According to federal law 54-FZ, all businesses must switch to online cash registers. This means that every organization and individual entrepreneur will have to purchase a new cash register and register it with the tax office. Good news - to register a new type of cash register, you don’t have to go to the Federal Tax Service office - everything can be done online. It’s simpler - filling out an application on the website is less likely to make a mistake, and the whole procedure will take 20 minutes. To register, you must purchase a qualified electronic signature.

How else can you register an online cash register with the tax office?

Visit the tax office in person

No one has canceled the old proven method of registering a cash register. To do this, you do not need to purchase a CEP, but you will have to go to the Federal Tax Service office twice.

Register a cash register in SBIS

SBIS users can register a cash register from their personal account, and not on the tax website. In VLSI this will only take a few minutes. Use the instructions to register.

When registering a cash register, it is important to enter all the data correctly - in case of an error, you will have to change the fiscal drive. If you are not confident in your abilities, contact the Tensor Center - our specialists will register the cash register for you.

Application for registration of CCP

According to paragraph 4 of Art. 7 of the Law of 07/03/2016 No. 290-FZ, from 02/01/2017, data transfer to the Federal Tax Service is carried out in electronic form through a fiscal data operator, except for the case when the cash register is used in areas inaccessible to communication networks. Therefore, first of all, it is necessary to conclude an agreement with the fiscal data operator.

Step one: filling out an application for registering a cash register.

You can submit an application in two ways:

- in electronic form by filling out a special form in the cash register account on the Federal Tax Service website - clause 4 of the appendix to the Order of the Federal Tax Service of the Russian Federation dated May 29, 2017 No. ММВ-7-20/ [email protected] , clause 9 of the procedure for maintaining the cash register office, approved by the Order of the Federal Tax Service of the Russian Federation dated 03/21/2017 N ММВ-7-20/ [email protected] ;

- on paper - by personal presentation or sending by mail to the Federal Tax Service.

The electronic method of filing an application is more convenient, but to use it, you must have a strong, qualified electronic signature. This procedure is established by clause 5 of the appendix to the Order of the Federal Tax Service of the Russian Federation dated May 29, 2017 No. ММВ-7-20/ [email protected] and clause 10 of Art. 4.2 of the Law of May 22, 2003 No. 54-FZ.

If you decide to submit an application on paper, you need to fill out the form approved by Appendix No. 1 to Order of the Federal Tax Service of the Russian Federation dated May 29, 2017 No. ММВ-7-20 / [email protected] (form 1110061). The rules for its preparation are given in Appendix No. 5 to the said order. According to the rules, it is necessary to take into account that:

- an application is filled out for each piece of equipment and can be completed either manually or on a computer;

- any corrections are excluded, as well as double-sided printing of the application;

- All columns must be completed, except for the cases listed in the order in which the application is completed. For example, there is no need to fill out the field “Reason code for re-registration”, as well as the fields of section 4 “Information on generated fiscal documents” of the application (clauses 7, 34 of the filling procedure).

No need to fill in the fields:

OGRN/OGRNIP, if the company is a foreign legal entity (item 2 of the order);

- intended to be filled out by an employee of the Federal Tax Service. Such details include information about the registration of the cash register with the tax office, the number of pages of the application and documents attached to it, as well as the date of submission of the application and its registration;

- line 150, if the organization does not use cash register systems to generate strict reporting forms in electronic form and print them on paper;

- section 3, if the organization uses cash register systems without electronically transmitting fiscal data to the tax authorities. However, in this case, you need to fill out line 170 “TIN of the fiscal data operator”, putting zeros in it.

If the user plans to use one cash register as part of several automatic devices for calculations, then it is necessary to fill out section 2.1 of the application form.

Please note: if a company registers an online machine at the location of a separate division, then it is necessary to take into account the specifics of the application for registering a cash register. Thus, in the “Checkpoint” field at the top of each page of the application, the checkpoint of the separate unit is indicated. In this case, the application is signed by the head of the separate unit.

Most common mistakes

According to statistics, entrepreneurs most often make the following mistakes:

- The wrong OFD is indicated - this happens when a person does not understand where to register the online cash register of an individual entrepreneur or LLC, or when he changes the operator and indicates one in his personal account, but another in the machine’s memory. In such cases, the equipment does not function properly.

- The number or TIN was entered incorrectly - a mechanical mistake (let’s say you missed the keyboard in a hurry and put 3 instead of 2) with the most serious consequences. The fiscal drive will be declared invalid.

- There is a discrepancy between the submitted data and the actual settings - they are not synchronized with each other, so you should make sure that what is recorded in the Federal Tax Service matches what is indicated in the Federal Tax Service database.

- Too frequent replacement of the OFD, installation address and other information - we remind you that they are allowed to be corrected no more than 12 times.

We examined in detail what a cash register (KKM) is, what documents and deadlines are needed to register an online cash register with the tax office for an individual entrepreneur or LLC.

We hope that now you can connect it correctly and quickly. And to make it more convenient for you to use it and generally conduct business, we offer Cleverence software products designed for this - contact us and order software that makes it easier to develop on the Internet. Number of impressions: 2791

OFD for registering cash registers

To work with online cash register systems, a company must enter into an agreement with a fiscal data operator (FDO). The list of operators is on the Federal Tax Service website at: https://www.nalog.ru/rn77/related_activities/registries/fiscaloperators/.

At the same time, you must select an operator and conclude an agreement with him before contacting the tax office for the purpose of registering a cash register.

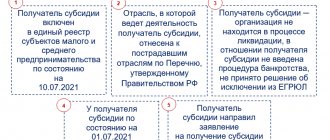

In Law No. 54-FZ, OFD is understood as an organization created in accordance with the legislation of the Russian Federation, located on the territory of our country and received permission to process fiscal data.

Data exchange will take place according to established protocols and within the framework of the concluded agreement between the cash register user and the fiscal data operator. Federal Law No. 54-FZ establishes requirements for them. Note that the operator can be, for example, a bank, an electronic document management operator or a telecommunications company. At the same time, such companies can form package offers, subsidize the purchase and maintenance of cash registers for their clients, or offer a wide range of additional services.

Entrepreneurs independently give preference to one or another operator. The deadline for concluding an agreement is not provided for by law, but it is worth noting that without such an agreement, the cash register will not be registered.

Simplified procedure for cash management for small businesses

A simplified procedure for cash transactions has been established since June 1, 2014. According to it, individual entrepreneurs can refuse to issue a receipt and debit order, and also not maintain a cash book. The responsibilities of an individual entrepreneur are only the preparation of settlement and payroll statements when paying wages to individuals or other remuneration in cash.

In addition, individual entrepreneurs and small organizations with up to 100 employees and revenue of up to 400 million rubles per year may not comply with the cash balance limit. But if individual entrepreneurs and small organizations are comfortable maintaining cash documents, they have the right to do so.

CCP registration report

Within the next day after receiving the registration number, the user must generate a cash register registration report.

Step three: generate and send a cash register registration report.

To generate a report, you need to enter the following information into the fiscal drive:

- CCP registration number;

- full name of the user;

- data on cash registers, fiscal storage and other necessary information.

The report must be sent to the Federal Tax Service through the cash register office, the fiscal data operator, or submitted in paper form.

Cash register registration card

Within 10 working days from the date of receipt of the application, fiscal officials must send the organization a card in the form approved by Order of the Federal Tax Service of the Russian Federation dated May 29, 2017 No. ММВ-7-20/ [email protected]

Step four: receive a cash register registration card.

Please note: you cannot punch checks until you receive the card.

The procedure for receiving a card depends on how the user sent the tax application (form 1110061). If the document is provided electronically, the card will be sent through your personal account or through a fiscal data operator.

To receive a card in paper form, you need to submit the appropriate application in any form. Fiscal officials will issue the document within 5 working days after receiving the application.

General rules for preparing documents for cash transactions

Cash transactions are carried out by a cashier or other employee, to whom the head of the organization or entrepreneur assigns the duties of a cashier. The cashier must familiarize himself with his official rights and responsibilities by signature. If an organization or individual entrepreneur has several cashiers, a senior cashier is appointed. If necessary, the head of the organization or individual entrepreneur can also conduct cash transactions.

NOTE! The cashier is the financially responsible person with whom the corresponding agreement is signed.

All cash documents, including the cash book, can be prepared in paper or electronic form. Documents on paper are drawn up by hand or on a computer and signed by authorized persons. Electronic documents are drawn up using technical means to ensure their protection from unauthorized access, distortion and loss of information. They are signed with electronic signatures in accordance with the requirements of the Law “On Electronic Signatures” dated 04/06/2011 No. 63-FZ.

Cash documents are signed by the chief accountant or accountant (in their absence, by the manager), as well as by the cashier. If the document is electronic, then it is signed with an electronic signature (EDS). The Ministry of Finance believes that when preparing primary accounting documents it is possible to use a simple electronic signature (letter dated July 17, 2017 No. 03-03-06/1/45323). The cashier is provided with a seal (stamp) containing the details confirming the cash transaction, as well as sample signatures of persons authorized to sign cash documents. The cashier is obliged to compare signatures with samples only if the document is not drawn up in electronic form with an electronic signature. In the case of conducting cash transactions and drawing up cash documents by the manager, sample signatures of persons authorized to sign cash documents are not drawn up.

If there is a senior cashier, transactions for the transfer of cash between the senior cashier and cashiers during the working day are reflected by the senior cashier in the book of accounting for received and issued cash.

How to check the registration of a cash register with the Federal Tax Service

Law No. 54-FZ does not allow registration with the tax authorities of a cash register, information about which is not in the Federal Tax Service register. Please note that registers of cash register equipment and fiscal storage devices are posted on the website of the Federal Tax Service of the Russian Federation (https://www.nalog.ru/rn77/related_activities/registries/).

Thus, a cash register, information about which is not in the register, cannot be used.

To check that a cash register is included in the Federal Tax Service register, you need to go to the website of the cash register verification service: https://kkt-online.nalog.ru/. Next, you should select the cash register model, which is indicated in the passport of the smart terminal, and click the “Check” button.

If the user received the answer: “The cash register is included in the register, not registered with the tax authorities,” then the device can be used. Otherwise, you need to check the serial number of the cash register in your passport and on the smart terminal in the “Settings-Cashier Maintenance” section. If the CCP number matches, then you should send a request to support with a passport photo and a photo of the model attached.

Step six: check the registration of the cash register with the Federal Tax Service.

If it is necessary to check the registration of the used model of cash register equipment, the user can contact the inspectorate at the place of registration as a taxpayer to obtain the relevant information. The inspection is carried out in accordance with the administrative regulations of the Federal Tax Service, approved by Order of the Ministry of Finance of the Russian Federation dated October 17, 2011 No. 132n.

Responsibility for violations of registration of cash transactions

Violation of the procedure for working with cash and the procedure for conducting cash transactions in 2022 is punishable. Violations include failure to receive cash proceeds, failure to comply with the cash limit, settlements with counterparties in cash in excess of established norms, and failure to comply with the procedure for storing funds. For such offenses an administrative fine is provided under Article 15.1 of the Code of Administrative Offenses of the Russian Federation.

If cash discipline in 2022 does not meet the stated requirements, violators will be fined:

- for officials - from 4,000 to 5,000 rubles;

- for legal entities - from 40,000 to 50,000 rubles.