Where does the VAT transaction type code appear?

The type of transaction distinguished in relation to the taxation of this operation with VAT is indicated in two types of documents drawn up in connection with this tax:

- in the declaration;

Note! The VAT declaration was updated by order of the Federal Tax Service dated March 26, 2021 No. ED-7-3/ [email protected] The form is used from the reporting campaign for the 3rd quarter of 2022.

You will find a line-by-line algorithm with examples of filling out all twelve sections of the report in ConsultantPlus. Trial access to the system can be obtained for free.

- accounting registers (purchase and sales books, invoice journals).

In both cases, a digital code is used for this, but the number of characters used is different:

- for sections of the declaration containing tax calculation data - 7 digits;

- for accounting registers, including when reflecting their data in the declaration - 2 digits.

The 7-digit transaction code in the VAT return is given in the sections:

- 2 (line 070);

- 3 (application no. 1, line code 020);

- 4 (lines 010, 060 and 090);

- 5 (line 030);

- 6 (lines 010, 070, 110);

- 7 (column 1).

It reflects, accordingly, the type of operation performed:

- tax agent (section 2);

- with fixed assets (Appendix No. 1 to Section 3);

- using a 0% rate (sections 4–6);

- without taxation (section 7).

In sections 8–11 of the declaration, consisting of data from accounting registers, the transaction code is taken from these registers and falls into the lines:

- 010 sections 8 (purchase book) and 9 (sales book), as well as appendix No. 1 to section 8 (additional sheets to the purchase book);

- 090 of Appendix No. 1 to Section 9 (additional sheets to the sales book);

- 020 sections 10 and 11 (logs of issued and received invoices).

In the registers themselves, columns of the main tables with numbers 2 (in books and additional sheets to them) and 3 (in invoice journals) are used to indicate codes.

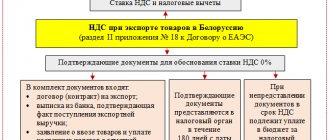

VAT when exporting goods to the EAEU countries

The procedure for paying VAT when exporting goods to the countries of the Eurasian Economic Union (EAEU) is established in the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, providing services, which is Appendix No. 18 to the Treaty on the Eurasian Economic Union Union of May 29, 2014 (signed in Astana on May 29, 2014) (Clause 1, Article 72 of the Agreement).

According to paragraph 2 of Article 1 of the Protocol, “export of goods” is the export of goods sold by a taxpayer from the territory of one EAEU member state to the territory of another EAEU member state.

Members of the EAEU are: the Republic of Belarus; The Republic of Kazakhstan; Russian Federation; Republic of Armenia (Article 1 of the Treaty on the accession of the Republic of Armenia to the Treaty on the Eurasian Economic Union of May 29, 2014 (signed in Minsk on October 10, 2014); Kyrgyz Republic (Article 1 of the Treaty on the accession of the Kyrgyz Republic to the Treaty on the Eurasian Economic Union dated May 29, 2014 (signed in Moscow on December 23, 2014).

Goods are understood as those sold or intended for sale: any movable and immovable property, vehicles, all types of energy.

When exporting goods from the territory of one EAEU member state to the territory of another EAEU member state, a zero VAT rate is applied if the exporting organization, within 180 calendar days from the date of shipment (transfer) of goods, confirms the validity of its application by submitting it to the tax authority simultaneously with the tax declaration of documents provided for in paragraph 4 of the Protocol (clause 1, clause 5 of the Protocol). In general, such documents are:

- agreements (contracts) concluded with a taxpayer of another EAEU member state or with a taxpayer of a non-EAEU member state, on the basis of which goods are exported;

- an application for the import of goods and payment of indirect taxes with a mark from the tax authority of the EAEU member state into whose territory the goods were imported (on paper in the original or in a copy at the discretion of the tax authorities of the member states), or a list of applications (on paper or electronic form with an electronic (electronic digital) signature of the taxpayer);

- transport (shipping) and (or) other documents provided for by the legislation of a member state of the Eurasian Economic Union, confirming the movement of goods from the territory of one member state to the territory of another member state;

- other documents confirming the validity of applying a zero VAT rate and (or) exemption from excise taxes, provided for by the legislation of the Member State from whose territory the goods were exported.

The Protocol does not directly establish the moment for determining the tax base. Moreover, in accordance with paragraph 9 of Article 167 of the Tax Code of the Russian Federation, when selling goods provided for in paragraph 1 of Article 164 of the Tax Code of the Russian Federation, the moment of determining the tax base is the last day of the quarter in which the full package of supporting documents is collected.

The exporter has the right to tax deductions in a manner similar to that applied to goods exported outside the EAEU. This procedure has a number of features and from 07/01/2016, after the introduction of appropriate amendments by Federal Law dated 05/30/2016 No. 150-FZ, it depends on what kind of goods are shipped for export - raw materials or non-raw materials.

For the purposes of applying VAT, raw materials include mineral products, products of the chemical industry and other related industries, wood and products made from it, charcoal, pearls, precious and semi-precious stones, precious metals, base metals and products made from them (para. 3 clause 10 article 165 of the Tax Code of the Russian Federation). Specific codes for types of goods related to raw materials were approved by Decree of the Government of the Russian Federation dated April 18, 2018 No. 466 in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union, approved. By decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54 (as amended on April 24, 2018).

If non-commodity goods are shipped for export:

- the deduction of the presented amount of VAT is carried out in the generally established manner, i.e., similar to the deduction for goods (work, services), property rights acquired for the implementation of transactions subject to VAT at rates of 18% and 10% (clause 3 of Article 172 of the Tax Code of the Russian Federation) ;

- The taxpayer does not have the obligation to determine the amount of VAT relating to goods (work, services), property rights acquired for the production and (or) sale of goods using a 0% rate, i.e. there is no obligation to maintain separate accounting (paragraph 2 p. 10, Article 165 of the Tax Code of the Russian Federation).

It should be noted that this procedure for claiming tax deductions for the sale of non-commodity goods applies only to purchased goods (work, services), property rights registered on July 1, 2016 (Clause 2 of Article 2 of Law No. 150-FZ).

If raw materials are shipped for export, then the procedure for claiming tax deductions remains the same as it was before 07/01/2016:

- deduction of the presented amount of VAT is made at the time of determining the tax base (clause 3 of Article 172 of the Tax Code of the Russian Federation);

- taxpayers are required to determine the amount of VAT related to goods (work, services), property rights acquired for the production and (or) sale of goods using a 0% rate in accordance with the adopted accounting policy, i.e. they are required to maintain separate accounting (para. 2 clause 10 article 165 of the Tax Code of the Russian Federation).

If a package of supporting documents is not submitted within 180 calendar days, the amount of VAT is subject to payment to the budget for the tax (reporting) period in which the date of shipment of goods for export falls.

In this case, the date of shipment is recognized as the date of the first drawing up of the primary accounting document issued to the buyer of the goods (the first carrier) (paragraph 2, clause 5 of the Protocol).

At the same time, regardless of what goods are shipped for export (raw materials or non-raw materials), the deduction of the amount of tax calculated by the taxpayer on the 181st calendar day in the absence of supporting documents is made on the date corresponding to the moment of subsequent confirmation of VAT at a rate of 0% (clause 10 Article 171, paragraph 3 of Article 172 of the Tax Code of the Russian Federation).

| 1C:ITS For more information on the procedure for calculating VAT and claiming tax deductions when exporting goods to the countries of the Eurasian Economic Union, see the “Value Added Tax” reference book in the “Taxes and Contributions” section. |

Let us remind you that as of October 1, 2017, changes have been made to the forms and rules for filling out (maintaining) invoices, the purchase book and sales book, the invoice journal, approved. Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

For more information about significant amendments and their support, read the article “Invoice from 10/01/2017: what will change.”

Basic lists of VAT transaction codes

The basic code values that should be used when filling out the above documents are approved by two different documents:

- for the declaration - the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] , where they are given in Appendix No. 1 to the procedure for filling out the report;

- for registers - by order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected]

In both documents, the codes are grouped into tables. In the first of them, the table is divided into 5 sections dedicated to operations:

- not subject to VAT;

- exempt from tax;

- taxable at a rate of 0%;

- committed by tax agents;

- carried out with fixed assets.

That is, when filing a VAT return, the transaction code for line 070 of section 2 must be looked for in section 4 of the table, and the codes of transactions not subject to VAT tax - in its section 1.

There is no such division in the table with codes for accounting registers. It simply shows serial numbers, descriptions and codes.

The current table of codes for the declaration and the table for VAT registers can be downloaded from ConsultantPlus. Trial access to the legal system is free.

However, the data contained in the orders for accounting registers for 2021 is not final, since additions have been made to the code set.

Purchase and shipment of non-commodity goods in “1C: Accounting 8” when exporting to the EAEU

Let's consider the procedure for reflecting in the 1C: Accounting 8 program, edition 3.0, transactions of acquisition and shipment of non-commodity goods for export to the EAEU countries.

Example 1

The organization Trading House LLC, which applies the general taxation system, purchased on July 20, 2018 from Sofa Factory LLC (supplier):

According to the concluded contract with the foreign partner Astana LLP (Kazakhstan), the organization Trading House LLC:

The sequence of operations is given in Table 1. Table 1 No.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Setting up accounting policies and accounting parameters

In accordance with paragraph 3 of the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, providing services (Appendix No. 18 to the Treaty on the Eurasian Economic Union) when exporting goods from the territory of one EAEU member state to territory of another EAEU member state:

- a zero VAT rate is applied when submitting to the tax authority the documents provided for in paragraph 4 of the Protocol;

- the right to tax deductions is exercised in a manner similar to that provided for by the legislation of the EAEU member state in relation to goods exported outside the EAEU.

If non-commodity goods are shipped for export to EAEU member states:

- the deduction of the presented amount of VAT is carried out in the generally established manner, i.e., similar to the deduction for goods (work, services), property rights acquired for the implementation of transactions subject to VAT at rates of 18% and 10% (clause 3 of Article 172 of the Tax Code of the Russian Federation) ;

- The taxpayer does not have the obligation to determine the amount of VAT relating to goods (work, services), property rights acquired for the production and (or) sale of goods using a 0% rate, i.e. there is no obligation to maintain separate accounting (paragraph 2 p. 10, Article 165 of the Tax Code of the Russian Federation).

Consequently, if the taxpayer sells only non-commodity goods for export to the EAEU and there are no other grounds for maintaining separate accounting (carrying out transactions that are exempt from taxation under Article 149 of the Tax Code of the Russian Federation, and (or) the place of sale of which is not recognized as the territory of the Russian Federation according to Articles 147 and 148 of the Tax Code of the Russian Federation, and (or) which are not recognized as an object of taxation under paragraph 2 of Article 146 of the Tax Code of the Russian Federation), then on the VAT tab of the Accounting Policy form (section Main - subsection Settings - hyperlink Taxes and reports) you need to check the absence of a flag for the values Separate accounting of incoming VAT and separate accounting of VAT by accounting methods are maintained.

According to paragraph 3 of Article 172 of the Tax Code of the Russian Federation, the procedure for deducting input VAT when purchasing goods (work, services), property rights for operations for the sale of goods for export using a tax rate of 0% depends on whether or not the exported goods are raw materials (clause 10 of Art. 165 of the Tax Code of the Russian Federation).

Codes of types of goods related to raw materials were approved by Decree of the Government of the Russian Federation dated April 18, 2018 No. 466 in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union, approved. By decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54 (as amended on April 24, 2018).

In accordance with the approved codes, it is necessary to indicate whether or not the goods sold for export belong to the group of raw materials by placing the appropriate flag for each specific HS code.

By default, the Commodity flag is cleared, i.e. all goods sold are classified as non-commodity products.

According to subparagraph 15 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation and subparagraph “a.1” of paragraph 2 of the Rules for filling out an invoice, approved. By Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, invoices issued for goods exported outside the territory of the Russian Federation to the territory of the EAEU member states must indicate the code of the type of goods in accordance with the Commodity Nomenclature of Foreign Economic Activity.

The corresponding HS code is automatically displayed in column 1a of the invoice when goods are exported to the territory of the EAEU member states if the following conditions are met:

- sales of goods are carried out using a tax rate of 0%;

- the HS code is indicated for the corresponding product item in the Nomenclature directory;

- the counterparty is a taxpayer of a member state of the EAEU (section Directories - subsection Purchases and sales).

Purchasing goods

The receipt of goods into the organization (operations: 2.1 “Receipt of goods”; 2.2 “Accounting for input VAT”) is registered in the program using the document Receipt (act, invoice) with the transaction type Goods (invoice) (section Purchases - subsection Purchases - hyperlink Receipts (acts , invoices)) (Fig. 1).

Rice. 1. Purchase of goods

Please note that if the taxpayer maintains separate accounting for VAT, i.e., on the VAT tab of the Accounting Policy form (Section Main - subsection Settings - hyperlink Taxes and reports) the flag Separate accounting for incoming VAT and Separate accounting for VAT by accounting methods is checked, then in the column The VAT accounting method for non-commodity goods purchased for export should be set to Accepted for deduction.

After posting the document Receipt (act, invoice), accounting entries will be generated:

Debit 41.01 Credit 60.01 - for the cost of purchased goods excluding VAT; Debit 19.03 Credit 60.01 - for the amount of VAT presented by the supplier on purchased goods.

For the purposes of tax accounting for corporate income tax, the corresponding amounts are also recorded in the NU resources: Amount Dt and Amount Kt for accounts with the NU attribute.

An entry with the type of movement Receipt and the event Submitted by VAT by the Supplier is entered into the VAT presented register.

To register the received invoice for purchased goods in the program (operation 2.3 “Registration of supplier invoice”), you must enter the number and date in the fields Invoice No. and from the document Receipt (act, invoice) (see Fig. 1) incoming invoice and click the Register button. In this case, the document Invoice received will be automatically created, and a hyperlink to the created invoice will appear in the form of the basis document (Fig. 2).

The fields of the Invoice document received will be filled in automatically based on information from the Receipt document (act, invoice).

Rice. 2. Invoice received for receipt

Besides:

- in the Received field the date of registration of the Receipt document (act, invoice) will be entered, which, if necessary, should be replaced with the date of actual receipt of the invoice. If an agreement has been concluded with the seller on the exchange of invoices in electronic form, then the date of sending the electronic invoice file by the EDF operator, indicated in its confirmation, will be entered in the field;

- in the line Base documents there will be a hyperlink to the corresponding receipt document;

- in the Operation type code field the value 01 will be reflected, which corresponds to the acquisition of goods (work, services), property rights in accordance with the Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ;

- The Receipt Method switch will be set to Hard copy if there is no valid agreement with the seller to exchange invoices electronically. If there is an agreement, the switch will be in the Electronic position.

Since the buyer does not maintain separate accounting, in the Invoice document received there is the possibility of a simplified application for deduction of input VAT, for which the flag for the value Reflect VAT deduction in the purchase book by the date of receipt is automatically set.

Please note that if the taxpayer maintains separate accounting for VAT, i.e., on the VAT tab of the Accounting Policy form (Section Main - subsection Settings - hyperlink Taxes and reports) the flag Separate accounting for incoming VAT and Separate accounting for VAT by accounting methods is selected, then in the document Invoice received is missing a line and a flag for the value Reflect VAT deduction in the purchase book by the date of receipt. In this case, the application for a tax deduction is always carried out using the regulatory document Formation of purchase ledger entries.

If it is necessary to change the specified data, for example, to clarify the date of receipt, the document should be repeated. To do this, click the Record and close button or execute the Run command from the list of available commands, opened by clicking the More button.

As a result of posting the Invoice document received, an entry will be made in the accounting register:

Debit 68.02 - for the amount of input VAT in the amount of RUB 162,000.00. Credit 19.03

An entry will also be made in the information register of the Invoice Journal. Register entries The Invoice Register are used to store the necessary information about the received invoice.

An entry with the type of movement Expense is made in the VAT accumulation register presented.

An entry with the event VAT Claimed for Deduction is made in the Purchase VAT accumulation register to register the invoice in the purchase book.

Based on the entry in the VAT Purchases register, the purchase book is filled out for the period of acceptance of purchased goods for accounting and receipt of a supplier invoice, i.e. for the third quarter of 2022 (section Reports - VAT subsection or Purchases section - VAT subsection) (see Fig. 3).

Rice. 3. Purchase book for the third quarter of 2022

The amount of input VAT on purchased goods will be reflected on line 120 of Section 3, as well as in Section 8 of the VAT tax return for the third quarter of 2022 (section Reports - subsection 1C-Reporting - hyperlink Regulated reporting).

Shipment of goods

The shipment of goods for export to the buyer “Astana” LLP (operations: 3.1 “Shipment of goods for export”; 4.2 “Write-off of the cost of goods sold”) is registered in the program using the document Sales (act, invoice) with the transaction type Goods (invoice) (Fig. 4).

Rice. 4. Shipment of goods for export

After posting the document, the following accounting entries are entered into the accounting register:

Debit 90.02.1 Credit 41.01 - for the cost of written-off sofas; Debit 62.21 Credit 90.01.1 - for the sale price of sofas.

A record with the type of movement Receipt for the sales book is entered into the VAT register for sales of 0%, reflecting the accrual of VAT at a rate of 0%.

To create an invoice for goods shipped for export (operation 3.3 “Issuing an invoice for the shipment of goods”), you must click on the Write invoice button at the bottom of the Sales document (act, invoice) (see Fig. 4).

In this case, the document Invoice issued is automatically created in the information base, and a hyperlink to the created invoice appears in the form of the basis document.

In the new posted document Invoice issued, which can be opened via a hyperlink, all fields will be filled in automatically based on the data in the Sales document (act, invoice).

From 01/01/2015, taxpayers who are not intermediaries acting on their own behalf (forwarders, developers) do not keep a log of received and issued invoices, therefore, in the document Invoice issued in the Amount line: it is indicated that the amounts to be recorded in the journal accounting (“of which by commission:”) are equal to zero.

The Transaction Type Code field will reflect the value 01, which corresponds to the shipment of goods (work, services), property rights, including transactions taxed at a tax rate of 0% in accordance with the Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [ email protected]

As a result of posting the issued Invoice document, an entry will be made in the information register of the Invoice Log. Register entries The Invoice Register are used to store the necessary information about the issued invoice.

Using the button Print the accounting system document Invoice issued, you can view the form of the invoice and then print it (see Fig. 5).

Rice. 5. Invoice for export goods

According to subparagraph 15 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation and subparagraph “a.1” of paragraph 2 of the Rules for filling out an invoice, approved. Resolution No. 1137, in invoices issued for goods exported outside the territory of the Russian Federation to the territory of the member states of the Eurasian Economic Union, column 1a indicates the code of the type of goods in accordance with the Commodity Nomenclature of Foreign Economic Activity.

Operations of shipment of goods for export until the validity of the application of the zero VAT rate is confirmed in the VAT tax return will not be reflected.

Receipt of payment

Receipt of payment for goods sold (operation 4.1 “Receipt of payment from buyer”) in the 1C: Accounting 8 version 3.0 program is reflected using the document Receipt to current account with the transaction type Payment from buyer, which is generated in the following ways:

- based on the document Invoice for payment to the buyer (section Sales - subsection Sales - journal of documents Invoices to buyers);

- by adding a new document to the Bank statements list (section Bank and cash desk - subsection Bank - document journal Bank statements).

As a result of posting the document, the following accounting entry is entered into the accounting register:

Debit 51 Credit 62.01 - for the amount of payment received, which is 600,000.00 rubles.

Additional ciphers - 2021-2022

Several new codes intended for accounting registers appeared in the letter of the Federal Tax Service of Russia dated January 16, 2018 No. SD-4-3 / [email protected] It contains the following codes:

- for the invoice journal: 33 - according to documents (including adjustment documents) issued upon receipt of an advance payment from the tax agent on account of the future supply of raw hides (scrap);

- 34 - according to documents (including adjustment documents) issued (received) by the commission agent (agent) in connection with the shipment of raw hides (scrap) to the tax agent;

- 41 - by deducting, as a buyer, the amount of VAT calculated when transferring the prepayment;

- 34 - when adjusting the cost of shipment downward;

- 33 - by prepayment against future delivery of raw hides (scrap);

- 41 - according to VAT on prepayment as from the seller;

The letter contains the caveat that the codes contained in it are recommended and apply until changes are made to the corresponding base register.

In addition, by letter of the Federal Tax Service of Russia dated January 16, 2018 No. SD-4-3/ [email protected], codes 37-40 were additionally introduced - for operations provided for in clause 7 of Art. 164 Tax Code of the Russian Federation.

Purchase of goods by an intermediary for the consignor

When purchasing goods on his own behalf for another company, the intermediary must receive an invoice from the seller in his name and register it in the second part of the Journal.

Note! The intermediary should not record the specified invoice in the purchase book.

Now the intermediary reissues the invoice to the principal, indicating the name of the supplier as the seller. This invoice must be reflected in Part 1 of the Intermediary's Journal. The principal, in turn, registers it in his purchase book.

In this case, invoices are registered for all participants in the transaction with Transaction Type Code 01.

Results

The indication of codes for transactions is provided both in the VAT return and in the accounting registers of documents drawn up in connection with this tax.

However, the ciphers of such codes for declarations and accounting registers have a different number of digits in them and are approved by different documents. For use in 2022, the basic code registries have been supplemented with a number of cipher values recommended by the Federal Tax Service of Russia. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Preparation of consolidated invoices

In practice, it often happens that an intermediary purchases goods for a commission agent from several suppliers or sells his goods to several buyers. In this case, consolidated invoices may apply. Next, we will consider their application in specific situations.

The intermediary sells the consignor's goods to several buyers

In this case, the intermediary issues a separate invoice to each buyer. The intermediary must register these documents in Part 1 of his Journal with code 27. After this, the data of all issued invoices is transferred to the principal, and he issues a consolidated invoice based on them. The principal must register this document in his sales book with code 27, listing information about all buyers in the appropriate columns, separated by commas. The intermediary reflects it in part 2 of his Journal, also indicating code 27. Information about each buyer must be indicated in separate lines in the columns that are intended for intermediary activities (10, 11 and 12).

The intermediary purchases goods for the principal from several suppliers

In this case, each individual invoice that the intermediary receives from the supplier is recorded in the second part of the Journal with code 27. Then, based on this data, the intermediary issues a consolidated invoice to the principal for the total amount of purchases. This document must be recorded in Part 1 of the Intermediary's Journal, and code 27 must also be indicated. Information about each supplier must be indicated in the appropriate columns of the Journal (10, 11 and 12).

The principal registers the received invoice in the purchase book with code 27. In the appropriate columns, you must indicate information about all suppliers, listing them separated by commas.