Advantages of the simplified tax system over other tax systems

The demand for “simplified taxation” among business representatives is quite understandable: it has a number of parameters that distinguish it favorably from other tax regimes. For example:

- Companies operating on the simplified tax system, instead of several types of taxes, pay one. That is, unlike those who apply OSNO, they do not have to pay property tax, income tax, VAT, etc.;

- Possibility to choose the so-called object of taxation. There are two options here: income minus expenses 15% and income 6%.

- “Simplified” can be combined with other tax regimes, for example, UTII;

- Due to the fact that maintaining accounting and tax records using the simplified tax system is not very difficult, individual entrepreneurs and founders of organizations can do this on their own, without resorting to specialized accounting assistance. In some cases, this allows you to significantly save the enterprise budget;

- One return must be submitted to the territorial tax service based on the results of the annual reporting period.

Consider employee costs

If the business involves hiring employees, then at the “income” object you can make a tax deduction for the amount of insurance premiums for employees and the amount of sick leave benefits paid at the expense of the employer. In this case, the tax amount can be reduced by no more than 50%. We gave examples of the use of tax deductions in the article on calculating the tax on the simplified tax system of 6%.

In the “income minus expenses” facility, you will be able to include employee salaries, insurance premiums, and sick leave benefits as expenses. This will reduce the tax base and, accordingly, the amount of tax payable.

Disadvantages of the simplified tax system

Along with some obvious advantages, the simplified mode also has its disadvantages. These include:

- Inability to develop business in other cities and regions, including opening representative offices or branches. Besides. “simplified” cannot engage in banking, legal, insurance business and some other types of activities;

- Those individual entrepreneurs and organizations that work under the simplified tax system do not use VAT in their work, and this can significantly narrow the circle of partners. Large companies most often apply VAT and require the same from their counterparties;

- Legal entities and individual entrepreneurs using the simplified tax system cannot offset all their expenses as expenses and thereby reduce the tax base;

- If strictly established limits are exceeded, for example, on the number of personnel or profit margins, companies lose the right to work on the simplified tax system. It will be possible to return only from the beginning of next year and subject to compliance with the framework established by law.

On “Income” contributions significantly reduce tax

Individual entrepreneurs are required to pay insurance premiums for themselves. This is 40,874 ₽ + 1% of the amount of income over 300 thousand ₽ for 2022. If you open an individual entrepreneur in the middle of the year, the fixed part of the contributions will decrease proportionally. In addition, employers pay insurance premiums for employees, totaling 30.2% of wages.

Under the simplified tax system “Income minus expenses,” contributions are taken into account as expenses. With them, the tax amount becomes smaller, but on “Income” the reduction mechanism is even more effective. There, contributions do not reduce the tax base, but the tax itself. Without employees - at least completely, with employees - a maximum of 50%. That is, an individual entrepreneur without employees, instead of 40 thousand in tax, will not pay at all.

It is better to make contributions in installments - quarterly. This way, the entrepreneur will gradually reduce advance payments under the simplified tax system - and at the end of the year there will be no overpayment.

How to switch to simplified tax system

In short, switching to “simplified” is not a difficult matter. It is possible in two ways:

- Immediately after registering an individual entrepreneur or LLC. Here you just need to attach to the main package of documents a notice of the transition to the “simplified language”;

- Change the taxation system during the operation of the enterprise. This is usually done in order to optimize taxation, or if the right to work under other tax regimes has been lost, for example, the types of activities of the enterprise have changed, or the individual entrepreneur has lost the opportunity to apply the patent system.

For your information! You can switch to the simplified tax system once a year, with the beginning of a new calendar year. At the same time, those wishing to do so must submit a notification to the territorial tax authority about the upcoming transition to “simplified taxation” in advance.

There is less bureaucracy at Income

Entrepreneurs on “Income” are exempt from accounting for expenses. Since expenses do not affect the amount of tax, they are not recorded in the accounting book (KUDiR). Only records of income remain in the book. They are rarely of interest to the tax authorities, so the risk of disputes with them will be lower.

On “Income minus expenses” the opposite is true. Entrepreneurs must compare expenses with the list from Art. 346.16 of the Tax Code of the Russian Federation, write them down in KUDiR and save supporting documents. During the audit, the tax office will try to challenge part of the expenses. Then the entrepreneur has to pay additional tax with fines and penalties.

Also, the costs must be economically justified. If you have a pet store and you have included the purchase of fish food as an expense, this is normal. But if such expenses are declared by an entrepreneur engaged in cargo transportation, the tax office will have questions. Or at the bank - according to 115-FZ, banks are required to monitor suspicious payments.

The simplified tax system “Income minus expenses” has more costs and risks. Therefore, if you pay about the same amount or even a little more tax on the simplified tax system “Income”, it is better to choose “Income”.

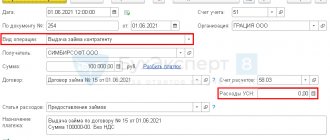

Objects of the simplified tax system: income 6% or income minus expenses 15%

Companies and individual entrepreneurs who have chosen the simplified tax system as their main tax system must then decide on the object of taxation. In simplified terms, there are two of them:

- Income minus expenses 15%. Here, tax payment is made from the difference between the profit and expenses of the organization; At the same time, we must not forget that not all expenses can be taken into account, but only those that are prescribed in the Tax Code of the Russian Federation. That is why it is necessary to keep careful and detailed records of the costs incurred within the framework of commercial activities;

- Income 6%. In this case, tax is paid exclusively on income. The main advantage here is that you do not need to keep track of expenses, that is, collect all kinds of checks, receipts, etc. supporting papers. In addition, it is believed that tax authorities rarely carry out inspections of those individual entrepreneurs and organizations that use the simplified tax system in their activities with a taxable income of 6%.

Attention! The more expenses an entrepreneur has, the more profitable it is for him to apply the object of taxation of income minus expenses of 15%. That is why it is often used by either novice businessmen or those who plan to actively develop their business.

Important! In some cases, for example, if an individual entrepreneur or a company located on the simplified tax system is engaged in social, scientific or industrial projects, it is exempt from paying this tax for a two-year period. True, this possibility can only be realized if local authorities have agreed to it.

Options for the object of taxation

If you decide to switch to a simplified system starting in the new year or are already applying the simplified tax system and are thinking about changing the object of taxation starting next year, then a decision on this must be made before the end of the current tax period. No later than December 31 of the year preceding the start of application of the simplification, a notification must be sent to the inspectorate, respectively:

- on the transition to the simplified tax system (clause 1 of article 346.13 of the Tax Code of the Russian Federation);

- changing the object of taxation (clause 2 of article 346.14 of the Tax Code of the Russian Federation).

In both cases, the key question is the choice of the object of taxation: “income” or “income minus expenses.” After all, the tax burden under this special regime directly depends on it.

Read more about the procedure for notifying tax authorities about the transition to using the simplified tax system in this article .

For information on how to change the object of taxation, read the article “The procedure for changing the object of taxation under the simplified tax system “income”” .

Important! ConsultantPlus warns Once you start using a new object, you need to follow certain rules in tax accounting. They depend on…(read more in K+).

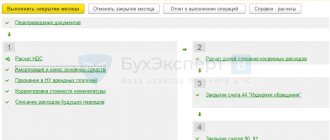

Rules for filing a declaration on the simplified tax system

Another procedure that simplifies the simplified tax system is filing a tax return. Those who work on the simplified exam must take it no more than once a year. Moreover, LLCs must transfer it to the tax authorities no later than March 31, and individual entrepreneurs - before April 30.

There are several ways to submit your tax return:

- In person at the tax office;

- By sending a letter with notification of delivery by Russian Post. It is advisable to include a description of the attachment with the letter. In this case, the deadline for filing the declaration will be the date of its dispatch;

- Through a trusted person. Here you will need a power of attorney certified by a notary;

- Through the website of the Federal Tax Service.

Who can work under the simplified tax system

The prevalence of “simplified” can be explained by the fact that it is acceptable for use by those representatives of the sphere of medium and small businesses who are engaged in providing a certain, and quite wide, range of services and work in relation to the population, as well as other individual entrepreneurs and legal entities. But there are also exceptions. For example, according to the simplified tax system the following are not allowed to work:

- Non-state insurance and pension funds;

- Those companies whose main activity is organizing and conducting gambling, etc.;

- Companies engaged in the extraction and sale of mineral resources;

- Lawyers, notaries;

- Foreign organizations;

- Any financial structures: investment funds, banks, pawnshops, microfinance organizations, etc.;

- Some other business representatives;

- A more complete list is presented here.

This list undergoes periodic changes, so if necessary, it can be clarified by the tax service.

“Expenditures” often have a lower tax rate

6% and 15% are the maximum possible rates, but in practice they are lower. Regional authorities reduce rates for all businesses or only for certain types of activities. Therefore, an entrepreneur must find out the indicator specifically for his case. Check yourself on the Federal Tax Service website. To see information about your region, select it at the top of the page.

General regional rates are more often lower on “Income minus expenses” than on “Income” - more than in a quarter of the regions. Instead of 15%, the rate will be 10%, 7% or even 5%. For example, in the Sverdlovsk region the rate is 7%. But there are also preferential conditions for those who produce clothing, furniture and food products - 5%.

On “Income” the total rate is most often the maximum. For example, in the same Sverdlovsk region it is 6%. But for 48 types of activities there is a preferential rate of 1%, and for trade in shoes and medicines - 4%.

Once you know your rates, you can compare the tax on “Income” and “Income minus expenses.” But besides taxes, there are also insurance premiums - that’s what we need to talk about.

Working conditions under the simplified tax system

Those companies and organizations that work on the simplified tax regime must remember that there are certain conditions under which the simplified tax system loses the right to apply this tax regime. This:

- Excess number of employees. Only those companies that employ more than 100 people have the right to use the simplified tax system;

- Exceeding the established income limit. That is, if an enterprise receives more than 60 million rubles a year, then it does not have the right to be on the simplified tax system;

- The share of participation of outside legal entities in an LLC using the simplified system should not exceed 25%.

- Legal entities with branches and representative offices also cannot operate under the simplified taxation system.

That is, if an enterprise has plans for serious business development, then it is better to abandon the simplified tax system.

How to choose the type of simplified tax system for an individual entrepreneur

The entrepreneur has the right to choose the appropriate simplified tax system. Your choice must be indicated in the notification sent to the tax office upon registration.

The simplified tax system “income” is beneficial for those who spend almost nothing on running their business - do not rent a large office or warehouse, do not purchase goods, do not pay salaries to employees. This type is also suitable for those who find it difficult to document expenses, since the tax office will not accept them.

The simplified tax system “Income minus expenses” is suitable in the opposite situation. Accountants recommend paying attention to this type if expenses account for more than 60% of turnover. For example, such an object of taxation is beneficial in the field of trade or production.

You can switch from one type of “simplified” to another only from January 1 of the next year. To do this, the entrepreneur informs the Federal Tax Service of his intention before December 31 of the current year, using form No. 26.2-6.