What to do if blocked

In order to eliminate the problem and restore solvency, it is first necessary to clarify what the decision is related to. You can check the restrictions and suspensions on your current account on the website of the Federal Tax Service - the tax service, upon request, provides information about the resolution that serves as the basis for the freeze.

Based on this information, you can decide on the further sequence of actions. The current Code contains provisions defining the time frame within which applied sanctions must be lifted after the taxpayer has complied with all the necessary requirements. The standard time allotted for the adoption of a resolution is one business day from the moment of confirmation, however, as practice shows, the wait can be prolonged - therefore it is better to control key processes in a timely manner, eliminating the possibility of an unpleasant situation.

How to remove a block imposed by decision of the Federal Tax Service

So, your bank account has been blocked - what should a person subject to such sanctions do? First of all, eliminate the reason for which the blocking was carried out. That is, it is necessary:

- pay the amount of tax, penalties or fines that caused the restriction of the ability to use the account;

- submit unsubmitted reports (declaration or calculation in form 6-NDFL);

- organize electronic exchange of documents with the tax authority;

- send an unsent document to the Federal Tax Service - confirmation of acceptance of the information or perform the actions proposed for execution in this information.

You can see a detailed algorithm of actions for each situation in the ConsultantPlus ready-made solution for unlocking an account by receiving a free trial access.

A decision taken by a tax authority to block an account is canceled by a document of similar status drawn up by the same authority. Moreover, for such registration, the Tax Code of the Russian Federation (clause 3.1, 8, article 76) establishes a specific period, counted as one working day from the date:

- receipt by the Federal Tax Service of originals or copies of payment documents indicating payment of the required amount of tax debt;

- filing the required report;

- ensuring the possibility of electronic interaction with the Federal Tax Service;

- sending a document to the tax authority - confirmation of receipt of information or completion of the actions proposed in this information (response to a request or appearance of a representative at the Federal Tax Service Inspectorate).

One more working day is given to the tax authority to send the decision to the bank (clause 4 of article 76 of the Tax Code of the Russian Federation). It is also sent there electronically. At the same time, this document is brought to the attention of the taxpayer (tax agent).

Possible reasons

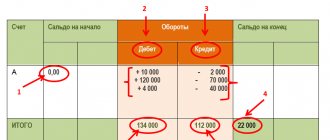

As a rule, when trying to check the blocking of an organization’s current account, it turns out that the restrictions applied by the tax authorities were the result of one of the following violations:

- Failure to comply with deadlines for filing a declaration. Such a measure provides for the seizure of the entire amount of funds on the balance sheet of a legal entity. In this case, it is possible to carry out operations in accordance with the legislation of the Russian Federation, for example, payment of taxes, payment of wages, etc.

- Failure to pay taxes assessed by the Federal Tax Service. In this case, the inspectorate has the right to block part of the money corresponding to the amount of underpaid tax, regardless of which company accounts they are stored in. A typical problem is the overly “diligent” implementation of the Federal Tax Service’s resolution, when the amount indicated for withholding is frozen several times, as a result of which its size actually increases. To unblock it, it is recommended to promptly send an application to the tax authority with a request to restore access.

- Failure to provide receipts for acceptance of electronic documents. One of the responsibilities of organizations is to confirm receipt of notifications sent by the Federal Tax Service - for example, about an scheduled visit, or a request to provide clarification on existing issues. The regulations provide six working days for this procedure. If another 10 days pass after the specified period, but no action has been taken by the company, the law allows for the possibility of blocking.

Ensuring a resolution on bringing to justice adopted following the results of desk or field events.

In the case of individuals, there is a fairly wide range of grounds, so checking tax decisions to suspend transactions on accounts requires analysis of several sources at once. Such factors include:

- Conducting illegal business activities, as well as work without formalizing labor relations between the employee and the employer.

- Failure of the individual entrepreneur to comply with the deadlines for scheduled reporting, including situations where actual activities were not carried out for the specified period.

In order to avoid more serious consequences, it is recommended to quickly clarify the actual reason for freezing money, and, if justified, take the necessary measures to eliminate it.

A convenient remote access banking system that provides secure access to your accounts at MORSIKY BANK (JSC) for making payments and transfers using a computer and the Internet.

Reasons for blocking a current account by the tax office

As one of the measures to influence a taxpayer or tax agent (legal entity or individual entrepreneur) who violates the requirements of tax legislation, a procedure such as blocking current accounts is applied, which is a ban on the use of funds belonging to the taxpayer.

Such a ban is imposed by the tax authority, and the same body lifts it when the grounds that served as the reason for the blocking disappear. The blocking rules are set out in Art. 76 of the Tax Code of the Russian Federation, included in Chapter. 11 of this document, dedicated to the methods used to ensure payment of tax payments. However, non-payment of taxes is not the only reason for banning the use of accounts.

In addition to unpaid tax (penalties, fines), the following are grounds for freezing settlement transactions (clauses 3, 3.2 of Article 76 of the Tax Code of the Russian Federation):

- failure to submit tax reports (declarations, 6-NDFL, RSV) within 20 working days (10 - before 07/01/2021) from the end of the period allotted for its submission - in this case, the account can be blocked for a 3-year period , counted from the date corresponding to the 20th (10th) working day from the date of expiration of the period allotted for filing the declaration;

From July 1, 2022, tax authorities have the right to notify the taxpayer about the upcoming blocking of an account for failure to submit reports - no later than within 14 business days before the corresponding decision is made. Please note that this is the right, not the obligation of the inspectorate, so they may not report it.

- unrealized obligation to provide an electronic method of interaction with the tax service - liability here arises if the taxpayer has not taken any action within 10 business days from the date the Federal Tax Service Inspectorate discovered such a violation;

- failure to send an electronic confirmation receipt to the Federal Tax Service Inspectorate in response to information received from the tax authority within 10 working days from the date of expiration of the deadline established for sending such a document (it is 6 working days).

In addition, the blocking of an account is caused by the need to ensure guaranteed implementation of decisions on the payment of additional assessments made during a tax audit (clause 10 of Article 101 of the Tax Code of the Russian Federation).

Responsibility in the form of freezing an account can be applied not only to a taxpayer (payer of insurance premiums) or a tax agent, but also to a tax evader if he is required to file declarations or reports on contributions (subclause 3, clause 11, article 76 of the Tax Code of the Russian Federation).

A credit organization does not have the opportunity not to comply with the decision of the tax authority to block an account (clause 6 of Article 76 of the Tax Code of the Russian Federation). At the same time, she is obliged to inform the tax authority about the balances on blocked accounts (clause 5 of Article 76 of the Tax Code of the Russian Federation).

ConsultantPlus experts explained how to unblock a current account if the Federal Tax Service has made a decision to suspend operations. If you don't already have access, get a free trial of online legal access.

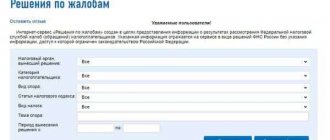

Checking account blocking on the Federal Tax Service website

The simplest method by which you can clarify the presence of restrictive measures is to use the official service provided by the Federal Tax Service. The algorithm for obtaining the necessary background information for both organizations and ordinary citizens is quite simple and includes the following steps:

- Using a browser, open the page located at service.nalog.ru and select the section “System for informing banks about blocking, suspension of account transactions and the status of processing electronic documents.”

- Oh, and enter the TIN of the legal entity and the BIC of the bank in the additional fields of the form.

- Confirm sending the data, after which a table will appear on the screen indicating the restrictions imposed.

It is important to note that the application reflects only basic details, such as date, number and code of the departmental body. To clarify the specific reasons for each of the identified sanctions, you should contact the department at your place of registration or residence.

Open an account and get 6% on your account balance!

Reasons for blocking accounts according to law 115-FZ

Law No. 115-FZ, dedicated to the issues of countering the use of funds to finance criminal activities, obliges structures that carry out transactions with funds to carry out (Articles 6, 7) the following measures:

- checking of persons, both those wishing to open an account and those already having one, for involvement in illegal acts (including through their beneficial owners);

- control over certain types of transactions (with the possibility of their suspension) if their turnover exceeds the amounts established by law, or with the participation in them of persons suspected of involvement in terrorism;

- transfer of information about identified facts of illegal activities or counteraction to ongoing control to Rosfinmonitoring;

- freezing the accounts of persons suspected of involvement in criminal activities.

Thus, blocking of an account under 115-FZ is carried out by the bank itself or another person (organization or individual entrepreneur) performing transactions with funds. There are few reasons used for this. Essentially, the possible reasons for blocking a current account by a bank come down to two (Article 3 of Law No. 115-FZ):

- The client was included in the official list of persons involved in criminal activities (including those related to terrorism, extremism or weapons of mass destruction).

- The client is not included in the above list, but there are reasons to suspect him of extremist or terrorist activities, and based on these reasons, Rosfinmonitoring or the interdepartmental commission authorized by it made a decision to freeze the account.

In the first case, the information must be present on the Rosfinmonitoring website in the corresponding list (subclause 6, clause 1, article 7 of Law No. 115-FZ). And in the second, the decision on blocking should be published on the website of the same department or interdepartmental commission. However, regardless of which of the grounds the blocking occurs, it is carried out no later than one working day from the moment this ground arises (subclause 6, clause 1, article 7, clause 5, article 7.5 of Law No. 115-FZ).

Inclusion in the list of persons involved in criminal activities occurs in the presence of a judicial or administrative act that has entered into force, another procedural document, lists and judicial acts of the international level, indisputably indicating the client’s involvement in terrorism or extremism (Clause 2.1 Article 6 of Law No. 115-FZ).

If the grounds for freezing an account are identified by the person carrying out transactions with funds independently, then he must promptly bring this to the attention of Rosfinmonitoring (clause 3 of Article 7 of Law No. 115-FZ), and in this case he has the right to independently suspend the transaction. dubious transaction for up to 5 working days (clause 10 of article 7, clause 8 of article 7.5 of law No. 115-FZ) pending a decision on blocking made by Rosfinmonitoring. The decision to block in this case can be made for up to 30 days (Article 8 of Law No. 115-FZ), which is intended to clarify the circumstances in more detail and take measures that give the right to permanently freeze the account.

Alternative verification methods

There are other methods that allow you to check account suspension, restrictions and blocking not only on the Federal Tax Service website. So, for example, the “Traffic Light” service is available to clients of SEA BANK, thanks to which they can obtain information about potential and existing counterparties and reduce business risks. The service not only warns about possible problematic aspects, but also provides an assessment based on two parameters:

- Adequacy. For some categories of counterparties (for example, individual entrepreneurs), there is not enough information in open sources for a comprehensive conclusion. For these, a message will be displayed indicating the need for additional verification.

- Materiality. This is the ability of a fact to influence relations with a counterparty. For example, a bankruptcy notice is a significant fact, but a traffic police fine is not. The most significant facts are marked in red.

This is a convenient method for those who prefer safety and reliability, since timely information based on current data eliminates the occurrence of unforeseen situations.

What happens when account operations are suspended

The PC freezing procedure involves several successive stages:

- Consideration by the controlling agency of the existing grounds and issuance of an appropriate order within the framework of the procedural regulations.

- Sending a notification to the bank that services the company or individual, suspending restrictions on the account.

- Sending a copy to the taxpayer, with receipt of confirmation of information in the form of a signature.

- Fulfillment by the bank of the presented requirement and subsequent transfer to the tax service of information about the amount of funds remaining at the disposal of the company or individual.

The decision to block a current account based on the results of an inspection by the Federal Tax Service can be made by the immediate head of the body, as well as his deputy. The standard template for drawing up resolutions is approved by the provisions enshrined within the framework of the order published on July 14, 2015 N ММВ-7-8/284, while an electronic form is sent to the credit institution.

There are a number of operations that can be carried out on the account if there are blocks by the Federal Tax Service. This list includes:

- Calculations for wages and severance pay.

- Payment of existing child support obligations.

- Repayment of insurance premiums and imposed fines for non-payment of taxes.

- Compensation for damage to health.

You can clarify information about the reasons for blocking your Federal Tax Service account, the duration of the ban and the amount of debt, as well as check the tax information about existing debts online. Moreover, even a resolution on suspension is not a basis for a ban on the transfer of mandatory fees, as well as the implementation of priority transactions, the procedure for the execution of which is regulated by the norms of the Civil Code.

Procedure for checking for blocking by TIN

Is the counterparty's account blocked - how to check? What data is needed for this? There is nothing complicated here. You can check whether a counterparty has blocked an account using the TIN, i.e., using an indicator that is publicly available.

The verification procedure itself is very simple. On the page that opens on the website, you must select the type of request that corresponds to the information on suspension decisions, and then enter the counterparty’s TIN and BIC of any of the existing banks in the available fields.

After entering a special code that provides protection against spam, the service will generate a response to the request, which will either contain a message about the absence of blocking, or will display a table with information about all decisions made about blocking and which banks they were sent to.

How to restore access to blocked funds

The most common factor that determines the application of sanctions by tax authorities is late payment of mandatory fees. In theory, the notification service about the blocking of a current account by the Federal Tax Service provides for notification of regulated entities, but in practice the procedure is not implemented properly in all cases, especially if the amount of debt due to which the ban is imposed does not exceed several rubles. In such situations, you should remain calm and act consistently.

Step 1. Clarify the reasons

For any decision taken by government departments, there must be an appropriate basis provided for in the legislative provisions. As you already know, information about accounts blocked by the Federal Tax Service is available on the website - checking the suspension by banks does not take much time. Having received the details, contact the responsible authority at the place of residence or registration of the organization and find out exactly which operations were not performed properly.

Step 2: Fix problems

The procedure for restoring access to your own money depends on how justified the requirements of the tax service are. In the event that the reason for the restrictive measures are actually violations, be it non-compliance with instructions, a violation of the electronic document flow cycle, or untimely filing of a declaration, it will be enough to correct the mistakes made. If the internal audit does not confirm the legitimacy of the claims, the proceedings will have to be carried out in court.

Step 3. Informing about execution

Upon satisfaction of claims, a corresponding notification should be promptly sent to the inspectorate, without waiting for an independent response from the department. The basis for canceling the arrest is a decree, which the bank is obliged to execute within one business day. Taking into account all the nuances of interaction, the total duration of the access restoration procedure does not exceed 72 hours from the moment of providing data on the elimination of previously identified violations.

Step 4. Monitoring progress

You can find out more about lifting the suspension on your account on the tax website or find out directly from the Federal Tax Service about the deadlines for making and executing the decision. In case of non-compliance with the established regulations, it is necessary to submit a written statement to the head of the department, outlining general information about the current situation.

Open an account and get 6% on your account balance!

Results

Blocking a current account is one of the measures to influence tax payers who violate the requirements of the Tax Code of the Russian Federation. The main reason for its use is non-payment of taxes. However, there are other reasons why an account may be frozen. Due to non-payment of taxes, accounts are blocked for the amount of the existing debt. In this case, the ability to use the account remains, but is subject to the presence of a minimum balance on it. In other situations, the account is frozen completely.

The presence of a block on at least one of the taxpayer's accounts entails a ban on opening new ones. In order to quickly provide banks with such information, the Federal Tax Service has created a special service that allows you to find out about account blocking on the tax service website. Access to the service is free and free, which allows any interested person to use it. The procedure itself for checking an account for blocking at the tax office presupposes knowledge of the TIN of the person being checked and does not present any technical difficulties.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Timing for resumption of inspections

In accordance with the resolution of the Government of the Russian Federation, the Federal Service for Economic Supervision published an official notice on the restoration of the standard procedure for the implementation of control procedures. Previously, due to epidemiological restrictions, this practice was temporarily suspended, but starting from 2022, conducting on-site events, monitoring the accrual and payment of mandatory fees, as well as assessing ongoing commercial transactions between interdependent entities are carried out in full. In addition, the deferment of control over the installation of cash terminals and compliance with the regulations for conducting cash transactions was not extended - these measures are also being implemented by the department from January 1.

SEA BANK (JSC) projects for salary transfer can be convenient and interesting for any enterprises and organizations, regardless of the number of employees working in them.

Zero reporting

Tax legislation provides for a mandatory procedure for providing reports on the activities of organizations and individual entrepreneurs - even in cases where they are not actually carried out. If information is submitted untimely, appropriate sanctions may be applied to violators, including account blocking. Identification of facts of non-compliance with deadlines, as well as incorrect completion of documentation, is the basis for a decision to freeze funds sent for execution by a credit institution.

It is worth noting that in such situations, the Federal Tax Service, as a rule, requires a personal visit to the inspection by the general director or an individual entrepreneur in order to serve him with a resolution on the imposed administrative fine. Pension and social insurance funds, as well as statistical departments, have the right to apply identical measures. The amount of the penalty, depending on the number of violations detected, varies from one to five thousand rubles.

It is also possible that electronic reporting is sent to the Federal Tax Service.

Similar sanctions are provided for non-compliance with accounting regulations and are established for each zero report. In this regard, it is recommended to adhere to current requirements and provide timely and complete reporting. This will help avoid additional time and financial costs.

SEA BANK (JSC) offers small, medium and large businesses to use the international corporate Visa Business card.

What to do to find out if your account is blocked

The client, as a rule, learns that the account has been blocked according to Law No. 115-FZ or by decision of the Federal Tax Service on the day this operation is carried out. No one will inform him about this in advance. Law No. 115-FZ (Article 4) generally prohibits informing the client that information about his involvement in criminal activity is being collected, making an exception for measures that have already actually been taken to limit the use of the account. And the Tax Code of the Russian Federation (clause 4 of Article 76) requires that the taxpayer be notified of the appearance of a decision to block no later than one business day from the date of adoption.

Therefore, it is unrealistic to know in advance whether a bank account will be blocked. The source of information could be data published on the website of Rosfinmonitoring, but the opportunity to use them is only available to persons performing transactions with funds, provided they have a personal account on the website of this department.

Information about tax blocking available to the client is provided by the website of the Federal Tax Service of Russia, but it appears there on the date the decision on it is made, i.e. just one business day before the official notice is sent to the taxpayer.

Read our article about how to check whether your counterparty’s account is blocked and why to do it.