Sign in certificate 2-NDFL

The indicator in the 2-NDFL certificate shows who (the tax agent or his legal successor) and in what case submits it.

This attribute can take the following values:

- sign 1 is a regular 2-NDFL certificate, which shows what income was paid to an individual, how much tax was accrued from it, withheld and transferred to the budget (clause 2 of Article 230 of the Tax Code of the Russian Federation);

- sign 2 means that certificate 2-NDFL is submitted as a message about the impossibility of withholding tax (clause 5 of Article 226 of the Tax Code of the Russian Federation);

- Sign 3 indicates that the certificate for the reorganized organization is submitted by the legal successor. The certificate reflects the income paid by the tax agent and the amount of tax accrued, withheld and transferred to the budget (clause 2 of Article 230 of the Tax Code of the Russian Federation);

- sign 4 is a certificate submitted by the successor organization if the tax agent paid an individual income from which he could not withhold tax (clause 5 of Article 226 of the Tax Code of the Russian Federation).

Read in the berator “Practical Encyclopedia of an Accountant”

How to fill out a 2-NDFL certificate

Introduction

According to the laws of the Russian Federation, every citizen is required to pay tax on income received. This is done in different ways: for individual entrepreneurs he pays himself, for the employee: the employer, for public sector employees: the state. This tax must be paid by both individual entrepreneurs and legal entities, no matter what form of ownership they have. Both the former and the latter are required to submit reports to the Federal Tax Service in form 2-NDFL, indicating the amount of taxes and various remunerations paid. In this form there is a “Sign” item, in which you need to put the number “one” or “two”. Let's consider what exactly needs to be added and what exactly are the differences between these features.

Signs 1 and 2 show whether taxes have been paid on the remuneration

Certificate 2-NDFL with sign 2

We’ll tell you separately when to fill out the 2-NDFL certificate with sign 2.

If a company paid income to one of its employees, but was unable to withhold tax from this income and did not transfer it to the budget, you need to report this to the inspectorate.

They also report this to the inspectorate with a 2-NDFL certificate, in which the sign “2” is indicated. It indicates the amount of income from which tax was not withheld and the amount of tax not withheld (clause 5 of Article 226 of the Tax Code of the Russian Federation). The deadline is March 1.

An individual will have to pay the tax not withheld from him by his employer himself no later than December 1. The inspectorate must send him a tax notice, so he does not need to submit a 3-NDFL declaration (subclause 4, clause 1, article 228, clause 1, article 229 of the Tax Code of the Russian Federation).

Who must indicate the identity of the taxpayer?

Only tax agents who ensure the receipt of income by taxpayers have the right to indicate the taxpayer’s designation in 2-NDFL. According to clause 1 of Article 226 of the Tax Code of the Russian Federation, the following are recognized as tax agents:

- Russian organizations;

- individual entrepreneurs;

- notaries engaged in private practice;

- lawyers who have established law offices;

- separate divisions of foreign organizations in the Russian Federation from which or as a result of relations with which the taxpayer received income.

Tax agents are required to calculate, withhold from the taxpayer and pay the amount of tax calculated in accordance with the specifics provided for by tax legislation.

In addition to calculating, withholding, and paying personal income tax, tax agents are required to provide reports on this to the tax authorities within strictly defined deadlines. A 2-NDFL certificate is periodically required directly by taxpayers to confirm income at various levels.

How to submit 2-NDFL certificates

2-NDFL certificates must be submitted to the tax office at the place of registration of the organization or at the place of residence of the individual entrepreneur via telecommunication channels.

You can submit certificates on paper if the number of employees does not exceed 10 people (Clause 2 of Article 230 of the Tax Code of the Russian Federation).

2-NDFL certificates on paper can be submitted to:

- personally to the tax office. This can be done by a manager (IP) or another person by proxy (clause 1 of article 26, clause 1 of article 27, article 29 of the Tax Code of the Russian Federation);

- send by mail with a description of the attachment.

If certificates are submitted in person to the inspectorate, they will be considered submitted on the day of submission, and if sent by mail, on the day the letter is sent.

To submit 2-NDFL certificates on paper, you need to create an accompanying register in two copies. The register form is given in Appendix 1 to the Order of the Federal Tax Service of Russia dated October 2, 2022 No. ММВ-7-11/ [email protected]

If an organization has separate divisions, then for the employees of these divisions and for individuals with whom the division has entered into civil contracts, certificates must be submitted to the tax office where the separate division is registered (clause 2 of Article 230 of the Tax Code of the Russian Federation).

Read in the berator “Practical Encyclopedia of an Accountant”

Certificate 2-NDFL of a separate division

Is it possible to make mistakes?

Now you know what sign 2 means in the 2-NDFL certificate and what is included in it. Therefore, let’s look at whether it is possible to make mistakes or confuse one with two? The tax office gives a clear answer - this is unacceptable; if an error is discovered, you will be fined 500 rubles for each declaration submitted. In this case, the filler has the opportunity to correct the error without imposing sanctions. Let's look at how this process occurs. There are three help options:

- Primary, that is, the one that the employer filled out and sent to the tax authority. In the primary form, two zeros are entered in the “adjustment number” section.

- Correctable, that is, one that required amendments. Accordingly, an adjustment code is entered into the specified section (consecutive numbers, for example, 04 or 05, if several edits are made).

- Finishing or canceling. Code 99 is entered in the required field, it cancels all previous documents and confirms that this is the final version.

That is, in essence, the employer or accountant has the opportunity to correct the mistakes made, and this service really works. Correction can take place in two ways: either the error was noticed after registration, or it was pointed out by a tax officer. If everything is changed quickly, without delaying the deadline, then penalties will not be applied.

How can they be fined?

If you miss the deadline for submitting 2-NDFL certificates, the tax inspectorate will charge you a fine of 200 rubles for each certificate (clause 1 of Article 126 of the Tax Code of the Russian Federation).

In addition, in this case, the head of the organization faces from 300 to 500 rubles (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Please note: you, as a tax agent, will not be fined if you independently discover errors and submit updated documents to the tax office before you learn that tax inspectors discovered inaccuracies contained in the documents (information) you provided (clause 2). Article 126.1 of the Tax Code of the Russian Federation).

How and when to submit reports

The employer is required to submit information about all remunerations (except those less than 4 thousand) to the tax authority every year. The deadlines for submission are as follows:

- Before March 1, you must submit documents for the second criterion.

- Before April 1, you must submit documents on the first basis.

That is, you must report for the past year before the specified date for each employee. If situations arise where it is not possible to accrue personal income tax, then two certificates are submitted to the tax office. In this case, the first indicator includes data on all income received, even if no payments were made to the budget for them. You can submit a declaration either in the traditional form, by filling out the form manually, or electronically. Only small businesses and individual entrepreneurs with fewer than 25 employees can submit paper certificates. Large companies rent them out exclusively in digital form.

Attention:

If you forget to file 2-NDFL or delay the deadline, the tax office will impose sanctions against you in the amount of 200 rubles for each employee. In addition, delays may justify additional inspection.

How to fill out the new form 2-NDFL

Obviously, along with the 2-NDFL form, the procedure for filling it out and electronic formats have been updated.

The Certificate form is still a title and 5 sections (see sample of filling out the new form 2-NDFL). Next, we’ll look at how to fill them out, taking into account the adopted innovations.

Fill out the Certificate separately for each personal income tax rate. If all the indicators do not fit on one page, the required number is filled in, and the title, information about the agent and his signature are placed on each page.

Heading

The title of the new form 2-NDFL for 2022 includes the year for which the Certificate is prepared, its number and the date of preparation. When drawing up a cancellation or correction form, indicate the same certificate number and the new date of preparation.

Field “Sign” – put “1” for a regular Certificate (“3” for legal successors), and “2” if 2-NDFL is submitted due to the impossibility of withholding tax (“4” for legal successors). If a certificate is prepared for issuance to an individual at his request, the field is not filled in (read more about this here).

“Adjustment number”: “00” for the primary Certificate, “01”, “02”, etc. for corrective The cancellation form is marked with “99”.

Read also: Adjustment of 2-NDFL for 2022

The Federal Tax Service code is indicated at the agent’s place of registration.

Section 1

When filling out a new form 2-NDFL, the following information about the tax agent is entered here:

- “OKTMO code” corresponding to the territory of the location of the agent (reorganized company), it can consist of 8 or 11 characters;

- contact number;

- TIN and checkpoint of the agent (legal successor), and if the certificate is submitted for a separate division, checkpoint - at the location of the “separate unit”;

- abbreviated company name/full name entrepreneur; the agent's legal successors indicate the name of the reorganized company;

- the code in the “Form of reorganization (liquidation)” field of the 2-NDFL certificate for 2018 (new form) is indicated by the successor in accordance with Appendix No. 2 to the order;

- the successor also indicates the “TIN/KPP of the reorganized organization.”

Section 2

The updated section 2 of the Certificate now reflects the following data about the individual who received the income (you can download the new form 2-NDFL 2022 at the end of this article):

- TIN assigned in the Russian Federation and in the country of citizenship (for foreigners). If there is no TIN, the fields are not filled in (read more about the TIN in 2-NDFL here);

- the surname, first name, patronymic (if any) of the individual is indicated in full, as in his identity card. For full name foreigners can use the Latin alphabet;

- “Taxpayer status” - indicated by a number from “1” to “6”. Thus, tax residents of the Russian Federation are “1”, non-residents are “2”, etc.;

- date of birth of the individual;

- the citizenship code is indicated according to the OKSM classifier; Russia code is 643. If an individual does not have citizenship, the code of the country that issued the identity card is indicated;

- the identification document code is selected from the list in Appendix No. 1 to the “Procedure for Filling Out”; Then we write its series and number.

As you can see, section 2 of Certificate 2-NDFL of the new 2018 form, a sample of which is presented here, has significantly decreased in volume.

Section 3

This part of Certificate 2-NDFL of the new form-2018 (form, sample published below) contains the income of an individual for the year.

If a Certificate with attribute “2” or “4” is submitted, the section includes income from which it is impossible to withhold tax (at the end of this article you can download a new form of certificate 2-NDFL).

The table in section 3 reflects:

- serial month for which income was accrued and received (in chronological order);

- income and deduction codes listed in Appendix 1 and 2 to the order of the Federal Tax Service of the Russian Federation dated September 10, 2015 No. ММВ-7-11/387 as amended. dated October 24, 2017. Since 2018, the list of codes has been updated, you can find out more about this here;

- the amount of income and deductions according to the code (except for standard, social, property), and the deduction cannot exceed income. If one “income” code corresponds to several deduction codes, the first deduction code and its amount are indicated opposite the code and amount of income, and the rest in the lines below, while the “income” lines opposite them are not filled in.

In the “Amount of Income” field, according to the corresponding code, you must reflect the entire amount of income actually received, regardless of the tax rate applied for each payment (letter of the Ministry of Finance of the Russian Federation dated July 21, 2017 No. 03-04-06/46690).

Section 4

This section of Certificate 2-NDFL (new form 2018), the form of which we are considering, contains deductions: standard, social and property.

- The “Deduction code” field is filled in according to the list of codes (Appendix No. 2 to the order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/387);

- the amount of the deduction is indicated according to its code;

- For social/property deductions, the notification details of the Federal Tax Service must be additionally filled in.

Read also: Social deductions in 2-NDFL

Section 5

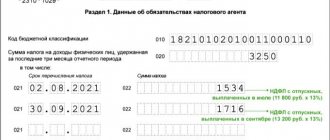

This section of the 2-NDFL form of the new form (the form can be downloaded from the link at the end of the article) summarizes the amounts of income and personal income tax:

- “Total amount of income” – we sum up all income from section 3, and for reference, signs “2” and “4” here reflect the amount of income from which tax is not withheld;

- “Tax base” - from the “Total amount of income” we minus tax deductions of sections 3 and 4;

- “Calculated tax amount” – “Tax base” is multiplied by the personal income tax rate; for reference with signs “2” and “4” - the amount of tax not withheld is indicated;

- The “fixed advance payment amount” taken into the tax reduction is reflected by those who have foreign employees under a patent; You should also indicate in a special field the details of the notification confirming the right to reduce the tax, and the code of the Federal Tax Service that issued it;

- “Tax amount withheld” – personal income tax withheld during the tax period;

- “Tax amount transferred” – personal income tax paid to the budget; in 2-NDFL certificates of the new form (see sample below) with signs “2” and “4”, zeros are indicated in this field;

- “Amount of tax over-withheld” includes amounts of personal income tax not returned to the individual by the agent, and overpayment of tax that arose when the tax status of the individual changed;

- “Amount of tax withheld” – the total amount of withholdings from an individual in the reporting year;

- “Tax amount not withheld” – tax that could not be withheld (reflected in certificates with any attribute);

- in the “Tax Agent” field, select the appropriate number: “1” if Certificate 2-NDFL of the new form-2018 is filled out and submitted by the agent himself, and “2” if the Certificate is submitted by his representative (legal successor). For the representative (legal successor), it is necessary to indicate the details of the document confirming the authority;

- full name must be indicated. The person who submitted the Certificate is signed by him.

Read also: Certificate 2-NDFL upon dismissal

New form 2-NDFL in 2022

Certificate 2-NDFL was approved by order of the Federal Tax Service of the Russian Federation dated October 30, 2015 No. ММВ-7-11/485. But a new order of the Federal Tax Service has already been approved to amend its form (Order of the Federal Tax Service dated January 17, 2018 No. ММВ-7-11/19). The reason for the updates was the provision of the opportunity to submit 2-NDFL information to the legal successors of the tax agent.

How does the new form 2-NDFL 2022 differ from the previous one?

- New fields on the form of reorganization (liquidation) and TIN/KPP of the reorganized company have been added to section 1 “Data about the tax agent”. They must be filled out by successors submitting information for the predecessor company.

- From the “Data about the individual - income recipient” of Section 2 in the new form 2-NDFL for 2022, all fields related to the individual’s place of residence have been removed: address, country code, subject code.

- The reflection of investment tax deductions in section 4 is excluded.

- The procedure for displaying a document confirming the authority of the agent’s representative (successor) has been clarified: it will be necessary to indicate its name and details.

- The barcode of the 2-NDFL certificate is changing.

A sample of the 2-NDFL certificate (new form 2018) can be found below. The new form will be used for reporting for 2022, after it comes into force on February 10, 2018.

Read also: Certificate 2-NDFL: new form 2019

Let us remind you that income certificates for 2022 with indicators “1” and “3” are submitted to the Federal Tax Service no later than 04/02/2018, and with indicators “2” and “4” - 03/01/2018.

Read also: Certificate 2-NDFL (2018) for a bank

Taxpayer identification in 2-NDLF

In the column of the 2-NDFL certificate “Sign”, a value from 1 to 4 is indicated:

| Sign | What does it mean |

| «1» | The certificate is submitted by the tax agent as part of the annual reporting |

| «2» | Represented as a tax agent if he reports the impossibility of withholding personal income tax from an individual |

| «3» | Represented as the legal successor of the tax agent as part of the annual reporting |

| «4» | Represents himself as the legal successor of the tax agent if he reports the impossibility of withholding personal income tax from an individual |

What happens if you enter the code incorrectly?

An attribute code specified incorrectly will be regarded by tax authorities as an error, that is, they will consider the information provided about income unreliable. According to Article 126.1 of the Tax Code of the Russian Federation, for each 2-NDFL certificate submitted with errors, a fine of 500 rubles is imposed. It can be avoided only if the reporting is corrected and resubmitted before the Federal Tax Service finds these errors. If the updated certificates are submitted on time, but after the tax authorities have discovered errors, you will not be able to avoid the fine.