Login to your personal account

In an attempt to change their lives for the better, active citizens go to rallies, vote, write complaints, and seek a face-to-face meeting with the city administration. Others remain inactive, convinced that the government does not care about their opinions.

Moscow authorities have decided to modernize communications between the city administration and ordinary residents. Several years ago, the “Active Citizen” project was launched. Now you can express your opinion by clicking a button in your personal account on the project website. Anyone who cares about the fate of the city can participate.

Login to the taxpayer’s personal account

Since both private and commercial users can create a personal taxpayer account, the authorization procedure differs for different personal accounts. To login:

- To an individual. Follow the link to the official website page, go to the Personal Account section, enter the login and password associated with your account in the form, and click “Login.”

Login through State Services

To log in to the platform for taxpayers of the Federal Tax Service in the section for individuals using an account on the Public Services portal, you must follow the link “Log in via Unified Automated identification and authentication” in the authorization form. In the new tab, select the method of logging into the government services account:

- by phone number;

- e-mail;

- SNILS number.

Click “Login” and grant access to the information. A similar option is presented in the individual entrepreneur’s personal account in the control block on the left - “Government Services Account”. Authorization is performed in the same way.

You can also log in to your personal account using a qualified electronic signature. To do this, you will need to download a special plugin for working with the certificate, then follow the link “Login using electronic signature.”

Mobile application Active Citizen

In addition to the website, the creators of the project have developed a mobile application “Active Citizen”. It is aimed at young people who prefer smartphones to computers. Through the application, users can vote from anywhere with internet access.

Download to phone

The application works on modern devices on Android, iOS, Windows Phone. Anyone can download it for free from official sources: for Android the download is available here, you can download the version for iOS from here, owners of Windows Phone devices can download the program here.

Login through government services

2. If there is an account , Users who have an account in the Unified Portal of State Services can log in to the “Taxpayer Personal Account for Individuals” service without visiting the tax office, provided that they have previously applied in person for identification to one of the authorized registration centers of the Unified Identification System and authentication (USIA): branch of the Federal State Unitary Enterprise "Russian Post", MFC of Russia, customer service center of OJSC "Rostelecom", etc.

There is an account for public services, but I can’t log in. Users of the Unified Portal of Public Services who have received access details (identity confirmation code) by registered mail or who have an unconfirmed account will not be able to connect to the “personal account” on the website of the Federal Tax Service of Russia using the Unified Portal account public services. There are two existing ways for them to connect to their “personal account”: using a login and password obtained from any inspection, regardless of the individual’s place of residence, or using an enhanced qualified electronic signature.

How to access?

You can access your account in 3 ways:

- having received a registration card with a password and login from the Federal Tax Service;

- through the State Services portal;

- using an EDS (qualified electronic signature).

Registration card

In the first case, the current password is issued by an inspection employee; instead of a login, a TIN is provided. To create an online registration, receive a registration card for your personal account . To do this, you will have to personally come to the tax office (you can contact any Federal Tax Service, regardless of your place of registration). To obtain credentials, you only need to have your passport with you .

The portal you are interested in is www.nalog.ru. To open the current entry in your personal account through the official website, click the block on the left. Please note that there are separate forms for legal entities, individuals and individual entrepreneurs.

To open an accounting record on the portal, enter the password code issued by the inspection and a valid TIN. There is no need to remember the session. Credentials for access to the system must be issued by the tax office - choose any division of the Federal Tax Service inspection. The data is recorded on a registration card, so if it is lost it can be easily restored, but you will need to present your passport. The service is available to applicants aged 14 years and older, but if the citizen has not yet reached the age of majority, access will be given to biological parents or other legal representatives.

Important. The code, which is generated automatically and issued by the Federal Tax Service, is recommended to be changed within the first month. This will ensure 100% data confidentiality.

It is impossible to receive login information by email, since it is issued strictly on physical media. You can register remotely only through State Services.

Login to your personal tax account for individuals on nalog.ru

Would you like to be able to pay your taxes and contributions without visiting an authorized organization? Then you need to obtain access to your personal web account with the Federal Tax Service. A citizen will need to go to the tax website and in the “Services” section select the appropriate type of account: for us, of particular interest is the account for individuals.

To use the wide functionality of your personal account, you must pass user verification, which requires a unique login and password. Your INN, assigned by the Tax Service to each tax payer, and your personal password are used as a login. However, to start using the service, you still need to register in the system.

Connection in inspection

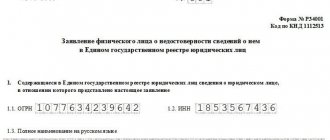

3. To do this, you must fill out an application to connect to the personal account of a taxpayer. If it is not possible to print the application, you can fill it out at the tax office. If you apply to the tax office at your place of registration, you will only need a passport. When applying to other inspectorates, you must have a passport and an original or copy of the TIN certificate with you. Based on your application, the tax office will generate a registration card on two sheets.

The registration card contains identification information for entering the account:

- user login;

- the user's primary password, which must be changed upon first login.

The account is activated the next day after receiving the registration card. This completes the connection to the taxpayer’s personal account.

What is the office for?

- receive up-to-date information about property objects and vehicles, about the amounts of accrued and paid tax payments, about the presence of overpayments, about tax debts to the budget;

- control the status of settlements with the budget;

- receive and print tax notices and receipts for tax payments;

- pay tax debts and tax payments through banks - partners of the Federal Tax Service of Russia*;

- download programs for filling out a personal income tax return in Form No. 3-NDFL, filling out a declaration in Form No. 3-NDFL online, sending a declaration in Form No. 3-NDFL to the tax office in electronic form, signed with the taxpayer’s electronic signature;

- monitor the status of the desk audit of tax returns using Form No. 3-NDFL;

- contact the tax authorities without a personal visit to the tax office.

Registration of a personal account for individuals

It is a deep misconception to believe that an ordinary citizen does not need a personal account on the Federal Tax Service website. With the help of a personal account, you can free up some of your time and not waste it on going to the tax office and sitting in queues. Such an account on the Federal Tax Service website will help an individual:

- Monitor taxes on property, land and transport;

- Pay taxes without commission;

- Return overpayments to your personal account;

- Quickly receive information remotely.

To register, you must contact any tax office or MFC, having your passport with you, and obtain an entry password from the inspectors.

How to register using digital signature?

It is very easy to register by visiting the tax office in person. It is enough to have your passport with you and fill out the application form. But there are situations in which a person cannot visit the Federal Tax Service. In such cases, it would be appropriate to register remotely. This can be done by mail and electronically using an electronic signature.

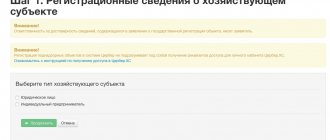

Before registering using an electronic signature, you must obtain an EDS key certificate and open a personal account on the tax service website. Having a CEP, the necessary software and a personal account on the Federal Tax Service website, you can register an individual entrepreneur or LLC without visiting the tax office. To do this you should:

- Prepare an application for registration;

- Collect the required package of documents (the package of documents for individual entrepreneurs and LLCs will be different);

- Send the collected package through your personal account to the Federal Tax Service.

You can learn more about the document submission technology directly on the Federal Tax Service website.

Where to get a password to access your personal account

An individual or legal entity can obtain the primary password and login for opening a personal account on the Federal Tax Service website at any branch of the tax inspectorate or at the Multifunctional Center for the provision of state and municipal services (MFC).

To receive a document with a login and password for an individual, it is enough to have a passport with you. Individual entrepreneurs need a OGRNIP, and legal entities must also provide the company’s constituent documents and personal data of the founder.

Voting on the portal ag mos ru

Registered users have the opportunity to vote on the “Active Citizen” portal. Polls are regularly updated on the site; they can be seen in the “Current Voting” section.

Click on one of the polls and the voting page will open. Select one of the options. Sometimes you need to evaluate the performance of an object or service on a 10-point scale. Confirm your choice with the “Finish voting” button.

Citywide and territorial (district) voting is held on the “Active Citizen” website. The latter relate to a specific area of the capital. To participate in regional surveys, you must indicate your registration address in Moscow in your personal account settings.

Earning points for voting

Trying to attract citizens to actively participate in surveys on the site, the capital authorities have developed a system of incentives. Bonuses are given to all citizens who are not indifferent to the fate of the capital.

To obtain the “Active Citizen” status, the user must score at least 1000 points. They can be exchanged for souvenirs (cups, T-shirts, phone cases, etc.), tickets to cultural and sporting events, and replenishment of the Troika transport card.

Active car enthusiasts can earn bonuses and exchange them for parking hours. The participant must be registered in the “Active Citizen” and “Moscow Parking” applications, and both profiles must be registered to the same phone number. 100 points are equivalent to 100 rubles.

You can select the desired prize in the “Rewards Store” section. Prizes are divided into four categories (souvenirs, museums, events, digital content). Souvenirs can be picked up at rewards distribution centers after pre-booking. The order form indicates the full name and email to which the profile is registered. Just in case, it is recommended to print out your order reservation.

Rewards store

When choosing tickets, details of their receipt are described in the reward description. Basically, an electronic coupon is sent by mail, after which it must be exchanged for a ticket at the box office of a theater, museum or other institution. The number of tickets to visit cultural institutions and events of the capital is limited.

Promotional codes: accrual and use

In addition to awarding bonus points for subsequent exchange, the “Active Citizen” project regularly organizes promotions. Participants have the opportunity to earn additional prizes. For example, in 2016, the capital authorities gave active citizens the opportunity to attend the rehearsal of the Victory Parade. 1000 tickets were provided for the event.

To receive a promotional promotional code, you need to follow the project news on the website or in a group on a social network. Promotions are often timed to coincide with holidays or important events in the life of the capital. You can use a promotional code through your personal account or mobile application. Enter it in the “Promotional Code” field of the “My Points” section.

The “New Year's Marathon” campaign is currently underway and will last until December 31 inclusive. Project participants can win souvenirs, tickets to slides and skating rinks, and even an invitation to the Mayor’s Christmas tree. Details of the promotion with promotional codes are here.

Promotion rules

Tax ru: login to your personal account of the Federal Tax Service

People go to the tax website not only to find their answers to questions about taxation of citizens, but also to check payments for their taxable items in their personal account of the Federal Tax Service. Previously, you had to wait for the postman to come and throw the receipt in the mailbox, then go to the nearest bank and stand in a kilometer-long line at the cashier’s window with a payment order. As a result, it took almost the whole day to pay several receipts.

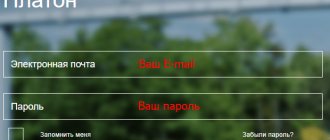

Now you can pay all possible taxes and duties yourself by going to the official tax website, selecting the type of account (individual, individual entrepreneur or legal entity) and entering your login (your Taxpayer Identification Number) and password and then the “Login” button.

If you do not have information to log into your personal account, then register on the website of the federal tax service.

Login using TIN with password

The tax office will give you a Registration Card for access to the LC. The form will indicate your login - this is your Taxpayer Identification Number (TIN) and password - for the initial login.

Registration card

Go to the Federal Tax Service website and enter the personal account registration form. Enter data in the appropriate fields.

Login to your account using your tax identification number

After logging in, go to your profile and confirm your phone number and email.

Check the box indicating that you agree to recover your password by email. Come up with and set a code word. You will need it to recover your password. And check the box if you agree to receive notifications about all events in your personal account.

Add phone and email address

Registration on the tax website of a personal account for individual entrepreneurs

A personal account in the tax office on the tax ru website for individual entrepreneurs has more advanced functionality than for individuals. This virtual office makes it easier for small businesses to deal with the tax office.

Functionality of the taxpayer’s personal account for individual entrepreneurs:

- conveniently monitor accrued income taxes;

- the user of his personal account can independently choose the tax rate for his business;

- receiving and sending messages to the tax office.

Convenient service saves the entrepreneur time. To obtain documents, such as extracts and certificates, you do not need to go personally to the Federal Tax Service office. Almost all documents can be received and sent online.

To register and receive a password for a taxpayer’s personal account, an individual entrepreneur chooses one of two methods:

- Login via login and password to the personal account of an individual. If a citizen was previously registered as an individual on the tax website, then these login details can also be used to draw up a personal account for an individual entrepreneur. It is necessary to additionally enter the OGRNIP data, however, the capabilities of such an account will still be limited until the (Qualified certificate of the electronic signature verification key) is used.

- Through KSKPEP. You can obtain a key from accredited certification centers. The approximate cost of a certificate for an individual entrepreneur is 1,500 rubles.

To register a personal account, an individual entrepreneur must follow the instructions on the website.

How to connect a personal account for individual entrepreneurs

A tax account for individual entrepreneurs is a virtual office for small businesses that simplifies interaction with the tax office. The personal account of individual entrepreneurs differs in functionality from the personal account of individuals. Here, a registered user can remotely monitor accrued income taxes, personally select a tax rate for their business, and receive and send messages to the inspectorate. A simple and understandable service saves the entrepreneur’s time; you don’t have to go to the Federal Tax Service for statements and certificates; most documents can be received and sent online.

For convenient use, the interface in your account can be changed, blocks can be rearranged, and the service can be customized as much as possible. There are two ways to register a personal account for an individual entrepreneur:

- Through the login and password to the individual’s account. If the user has already created a record for an individual, the login data for it can also be used for the individual entrepreneur’s account. After the account is opened, you will need to enter additional OGRNIP data. The capabilities of such an account are limited; the user can view information, request extracts and reports. To send documents to the inspection online, you need KSKPEP (Qualified Certificate of Electronic Signature Verification Key).

- Through KSKPEP. A certificate is an electronic or paper document that confirms ownership of a key by a specific person. You can obtain it from accredited certification centers. The issuance of the KSKPEP occurs in the same way as the receipt of an electronic signature. The cost of the certificate for an individual entrepreneur is 1,500 rubles. To register an individual entrepreneur’s account, the signature carrier must be connected to the computer and follow the instructions on the website.

Accounts for individuals and individual entrepreneurs are integrated, the user can switch from one account to another. All functionality of the site will be available to those who registered through KSKPEP.

Registration and login to your personal account using the State Services portal

The third way to access the taxpayer’s personal account is to use an account on the State website class=”aligncenter” width=”780″ height=”224″[/img]

The difficulty is that this type of registration is only possible if you have confirmed your identity by being present at the user service center. If you, like most users, confirmed your identity using a registered letter, then you should contact one of the centers for identification.

Through the personal account of an individual

- Log in to the personal account of an individual entrepreneur using your username and password from the account for individuals.

- Fill in the details for the entrepreneur: OGRNIP, email for notifications.

- Create a password for your personal account and confirm it.

- Click Next.

Not all features of your personal account will be available. To get full access to the functions of your personal account, register using an electronic signature.

About the Moscow Government project “Electronic Active Citizen”

The capital project “Active Citizen” is an electronic questionnaire created on the initiative of the Moscow Government. The project started in 2014. The purpose of its creation is to actively involve citizens in improving Moscow; now, before making a final decision, the opinion of each voting participant is taken into account.

On the “Active Citizen” portal, each participant expresses his personal opinion by voting. Surveys appear on the website once a week, and cover all areas of life in the capital. You can vote after registering in your personal account. “Active Citizen” helps residents of the capital express their opinion on everything that falls within the competence of the Moscow Government: from the arrangement of the next children’s playground to the demolition of street retail outlets near the metro.

Over the 4 years of operation of the “Active Citizen” project, many changes have been achieved, here are some of them:

- Improvement of local areas in more than 1000 Moscow courtyards.

- Changing the format of work of government institutions: clinics, kindergartens, MFCs, etc.

- Allowing citizens to independently choose the design of new metro stations.

- The choice of artists to perform at the prom in the park. Gorky.

- Construction of bicycle paths in park areas.

- Opening of new testing centers on the basis of children's sports schools.

- Launch of new urban transport routes.

- Opening of more than 500 sports sections and interest groups on the basis of Children's Creativity Houses.

Anyone can familiarize themselves in detail with the report on the work of “Active Citizen” from its creation to the present here.

Functionality of your personal account

The following functions are available in the taxpayer’s personal account:

- receiving tax notices, receipts, printing them for payment;

- control of settlements with the state;

- familiarization with the news of the Federal Tax Service;

- obtaining up-to-date data on accrued and paid tax payments, overpayments and debts;

- filling out an electronic version of the income statement;

- obtaining addresses and contacts of taxpayer service centers;

- monitoring the verification of the declaration by Federal Tax Service specialists;

- creating requests for information;

- consultation with tax representatives.

Individuals also have the opportunity, using the taxpayer’s personal account, to pay payments, fees, and taxes at any convenient time through a bank card or electronic wallet.

Old and new version of your personal account

The new version of the personal account is more informative and there are more features. It has become easier to send a 3-NDFL tax return. Supporting documents can be easily attached and sent. No need to wait for paper notifications of accrued taxes. You will track everything in your personal account. If you receive a property benefit, immediately send a notification on the website.

Declarations that were submitted earlier, an archive of messages until August 2022, remained in the old version of the office. Data is available in viewing and reading mode. But you cannot send a new declaration.

You can also view the message archive from your new personal account. To do this, go to “Messages” and click on “Message Archive”.

Archive of messages in your personal tax account

Methods for obtaining a password from a taxpayer’s personal account

During the registration of a tax payer in the Federal Tax Service system, he is assigned a unique login and password. In this case, it does not matter at all which of the above methods the registration took place; as a result, the client will receive a login that corresponds to his Taxpayer Identification Number (TIN) and a unique password to confirm login to the system. If the client registered through the tax office, then the generated password will have to be immediately changed to a new one, more secure and unknown to anyone. If an electronic digital signature has been created, then it will be the unique password for accessing your personal page.

How to change or recover your password

If the data received for registering a virtual personal account has not been activated, the procedure must be completed again. The algorithm of actions is no different: you need to select an inspection or MFC, fill out a form, and receive a login-password pair. In addition, after entering unique data, you need to change your password for additional protection. This is done immediately in the tax office. After the first login to your account, the “User Profile” will open, in which the identifier changes.

For the current password, enter the one issued by the inspection. For a new one, the user comes up with his own unique code. After creating a new password, be sure to link your account to your email. If the login keys are lost, for example, if the account owner has forgotten the password, it can be recovered via Email.

You need to check the appropriate box and come up with a code word. To recover the password from your personal tax account, you are given 3 attempts. If a user enters an incorrect ID 4 times, the account is blocked for 24 hours. Then you can try again. As a last resort, you can update your password at the inspectorate. To do this, the taxpayer must come to any branch of the Federal Tax Service with documents.

How to receive login and password by email

Data for access to your personal account is provided personally on physical media; therefore, it is impossible to receive it by email. An exception is registration through the government services website if you have a user account there.

Login via username and password

After receiving the registration form, an individual can access his user account by going to the page for entering input data. Here you can save them so that in the future the system does not require repeated entry.

Login to your personal account

What to do if a person has forgotten the password

If the user has forgotten the code, lost the registration card, or there are suspicions that the authorization data has been stolen, he needs to contact the Federal Tax Service to obtain new authorization parameters in the personal account.

You can also block your account for security reasons. This is done in your profile, in the “contact information” section, by clicking on the “Refuse to use the service” button.

A notification will appear on the page that opens, in which you need to indicate the reason for stopping the use of your personal account. Then click “send application”.

Create a new user account

In order to create an account in your personal account, a new user must fill out the following form. When entering a password, an individual should take into account the following: length from 7 characters, consists of numbers, signs and letters of the Latin alphabet.

After filling out the form, an email with an activation link will be sent to the specified address. In order to make your account active, you need to go to it. Otherwise, registration will not occur.

How to connect a personal account for individual entrepreneurs

A tax account for individual entrepreneurs is a virtual office for small businesses that simplifies interaction with the tax office. The personal account of individual entrepreneurs differs in functionality from the personal account of individuals. Here, a registered user can remotely monitor accrued income taxes, personally select a tax rate for their business, and receive and send messages to the inspectorate. A simple and understandable service saves the entrepreneur’s time; you don’t have to go to the Federal Tax Service for statements and certificates; most documents can be received and sent online.

For convenient use, the interface in your account can be changed, blocks can be rearranged, and the service can be customized as much as possible. There are two ways to register a personal account for an individual entrepreneur:

- Through the login and password to the individual’s account. If the user has already created a record for an individual, the login data for it can also be used for the individual entrepreneur’s account. After the account is opened, you will need to enter additional OGRNIP data. The capabilities of such an account are limited; the user can view information, request extracts and reports. To send documents to the inspection online, you need KSKPEP (Qualified Certificate of Electronic Signature Verification Key).

- Through KSKPEP. A certificate is an electronic or paper document that confirms ownership of a key by a specific person. You can obtain it from accredited certification centers. The issuance of the KSKPEP occurs in the same way as the receipt of an electronic signature. The cost of the certificate for an individual entrepreneur is 1,500 rubles. To register an individual entrepreneur’s account, the signature carrier must be connected to the computer and follow the instructions on the website.

Accounts for individuals and individual entrepreneurs are integrated, the user can switch from one account to another. All functionality of the site will be available to those who registered through KSKPEP.

Registration using a State Services account

To register an account using an account in the Unified System of Identification and Authentication (USIA), the user must be registered on the government services website.

Attention! An account on the government services website is created upon personal application of an individual to the Unified Identification and Logistics Agency

Registration using an electronic digital signature

The creation of a personal account of an individual can be done if he has an electronic signature, which is issued by an accredited center of the Ministry of Telecom and Mass Communications. A list of such centers in a specific region and city can be found on the website.

Registration with the Federal Tax Service inspection

If you urgently need to get into the taxpayer’s personal account and the two methods described above do not suit you, we recommend using this option. Take your passport as a citizen of the Russian Federation with you and go to the nearest tax office (your place of registration does not matter). Join the electronic queue when you arrive at the operating room. Wait for your appointment with a Federal Tax Service employee and receive a login and password to enter the taxpayer’s personal account on the website.

Digital signature key

Citizens can receive an electronic digital signature key and authorize on the portal using it. A digital signature is issued at a Certification Center accredited by the Ministry of Telecom and Mass Communications.

If the digital signature key is lost, the user must contact the Certification Center that issued the electronic signature.

Help: A list of accredited Certification Centers can be found on the website minsvyaz.ru in the “activities” section.

When using an electronic digital signature or the State Services portal for authorization, you do not need to enter a login.

Creating an account on the inspection website allows taxpayers to use tax services without leaving home. To do this, it is enough to visit the tax office once and receive a registration card. After changing the password, the cipher set by the user cannot be changed and is valid indefinitely.

Recovering your personal account password Tax ru

If you are unable to log into the website of the federal tax service, we recommend that you check that you have entered your login and password correctly. You may have misspelled a letter or number, or you may have pressed the Caps Lock key. If your next attempts to log into your account are unsuccessful, we recommend using the function to recover your personal account password.

To do this, go to the login page for your personal account on the tax website and click the “Forgot your password?” button.

A page will open where you will need to enter your TIN number, email address and the control word you specified when registering on the site.

Next, click the “Recover Password” button. A letter from the tax office will be sent to your e-mail address with further instructions (the letter will contain a link to reset your password) on how to recover your password to your personal account.

Be careful and fill out your details slowly! If you enter the data incorrectly 3 times, the ability to recover the password from your account will be blocked for 1 day.

And now the last step - come up with a new password to log into your personal account and save it.

If suddenly you are unable to restore access to the site, contact the nearest Federal Tax Service office in person. Tax service employees will help you restore access to your personal account.

Change primary password

After logging into your Personal Account for the first time, you need to change your password.

This can be done in your Profile. On the main screen, tap on Profile. In the window that opens, go to the “Contact Information” tab and click “Change Password.”

Go to the profile menu Click the “Change password” button

In the fields that appear, first enter your primary password, which you used to log in, and in the next two, enter your new password.

You need to come up with a strong password that will consist of at least 7 characters. Only Latin letters can be used. The password must use a combination of all character options. Must contain an uppercase letter, a lowercase letter, a number, and a special character. For example - [email protected]

After entering your password, do not forget to click “Save”.

Enter the old and new password and save

This can happen when the primary password is not suitable and when entered, the message “Invalid TIN/password” is displayed.

Common mistakes:

- If you entered the characters incorrectly, please re-enter them carefully, respecting the case of letters. As you enter into the field, you can click on “Show password.” Then you will see what letters and symbols you enter. You can type the password first in a text editor, copy it and paste it into the password field. Just copy carefully, without spaces.

- Entered in Russian letters - translate the input language into English.

- All characters are entered in capital letters - turn off Caps Lock.

There may be technical problems with the network or the tax office portal. Try logging in again in a few hours.

You can contact technical support on the website and describe your login problem.

If you still cannot log in and the password does not work, then go back to the tax office and ask for a new password.

Find out your debt in your personal tax office account

In order to find out the debt to the state, you need to log into your account on the Federal Service website, as described above.

Inside the office you can get the following information: how much must be paid to the treasury, how much was paid, whether there was an overpayment and how much it amounted to, if there is a debt on the account. In addition, for each item you can find out more detailed information by going to each tab: for what service and by whom the tax was calculated, when the bill was paid, whether a penalty was charged and why, etc.

How to find out debt by TIN and last name?

All working people are required to participate in the national taxation system. For individuals running individual entrepreneurs, an annual payment of a fixed tax on earned income is mandatory. To find out whether there is a debt, a citizen can go to the “Overpayment/Debt” section of the LC and view the current data.

But if the right to access the personal account has not yet been obtained, then you can view the debt using the bailiffs website. The free fields indicate the full name and tax identification number of the citizen whose data needs to be obtained. If the taxpayer has a debt, then it will be reflected on the website and any person or organization can view it.