year, 33 - 9 months.

- Reporting period . The corresponding year is indicated - 2022.

- Code of the tax authority to which the declaration is submitted. This is a four-digit code, the first two digits of which correspond to the region code, and the last two digits correspond to the tax office code.

» data-medium-file=»https://kontursverka.ru/wp-content/uploads/2018/02/3NDFL-212×300.jpg» data-large-file=»https://kontursverka.ru/wp -content/uploads/2018/02/3NDFL-724×1024.jpg" loading="lazy" class="wp-image-5519 size-full" title="Filling out the title page" src="https://kontursverka. ru/wp-content/uploads/2018/02/3NDFL.jpg" alt="Form 3-NDFL, title" width="1654″ height="2339″ srcset="https://kontursverka.ru/wp-content /uploads/2018/02/3NDFL.jpg 1448w, https://kontursverka.ru/wp-content/uploads/2018/02/3NDFL-212×300.jpg 212w, https://kontursverka.ru/wp-content /uploads/2018/02/3NDFL-768×1086.jpg 768w, https://kontursverka.ru/wp-content/uploads/2018/02/3NDFL-724×1024.jpg 724w" sizes="(max-width : 1654px) 100vw, 1654px" /> Title page of the 3-NDFL declaration

Next, fill in information about the taxpayer. In the “ Country code ” field for Russia the code “643” is entered. The next field “ Taxpayer Category Code ” is very important. The data for it is taken from Appendix 1 to the procedure for filling out the report from the mentioned Order of the Federal Tax Service. We have listed these codes in a table:

Table. Taxpayer category code for 3-NDFL

| 720 | an individual registered as an individual entrepreneur |

| 730 | a notary engaged in private practice, and other persons engaged in private practice in accordance with the procedure established by current legislation |

| 740 | lawyer who established a law office |

| 750 | arbitration manager |

| 760 | another individual declaring income in accordance with Articles 227.1 and 228 of the Code, as well as for the purpose of obtaining tax deductions in accordance with Articles 218 - 221 of the Code or for another purpose |

| 770 | an individual registered as an individual entrepreneur and who is the head of a peasant (farm) enterprise |

Next comes a block of information about the taxpayer . You must specify:

- last name, first name and patronymic (if available);

- date of birth in the format XX.XX.XXXX;

- Place of Birth.

The next block contains details of the identity document . First of all, its code is indicated. For a passport - code 21, for other documents the code must be taken from Appendix No. 2 to the procedure for filling out the form (in the Order).

The last parameter in this block is taxpayer status . How to fill it out is indicated in the form itself:

- a person who is a tax resident of Russia sets the value “1”;

- person who is not a tax resident - value “2”.

The lower part of the title page is completed if the declaration is submitted by a representative of the taxpayer . In the corresponding field, enter the code “2”, and then - information about the representative:

- first name, last name and patronymic of an individual;

- full name of the legal entity.

Below you must indicate the document on the basis of which the representative acts. In addition, a copy of this document must be attached to the declaration.

Completing section 1

This section reflects the amount of tax that is subject to payment to the budget or refund if the tax was overpaid.

In line 010 you need to indicate:

- 1 - if the tax is subject to additional payment;

- 2 - if the tax must be returned from the budget;

- 3 - if the tax is equal to what was paid, that is, no additional payment or refund needs to be made.

Line 020 indicates the budget classification code, line 030 indicates the OKTMO code.

Lines 040-050 are resultant, that is, their indicators are calculated based on the data presented on the following declaration sheets. In other words, these lines are filled in last. If, as a result of the calculation, personal income tax is payable to the budget, this amount is reflected on line 040, if returned from the budget - on line 050.

» data-medium-file=»https://kontursverka.ru/wp-content/uploads/2018/02/44-300×199.jpg» data-large-file=»https://kontursverka.ru/wp -content/uploads/2018/02/44-1024×679.jpg" loading="lazy" class="wp-image-5521 size-full" title="Completed section 1 with the amount of personal income tax to be returned" src="https ://kontursverka.ru/wp-content/uploads/2018/02/44.jpg" alt="3-NDFL, section 1" width="1654″ height="1097″ srcset="https://kontursverka. ru/wp-content/uploads/2018/02/44.jpg 1654w, https://kontursverka.ru/wp-content/uploads/2018/02/44-300×199.jpg 300w, https://kontursverka. ru/wp-content/uploads/2018/02/44-768×509.jpg 768w, https://kontursverka.ru/wp-content/uploads/2018/02/44-1024×679.jpg 1024w, https: //kontursverka.ru/wp-content/uploads/2018/02/44-420×280.jpg 420w" sizes="(max-width: 1654px) 100vw, 1654px" /> Filling out section 1 of the 3-NDFL declaration

Completing section 2

Section 2 provides the calculation of the tax base and the amount of tax payable. Let's look at filling it out with an example.

Ivan Petrovich Sidorov sold an apartment he owned in 2022 for 2,200,000 rubles. Citizen Sidorov owned the property on the basis of ownership for 1 year.

Section 2 of the 3-NDFL declaration of citizen Sidorov will look like

» data-medium-file=»https://kontursverka.ru/wp-content/uploads/2018/02/33-1-300×234.jpg» data-large-file=»https://kontursverka.ru /wp-content/uploads/2018/02/33-1.jpg" loading="lazy" class="wp-image-5520 size-full" title="This is how section 2 is filled in for income from the sale of property" src=" https://kontursverka.ru/wp-content/uploads/2018/02/33-1.jpg" alt="3-NDFL, section 2" width="738″ height="576″ srcset="https:/ /kontursverka.ru/wp-content/uploads/2018/02/33-1.jpg 738w, https://kontursverka.ru/wp-content/uploads/2018/02/33-1-300×234.jpg 300w "sizes="(max-width: 738px) 100vw, 738px" /> Section 2 of the 3-NDFL declaration when selling an apartment

Let's explain:

- line 002 indicates the code of the type of income, in this case it is “3” - other income;

- line 010 indicates the amount of income corresponding to the cost of the apartment;

- line 020 is intended to reflect the non-taxable amount, in this case it is zero;

- line 030 calculates the amount of income subject to personal income tax;

- line 040 reflects the amount of the tax deduction, in this case it is 1 million rubles (calculated according to the data of the following sheets in the declaration);

- lines 050-051 are filled in if the data specified in them is available, in our example they are zero;

- line 060 reflects the amount of the tax base: the tax deduction is excluded from the amount of taxable income;

- in line 070 the amount of tax payable is calculated: the amount from line 060 is multiplied by the personal income tax rate of 13%.

Filling out sheets A-I

Of the remaining sheets of the 3-NDFL declaration, the taxpayer must fill out only those that relate to his income and deductions .

- Sheets A-B are intended to reflect income:

- A - from sources in Russia;

- B - from sources outside the country;

- B - from entrepreneurial activity (it is filled out by individual entrepreneurs, notaries, lawyers, and so on).

- Sheet D is used to indicate the amounts of income that are not subject to taxation.

- Sheets D-G are intended for calculating various tax deductions.

- Sheets Z-I are filled out if there is income from investment activities.

In the example discussed above, the income of Sidorov I.P. was formed as a result of the sale of property, that is, it was received on the territory of the Russian Federation (Sheet A). When calculating the tax, the citizen applied a tax deduction for income from the sale of property (Sheet D2). Thus, his declaration will consist of a Title Page, Section 1, Section 2, and Sheets A and D2.

When filling out 3-NDFL, we recommend that you clarify in the Order exactly which sheets need to be filled out in a particular case.

How to fill out the 3-NDFL declaration in the program - instructions for filling it out

To receive tax deductions (purchase of an apartment, treatment, education) and declare your income, you need to submit and fill out a personal income tax return. Now this does not require special knowledge and experience, there is no need to look for a specialist or pay money. It is enough to simply enter the data into it. At the same time she:

- calculates tax amounts and deductions automatically,

- helps the taxpayer not to make mistakes when filling it out,

- frees you from filling out the same information manually,

- allows you to print the finished form on a printer.

After downloading the software, without any activation or connections, you can start declaring. This article provides detailed instructions for filling out the 3-personal income tax declaration in the 2022 declaration program.

Video instructions on how to download, install and use the program:

When you start the program, a sheet automatically appears in the “Set Conditions” mode

When creating a declaration, you should fill out all the blocks and columns of the sheet from top to bottom. That is, as such, a filling sample is not needed. It is enough to follow the algorithm of actions.

Block “Declaration type”

Activate the element (put a dot in the position) “3-NDFL” (see position No. 1). Typically this item is enabled by default.

Block "General information"

In the “Inspection Number” line, click the selection button and determine the territorial inspection that serves your registration address (a list will appear, in it you should select the desired Federal Tax Service/Moscow Tax Inspectorate) (position No. 2);

In the “Adjustment number” line, you should put the number that corresponds to the number of previously filed returns for a given tax year. If a declaration has not been submitted previously, then “0” is entered;

OKTMO enter the code of your locality, which can be found in your tax office or determined on the Federal Tax Service website, to do this, follow the link, enter your address, digital code in the “Municipal entity:” field and there is OKTMO (position No. 3).

Block “Taxpayer Attribute”

Select the position “Other individual” (No. 4).

Block “Income available”

Check the box “Taking into account certificates of income of an individual...” (No. 5), the remaining points do not need to be used.

Block “Reliability Confirmed”

Accept the element “Personally” (No. 6).

Next, select the sheet “Information about the declarant” (click on the button)

Block "F.I.O."

It contains the surname, first name, patronymic - fill in as indicated in the passport of a citizen of the Russian Federation (No. 7). Information about the date and place of birth is entered in the same way (No. 9). TIN line indicate your own taxpayer identification number (No. 8). Information about your TIN, if you do not know it, can be found through the tax service.

Block “Citizenship Data”

It is offered automatically; if the line is empty, then code 643 is entered, which corresponds to Russian citizenship (No. 10).

Block “Information about the identity document”

In the “Type of document” line, select position 21 – Passport of a citizen of the Russian Federation (No. 11), the remaining lines are filled in as in the passport (No. 12).

Block “Contact phone number”

Here you need to indicate your phone number, which will be accessible and it will be easy to contact you to resolve technical and other important issues. Fill in with regular numbers. The first one is “8” (No. 13).

Then the sheet “Income received in the Russian Federation” is activated

We are interested in the “13 ” tab; we need to select the yellow position (number) (No. 14).

In the “Payment source” block

You need to click on the top “green plus”.

A window with the same name “Payment Source” will appear. It contains information about the employer (position 16). Data is entered according to the available lines in the window. This data can be obtained from the 2-NDFL certificate, which is received from the employer on paper or electronically through the Federal Tax Service website (after registering in the taxpayer’s personal account);

If there are several employers, then a separate window opens for each by repeatedly clicking on the “plus” (No. 14). Depending on which employer applied the standard deduction for children in that box, check the box “Calculate standard deductions using this source” (No. 17). You can only tick one employer;

Completing the window formation by starting with the “Yes” button (No. 18). That is, each window closes separately. Then, accordingly, another one is opened (for another employer), etc.

Block “Month income...Income code...”

By clicking on the “green plus” on the left, the “Income Information” window (No. 19) will pop up. Immediately click on the “Income Code” line button and the “Directory of Income Types” list will appear (position No. 20). From this list, select the desired code - our appropriate line, click. Enter the amount manually (No. 21). Indicate the number of the corresponding month (No. 22). When the information about a specific month is completed, click the “Yes” button (No. 23). All data should be taken from the 2-NDFL certificate. A separate window is filled in for each amount (click on the green plus each time) (No. 19).

Block “Total amounts by payment source”

The line “Total amount of income” is displayed automatically.

The line “Tax amount withheld” is entered manually (No. 28). It is usually equal to the result obtained by multiplying the Amount of Income by 13%. But if there were tax deductions applied by the employer, then you need to additionally fill out another box just below.

Block “Standard, social and property deductions presented by a tax agent”

Click the “Green plus sign” and the “Deductions specified in section 3 of the 2-NDFL certificate” window will appear (24).

Select the line “Deduction code” from the list, depending on the type of deduction and life situation (No. 25);

The deduction amount must correspond to the 2-NDFL certificate. Moreover, for each deduction the total annual amount is taken, and not monthly (No. 26).

There is a separate window for each deduction. Once completed, click “Yes” (No. 27).

Go to the “Deductions” sheet

On this sheet, the taxpayer has options for the development of events. And they are related to the choice of a specific deduction. There are 4 types of deductions in total, but three are in demand:

- Property;

- Social;

- Standard.

By the way, you can take into account all deductions in one declaration, so to speak in one filling session. To do this, in each deductible section, immediately under the section tab (top of the sheet to the left), put a checkmark in the “Provide ......” position.

Since most of the questions concern exactly how to correctly fill out a declaration for the return of a property tax deduction, let’s go over this deduction section. Let’s take for example the most common life case (when getting a refund from the budget when buying an apartment)

Go to the “Property” tab (No. 29)

Immediately check the box “Submit property tax deduction” (see No. 30). What was discussed a little higher;

Activate the “Object Information” block

Click on “Green Plus” (No. 31) and the “Object Data” window pops up;

At the top of the window (No. 32),

In the line “Name of object” from the list of types of real estate we find the item apartment (No. 33);

Next, you are interested in the line “Taxpayer Characteristics”. Based on your life situation, you need to make a choice. Everything is obvious there; the declarant, as the applicant for the deduction, determines his status. There will be no difficulties (No. 34);

“Object number code.” In the vast majority of cases, we are talking about the cadastral number, select this position (No. 35);

“Object number” Here, in fact, the cadastral number itself is indicated exactly as it is indicated in the extract from the state register (No. 36);

"Location". We are talking about the same property, its address is exactly the same as written in the extract from the state register (No. 37);

“Date of property registration...”. Again, we enter the exact date, copying it from the Rosreestr state register extract. This date is also indicated in the registrar’s stamp on the agreement; it does not coincide with the date of conclusion of the agreement (No. 38);

“Share” is entered automatically by the program (No. 39);

“Cost of the object (share).” This indicator is indicated in the contract and confirmed by payment documents. In this case, there is no need to reduce the size in proportion to the size of your share (if shared ownership) (position No. 40).

"Interest on loans for all years." Indicate data on interest paid in general (No. 41)

If you are a pensioner, then you need to check the “I am a pensioner” box.

At this point the window will be completely filled, click “Yes” (No. 42).

If there are several objects for which compensation is made. For example, if a deduction has already been applied to another apartment, then you need to enter data about this object as well. So that you can further adjust the data for calculating deductions for previous periods.

Block “Calculation of property deduction”

In the fields “Total cost of all objects” and “Interest on loans for all years” the program will independently enter the required values, taking into account restrictions by law (No. 43).

But in the “deduction for previous years” field, both for the object and for the loan, you need to enter the values manually. Naturally, you need to enter data about the amounts actually confirmed and received for past declarations. The amount that was actually withheld by the employer is also taken into account.

For reference: A paper declaration is more difficult to fill out. So the line “Deduction for previous years” requires entering additional data. If this is the first deduction declaration, then “0” is entered; if this is a subsequent declaration, then the amount of the due deduction for the previous year is indicated (that is, the indicator that appeared in the previous declaration in sheet D1, lines 2.7. or 2.8). When there are more than two declarations for previous periods, then the line indicator is 2.7 or 2.8. all declarations add up).

The line “Amount transferred from the previous period” if the declaration is primary, the value “0” is entered, if a subsequent declaration is filled out (to receive the remainder of the deduction), then the deduction received ( accrued) in the previous tax period (this amount is indicated in the previous declaration in sheet D1 in line 2.10), the resulting difference is entered into the “Amount transferred from the previous period” and so on with a cumulative total for subsequent years

The final stage

Click the “Check” button

If there are blank data or incorrect values (for some fields, for example, TIN), the program will offer to correct the inaccuracies (No. 44).

"Save"

Save the completed result by clicking “Save” (No. 45).

Be sure to display the results obtained in a visual format.

Click “View (No. 46)”. We will see the declaration in the form it is filled out on the form. That is, this is your example of filling out before printing. You need to read it carefully, check the data again, etc.

"Seal"

With this button, everything filled out in the required format will be printed on paper (No. 47).