General provisions

Insurance premiums are a fee that organizations and individual entrepreneurs in Russia are required to pay.

They have been introduced since 2010, when they replaced the single social tax (UST). Until 2022, insurance premiums were not formally part of the Russian tax system, but have always played a vital role in our country’s compulsory social insurance system. Their payment ensures the right to receive financial support during retirement, pregnancy and in the event of the birth of a child, or illness. The right to receive free medical care is also inextricably linked with the payment of insurance premiums.

From January 1, 2022, the collection of insurance premiums, except for injuries, is regulated by the Tax Code of the Russian Federation. Now tax authorities monitor compliance by policyholders with legislation on taxes and fees through desk and on-site audits. However, the FSS checks whether contributions for injuries have been calculated and transferred correctly, and whether benefits have been paid correctly, as before. The changes are provided for by Federal Law No. 243-FZ of July 3, 2016.

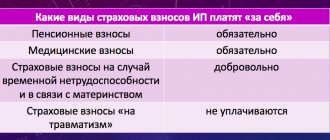

Insurance premiums include:

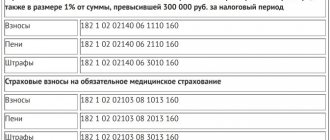

- Insurance contributions for compulsory pension insurance (OPI). They are transferred to the Federal Tax Service from 2022.

- Insurance contributions for compulsory social insurance for temporary disability and in connection with maternity. They are transferred, as before, to the Social Insurance Fund of the Russian Federation.

- Insurance premiums for compulsory health insurance (CHI). They are transferred from 2022 to the Federal Tax Service.

There are also so-called injury contributions (insurance contributions for compulsory social insurance against industrial accidents and occupational diseases), however, they are regulated by another federal law and stand somewhat apart. A separate material is devoted to contributions for injuries in our 2022 tax guide.

Results

Employing companies are required to pay insurance premiums from the salaries of their employees. Contributions can be classified into 3 main types - regular, preferential and additional, with different rates.

You can learn more about the specifics of employers transferring contributions to state funds in the articles:

- “Benefits for public catering on VAT and insurance contributions from 2022”;

- “What forms of reporting to submit for insurance premiums”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Basis and legal basis

Issues of insurance premiums were previously regulated by a number of federal laws. Fundamental among them was Federal Law No. 212-FZ of July 24, 2009, which became invalid due to amendments to the Tax Code.

Now the norms of the Tax Code of the Russian Federation apply to the calculation and payment of insurance premiums. New section 11 and chapter 34 of the Code are devoted to insurance premiums.

From 2022, tax authorities:

- control the completeness and timeliness of payment of insurance premiums accrued according to the new rules;

- accept and check reports starting with the calculation of insurance premiums for the first quarter of 2022;

- collect arrears, penalties and fines on insurance premiums, including for 2016 and previous periods.

With regard to insurance premiums for periods expired before 2022, the Pension Fund and the Social Insurance Fund continue to conduct inspections and identify the presence of arrears.

The Tax Code in Article 8 establishes the concept of insurance contributions - these are mandatory payments for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, for compulsory medical insurance, collected from organizations and individuals for the purpose of financial security for the implementation of the rights of insured persons to receive insurance coverage for the corresponding type of compulsory social insurance.

Insurance contributions are also recognized as contributions collected from organizations for the purpose of additional social security for certain categories of individuals.

The Tax Code of the Russian Federation in its latest edition establishes:

- general conditions for establishing insurance premiums (Article 18.2 of the Tax Code of the Russian Federation);

- circle of contribution payers (Article 419 of the Tax Code of the Russian Federation);

- obligations of payers (Article 23 of the Tax Code of the Russian Federation);

- the procedure for calculating insurance premiums (Article 52 of the Tax Code of the Russian Federation);

- taxable object and base (Articles 420 and 421 of the Tax Code of the Russian Federation);

- tariffs of insurance premiums (Articles 425-429 of the Tax Code of the Russian Federation);

- the procedure for paying insurance premiums (Article 431 of the Tax Code of the Russian Federation);

- liability for violation of legislation on insurance premiums and other issues.

Payers of insurance premiums

According to Article 419 of the Tax Code of the Russian Federation, payers of contributions are persons making payments and other remuneration to individuals:

- organizations;

- individual entrepreneurs;

- individuals who are not individual entrepreneurs.

Contributions are also paid by individual entrepreneurs, lawyers, mediators, notaries engaged in private practice, arbitration managers, appraisers, patent attorneys and other persons engaged in private practice in accordance with the legislation of the Russian Federation. These are payers who do not make payments or other remuneration to individuals. A separate material is devoted to them in the tax reference book.

If the payer belongs to several categories simultaneously, he calculates and pays insurance premiums separately for each basis.

Object of taxation of insurance premiums

Tax Code in Art. 420 provides rules for determining the object of taxation of insurance premiums in three cases.

For organizations and individual entrepreneurs making payments in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance, the object of taxation is payments and other remuneration accrued:

- within the framework of labor relations and civil contracts, the subject of which is the performance of work and the provision of services;

- under copyright contracts in favor of the authors of works;

- under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art;

For individuals who are not recognized as individual entrepreneurs, the following are recognized as objects of taxation:

- payments and other remuneration under employment contracts and civil law contracts, the subject of which is the performance of work, provision of services, paid by payers of insurance premiums in favor of individuals (with the exception of remunerations paid to individual entrepreneurs, lawyers, notaries and other persons engaged in private practice) . The concepts of the object of taxation for these payers have been transferred without significant changes from Federal Law No. 212-FZ, which has lost force.

What is new in the Tax Code is the allocation of a separate facility for individual entrepreneurs, lawyers, notaries and other persons engaged in private practice . This:

- the minimum wage established at the beginning of the corresponding billing period, and if the amount of income of such a payer for the billing period exceeds 300,000 rubles, his income is also considered subject to insurance premiums.

What payments are not subject to insurance premiums:

- Payments and other remuneration within the framework of civil contracts, the subject of which is the transfer of ownership, and contracts related to the transfer of property for use (except for contracts of author's order, contracts for the alienation of the exclusive right to works of science, literature, art, publishing licenses contracts, licensing agreements on granting the right to use works of science, literature, art). These are contracts of purchase and sale, lease, loan, borrowing, etc.

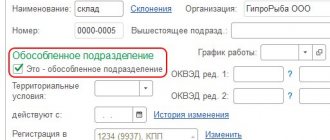

- Payments to a foreign citizen or stateless person on the basis of an employment contract, according to which the person’s place of work is a separate division of a Russian organization outside the Russian Federation, or a civil contract for the performance of work (rendering services), the execution of which also takes place outside the territory of the Russian Federation.

- Payments to reimburse a volunteer’s expenses within the framework of the execution of a civil contract concluded in accordance with Federal Law No. 135-FZ of August 11, 1995 “On Charitable Activities and Charitable Organizations,” with the exception of food expenses in an amount exceeding daily allowance standards.

- Payments to foreign citizens and stateless persons under employment contracts or under civil law contracts in connection with the preparation and holding of the 2018 FIFA World Cup and the 2022 FIFA Confederations Cup in the Russian Federation. Payments made to volunteers under civil law contracts that are concluded with FIFA to reimburse the expenses of volunteers in connection with the execution of these contracts in the form of payment for the costs of processing and issuing visas, invitations and similar documents, payment of travel costs, accommodation, meals, sports equipment, training, communication services, transportation support, and others .

The list of amounts not subject to insurance premiums, given in Article 422 of the Tax Code of the Russian Federation, is slightly different from the list that was enshrined in Art. 9 of Federal Law N 212-FZ.

Previously, employer contributions paid in accordance with the legislation of the Russian Federation on additional social security for certain categories of employees in the amount of paid contributions were not subject to insurance contributions. In the new list, such employer contributions are not mentioned, which means that contributions will have to be deducted from their payment.

The second change is that previously, when payers paid for travel expenses of employees, per diem allowances were not subject to insurance premiums, regardless of the amount. Now, when payers pay expenses for business trips, daily allowances will not be subject to insurance contributions, only those provided for in paragraph 3 of Art. 217 Tax Code of the Russian Federation.

The third change: among payments not subject to insurance premiums, payments to guardians were previously mentioned, but there was no indication of the conditions for such payments. Now there is a rule that the amount of one-time financial assistance provided to guardians when establishing guardianship over a child, paid during the first year after the establishment of guardianship, but not more than 50 thousand rubles, is not subject to insurance contributions. for each child.

The following are not subject to insurance premiums under Article 422 of the Tax Code of the Russian Federation:

- State benefits, including unemployment benefits, as well as benefits and other types of compulsory insurance coverage for compulsory social insurance.

- All types of compensation payments (within the limits established in accordance with the legislation of the Russian Federation) - the article provides an exhaustive list of them.

- Amounts of one-time financial assistance to employees in connection with a natural disaster (emergency circumstances, terrorist attacks); with the death of a family member; upon the birth (adoption) of a child or the establishment of guardianship, but not more than 50,000 rubles for each child.

- Income of communities of indigenous peoples of the North, Siberia and the Far East from the sale of products obtained as a result of their traditional types of fishing (except for wages of workers).

- Amounts of insurance payments (contributions) for compulsory insurance of employees carried out by the payer in the manner established by the legislation of the Russian Federation, amounts of payments under contracts of voluntary personal insurance of employees concluded for a period of at least one year, amounts of payments under contracts for the provision of medical services to employees concluded for a period of at least one year, the amount of payments under voluntary personal insurance contracts for employees, concluded exclusively in the event of the death of the insured person and (or) harm to the health of the insured person, as well as the amount of pension contributions of the payer under non-state pension agreements.

- Employer contributions to a funded pension in the amount of contributions paid, but not more than 12,000 rubles per year per employee for whose benefit employer contributions were paid.

- The cost of travel for employees to and from the vacation destination and the cost of luggage weighing up to 30 kilograms, paid by the payer of insurance premiums to persons working and living in the Far North.

- Amounts paid to individuals by election commissions, referendum commissions, as well as from the election funds of candidates for the position of President of the Russian Federation, candidates for State Duma deputies, candidates for deputies of the legislative (representative) body of state power of a constituent entity of the Russian Federation, candidates for a position in another state body of a constituent entity of the Russian Federation Federation for the performance by these persons of work directly related to the conduct of election campaigns and referendum campaigns.

- The cost of uniforms and uniforms issued to employees in accordance with the legislation of the Russian Federation, as well as to civil servants of federal government bodies free of charge or with partial payment and remaining for their personal permanent use.

- The cost of travel benefits provided by the legislation of the Russian Federation to certain categories of employees.

- Financial assistance to employees up to 4,000 rubles. per person per calendar year.

- Amounts of tuition fees for employees in basic professional educational programs and additional professional programs.

- Reimbursement of employee expenses for paying interest on a loan for the purchase or construction of housing.

- Amounts of monetary allowance, food and clothing support in connection with the performance of military service duties and service in the specified bodies in accordance with the legislation of the Russian Federation.

- All types of payments and remuneration under civil law contracts, including copyright contracts, in favor of foreign citizens and stateless persons temporarily residing in the territory of the Russian Federation.

- Daily allowances for business trips provided for in paragraph 3 of Article 217 of the Tax Code of the Russian Federation, as well as actually incurred and documented targeted expenses for travel to the destination and back.

- Expenses of members of the board of directors or members of another similar body of the company in connection with their arrival to participate in its meeting.

What taxes should an individual entrepreneur pay?

This depends on the chosen taxation system.

General taxation system

OSN (or OSNO) is the default tax system. It applies if the entrepreneur has not switched to any other regime from those that we will talk about later.

Individual entrepreneurs pay the following taxes on OSN:

- Personal income tax - 13%, with the exception of the Tax Code of the Russian Federation, Article 224 “Tax rates” for certain types of income. Only profits will be taxed. To determine it, business expenses are subtracted from revenue. If expenses cannot be supported by documents, the professional deduction will be equal to 20%. You can apply other tax deductions available to individuals - for the purchase of housing, treatment or education. The tax is paid during the year in three advance payments, the balance is paid before July 15 of the following year.

- Value added tax on the sale of goods and services, when importing goods from abroad, and so on - depending on their type - 0, 10 or 20%. VAT is paid by the Tax Code of the Russian Federation, Article 164 “Tax Rates” in the current quarter for the previous one. The total amount is divided into three parts and paid monthly until the 25th. You can obtain a VAT exemption from the Tax Code of the Russian Federation, Article 145 “Exemption from the duties of a taxpayer”, if for the last three months the revenue excluding tax did not exceed 2 million.

- Property tax, if any, is no more than 2.2%, the rate depends on the region. Payment must be made by December 1 upon notification from the tax office.

- Transport and land taxes - rates are set by local authorities. You also need to deposit money before December 1st.

Simplified taxation system

An entrepreneur can switch to a simplified system (STS) if he writes a tax notice. It will not be possible to be on the simplified tax system if the individual entrepreneur has more than 130 employees, annual income exceeds 200 million rubles, or the residual value of fixed assets exceeds 150 million.

But there is a nuance here. Initially, the restrictions for the simplified tax system were lower: no more than 100 employees, income no more than 150 million, or the residual value of fixed assets no more than 100 million. These figures are preserved in the Tax Code of the Russian Federation, Article 346.12 “Taxpayers”. Previously, if an individual entrepreneur reached one of the indicators, he was automatically transferred to the general taxation regime. Now, if he remains in the range between the numbers from the first or second paragraph, then he retains the right to the simplified tax system. He simply pays tax at the new rates. They are subject to taxation of income from the beginning of the quarter in which there was an excess.

The simplified tax system allows you to choose how an entrepreneur wants to pay taxes:

- 6% on all income, but 8% if there are from 100 to 130 employees, income from 150 to 200 million, or the residual value of fixed assets from 100 to 150 million;

- 15% of the difference between income and expenses (but not less than 1% of revenue) or 20% if it falls within the transition range.

Regions may reduce rates for all or for certain types of activities. In addition, for new entrepreneurs, the Tax Code of the Russian Federation, Article 346.20 “Tax Rates” provides for tax holidays for up to two years, when taxes do not have to be paid at all. But only entrepreneurs working in the production, social, scientific spheres, as well as providing household services to the population, can take advantage of the benefit.

Tax on the simplified tax system is paid quarterly - no later than the 25th day of the month following the reporting period. An exception is made only for the last payment; it must be made no later than April 30 of the following year.

Keep in mind: when paying 6% of all income, an individual entrepreneur can deduct insurance premiums paid from the tax amount - in full, if there are no employees, or by no more than 50%, if there are any.

Patent tax system

PSN is available under the Tax Code of the Russian Federation, Article 346.43 “General Provisions” only for certain types of activities. Among them, for example:

- shoe repair, cleaning, painting and sewing;

- hairdressing and beauty services;

- dry cleaning, painting and laundry services;

- production and repair of metal haberdashery, keys, license plates, street signs.

Moreover, one individual entrepreneur may have several patents. To switch to this tax system, the company must have fewer than 15 employees and total annual revenue of no more than 60 million.

An entrepreneur buys a patent for a certain type of activity, and that’s it, no other taxes need to be paid. But this does not exempt you from insurance premiums.

The cost of a patent is set by regional authorities based on the average earnings of a business in this area. Payment terms depend on the validity period.

- If the patent is issued for a period of less than 6 months, then the money is paid while it is valid in one payment.

- If the patent is issued for a period of more than 6 months, then a third of the cost is paid within 90 days from the date of its receipt, the rest - until the expiration of validity.

A patent is issued only within one calendar year, so you won’t be able to get it for 12 months in May—until December 31st at most.

The cost of a patent can also be reduced by the amount of insurance premiums paid. Here, as with the simplified tax system - entirely, if there are no employees, or no more than 50%, if there are any.

Unified agricultural tax

Unified agricultural tax is suitable for those who grow, process or sell agricultural products. To calculate it, income minus expenses and losses from previous years is multiplied by the tax rate. By default it is 6%, but regions can reduce it down to zero.

The tax is paid in two stages:

- advance payment for the first half of the year - until July 25;

- payment at the end of the year - until March 31.

In addition, entrepreneurs on the Unified Agricultural Tax must pay VAT (details about this tax were in the paragraph about the general taxation system).

Base for calculating insurance premiums

How is the assessment base determined for 2022?

The base for calculating insurance premiums for payers making payments and other remunerations to individuals is determined by Article 421 of the Tax Code of the Russian Federation as the amount of payments and other remunerations provided for in paragraph 1 of Art. 420 of the Tax Code of the Russian Federation, accrued by payers of insurance premiums for the billing period in favor of individuals (except for amounts not subject to insurance premiums specified in Article 422 of the Tax Code of the Russian Federation).

The base for calculating insurance premiums is determined separately for each individual from the beginning of the billing period at the end of each calendar month on an accrual basis.

When calculating the base, remuneration paid both in cash and in kind is taken into account. The base for payments in kind is defined as the cost of goods (work, services) received by an individual.

Limit amount of payments for calculating contributions

In 2022, the size of the maximum base for calculating insurance premiums is provided separately for insurance premiums for compulsory pension insurance and insurance for temporary disability and maternity. There is no maximum base for calculating insurance premiums for compulsory medical insurance.

The maximum value of the base for calculating insurance premiums is established taking into account increasing factors for each year from 2017 to 2022. In 2022, its value is:

- for calculating insurance premiums for temporary disability and in connection with maternity - 876,000 rubles;

- for calculating insurance premiums for compulsory pension insurance - 755,000 rubles.

The size of the maximum base for calculating insurance premiums is rounded to the nearest thousand rubles. In this case, the amount of 500 rubles or more is rounded up to the full thousand rubles, and the amount less than 500 rubles is discarded.

Payments when calculating the base relating to an author's order agreement, an agreement on the alienation of the exclusive right to works of science, literature, art, etc. is defined as the amount of income received under these contracts, reduced by the amount of actually incurred and documented expenses associated with the extraction of such income.

If such expenses cannot be documented, they are accepted for deduction in the following amounts (as a percentage of the amount of accrued income):

- for the creation of literary works, including for the theater, cinema, stage and circus - 20 percent;

- for the creation of artistic and graphic works, photographs for printing, works of architecture and design - 30 percent;

- for the creation of works of sculpture, monumental and decorative painting, decorative and decorative art, easel painting, theatrical and film set art and graphics, made in various techniques - 40 percent;

- for the creation of audiovisual works (video, television and cinema) - 30 percent;

- for the creation of musical stage works (operas, ballets, musical comedies), symphonic, choral, chamber works, works for brass band, original music for film, television, video films and theatrical productions - 40 percent;

- for the creation of other musical works, including works prepared for publication - 25 percent;

- for the performance of works of literature and art - 20 percent;

- for the creation of scientific works and developments - 20 percent;

- for discoveries, inventions and the creation of industrial designs (percentage of the amount of income received in the first two years of use) - 30 percent.

Maximum amounts of accruals for individual entrepreneurs

Rates for social and pension contributions may change for employers who pay their subordinates well. There are maximum amounts of employee income at which tariffs change:

- pension contributions until the end of the year will be only 10% if the employee receives from 1,465,000 rubles per year;

- Social insurance contributions are not charged if the employee’s annual income is more than 966,000 rubles.

These rates are revised every year.

Insurance premium rates in 2022

If an organization does not have the right to apply reduced tariffs, then it charges contributions at the basic tariffs. They are indicated in Art. 426 Tax Code of the Russian Federation.

Tariffs of insurance premiums for payments to employees not exceeding the maximum base:

- For compulsory pension insurance (OPI) - 22%;

- For insurance for temporary disability and in connection with maternity (VNIM) - 2.9%;

- For compulsory health insurance (CHI) - 5.1%.

Tariffs of insurance premiums for payments to an employee in the part exceeding the maximum base:

- For compulsory pension insurance - 10%;

- For compulsory health insurance - 5.1%.

Reduced contribution rates are established, in particular, for the following categories of organizations:

- IT organization (Tariffs: OPS - 8%, VNiM - 2%, compulsory medical insurance - 4%);

- An organization on the simplified tax system that conducts preferential activities according to paragraphs. 5 p. 1 art. 427 of the Tax Code of the Russian Federation (Tariffs: OPS - 20%, VNiM - 0%, compulsory medical insurance - 0%);

- Pharmacy on UTII in relation to payments to employees engaged in pharmaceutical activities (Tariffs: OPS - 20%, VNiM - 0%, compulsory medical insurance - 0%).

Organizations whose annual income does not exceed 79 million rubles have the right to apply a reduced tariff.

Contributions to compulsory health insurance at additional rates are charged to organizations that have employees engaged in work that give the right to early assignment of an insurance pension (listed in paragraphs 1 - 18, part 1, article 30 of Law N 400-FZ). This is indicated by Art. 428 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance dated November 16, 2016 N 03-04-12/67082, Ministry of Labor dated February 25, 2014 N 17-3/B-76.

Who pays additional contributions for employees

Some business entities are required to pay additional insurance premiums. These are the companies that hire workers:

- for hazardous working conditions (additional contribution rate - 9%);

- for difficult working conditions (contribution rate - 6%).

Moreover, if these companies conduct a special assessment, based on the results of which workplaces are assigned one or another subclass of danger or harmfulness, a differentiated tariff is established depending on the specific subclass. It can range from 2% (division 3.1 hazardous conditions) to 8% (division 4 hazardous conditions).

3. Organizations that are employers:

- for airplane and helicopter crews (rate - 14%);

- coal industry workers (rate - 6.7%).

Payment of fees. Reporting on insurance premiums

Payment of contributions by employers

Payment of insurance premiums from payments to individuals assumes that during the billing period (year) it is necessary to calculate and pay contributions in the form of monthly mandatory payments.

At the end of each reporting period - the first quarter, half a year, 9 months, calendar year - you need to summarize the payment of insurance premiums: fill out and submit calculations for accrued and paid premiums for these periods.

At the same time, it is necessary to keep records of accrued payments and contributions for each employee.

A monthly mandatory payment is paid from 2022 to the Federal Tax Service for all employees in the total amount (except for the contribution to the Social Insurance Fund). The amounts of monthly mandatory payments must be transferred in rubles and kopecks.

Monthly mandatory payments for insurance premiums must be paid no later than the 15th day of the month following the month for which they were accrued. If the last day for payment falls on a non-business day, the payment deadline will be the next business day.

Reporting on insurance premiums

On January 1, 2022, new rules for reporting insurance premiums came into force.

Starting from the 1st quarter of 2022, you must submit a new unified calculation of insurance premiums to your tax office. It combines data from four reports to funds at once: RSV-1 PFR, 4 - FSS, RSV-2 PFR and RV-3 PFR. The calculation, format and procedure for filling out are approved by Order of the Federal Tax Service of Russia dated 10.10.2016 N ММВ-7-11/ [email protected]

Important! The deadline for submitting calculations has changed.

Calculation of contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance must be submitted to the tax authority once a quarter no later than the 30th day of the month following the billing (reporting) period (p 7 Article 431 of the Tax Code of the Russian Federation). The innovation is due to the fact that the Tax Code of the Russian Federation has been supplemented with provisions on the collection of insurance premiums (except for contributions for injuries).

From the clarification of the FSS it follows that the calculation must be submitted for periods beginning no earlier than January 1, 2022. Reporting on contributions, including updated ones, for earlier periods is submitted according to the old rules. They are as follows: the electronic 4-FSS must be submitted to the territorial body of the FSS no later than the 25th day, the paper one - no later than the 20th day of the month after the reporting period. RSV-1 in electronic form should be sent to the territorial body of the Pension Fund no later than the 20th day, in paper form - no later than the 15th day of the second month following the reporting period.

The deadline for paying contributions remains the same - the 15th day of the month following the month for which they were accrued.

The changes are provided for by Federal Law No. 243-FZ of July 3, 2016.

Note! For late submission of payment calculations, inspectors are fined under Art. 119 of the Tax Code of the Russian Federation, the minimum fine is 1,000 rubles.

Reports for your employees

In addition to timely payment of all contributions, the entrepreneur is obliged to submit reports on this:

| Report | Due dates |

| 6-NDFL to the Federal Tax Service | quarterly until April 30, August 2, November 1 and general annual report until March 1 |

| 2-NDFL to the Federal Tax Service (as an annex to 6-NDFL) | annually until March 2 |

| 4-FSS in FSS in paper form | until the 20th of April, July, October and January |

| 4-FSS in FSS in electronic version | until the 25th of April, July, October and January |

| on insurance premiums and the average number of employees in the Federal Tax Service | until the 30th in April, July, October and January |

| data on the average number of employees (as part of the calculation of insurance premiums) | annually until January 20 |

An entrepreneur is required to submit all of the listed reports, even if he has 1 employee.

Personalized accounting

Reporting deadlines for personalized accounting - new in 2022

On January 1, 2022, the law on new deadlines for filing personalized reports came into force.

The deadline for submitting monthly personalized reporting (form SZV-M) has been moved from the 10th to the 15th of the month following the reporting month.

In addition, the data that employers, according to the old rules, submitted once a quarter as part of RSV-1, now needs to be sent to the Pension Fund annually (no later than March 1 of the next year). An exception is information about the amount of income subject to contributions to compulsory pension insurance and their size. The frequency of submission of this information remains the same, but it is required to submit it to the tax authority.

The changes apply to periods beginning no earlier than January 1, 2017.

The changes are provided for by Federal Law No. 250-FZ of July 3, 2016.

A fine has been introduced for the fact that personalized accounting information is not submitted electronically. If the policyholder is required to provide personalized accounting information in electronic form, then failure to fulfill this obligation will entail a fine of 1,000 rubles.

A statute of limitations has been established for prosecution - the territorial body of the Pension Fund of the Russian Federation will be able to prosecute for an offense in the field of personalized accounting only if less than three years have passed from the date on which it became known.

Reporting forms for personalized accounting

- Form SZV-M for submitting information about insured persons. Approved by Resolution of the Pension Fund Board of February 1, 2016 N 83p.

- Form for calculating insurance premiums. The procedure for filling out and the format for submitting calculations in electronic form are approved by Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11 / [email protected] The form is applied starting from the submission of calculations for insurance premiums for the 1st quarter of 2022 (Article 423 of the Tax Code of the Russian Federation, paragraph 2 Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/ [email protected] ).

- Data on the length of service of employees. They should be submitted to the Pension Fund of Russia at the place of registration in a form approved by the Pension Fund (clause 2 of Article 8, clauses 1, 2 of Article 11 of the Law on Personalized Pension Accounting). For the first time in this order, information about the length of service is submitted for 2017 no later than March 1, 2022.

- Form SPV-2, required to provide information about the insurance experience of the insured person for the purpose of establishing a labor pension. The form itself and instructions for filling it out were approved by Resolution of the Pension Fund Board of June 1, 2016 N 473p. The information must be submitted to the territorial body of the Pension Fund of the Russian Federation within three calendar days from the day on which such person applied to submit it.

- Form SZV-K. The form and rules for filling it out were approved by Resolution of the Pension Fund Board of June 1, 2016 N 473p. Information about the work experience of the insured person for the period before registration in the compulsory pension insurance system (before 01/01/2002) is submitted to the territorial body of the Pension Fund of the Russian Federation at the request of the Pension Fund of the Russian Federation.

How to choose a tax system for individual entrepreneurs

You must decide on the system within the next 30 days from registration. If this is not done, the individual entrepreneur will automatically work for the OSNO with the highest tax.

Select modes that fit the restrictions. First of all, pay attention to patent and NAP - potentially the most profitable regimes for a new entrepreneur. If you work in agriculture, choose Unified Agricultural Tax.

When none of the above works, choose a simplified one. In rare cases, if you are going to work with corporations, you can leave OSNO.

Choose a tax system for individual entrepreneurs that is easier to work with. Consider the volume of reporting: choose the one where you need to report less often. In addition to a patent and self-employment, minimal reporting is required on a simplified basis.

Calculate which system is cheaper. This depends on the type of activity, location and expenses of the individual entrepreneur. Next, let's look at what to look for.

Online cash register on a smartphone

To operate as an individual entrepreneur, you need an online cash register. You already have it in your smartphone, all you have to do is download the application and buy a fiscal registrar.

The application manages sales, and the registrar prints and sends checks to the tax office.