Tax secrecy consists of individual information available to the tax authorities about payers of taxes and fees. In its letters, the Ministry of Finance has repeatedly pointed out the need to exercise due diligence when choosing business partners. But to those who contact the tax authorities with requests to provide information about a particular legal entity, tax officials say that it is impossible to disclose information under the guise of tax secrecy. So what information relates to tax secrets, and how this information should be protected, we will tell you in this article.

Information protected under tax secrecy regime is confidential

Tax secrecy is given a separate article of the Tax Code of the Russian Federation with the same name, number 102. Tax secrecy is a legally established special procedure for accessing and using information about taxpayers obtained by tax authorities in the course of interaction with taxpayers. In the process of companies working with tax authorities, the latter receive a lot of information that relates to the companies’ business activities. Which, of course, leads to concerns about the safety of such information. According to Art. 102 of the Tax Code of the Russian Federation, information protected under the tax secrecy regime is secret and should not be disclosed by tax authorities and other government agencies, their employees and other persons who, due to their official duties, became aware of this information.

Mandatory stage

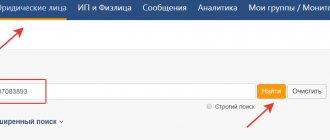

The ability to check a counterparty using the Taxpayer Identification Number (TIN) on tax.ru has become firmly established in business practice. Moreover, on the one hand, this is your right, but on the other hand, it is also your duty to exercise the necessary caution when choosing business partners.

If you check a counterparty using the Tax.ru Taxpayer Identification Number (TIN), you can be sure that you are receiving reliable information from official sources. In particular, they make it possible to:

- draw conclusions about the solvency of the counterparty, including mandatory payments to the treasury;

- can it be classified as ephemeral;

- find out the legal address and full name. the head of the organization of interest.

Meanwhile, in practice, checking a counterparty using the TIN on tax.ru does not always provide a sufficient amount of information to confidently draw a conclusion about the degree of reliability of the counterparty.

Responsibility for disclosure of information constituting tax secrets

Information constituting a tax secret has a special procedure for access and storage. The loss of documents containing information constituting a tax secret, as well as the disclosure of information classified as secret, entails liability of officials within the framework of the legislation of the Russian Federation, even criminal liability. Employees do not have the right to disclose information that they received in the course of their work without the consent of the owner of this information, except in cases provided for by the Federal Law (at the request of the courts, preliminary investigation or inquiry bodies). Tax authorities are not allowed to provide databases and archives, except in cases established by the legislation of the Russian Federation.

Data bank of bailiffs

If you have old debts on taxes, loans, fines in the traffic police, traffic police, traffic police, etc., which you have been ordered to collect from you in court, you end up in the bailiffs database.

You can find out if your name is on the list of debtors using the service on the website www.fssprus.ru:

- – go to the website;

- – go to the “Information Systems” section, then to the “Bailiff Data Bank”;

- – indicate the first name, patronymic and last name, date of birth, region of registration;

- – press the “Search” button.

What taxpayer information is considered tax secret?

The list of information provided to the tax authorities and permitted for disclosure is strictly limited. This means that tax secrecy includes information not specified in the above list of exceptions. This can include any information about the production processes taking place in the company, the organization’s partners and the terms of transactions. Data constituting a tax secret also refers to information received as part of tax audits, data received from licensing authorities, social security institutions, medical and educational institutions, notary offices and banks. In particular, information contained in special declarations submitted by citizens within the framework of the law “On the voluntary declaration by individuals of assets and accounts (deposits) in banks...” dated 06/08/2015 No. 140-FZ is classified as secret.

Why is information about a company’s tax authority important?

Each taxpayer, be it a legal entity or an individual, is assigned to a specific branch of the Federal Tax Service. It may be located at the place of registration or business. In large cities, it is not easy to understand which department a taxpayer belongs to. It is recommended to figure out how to find out the tax authority code of an individual entrepreneur.

Individuals may need a branch code in the following cases:

- to obtain a TIN;

- for submitting declarations 3-NDFL, 4-NDFL;

- to pay taxes (property, land, transport, etc.).

The tax authority code according to the TIN of a legal entity will be required in the following cases:

- for filing tax and accounting reports;

- for registration.

In order to avoid troubles with the fiscal department in the future, you should find out the counterparty before concluding a transaction. Using the certificate, you can check your competitors for honesty. As a result of such a check, the interested party will be able to learn about the use of illegal business methods. For example, about creating shell companies for the purpose of tax evasion. This is the main reason for the audit, since the goal of such companies is to make a profit without paying taxes and intending to operate in the future.

Are Tax Returns Trade Secrets?

Tax secrecy is part of information that is confidential. The organization is interested in hiding information about its clients and suppliers, about the methods and methods of carrying out its business activities, etc. This information is protected by the concept of trade secret. Trade secrets are regulated by the law of the same name dated July 29, 2004 No. 98-FZ. Art. 5 of this law establishes a list of information that cannot be a trade secret. Tax returns are not mentioned in this list. Consequently, tax returns may be a trade secret, which an organization can enshrine in its regulatory document - the Regulations on Trade Secrets.

To find out which information leak can be protected by a trade secret provision, you can download a sample of it in the article “Regulations on Trade Secrets - Sample 2016”.

Personal visit to the tax office

If for some reason you cannot use the electronic services of the Federal Tax Service of the Russian Federation, you should personally visit the tax office.

To do this, you will need a passport and TIN number.

And, of course, do not forget to ask in advance what hours taxpayers are received.

The advantages of this method are obvious:

You will immediately receive a notification about debts, you will be able to ask all your questions and consult with employees of the Federal Tax Service of Russia.

But, if you come at an odd time, you will have to stand in line for several hours or even leave with nothing.

Results

When interacting with tax authorities, the management of any organization hopes to preserve the confidential nature of the transmitted information.

Confidentiality, according to taxpayers, should be facilitated by the presence of an article in the tax code dedicated to tax secrecy. It regulates what information must remain hidden and what information can be made available to the public. Recently, there has been a tendency to remove more and more information about taxpayers from being classified as “tax secret”. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Find out tax debt using INN or UIN

The payment of taxes by citizens and organizations within the time limits established by law forms the basis of the country's budget. In the Russian Federation, all income of individuals, as well as property in the form of real estate, a car or a plot of land, are subject to mandatory taxation. The obligations of taxpayers to pay taxes on time are enshrined in the Constitution of the country, as well as in the Tax Code. The tax period for personal taxes is set at 1 year (from January to December). Thus, taxes for 2022 are paid until December 1, 2022.

How to find out personal taxes online?

In the Russian Federation, payment of taxes by citizens concerns their income and property. The status and obligations of the taxpayer are assigned to the owners of apartments and residential buildings on land, land plots, non-residential real estate, transport and other types of property. From August to November, Federal Tax Service inspectorates send notices to payers with calculations of payments for a specific individual. If for some reason a citizen has not received a tax notice, then he will be able to find out his debt:

- through a personal visit to tax departments

- in the taxpayer’s personal account on the website of the Federal Tax Service of Russia nalog.ru

- on the State Services portal

- on our portal online

A trip to the tax department involves a certain amount of time traveling and waiting in line for service. On our portal, any individual can obtain the information of interest. Searching for taxes using the taxpayer's INN will show existing tax debts, and using the UIN of the tax notice, you can find out current payments.

Why do you need to check your taxes online?

Since the obligation of taxpayers to pay taxes online or in banking institutions is enshrined in law, late payment of taxes leads to the application of financial sanctions against the debtor. The amount of debt will be collected by the Federal Tax Service through the judicial authorities and the FSSP. To prevent this situation from occurring, we recommend that you find out your tax debt online using our website. To do this, you only need the TIN or UIN number of the notification from the Federal Tax Service.

What personal taxes can be found out and paid on the Peney.net website?

On the official website you can find out the debt for the following taxes of individuals:

- Transport

- Land

- For property

- Personal income tax

- Property taxes of an individual entrepreneur

Paying taxes online is possible with any bank card.

How to check and pay taxes online on the official website

The search for tax debts is carried out based on a user request in the official database of the Federal Tax Service - the state system of GIS GMP. Request for information is made:

- by TIN (if you don’t have the document itself, you can use the “Find TIN” service);

- according to the UIN of the tax notice.

The portal allows you to search and pay taxes without registering or creating a personal account.

Attention! We recommend checking your tax debt at least once every six months. This way you can see the charges on time and pay them online.

Payment terms, consequences of delay

Personal taxes for 2022 must be paid within the following deadlines:

- Transport, land, real estate - until December 1, 2021

- Personal income tax on declaration – until July 15, 2022

Responsibility for delay is enshrined in Article 122 of the Tax Code of the Russian Federation:

- Fine of 20% of the amount

- Penalties for each day of delay

Pros of using Peney.net to search and pay taxes

Working with the site has a number of undeniable advantages:

- Comfort and speed – you don’t need to leave your home to search and pay taxes;

- User trust – the site has been operating since 2013;

- High level of security and protection of personal data;

- Guarantee of quality of services - the responsibility of the portal administrator is insured by RSO "EVROINS".

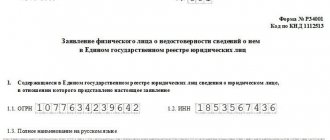

Find out the TIN on the tax service website

The official website of the Federal Tax Service of the Russian Federation allows you to check the TIN not only for citizens of the Russian Federation, but also for any foreign citizen by selecting the appropriate type of passport.

Please read the following instructions carefully:

- Open the main page of the website of the Federal Tax Service of the Russian Federation: nalog.gov.ru.

- In the “Services” block, open the “Information about TIN of an individual” menu.

- Next, you need to familiarize yourself with the information about the processing of personal data - set the appropriate marker and continue. This is a mandatory procedure to use the service.

- On the page that opens, fill out the form that appears - full name, date of birth (check the box if there is no middle name).

- If necessary, add the place of birth, but this is not necessary.

- We select the document with which you need to verify your identity - “passport of a citizen of the Russian Federation” (document code 21) or “passport of a foreign citizen” (document code 10).

- Indicating the series and number of the passport with entering the date of issue of the document in the established format.

- Click on the “Send request” button.

The result appears immediately at the top of the page on which the request form was filled out.

Contact center of the Federal Tax Service of Russia: 8-800-222-22-22