Reasons for making changes to the register

Every organization, from time to time, goes through various transformations. They may be related to:

- expansion or change of activities;

- moving to a new place;

- “redistribution” of shares of company participants, etc.

All significant changes must be reflected in the constituent documents, which, in turn, are a source of information for the state register of legal entities.

Thus, information about significant changes occurring in the enterprise must be conveyed to supervisory structures. These important changes include:

- removal from office and subsequent appointment of a new director;

- change of LLC participants.

This data is also required to be contained in the state. register and all metamorphoses associated with these persons must be taken into account in it.

Any person can check how reliable the information about him is in the Unified State Register of Legal Entities and, if any inaccuracies are found, file an objection.

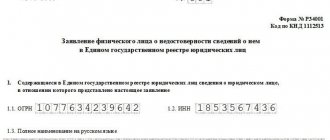

For this, legislators developed form P34001.

Who can submit an application on form P34001

Form P34001 is intended to be completed by individuals: directors or former directors, as well as participants or former participants of legal entities.

The nuance is that through it a person can convey information about the unreliability of information only about himself.

The exception is when the form is filled out by a citizen’s authorized representative, and then only on the condition that the principal’s representative has in his hands a power of attorney notarized according to all the rules.

When to use form P38001

The application is submitted to the Federal Tax Service if there is disagreement:

- with registration of changes in the organization’s charter;

- with the inclusion of upcoming information in the Unified State Register of Legal Entities, including the exclusion of a legal entity from the register.

Exclusion from the Unified State Register of Legal Entities on the grounds provided for in Art. 21.1 of Law No. 129-FZ “On state registration of legal entities and individual entrepreneurs” dated 08.08.2001, is carried out on the basis of a decision of the tax authority. The law provides for the mandatory publication of information about the upcoming exclusion, and over the next three months, the organization or other interested parties have the right to submit reasoned objections if they do not agree with the removal of the company from the register.

How to send

There are several ways to submit a statement about false information:

- The simplest and most reliable way is to go to the tax office in person and hand over the form to a specialist from the local inspectorate.

- It is allowed to submit an application with the help of a representative, having previously issued a power of attorney for it from a notary.

- Another method is to send the document via regular mail, registered mail with return receipt requested, or via courier service.

- And finally, you can use electronic means of communication - this method of conveying the necessary information to supervisory services has become widespread only recently.

How do I fill out Form 38001?

The document can be filled out manually or printed on a printer. Corrections are possible, but they must be properly certified - with the signature and seal of an official. The use of a corrector is not permitted.

There are several ways to submit an application to the tax authority:

- The applicant personally submits Form 38001 to the Federal Tax Service. In this case, there is no need to notarize. The inspector will independently certify and put the necessary mark on the form.

- Through a representative. In this case, a power of attorney is required for the representative to submit the form to the Federal Tax Service. And the objection itself will need to be certified by a notary.

- For telecommunication systems. To submit objections in this way, an electronic digital signature is required.

- By mail. Notarization of the form is required. In addition, when sent by mail, the delivery time increases significantly, because... It takes several days for mail to be sent and received.

Features of filling out the form

Form P34001 is a unified standard document that is mandatory for use. When filling it out, you need to follow some simple rules.

Information on the form can be entered either by hand or on the computer.

If the second option is used, after filling out the form must be printed (each page is printed on a separate sheet of paper) and certified with a “live” signature of the notifier.

Information on the form must be entered only in capital letters, clearly and clearly (illegibility of data may serve as a reason for refusal to accept the application). If filling is done by hand, it is better to use a blue or black ballpoint pen.

Inaccuracies, mistakes, and blots cannot be made, but if they do happen, they do not need to be crossed out and corrected; it is better to fill out a new form.

You also need to carefully ensure that the information is reliable and accurate - if deliberately false information is discovered, sanctions may follow from regulatory authorities.

The application is prepared in one copy , but if necessary, you can make a copy of it, which, after the tax specialist marks it as accepting the document, you must keep.

How to file objections to the exclusion of an inactive legal entity

Lawyer Antonov A.P.

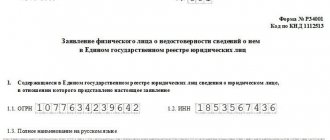

The legal entity itself, its creditors or another person whose rights and legitimate interests are affected by the exclusion of the legal entity from the register may send to the registration authority an application with an objection to the upcoming exclusion of the person from the Unified State Register of Legal Entities (hereinafter referred to as the objection). In this case, the decision to exclude the legal entity from the Unified State Register of Legal Entities is not made (clauses 3, 4, Article 21.1 of the Law on State Registration of Legal Entities and Individual Entrepreneurs). If the application is not received by the registration authority, then the legal entity will be excluded from the Unified State Register of Legal Entities (Clause 7, Article 22 of the Law on Registration of Legal Entities and Individual Entrepreneurs). The objection must be filed within three months from the date of publication in the journal “Bulletin of State Registration” of the decision of the registering authority on the upcoming exclusion of a legal entity from the Unified State Register of Legal Entities. Along with the decision, the registering authority is also obliged to publish the procedure and deadlines for filing objections (clause 3 of Article 21.1 of the Law on State Registration of Legal Entities and Individual Entrepreneurs). Creditors or other persons whose rights and legitimate interests are affected in connection with the exclusion of an inactive legal entity from the Unified State Register of Legal Entities may appeal the decision to exclude the legal entity from the register. This is possible within a year from the day when they learned or should have learned about the violation of their rights (clause 8 of Article 22 of the Law on State Registration of Legal Entities and Individual Entrepreneurs). The procedure for appealing a decision to exclude an inactive legal entity from the Unified State Register of Legal Entities is the same as for refusing state registration of a legal entity. Objections are submitted in form N P38001 (approved by Order of the Federal Tax Service of Russia dated 02/11/2016 N ММВ-7-14 / [email protected] ). This follows from the explanations of the registration authority posted on the website of the Federal Tax Service of Russia (https://www.nalog.ru/rn42/news/tax_doc_news/6973827/).

A written objection can be sent to the registration authority (clause 6 of article 9, clause 4 of article 21.1 of the Law on State Registration of Legal Entities and Individual Entrepreneurs): by post. We recommend sending it by post with declared value when forwarding it with a list of the contents; in the form of an electronic document signed with an electronic signature, using information and telecommunication networks, including the Internet; submitted directly to the registration authority. In addition, it can be sent through a notary for a fee (Article 22, 86.3 of the Fundamentals of Legislation on Notaries).

3. What are the consequences of the exclusion of a legal entity from the Unified State Register of Legal Entities as an inactive one? The exclusion of an inactive legal entity from the Unified State Register of Legal Entities entails the same consequences as its liquidation. Namely: this entails the termination of the organization without transfer in the order of universal succession of its rights and obligations to other persons (clause 1 of article 61, clause 2 of article 64.2 of the Civil Code of the Russian Federation). That is, from the moment the corresponding entry is made in the Unified State Register of Legal Entities: the legal entity loses its legal capacity (clause 3 of Article 49 of the Civil Code of the Russian Federation). In particular, it follows that the legal entity loses the ability to enter into transactions and perform other legal actions; all obligations of the legal entity are terminated. An exception is those cases when, by law or other legal acts, the fulfillment of the obligations of a liquidated organization is assigned to another person (Article 419 of the Civil Code of the Russian Federation, paragraph 41 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 11, 2020 N 6). In addition, the exclusion of an inactive legal entity from the Unified State Register of Legal Entities entails an actual ban on creating new legal entities, becoming one of the founders (participants) or becoming a director. Such a prohibition is expressed in the fact that the registration authority will refuse to carry out the relevant registration actions. The ban applies (subclause f, clause 1, article 23 of the Law on State Registration of Legal Entities and Individual Entrepreneurs): to LLC participants who, at the time of exclusion of the company from the Unified State Register of Legal Entities, owned at least 50% of the votes of the total number of votes of participants; managers of any legal entity excluded from the Unified State Register of Legal Entities. At the same time, in order to apply the ban (refusal of state registration), it is necessary that the organization excluded from the Unified State Register of Legal Entities at the time of exclusion had a debt to the budget, or in relation to it the specified debt was considered uncollectible due to the presence of signs of an inactive legal entity (paragraph “f” p 1 Article 23 of the Law on State Registration of Legal Entities and Individual Entrepreneurs). The ban is valid for three years from the moment the legal entity is excluded from the Unified State Register of Legal Entities (subclause “f”, paragraph 1, article 23 of the Law on State Registration of Legal Entities and Individual Entrepreneurs). The exclusion of a legal entity from the Unified State Register of Legal Entities does not entail the loss of the opportunity to bring: 1) its manager to administrative responsibility. In particular, he may be fined for violating the deadlines for submitting a tax return (calculation of insurance premiums), which the legal entity had to submit before it was excluded from the Unified State Register of Legal Entities (Article 15.5 of the Administrative Code). In relation to the organization itself, the execution of decisions on the imposition of administrative penalties issued before its exclusion from the Unified State Register of Legal Entities (clause 3.2 of Article 31.7 of the Code of Administrative Offenses of the Russian Federation) is terminated; 2) civil liability of the director, members of collegial bodies and persons who have the actual opportunity to determine the actions of the organization, namely: damages caused to the legal entity excluded from the Unified State Register of Legal Entities may be recovered from them (Article 53.1, paragraph 3 of Article 64.2 of the Civil Code of the Russian Federation ). In addition, the directors of the LLC, members of its collegial bodies, and persons who have the actual ability to determine the actions of the company, the creditors of the LLC may be held vicariously liable for the obligations of this company. This is possible if the company’s failure to fulfill obligations (including due to harm) was due to the fact that these persons acted in bad faith and unreasonably (unless they prove otherwise) (clauses 1 - 3 of Article 53.1 of the Civil Code of the Russian Federation, p. 3.1 Article 3 of the LLC Law, Resolution of the Constitutional Court of the Russian Federation dated May 21, 2021 N 20-P).

Sincerely, lawyer Anatoly Antonov, managing partner of the law firm Antonov and Partners.

Still have questions for your lawyer?

Ask them right now here, or call us by phone in Moscow +7 (499) 288-34-32 or in Samara +7 (846) 212-99-71 (24 hours a day), or come to our office for a consultation (by pre-registration)!

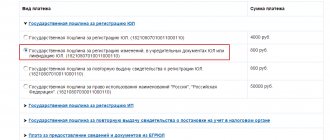

Sample of filling out form P34001

The form consists of several pages. The first indicates the OGRN of the enterprise, its tax identification number and full name (with a decoding of the abbreviation of the organizational and legal status). Below, in encrypted form, it is indicated in relation to which data the applicant expresses his disagreement (one of the three numbers “1”, “2”, “3” must be put in the corresponding cell).

The second page first contains personal information about the individual who is filling out the application. Here his last name, first name and patronymic, information about birth (date, place) is indicated.

Further (here on the second page) the document includes data from a passport or other document identifying the citizen. First, write the document type code (explanations on this point are at the bottom of the page), then its series, number, place, date of issue, department code. Also just below you need to include contact information: telephone number and email address.

In the last part of the document, on the third page of the form, the applicant puts his signature, which certifies the fact that all the information entered in the application is correct. If the application is submitted through a representative, this is also displayed on this sheet.