Why do you need PBU 4/99?

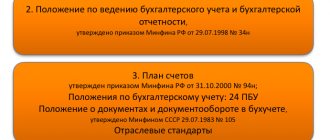

PBU 4/99 (hereinafter referred to as PBU) was introduced for mandatory application by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n.

This PBU represents a methodological basis and set of rules for the preparation of reporting by legal entities. Its effect applies to all organizations, with the exception of credit and state (municipal) institutions (clause 1 of the PBU), which are guided in reporting matters by special methodological documents, also approved by the Ministry of Finance of the Russian Federation. For example, autonomous municipal institutions operate in accordance with the order of the Ministry of Finance of the Russian Federation dated December 28, 2010 No. 191n. In PBU 4/99, an accountant will be able to find answers to the questions (clause 3 of PBU):

- about the report forms used;

- about the procedure for their compilation;

- about a simplified version of accounting;

- about the features of the formation of consolidated, liquidation and reorganization reporting;

- on the publication of reporting documents in the media.

Read about who can create accounting reports in a simplified form in this article.

In what cases, when preparing financial statements, is it permissible to deviate from the rules of PBU 4/99? The answer to this question is in ConsultantPlus. Get free demo access to K+ and go to the material to find out the opinion of K+ experts.

List of PBUs on accounting in 2021-2022

The accounting rules applied in the Russian Federation in 2021-2022 are presented in the following list:

- PBU 7/98 - establishes the procedure for reflecting events after the reporting date in accounting;

- PBU 4/99—establishes the methodological basis for financial reporting of legal entities;

- PBU 9/99 - establishes the procedure for reflecting income in the accounting of organizations;

- PBU 10/99 - fixes the procedure for reflecting expenses in the accounting of legal entities;

Read about PBU 9/99 and 10/99 here .

- PBU 13/2000 - regulates the reflection in accounting of information on state assistance to commercial firms;

- FSBU 5/2019 (until 2022 - PBU 5/01) - regulates the reflection of inventories in accounting;

Find out what nuances should be taken into account when applying the accounting standard FSBU 5/2019 in the Review from ConsultantPlus. To do everything right, get trial access to the system and study the material for free.

- FSBU 6/2020 “Fixed assets” and FSBU “Capital investments” (until 2022 - PBU 6/01) - establishes the rules for reflecting fixed assets and capital investments in accounting;

PBU 6/01 has become invalid since 01/01/2022. Instead, two new FSBUs were introduced: 6/2020 “Fixed Assets” and 26/2020 “Capital Investments”. ConsultantPlus experts explained in detail what the new standards have changed compared to PBU 6/01. Get trial demo access to the K+ system and upgrade to the Ready Solution for free.

- PBU 16/02 - regulates the disclosure of information on discontinued activities in accounting;

- PBU 17/02 - regulates the reflection of information on expenses for scientific research in accounting;

- PBU 18/02—establishes the rules for reflecting information on income tax calculations in accounting;

ConsultantPlus experts explained in detail how to apply PBU 18/02 when permanent and temporary differences arise between accounting and tax accounting. Get trial access and go to the Ready solution.

- PBU 19/02—regulates the rules for reflecting financial investments in accounting;

- PBU 20/03 - establishes the rules for reflecting in accounting information about the participation of a business entity in joint activities;

- PBU 3/2006—regulates the reflection in accounting of information about the assets and liabilities of a company in foreign currency;

- PBU 14/2007 - establishes the rules for reflecting information about intangible assets in accounting;

- PBU 1/2008—defines how an enterprise should formulate and disclose accounting policies;

- PBU 2/2008 - establishes rules for disclosing in accounting information about the activities of construction contractors (or subcontractors);

- PBU 11/2008 - establishes how to disclose information about related parties in reporting;

- PBU 15/2008 - establishes how to reflect in accounting information about expenses on loans and borrowings;

- PBU 21/2008 - establishes how to disclose information about changes in estimated values in reporting;

- PBU 8/2010 - regulates how estimated and contingent liabilities, as well as contingent assets, should be reflected in accounting;

- PBU 12/2010 - establishes the procedure for reflecting information by segments in the accounting records of organizations;

- PBU 22/2010 - regulates the procedure for correcting errors and reflecting information about them in accounting;

- PBU 23/2011 - regulates how a cash flow statement should be prepared;

- PBU 24/2011 - establishes the procedure for reflecting information on expenses for the development of natural resources in accounting.

FSBU 25/2018 “Rent”, approved by order of the Ministry of Finance of Russia dated October 16, 2018 No. 208n, must be applied from 2022. You can read about it here.

From 2022, FAS 27/2021 “Documents and document flow in accounting” is also mandatory. Read how to implement the new standard here.

Users of financial statements

Accounting must be neutral in nature, that is, satisfy the interests of all groups of its users (clause 7 of the PBU), which can be divided into external and internal.

Internal include business owners, managers, internal services and company employees. For example, top managers are interested in final financial indicators for strategic planning of activities and adjustments to the current plan; Sales department specialists will be interested in information about receivables from counterparties for the purpose of further collection.

For internal purposes, a balance sheet may:

- be drawn up for a specific date;

- have an abbreviated form;

- formed for each type of economic activity of the company;

- appear in the form of a current forecast, preliminary and interim report.

External users may need financial information for various purposes:

- tax authorities - to verify the correctness and completeness of payment of taxes and fees;

- credit organizations - to assess the solvency and financial stability of the organization, for example, when making a decision to issue a loan or loan;

- investors and sponsors - for a long-term assessment of their financial investments in a commercial business and obtaining financial returns;

- counterparties - to be confident in the reliability of your business partner.

To correctly analyze reporting indicators, various methods are used, which you will learn about from our material “Rules and methods for evaluating balance sheet items .

Latest edition of PBU 4/99 “Accounting statements of an organization”

The latest (current) edition of PBU 4/99 is dated November 8, 2010, as amended by the Decision of the Supreme Court of the Russian Federation dated January 29, 2018 No. AKPI17-1010. Compared to the text that existed before it, the provisions of the PBU have changed slightly.

The updates turned out to be related to the replacement of wording. The definition of “budgetary organizations” was replaced by “state (municipal) institutions” due to a change in the status of the latter (Order of the Ministry of Finance of the Russian Federation of November 8, 2010 No. 142n). Such institutions were divided into budgetary, autonomous and state-owned.

And the Supreme Court excluded from the PBU the requirement for the preparation of interim reports by all organizations.

Financial statements of the organization according to PBU 4/99 in 2020–2021

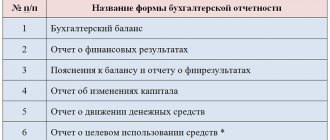

The financial statements for 2022 include (clause 5 of the PBU):

- balance sheet;

Read about the rules for filling it out in the article “Procedure for drawing up a balance sheet (example)” .

For a sample filling, see the material “Balance Sheet for 2022: Sample Completion.”

- financial results report;

For information on how to fill it out, read the article “Filling out Form 2 of the balance sheet (sample)” .

- reports on changes in capital, cash flows and intended use of funds;

For information on these forms, see the publication “Filling out Forms 3, 4 and 6 of the Balance Sheet” .

- explanatory note for accounting.

Read about the features of its design in the material “Drafting an explanatory note to the balance sheet (sample)” .

ATTENTION! From 2022, financial statements, incl. simplified, submitted exclusively electronically. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here. We also remind you that in 2022 the reporting forms were updated.

I. General provisions

1.

This Regulation establishes the composition, content and methodological basis for the preparation of financial statements of organizations that are legal entities under the legislation of the Russian Federation, except for credit organizations and state (municipal) institutions.

2.

The provision does not apply when generating reporting developed by an organization for internal purposes, reporting compiled for state statistical observation, reporting information submitted to a credit organization in accordance with its requirements, and compiling reporting information for other special purposes, if the rules for the preparation of such reporting and information the use of this Regulation is not intended.

3.

This Regulation is applied by the Ministry of Finance of the Russian Federation when establishing:

- standard forms of financial statements and instructions on the procedure for preparing statements;

- simplified procedure for preparing financial statements for small businesses and non-profit organizations;

- features of the formation of consolidated financial statements;

- features of the formation of financial statements in cases of reorganization or liquidation of an organization;

- features of the formation of financial statements by insurance organizations, non-state pension funds, professional participants in the securities market and other organizations in the field of financial intermediation;

- procedure for publishing financial statements.

General rules for preparing financial statements according to PBU 4/99

Despite the fact that each form has its own characteristics of filling out, the PBU prescribes a general approach to the preparation of accounting records, which highlights the following points:

- accounting records must be reliable and complete, must be compiled in accordance with the norms of current legislation (clause 6 of the PBU);

- it is filled out in Russian (clause 15 of PBU) and indicating the amounts in rubles (clause 16 of PBU);

- for enterprises with branches, unified (general) reporting is generated (clause 8 of the PBU);

- data for the reporting year must be interrelated with previous periods (clause 33 of the PBU);

- the allocation of information reflected in the reporting determines the principle of materiality (clause 25 of the PBU);

- reporting period - calendar year (clause 13 of PBU);

- it is possible to prepare interim reporting (clauses 48–52 of the PBU) on a monthly or quarterly basis on an accrual basis with 2 mandatory forms (balance sheet and financial results report) no later than 30 days after the end of the period;

- accounting records are open to access by interested parties (clause 42 of the PBU);

- assets and liabilities of the balance sheet are divided into short-term (up to 1 year) and long-term (more than 1 year) (clause 19 of PBU);

- accounting data should be confirmed by an inventory of property and liabilities (clause 38 of the PBU);

- offset between the items of assets and liabilities, profits and losses is not carried out, except for the cases prescribed in PBU 4/99 (clause 34 of PBU);

- indicators must be reflected at net (net) value (clause 35 of PBU 4/99).

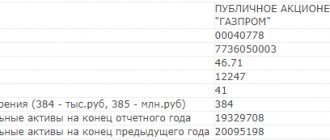

In the report header you will need to indicate:

- the unit of measurement is in thousands of rubles, you cannot fill out reports in millions;

- code from OKVED2.

Contents of the income statement

21. The profit and loss statement must characterize the financial results of the organization for the reporting period.

22. In the income statement, income and expenses must be shown with divisions into ordinary and extraordinary.

23. The profit and loss statement must contain the following numerical indicators (taking into account what is stated in paragraphs 6 and 11 of these Regulations):

- Proceeds from the sale of goods, products, works, services minus value added tax, excise taxes, etc. taxes and obligatory payments (net revenue)

- Cost of goods, products, works, services sold (except for commercial and administrative expenses)

- Gross profit

- Business expenses

- Administrative expenses

- Profit/loss from sales

- Interest receivable

- Percentage to be paid

- Income from participation in other organizations

- Other operating income

- Other operating expenses

- Non-operating income

- Non-operating expenses

- Profit/loss before tax

- Income tax and other similar mandatory payments

- Profit/loss from ordinary activities

- Extraordinary Income

- Extraordinary Expenses

- Net profit (retained profit (uncovered loss)

Contents of financial statements

The balance sheet must indicate the financial position of the company as of the reporting date (clause 18 of the PBU). This is achieved by reflecting data on the balances in the accounts of assets and liabilities as of this date. The balance sheet includes numerical indicators reflected in 5 of its sections (clause 20 of the PBU):

- 2 asset sections dedicated to non-current and current assets;

- 3 sections of liabilities allocated to capital and reserves, long-term and short-term liabilities.

Income and expenses in the financial results report are divided into ordinary and other, which must be presented in several numerical indicators (clause 23 of the PBU).

Explanations for the balance sheet and financial results report take the form of 3 additional reports (on cash flows, changes in capital, intended use of funds) and an explanatory note (clause 28 of the PBU).

Explanations for accounting statements must contain the following information (clause 27 of the PBU):

- on the availability at the beginning and end of the period, the movement of fixed assets (including leased ones) and intangible assets, financial investments; on capital, issued shares, accounts receivable and payable, reserves for future expenses;

- about sales volumes;

- about production costs;

- about other income and expenses;

- about received and issued obligations;

- about emergency events that occurred in the activities of the enterprise;

- about facts that happened at the enterprise after the reporting date.

And also (clause 31 of PBU):

- legal address of the company;

- main types of activities carried out by the enterprise;

- data on the average annual number of personnel;

- composition of the executive and supervisory bodies of the company, indicating positions.

The cash flow statement must reflect information about cash flows for 3 types of activities: financial, current and investing. It discloses actual data on balances at the beginning and end of the reporting period, cash inflows and outflows (clause 29 of the PBU).

The report on changes in capital must inform about the decrease and increase in capital: additional, authorized, reserve (clause 30 of the PBU).

The explanatory note must contain a note stating that the statements have been prepared in accordance with the requirements of Russian accounting legislation (clause 25 of the PBU).

Explanations must contain information about the applied accounting policy and additional information disclosing the data included in the reporting (clause 24 of the PBU). This information cannot be shown in the balance sheet and financial results report. But without them it is impossible to give a real assessment of the financial condition of the enterprise.

Composition of financial statements and general requirements for them

5. Accounting statements consist of a balance sheet, a profit and loss statement, appendices thereto and an explanatory note (hereinafter, the appendices to the balance sheet and profit and loss report and the explanatory note are referred to as explanatory notes to the balance sheet and profit and loss report), and also an auditor’s report confirming the reliability of the organization’s financial statements, if they are subject to mandatory audit in accordance with federal laws.

6. Accounting statements must provide a reliable and complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position. Financial statements prepared on the basis of the rules established by regulatory acts on accounting are considered reliable and complete. If, when preparing financial statements based on the rules of these Regulations, an organization reveals that there is insufficient data to form a complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position, then the organization includes relevant additional indicators and explanations in the financial statements. If, when preparing financial statements, the application of the rules of these Regulations does not allow one to form a reliable and complete picture of the financial position of the organization, the financial results of its activities and changes in its financial position, then the organization in exceptional cases (for example, nationalization of property) may deviate from these rules.

7. When preparing financial statements, the organization must ensure the neutrality of the information contained in it, i.e. unilateral satisfaction of the interests of some groups of users of financial statements over others is excluded. Information is not neutral if, through selection or presentation, it influences the decisions and evaluations of users to achieve predetermined results or consequences.

8. The organization’s financial statements must include performance indicators for all branches, representative offices and other divisions (including those allocated to separate balance sheets).

9. When drawing up the balance sheet, profit and loss statement and explanations thereto, the organization must adhere to its accepted content and form consistently from one reporting period to another. Changes to the accepted content and form of the balance sheet, profit and loss statement and explanations thereto are permitted in exceptional cases, for example, when the type of activity changes. The organization must provide confirmation of the validity of each such change. A significant change must be disclosed in the notes to the balance sheet and income statement together with the reasons for the change.

10. For each numerical indicator of the financial statements, except for the report prepared for the first reporting period, data must be provided for at least two years - the reporting year and the one preceding the reporting one. If the data for the period preceding the reporting period are not comparable with the data for the reporting period, then the first of these data are subject to adjustment based on the rules established by regulatory acts on accounting. Each material adjustment must be disclosed in the notes to the balance sheet and income statement along with the reasons for the adjustment.

11. Items of the balance sheet, profit and loss statement and other separate forms of financial statements that, in accordance with accounting provisions, are subject to disclosure and for which there are no numerical values of assets, liabilities, income, expenses and other indicators, are crossed out (in standard forms ) or are not provided (in forms developed independently and in the explanatory note). Indicators about individual assets, liabilities, income, expenses and business transactions should be presented separately in the financial statements if they are significant and if without knowledge of them by interested users it is impossible to assess the financial position of the organization or the financial results of its activities. Indicators about certain types of assets, liabilities, income, expenses and business transactions may be presented in the balance sheet or profit and loss statement in a total amount with disclosure in the notes to the balance sheet and profit and loss statement, if each of these indicators individually is not significant for assessments by interested users of the financial position of the organization or the financial results of its activities.

12. For the preparation of financial statements, the reporting date is considered to be the last calendar day of the reporting period.

13. When preparing financial statements for the reporting year, the reporting year is the calendar year from January 1 to December 31 inclusive. The first reporting year for newly created organizations is considered to be the period from the date of their state registration to December 31 of the corresponding year, and for organizations created after October 1 - to December 31 of the following year.

14. Each component of the financial statements provided for in paragraph 5 of these Regulations must contain the following data:

- name of the component part;

- indication of the reporting date or reporting period for which the financial statements were prepared;

- name of the organization indicating its organizational and legal form;

- format for presenting numerical indicators of financial statements.

15. Accounting statements must be prepared in Russian.

16. Accounting statements must be prepared in the currency of the Russian Federation.

17. Accounting statements are signed by the head and chief accountant (accountant) of the organization. In organizations where accounting is carried out on a contractual basis by a specialized organization (centralized accounting department) or a specialist accountant, the financial statements are signed by the head of the organization and the head of the specialized organization (centralized accounting department) or by a specialist conducting accounting.

Publication of financial statements

Since accounting must be open to its users, the enterprise must provide access to it. Some companies are required to publish their financial statements. These include:

- public joint stock companies;

- credit and insurance organizations;

- companies preparing consolidated financial statements;

- joint stock companies and LLCs that engage in public placement of securities.

Public joint stock companies are exempt from the obligation to publish accounting reports in printed publications (letter of the Ministry of Finance of the Russian Federation dated June 5, 2014 No. 45n).

Results

PBU 4-99 - Financial statements of an organization are mandatory for use by all legal entities in our country, except for credit and state (municipal) organizations.

This document sets out the composition of accounting reports, its content, the procedure for compilation and publication. Accounting records must be complete and reliable, and also formed in accordance with the norms of current legislation. The financial statements include 6 forms. In cases of a mandatory audit, its conclusion is attached to the accounting records. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

II. Definitions

4. For the purposes of these Regulations, the concepts below mean the following:

- accounting statements - a unified system of data on the property and financial position of an organization and the results of its economic activities, compiled on the basis of accounting data in established forms;

- reporting period - the period for which the organization must prepare financial statements;

- reporting date - the date as of which the organization must prepare financial statements;

- user - a legal or natural person interested in information about the organization.