What does the legislation say about zero 4-FSS?

Reporting to social security in Form 4-FSS is a calculation presented in tabular form, containing information:

- on insurance premiums for compulsory insurance against accidents at work and occupational diseases (ASP and OPD), accrued and paid in the reporting period (for injuries);

- expenses for payment of insurance coverage under NSP and PZ.

ATTENTION! The FSS was preparing a new calculation form 4-FSS in connection with the transition of the entire country to the FSS pilot project “Direct Payments”. But the form will not be ready by the 1st quarter. And we will report for the 1st quarter of 2021 on the current form from the order of the FSS of the Russian Federation dated September 26, 2016 No. 381 (as amended on June 7, 2017). We described how to fill out a report according to the rules of the pilot project here.

Zero calculation 4-FSS is a type of insurance reporting in the absence of reporting data. This situation arises if the company has suspended, ceased or is just planning to start operations.

The condition for the mandatory submission of such a calculation is contained in Art. 24 of the Law “On compulsory social insurance against accidents at work and occupational diseases” dated July 24, 1998 No. 125-FZ. This article speaks of the need for quarterly reporting on insurance premiums by all policyholders.

Find out who is taking the 4-FSS from this article.

Note! An individual entrepreneur without employees does not submit a zero to the Social Insurance Fund, since he is not an insurer.

There is no mention of zero form 4-FSS in the law. Nothing is said about this type of reporting in the FSS order No. 381 dated September 26, 2016, which describes the technology for filling out this reporting form.

However, this does not mean that the lack of reporting data relieves policyholders from submitting 4-FSS - everyone needs to report every reporting quarter. We will tell you how to do this in the following sections.

Deadlines and penalties

Reporting must be submitted within the established time frame, otherwise the policyholder will be subject to sanctions for failure to provide zero reporting to the Social Insurance Fund in 2022. The deadline for submitting 4-FSS depends on the filing format. For example, if the staff of an economic entity includes up to 25 people, then the report must be submitted on paper. In this case, the due date is no later than the 20th day of the month following the reporting quarter.

IMPORTANT!

Submit your 4-FSS zero calculation for the 4th quarter of 2022 on paper by 01/20/2022.

If an enterprise or individual entrepreneur has 25 employees or more, then reports will have to be submitted to Social Security in electronic form. In this case, the deadline is extended until the 25th day of the month following the reporting quarter (01/25/2022 for the report for the 4th quarter of 2021).

Fines are also established for zero reports. 125-FZ defines fines for unsubmitted 4-FSS reports with zero reporting - the penalty is calculated as 5% of the amount of insurance premiums reflected in the reports, but not more than 30% of the total amount and not less than 1000 rubles (clause 1 of Article 26.30 125-FZ dated July 24, 1998). If the reporting does not contain information about insurance coverage, then the minimum penalty is applied - 1000 rubles.

Representatives of the Social Insurance Fund have the right to punish the official responsible for providing information. The penalty for a manager or individual entrepreneur who fails to submit a report is a fine of 300 to 500 rubles.

Violation of the procedure for mandatory provision of zero calculations in electronic format is punishable by a fine of 200 rubles. If a company with 40 employees submits a report on paper, it will be fined 200 rubles.

Since 2022, the rules have changed dramatically. ConsultantPlus experts have compiled instructions and told you what to do to pay benefits, including directly from the Social Insurance Fund.

Mandatory zero sheets

Social insurance expects 4-FSS from policyholders in any case - whether they made payments in the reporting period in favor of individuals or not. If there is nothing to write down in the report, the employer will be required to submit a 4-FSS zero calculation completed according to special rules.

Its main difference from a regular (data-filled) calculation is the reduced volume of tables presented.

If in one of the quarters, for example, in the first, you had accruals for hired employees, but not in subsequent quarters, the report until the end of the year will not be zero, because some lines are filled with a cumulative total. ConsultantPlus experts explained the nuances of filling out each line of form 4-FSS. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Calculation 4-FSS - 2022 is filled out on the form approved. by order of the FSS dated September 26, 2016 No. 381, as amended. from 06/07/2017. You can download it below.

The minimum set of sheets and tables of the report is defined in clause 2 of Appendix No. 2 to Order No. 381 - it includes:

- title page;

- 3 tables (1 - calculation of the base for calculating insurance premiums, 2 - calculation of injury premiums and 5 - results of assessing working conditions).

These are mandatory sheets for 4-FSS. The remaining calculation tables (1.1, 3 and 4) may not be filled out - this is indicated in clause 2 of the Procedure for registration of 4-FSS, approved. by order No. 381 (Appendix No. 2). Therefore, you can create a zero calculation without them.

We will talk about the specifics of filling out the cells of the zero calculation tables in the next section.

What sheets to fill out in the 4-FSS report without indicators

Some sections in the 4-FSS report are required to be completed. The instructions for filling out from FSS Order No. 381 dated September 26, 2016 (as amended on June 7, 2017) determine which sheets to submit if the 4-FSS is zero for the 4th quarter of 2022:

- title page;

- “Calculation of the base” (table No. 1);

- “Calculations for Social Insurance” (Table No. 2);

- “Information on the special assessment of working conditions and mandatory medical examinations of workers at the beginning of the year” (Table No. 5).

Sometimes it is necessary to fill in tables No. 1.1, 3 and 4 in the “zero”.

How to prepare a report if there is no data - zeros, dashes or empty cells?

To correctly fill out the zero calculation in Form 4-FSS, use the algorithm set out in Appendix No. 2 to Order No. 381:

| Clause of Appendix No. 2 to Order No. 381 | Decoding |

| 2 | Dashes are added to table cells if there is no reporting indicator. |

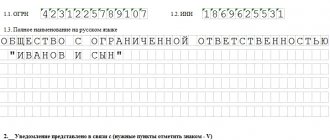

| 5.8 | When filling out the “TIN” field in the 2 initial cells (zone of 12 cells), enter zeros (00) if the TIN consists of 10 characters. How to find out the FSS registration number by TIN in a couple of minutes, see the material |

| 5.10 | In the 1st and 2nd cells of the field “OGRN (OGRNIP) of the legal entity, enter zeros (their OGRN consists of 13 characters with a 15-digit zone to be filled in) |

In addition, individual calculation cells are not filled in at all - neither with zeros nor dashes. For example:

- the field “Cessation of activity” located on the title page - according to clause 5.6 of Appendix No. 2 to Order No. 381, code “L” is entered in this field (if the company or individual entrepreneur is liquidated in the reporting period) or it is not filled in at all;

- field “Budgetary organization” - only state employees work with it (clause 5.12 of Appendix No. 2 to Order No. 381), and in the reporting of other companies and individual entrepreneurs it remains blank.

From these features of the calculation filling technique, the following conclusion can be drawn:

- zeros are entered only in the 1st and 2nd cells of the “TIN” and “OGRN” fields if the value indicated in them consists of 10 or 13 characters, respectively;

- In the cells of the form tables, if there is no data, dashes are inserted;

- individual cells for a specific purpose are left unfilled.

If you generate several different reports in parallel at once, read the next section to protect yourself from errors.

Zero reporting 4-FSS: how to fill out

FSS specialists have repeatedly explained whether it is necessary to submit reports to the FSS if there are no employees: organizations submit reports, but individual entrepreneurs do not. The procedure for filling out zero reporting has its own peculiarities. You will have to enter zeros in some columns and fields of the report, dashes in some cells, and leave some fields blank. The basic requirements for submitting a zero declaration to the Social Insurance Fund are as follows:

- Place dashes in all fields, columns and cells that do not contain data to fill out.

- When filling out the TIN field on the title page, enter zeros in the last two cells if your company’s TIN consists of 10 digits. A similar rule is provided for filling out the OGRN: if the code consists of 13 digits, then enter zeros in the first two cells of the 15-digit field.

- If your company has not ceased its activities, then leave the “Cessation of activities” field empty. We do the same with the “Budget organization” field. Only public sector institutions are required to fill out this cell. If your company does not qualify, then leave the field blank.

IMPORTANT!

These recommendations apply only to the preparation of 4-FSS! When filling out other reporting forms, take into account the requirements that apply to them.

Please note that it is unacceptable to put dashes in all fields of the report. Some strings have numeric values:

- Line 5 of table No. 1. In it, indicate the insurance rate at which your company should calculate insurance coverage against accidents and occupational diseases. This field must not be left blank.

- Line 9 of table No. 1. Always filled in, contains the result of arithmetic operations with the values of the basic tariff, allowances and benefits. If a decision is made regarding an enterprise to reduce or increase the tariff, then you will have to indicate the data in additional reporting lines.

- The rows of table No. 2 have numerical values if the organization has a debt or overpayment for past periods. You will also have to reflect information about the calculations made. In the zero calculation for the 4th quarter of 2022, you will have to indicate payment information if the company paid the debt on insurance premiums for the previous quarter (period).

Sample zero 4-FSS for the 4th quarter of 2022:

Technology of filling out calculations - how not to make a mistake?

The above method of filling out the fields is typical only for 4-FSS. When registering, for example, the calculation of contributions, a different scheme is used:

- 12 acquaintances of the “TIN” field of a single calculation for insurance premiums must be filled out from the first cells, and with a 10-digit TIN, dashes are entered in the last 2 cells (for example, 8970652349—);

- missing indicators (quantitative and total) are filled with zeros; in other cases, empty cells are crossed out.

For a sample zero-sum calculation for insurance premiums, please follow the link.

Do not confuse these technical features of the design of different reporting forms, otherwise problems may arise with the timely acceptance of the 4-FSS calculation by social insurance specialists. They may not accept the calculation on formal grounds - due to non-compliance with the procedure established by law for filling it out.

How much the policyholder will have to pay if, due to a technical or other error, the calculation is not submitted on time, find out here.

How to fill out table 5

Table 5 shows the data:

- on special assessment (certification) of jobs;

- medical examinations of workers.

The peculiarity of this table is that the data in it is presented exclusively as of the end of last year. If something changes during the reporting year, the information will be reflected in the report for the next year.

It is possible that, despite the absence of accruals and payments for contributions in the reporting year, the employer will have jobs that have undergone a special assessment. Strictly speaking, 4-FSS may not be zero in 2022 due to the availability of indicators for the special assessment carried out in 2022.

In the case of medical examinations, the following scenarios are theoretically possible:

- Employees who passed the medical examination went on leave in the year preceding the reporting year, followed by dismissal, and this leave ended in the reporting year.

- The company has concluded civil contracts, which provide for both contributions for injuries and medical examinations (and they were carried out), but at the same time, in the reporting year there were no paid orders under such contracts (as a result, contributions were not accrued).

In these two scenarios, the report will contain real figures - and for medical examinations, too, since they will be relevant at the beginning of the reporting year.

Both a special assessment of the workplace and a medical examination can be carried out for the position of the general director. In trade, for example, medical examinations are mandatory for all employees (Resolution of the Supreme Court of the Russian Federation dated December 6, 2017 No. 34-AD17-5). In this case, the data in Table 5 will be reflected in any case, even if the company has no other employees except the director, who is required to be appointed.

Where can I get the information for Table 5?

Always fill out this table, regardless of whether the indicators are in the other calculation tables or not. It is devoted to the results of a special assessment of working conditions (SOUT) and mandatory medical examinations performed at the beginning of the year.

Please put dashes in all cells if you have registered as an insured this year. Other companies and individual entrepreneurs need to collect information:

- from the personnel service - about the number of jobs (this information is needed for column 3), the number of employees required to undergo medical examinations (column 7) and those who have already passed them (column 8);

- from the SOUT report - on the number of certified workplaces, including those classified as harmful and dangerous working conditions (columns 4–6).

What the law on SOUTH refers to as hazardous working conditions is described here.

For all the details on filling out this table, see our material “4-FSS - Table 5: how to fill out in 2022.”

Legislative basis

The need to provide form 4-FSS follows from the provisions of Law No. 125-FZ of July 24, 1998. Article 24 is devoted to contributions for compulsory social insurance against accidents at work and occupational diseases (for brevity they are called “injuries”). How to fill out the form is described in the FSS order No. 381 dated September 26, 2016.

The calculation is submitted quarterly by all policyholders, including during periods of inactivity. Therefore, if a company has just been formed and has not yet started operating, has temporarily suspended its activities or has ceased its activities, but has not yet closed, 4-FSS must be submitted. In the mentioned cases, a zero calculation is submitted.

Sample 4-FSS with an example for a novice policyholder

Let's consider the scheme for filling out 4-FSS 2022 for a company created in the 1st quarter.

Example

Initial data:

- Stroika Plus LLC was registered in March 2022.

- At the end of the 1st quarter, activities had not yet begun, staff had not been recruited, payments had not been made, insurance premiums had not been paid.

- Only the director is on staff.

- The injury contribution rate is 2.3% (without discounts or surcharges).

- The SOUT is scheduled for May 2022.

Despite the lack of activity, in April 2022 the company will be required to submit its first calculation to social insurance in Form 4-FSS. It will be null because there is no data to fill:

- table 1—no injury payments were accrued;

- table 2 - Stroika Plus LLC did not conduct mutual settlements with the Social Insurance Fund;

- table 5—there is no information about the results of special assessment tests and mandatory medical examinations.

How to complete a zero calculation, see the sample of filling out 4-FSS, latest edition 2022.

Fines for failure to submit 4-FSS

The law provides for the following fines for violations of the provision of a zero 4-FSS report:

- for a delay that does not exceed 180 calendar days, the fine will be 5% of the amount of contributions for each full and partial month, but not more than 30% and not less than 100 rubles;

- for a delay that exceeds 180 calendar days, the fine from 181 days additionally increases by 10% for each full and incomplete month, the maximum amount of the fine is not limited, the minimum amount is 1,000 rubles;

- if the 4-FSS report is not submitted at all, officials may be fined in the amount of 300 to 500 rubles based on Article 15.33 of the Code of Administrative Offenses of the Russian Federation.

Checking the submitted 4-FSS

The control procedure is carried out through desk and on-site inspections.

A desk audit is carried out at the location of the FSS on the basis of the submitted calculations and other information available to the FSS. The inspection is carried out by authorized persons in accordance with their official duties within 3 months from the date of submission of the 4-FSS without a special decision from the head of the FSS. If errors in calculations and inconsistencies in information in documents are identified during the inspection, the policyholder is informed with a requirement to provide explanations or corrections within 5 days.

An on-site inspection is carried out on the territory of the person being inspected, which requires a decision from the head of the Social Insurance Fund, provided that inspections are carried out more often than once every 3 years (excluding inspections of its separate divisions). During an on-site inspection, a period of no more than 3 years prior to the year in which the inspection decision was made is verified. The maximum duration of an on-site inspection is no more than 2 months, but this period can be extended to 4 or 6 months if there are such grounds:

obtaining during the inspection from any sources data indicating the presence of violations

- presence of force majeure in the territory of the inspection

- presence of several separate divisions

- failure to submit documents within the established period for an on-site inspection

The person in respect of whom the inspection was carried out, in case of disagreement with the facts set out in the inspection report and with the conclusions and proposals of the inspectors, within the prescribed period, may submit written objections, attaching documents (their copies, certified in the prescribed manner) confirming the validity of his position .

Expert of the Legal Consulting Service GARANT O. Volkova