What form should I use to report?

Taxpayers use the VAT return form for the 4th quarter of 2022 from the order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated 10/29/2014 as amended by the order of the Federal Tax Service of Russia dated 03/26/2021 No. ED-7-3/ [email protected]

IMPORTANT!

This is a new form that is used for the first time to send information for the 3rd quarter. And from the 1st quarter of 2022, the form will be changed again. The draft amendments to order No. ММВ-7-3/ [email protected] dated 10/29/2014 are undergoing a public discussion procedure.

Value added tax reporting is submitted only electronically through specialized electronic document management programs and telecommunication channels. Exceptions apply to tax agents and foreign organizations. Tax agents are recognized as both legal entities and individual entrepreneurs. There are no preferences for institutions.

IMPORTANT!

We report on the reports for the 3rd quarter of 2022 (including the 4th quarter) on a new form: the changes are enshrined in the order of the Federal Tax Service of Russia No. ED-7-3 / [email protected] dated 03.26.2021. The adjustments are related to the implementation of a product traceability system from 07/01/2021. Amendments were made to sections 8–11 of the report.

From the explanatory note it follows that tax authorities are changing the forms of the journal for recording received and issued invoices, the purchase books and sales books and the procedure for filling them out. The journal of received and issued invoices, the purchase book and the sales book are supplemented with the indicator “cost of goods subject to traceability, excluding tax in rubles.”

IMPORTANT!

As of July 1, 2021, the rules for blocking accounts for overdue declarations have also changed (368-FZ dated November 9, 2020). Before suspending accounts, the Federal Tax Service sends a notification 14 days before the current account is blocked. And the permissible delay is now not 10, but 20 working days (Part 3 of Article 76 of the Tax Code of the Russian Federation).

KBK for payment of VAT in 2022

To pay VAT in 2022, the budget classification codes remain the same as in previous years:

| VAT on goods (work, services) sold in Russia: Tax 182 1 0300 110 Penalty 182 1 0300 110 Fine 182 1 0300 110 |

| VAT on goods imported into Russia (from the Republics of Belarus and Kazakhstan): Tax 182 1 0400 110 Penalty 182 1 0400 110 Fine 182 1 0400 110 |

| VAT on goods imported into Russia (payment administrator - Federal Customs Service of Russia): Tax 153 1 0400 110 Penalty 153 1 0400 110 Fine 153 1 0400 110 |

The difference between the first three digits in the BCC “182” and “153” is explained by the fact that the administration of VAT in 2022 is entrusted to two federal structures - the Federal Tax Service and customs. At the KBK for the Federal Tax Service, payments are made for transactions within the country and for import transactions from member countries of the EAEU. At the KBK of the federal customs service, VAT is transferred when importing goods from outside the EAEU countries.

We consider it necessary to note that the BCC for some other taxes, as well as insurance premiums, have changed in 2022. They are published here: Current KBK 2022.

In particular, the details for paying insurance premiums have changed. Therefore, be careful.

A number of changes have also been made to payment orders for the payment of insurance premiums.

Who is obliged to take

The declaration is submitted to the territorial tax inspectorates (IFTS) at the place of registration. The following categories of taxpayers must submit it (clause 5 of Article 174 of the Tax Code of the Russian Federation):

- business entities paying value added tax. These include legal entities and individual entrepreneurs on the main taxation system. Filling out is also mandatory for persons on the Unified Agricultural Tax, with the exception of those who are exempt from paying value added tax;

- organizations that are tax agents;

- legal entities are intermediaries who do not pay value added tax, but highlight the amount of this tax in invoices.

Who doesn't submit a report?

Economic entities on special taxation systems - simplified tax system, PSN, unified agricultural tax - that do not pay VAT do not submit the form according to KND 1151001.

Filling out is optional for organizations and individual entrepreneurs exempt from fulfilling taxpayer duties, whose total income does not exceed 2 million rubles excluding value added tax for the three previous consecutive months (Part 1 of Article 145 of the Tax Code of the Russian Federation). But such legal entities and entrepreneurs must first send a notification to the Federal Tax Service. Only after accepting such a notification they have the right not to submit a declaration.

Taxpayers who did not conduct financial and economic activities in the reporting period and did not use funds in their current accounts do not submit a VAT report either. Instead of a VAT report, they submit a single simplified declaration (SUD).

VAT return on paper in 2022

In 2022, tax agents who are not VAT payers (or are exempt from the obligation to pay this tax) have the right to submit VAT returns on paper (paragraph 2, clause 5, article 174 of the Tax Code of the Russian Federation).

However, there are exceptions for this case:

- if the number of employees exceeds 100 people;

- if the tax agent is the largest taxpayer;

- if tax agents work under a commission agreement, an agency agreement or under transport expedition agreements, submitting a declaration in electronic form is also mandatory for them (paragraph 3, paragraph 5, article 174 of the Tax Code of the Russian Federation).

Let's give an example: a company uses a simplified taxation system (STS) and is exempt from paying VAT. At the same time, this company leased state (municipal) property. In this situation, the organization is obliged to pay VAT (as a tax agent). Providing a VAT return on paper is acceptable in this case.

If the taxpayer does not carry out transactions that result in the movement of funds in his bank accounts, and also does not have objects of taxation for VAT, then after the expiration of the reporting period he has the right to submit a single simplified tax return, which includes information on VAT.

When to take it in 2022

The procedure is as follows: information must be submitted no later than the 25th day of the month following the reporting quarter. The table shows the deadlines for submitting the value added tax return in 2022:

| Reporting period | Deadline for submission | Period code |

| 4th quarter 2022 | 25.01.2021 | 24 |

| 1st quarter 2022 | 04/26/2021 (April 25 - Sunday) | 21 |

| 2nd quarter 2022 | 07/26/2021 (July 25 - Sunday) | 22 |

| 3rd quarter 2022 | 25.10.2021 | 23 |

| 4th quarter 2022 | 25.01.2022 | 24 |

IMPORTANT!

The deadline for submitting the VAT return for the 4th quarter of 2022 is 01/25/2022!

Other VAT reporting

In addition to the VAT return, taxpayers must provide other reporting:

- invoice journal (for intermediaries);

- declaration on indirect taxes if import operations were carried out from the territory of member countries of the Customs Union.

A declaration on indirect taxes when carrying out operations to import goods from the countries of the Customs Union must be submitted every month no later than the 20th day of the month following the reporting month. The form and procedure for filling out the declaration on indirect taxes are prescribed in the order of the Federal Tax Service dated September 27, 2022 No. CA-7-3 / [email protected]

Responsibility for violations

If an organization or individual entrepreneur reports VAT on time or does not submit a declaration, the tax inspectorate will impose a fine, the amount of which will be 5% of the amount of value added tax calculated in the report (Article 119 of the Tax Code of the Russian Federation).

If the taxpayer makes the payment on time, before the inspector takes into account the proper amount, or submits a zero return, then a fine of 1,000 rubles will be assessed.

Check that everything is filled out correctly using the ready-made solution ConsultantPlus. Get free access using the link below.

to read.

General requirements for the declaration

The document is formed in a strictly established form and order, fixed by the current edition of order No. ММВ-7-3 / [email protected] Here are step-by-step instructions for dummies on the VAT declaration (basic filling procedure):

- The report includes a title page, which is found in any reporting form, and 12 sections. Of all the blocks, only the first section is required to be completed, since it reflects data on the location of the taxpayer (OKTMO), the total amount of VAT payable to the budget, and the budget classification code by which the contribution is transferred.

- The procedure for completing any tax reporting does not allow double-sided printing. It is prohibited to staple the declaration in such a way that the sheets are damaged (with a stapler, stitching, etc.).

- All values are indicated on each line with a capital letter in Courier New font from 16 to 18 sizes. Those who submit a declaration in paper form must enter the indicators in the same way, using a black, blue or purple pen. Write in block letters. The line-by-line order of filling is in effect: information is entered from the left edge, empty cells are filled with a “—” sign.

- Amounts are indicated as an integer value. If in accounting the figures are reflected in kopecks, then in the report they are rounded to full values. The procedure is as follows: less than 50 kopecks are discarded, more are added.

- It is prohibited to correct errors and inaccuracies using various corrective means. Pages are numbered from the first, title page and in order.

What has changed in the new VAT return?

There are no fundamental amendments to the VAT return, they are targeted. The reporting has changed:

- title page;

- section 1;

- sections with data from invoice journals and purchase and sales books;

- list of transaction codes (not recognized as an object of taxation, exempt from taxation, taxed at a zero rate).

Let's consider all the adjustments made to the updated declaration form in more detail.

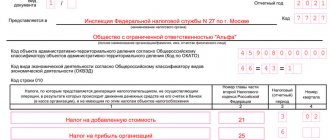

Title page

The line “Code of the type of economic activity according to the OKVED classifier” was removed from the first sheet of the reporting form. This is what the modified sheet looks like:

The barcodes of all declaration sheets have changed. For title - 0031 2011.

Section 1

In the section “Amount of tax subject to payment to the budget (reimbursement from the budget) according to the taxpayer”, lines were added for taxpayers who have entered into an agreement on the protection and promotion of investments (SZPK):

- 085 - a sign of concluding an agreement on the protection and promotion of investment;

- 090 - to reflect the amount of VAT payable by a taxpayer who is a party to the SZPK;

- 095 - to reflect the amount of tax calculated for reimbursement from the budget by a taxpayer who is a party to the SZPK.

They are filled out only by payers officially recognized as a party to the SPPK.

Operation codes

For preferential transactions that are not recognized as subject to VAT or are exempt from taxation (taxed at a zero rate), new codes have been introduced:

- 1010831 - to designate an operation to transfer, free of charge, property intended for use to prevent and prevent the spread of a new coronavirus infection, for the diagnosis and treatment of covid patients, to state authorities and management, local governments, state and municipal institutions, state and municipal unitary enterprises ;

- 1011450 - to designate the operation of transferring real estate free of charge to the state treasury of the Russian Federation;

- 1011451 - to indicate the transfer of property for organizing and/or conducting scientific research in Antarctica into the ownership of the Russian Federation free of charge;

- 1011208 - to indicate operations for the sale of municipal solid waste (MSW) management services provided by MSW management operators in the regions of the Russian Federation;

- 1011446 - to reflect the sale of international air transportation services at international airports of the Russian Federation, according to the list approved by the government.

New codes have been added to Appendix No. 1 to the Procedure for filling out a VAT return. Previously, tax officials recommended using these codes in letters. Now they are systematized. Additionally, new codes for taxable and non-taxable transactions have been introduced for taxpayers in the IT sector. A number of codes were brought into line with the terms and provisions of the Tax Code of the Russian Federation.