A letter on the application of the simplified tax system for a counterparty is an important part of the business life of an entrepreneur. Thus, he has the right to inform his business partner of the reasons why he does not include VAT in the cost of his products or services.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

The difficulty lies in the fact that each manager himself has the right to choose the form of taxation and switch from one to another. And the counterparties with whom he works are not always ready for changing conditions. They may not be aware of changes that have occurred in the form of taxation of the organization with which they interact, or cooperation between the parties is just being established.

For these reasons, a letter on the application of the simplified tax system for a counterparty is a useful document for organizing fruitful business communication.

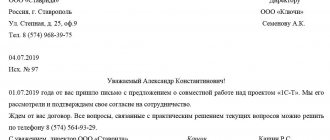

Components

A letter most often consists of a header, an introductory part, a body and a conclusion of the document. The header contains information about:

- Full name of the organization. The one who sends a letter to her counterparty.

- Basic details. Large companies issue special forms, immediately indicating the address, telephone number, INN, OGRN, checkpoint. It makes sense to place letters of business content on them.

- The request made. It makes sense to refer at the very beginning to the number and date of the request that was received by the organization. It is considered good form in business communication to remind that the counterparty requested the data and on what date he did it. In addition, this protects both parties from confusion when there is a large flow of incoming documentation.

- Number and date of the current document. Naturally, if the organization has adopted such numbering for convenience.

The main part usually has an introduction in the form of a link to the request received from the counterparty. After the motivation comes a message of basic data, namely:

- From what time and where was the company registered, what taxation system did it use from the moment of opening.

- In the event of a change in the taxation system - when this change occurred.

- Link to supporting documents. Copies of them are attached to the letter. Applications may include a tax return, a notice of termination of activities under one of the taxation systems.

- The document will have more credibility if copies of notifications are certified by the Federal Tax Service of Russia.

The mandatory content of the final part is the signature of the head of the institution (for example, the general director) or his authorized representative, with the position and transcript of the signature.

Letter on the application of the general taxation system: sample

You can inform your counterparty about the applicable taxation system in any form. If your partner has asked you for a document to verify that you are using OSNO, you can write an information letter on using OSNO (an example of filling is provided at the end of the article), in which you must indicate the following information:

- your company name, details;

- information about registration with the tax authority (according to the registration certificate);

- information that the company is a VAT payer, for example.

In addition, it is possible to attach a copy of the VAT return and documents confirming payment of tax to the budget. The letter must be signed by the General Director, indicating the position and full name, and seal.

Certificate about the taxation system: sample for OSNO

Tax regimes

In the Russian Federation, in addition to the main tax regime under which VAT is paid, there are a number of special regimes. These include:

- USN. Stands for “simplified taxation system.”

- Unified agricultural tax.

- Patent taxation system.

- Single tax on imputed income for certain types of activities.

- CH in the implementation of production sharing agreements.

The tax code describes each of them precisely. At the same time, it says that “simplers” do not pay VAT (Article 366.11).

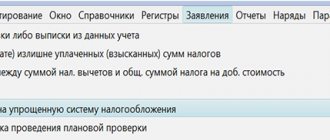

How to fill out a notice of transition to the simplified tax system

Let's move on to how to fill out an application for using the simplified system. At first glance, the form looks simple, but there are three situations in which it must be filled out:

- when submitting documents for registration of an individual entrepreneur or LLC;

- within 30 days after registration;

- when switching to the simplified tax system from other taxation systems.

Each situation has its own nuances; let’s look at them in more detail.

When registering an individual entrepreneur or LLC

If you submit an application to switch to the simplified tax system along with other documents for registration, then there are no TIN and checkpoint codes yet. They are assigned after the entrepreneur or organization is registered for tax purposes. Accordingly, in this case the upper cells of the notification are not filled.

Now you need to pay attention to the taxpayer attribute code. The codes are explained in the footnotes at the bottom of the document. When submitting a notification to the simplified tax system along with documents for registration, it is “1”.

Below you must enter the full name of the individual entrepreneur or the company name of the organization. And immediately below these lines there is one cell for indicating the date code for the transition to the simplified tax system. In this case, its value is “2”, that is, from the date of registration of the LLC or individual entrepreneur for tax registration.

Next, you need to indicate the selected tax object:

- “1” for simplified tax system Income;

- “2” for the simplified tax system Income minus expenses.

And below is the year the notification was submitted, for example, 2022.

Income and the residual value of fixed assets are not filled in when registering an individual entrepreneur or LLC, because the business has not even been created yet.

It remains to fill out the lower left block, where the applicant’s data is indicated. Here you must first select the taxpayer attribute code:

- “1” for an individual entrepreneur or manager for a representative (with this method of submission, you must indicate the details of the power of attorney at the bottom).

Below, enter your full name as the LLC director or authorized representative. The individual entrepreneur does not fill out these lines. The applicant indicates the contact telephone number, the date of submission of the notification and signs.

Notification on the simplified tax system upon registration (filling sample)

Within 30 days after registration

The notification, which is submitted within 30 days after registration of an individual entrepreneur or LLC, is filled out in exactly the same way, with the exception of two nuances:

- TIN and KPP codes must be indicated, because they have already been assigned;

- The taxpayer attribute code is different; instead of “1” you must enter “2”.

Notification to the simplified tax system within 30 days after registration (filling sample)

When switching from other tax regimes

If an organization or individual entrepreneur already operating in other modes switches to the simplified tax system, the filling procedure will be different.

Please note these differences:

- taxpayer attribute code “3”;

- the date code for the transition to the simplified tax system is “1”, which means from the new year;

- after the word “where” you must indicate the year from which the simplified application begins;

- lines are filled in for income for nine months in the year of transition and the cost of fixed assets (the requirement applies only to organizations).

Important: when an LLC switches from other taxation systems, the following limits apply: income for nine months should not exceed 116.1 million rubles, and the residual value of the fixed assets should not exceed 150 million rubles. If the numbers are higher, then your company will not be able to work on the simplified tax system.

Notification to the simplified tax system when switching from other taxation systems (filling sample)

Free tax consultation

Information mail

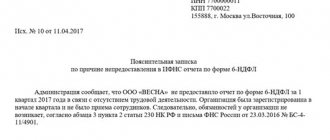

As you know, in order to switch to a simplified taxation system, an entrepreneur only needs to contact the tax office at his location. She has no right to refuse passage to anyone.

In order to request information about the submitted application for transition, as well as to find out whether a declaration was provided on his behalf, the taxpayer (IP, LLC, JSC) can send his request to the tax office. And she must answer him using the form 26.2-7 “Information letter” specially provided for this purpose.

It is precisely this that is the main appendix to the letter on the application of the simplified tax system for the counterparty. However, in order to receive it, an organization or individual entrepreneur should independently create a request to the tax office.

Important! The taxpayer is not required to request an information letter from the tax office. However, for full-fledged business communication in some cases, this may be necessary.

Results

Tax authorities do not issue notification of the possibility of applying the simplified tax system. However, the taxpayer can at any time contact the Federal Tax Service with a request to issue written confirmation of the application of the simplified tax system. The tax authority issues confirmation of the application of the simplified tax system in the form of an information letter in form 26.2-7, which indicates the date of submission of the notification of the transition to the simplified tax system.

For more information about the possibility of switching to the simplified tax system, see the section “Transition to the simplified tax system.”

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected]

- Order of the Ministry of Finance of Russia dated July 2, 2012 No. 99n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Ways of interaction

As for correspondence with the counterparty, the situation here is quite sensitive. Some organizations are content with the minimum content of the documentation provided, while others are more extensive. There are such participants in economic turnover who formulate requests for documents that do not exist in nature. Thus, an organization has three ways to interact with a counterparty who has increased requirements for the grounds for attachments to a letter on the application of the simplified tax system:

- Stop cooperation.

- Provide all the documents that the counterparty mentioned in its request.

- Agree by convincing the business partner to reduce the list of required documents to a manageable one.

A downloadable sample letter on the application of the simplified tax system for a counterparty can be found at the top of this article.

You can change the simplified tax system option only within a certain period of time

Although the simplified tax system is a unified taxation system, its options are very different from each other. In addition, the simplified tax period is a calendar year, so the final tax calculation occurs at the end of the year.

Taking this into account, it becomes clear why the transition from the simplified tax system Income to the simplified tax system Income minus expenses and vice versa is allowed only from the new year. There is a direct indication of this in Article 346.14 of the Tax Code of the Russian Federation.

To change the system, you must submit a notification of a change in the object of taxation to your Federal Tax Service no later than December 31. For example, if you contact the tax office before the end of this year, the change of object to the simplified tax system will occur in 2023.

There is another non-obvious option for changing the simplified tax system Income to the simplified tax system Income minus expenses and vice versa, but it is only suitable in the first 30 days after registering a business. This method was proposed by the Federal Tax Service itself on its website.

If you first submitted a notice of transition to the simplified tax system with one taxable object, then within 30 days you can still change your mind and submit a second notice. In addition, you must attach a letter stating that the first notification is canceled.

Another way to change the object of taxation to the simplified tax system in the middle of the year is often recommended on the Internet. If an individual entrepreneur is not satisfied with his simplified version, he can be deregistered, and after a few days register again. Then the 30-day period for switching to the simplified tax system begins to run again, and now you can select the desired object of taxation.

Indeed, the law does not prohibit re-registration of individual entrepreneurs within a year, while there is no special procedure for switching to the simplified tax system in such a situation.

But the fact is that the Federal Tax Service sees signs of a tax scheme here, because the only reason for closing and opening individual entrepreneurs is to reduce the fiscal burden. This is exactly the situation that was considered by the Supreme Court (Decision of the Supreme Court dated June 30, 2015 No. 301-KG15-6512).

An individual entrepreneur decided to change the taxation system without waiting for the new year. To do this, the individual entrepreneur was deregistered and after a short time registered again in order to switch from the simplified tax system Income to the simplified tax system Income minus expenses.

However, the tax inspectorate proved that in this case the individual entrepreneur had no intention of stopping business activities, which means that the deregistration was fictitious. The transition from the simplified tax system Income to Income minus expenses was not recognized, and the tax was additionally assessed within the framework of the initially selected object of taxation.

Thus, there is only one deadline for submitting an application to switch from the simplified tax system Income to the simplified tax system Income minus expenses and back: no later than December 31 of the current year. And you can work on another taxable object only next year.