Statistical report on occupational safety and health for employers

For the last few years, employers have been reporting on the state of working conditions at the enterprise and compensation paid for work in hazardous and (or) hazardous industries. 1-T reports on labor protection were approved, their submission to regulatory authorities at the end of the year and instructions for filling them out, which should be used to transfer data for 2022.

The report traditionally contains the following data:

- about harmful factors that exist in employees’ workplaces;

- on guarantees and compensation provided to workers engaged in hazardous and (or) hazardous work.

If you previously reported, then update the report form. Although officials made minor technical changes, the law requires reporting on current forms, and old ones cannot be used.

Which form to use

Rosstat has updated Form 1-T information on the number and wages of employees: the new form was approved by Order No. 457 of July 30, 2021. This standard provides the formal form of the report, instructions for filling out and deadlines for submission.

Reports are submitted at different intervals to the territorial representative office of statistical observation Rosstat. Their list depends on the type of organization. Legal entities have the opportunity to find out from the TIN what and when needs to be sent to Rosstat.

Read more: “What kind of reporting should your organization submit to Rosstat: checking by TIN.”

The annual forms include the salary report 1˗T and 1˗T (working conditions) “Information on the state of working conditions and compensation for work with harmful and (or) dangerous working conditions.” The latest form is designed for organizations with harmful factors to the health of employees.

Read more: “How to fill out and submit a new report on working conditions (Form 1-T).”

Periodically, once every 2 years in even years, as of October 31, they submit No. 1˗T (professional) “Information on the number and needs of organizations for workers by professional groups.” The report is prepared by those organizations that are included in the Rosstat selection list.

Read more: “Instructions: prepare a report according to Form 1-T (professional).”

Less often, at the request of the Rosstat order, once every 3-4 years they provide reporting No. 1 (personnel) “Information on training (vocational education and vocational training) and additional education of employees of organizations.”

Read more: “How to fill out statistical form 1 (personnel).”

Who submits the 1-T report

The new report form states on the title page who submits the 1-T report on working conditions at the end of the year. The completed form is submitted to the territorial body of Rosstat by legal entities of all forms of ownership that carry out activities in accordance with the classification according to OKVED (All-Russian Classifier of Types of Economic Activities):

- on mining;

- in manufacturing industries;

- for the production and distribution of electricity, gas and water;

- in construction;

- in transport and communications;

- in the field of agriculture, forestry, and fisheries.

Although the form does not indicate whether organizations that carry out activities in agriculture, hunting and forestry must submit information on working conditions if they have branches and representative offices, the instructions for filling it out say that in this case, each division should be reported separately. Information should be submitted if there are stationary jobs - places created for a period of more than 1 month.

IMPORTANT!

Since concessions have been made for legal entities belonging to small enterprises, the answer to the question of whether small businesses submit information in Form No. 1-T (working conditions) is negative. If you are required to provide such information, please provide an extract from the register of SMEs.

Rules for filling out the report

The document is compiled based on the results of the year - as of December 31.

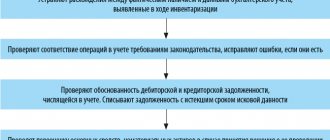

Step-by-step instructions on how to fill out form 1-T in statistics for respondents:

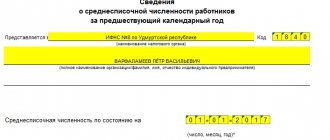

Step 1. The title page must indicate the reporting period, the name of the legal entity, the address of registration and actual location, and the OPKO code.

Step 2. On the next sheet in the table indicate the average number of employees of the enterprise, taking into account the sectors of activity. It is defined as the total sum of the average number of employees for all months of the reporting year / 12. It is necessary to take into account all categories of employees with whom employment contracts have been concluded: part-time workers, seasonal and temporary workers, managers of an enterprise or company, if they are paid salaries. External part-time workers, employees on parental and educational leave, and persons working under civil contracts are not included in the final summary.

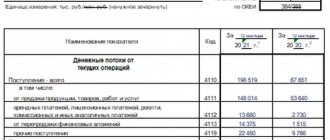

Step 3. On page 3, information about the wage fund of the main payroll workers, part-time workers and those working under the GPA is entered into the table. The corresponding columns indicate all social benefits provided, data on salaries, bonuses, and remunerations. Sick leave is excluded from the final calculation.

The reporting is signed by the manager or employee responsible for providing information to Rosstat. The contractor indicates the date of preparation of the document, telephone number and email address for communication.

When to submit occupational safety information

If you are not among the lucky ones who do not need to submit a report, then the deadline for submitting Form 1-T for 2022 is no later than 01/21/2022. Annual submission of information is necessary due to possible changes in production, exceptions or the emergence of new harmful (hazardous) labor factors.

ConsultantPlus experts discussed how to fill out form No. 1-T (working conditions) starting with the report for 2022. Use these instructions for free.

When should I report?

The deadline for submitting 1-T working conditions for 2022 is 01/21/2022. This is Friday, a working day, and no transfers are provided. Failure to comply with delivery deadlines will result in fines (Article 13.19 of the Code of Administrative Offenses of the Russian Federation):

- from 20,000 to 70,000 rubles. — for a legal entity;

- from 10,000 to 20,000 rub. - for responsible and (or) officials.

The organization will be punished for providing false information and if the company does not submit a report.

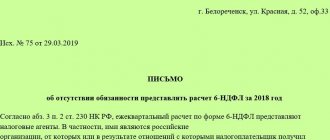

Order No. 457 regulates when a report in Form No. 1-T (working conditions) is submitted and in what form respondents should report. Reporting is sent to the territorial body of Rosstat exclusively in electronic form (500-FZ dated December 30, 2020). The file with the report is signed with an electronic signature and sent to the statistics department by e-mail.

How to fill out form 1-T

The use of any arbitrary forms developed by the enterprise is not permitted. Only the labor safety report form for 2022 No. 1-T working conditions from the order of Rosstat is used. Appendix 1 to Rosstat Order No. 457 dated July 30, 2021 also contains instructions on how to fill out Form 1-T line by line in each section.

Let's look at what a sample report on occupational safety and health at an enterprise for 2022 looks like. Let's start with the title page (header).

A cap

In the header of the form indicate:

- name of the organization (full and short);

- postal address of the enterprise and its index;

- actual location of the company.

If the actual address does not coincide with the legal address, then indicate the actual (postal) address. For a separate division without a legal address, a postal address with a postal code is indicated.

After filling out the header, we’ll figure out how to fill out the 1-T labor report in the main part, section by section.

First section

It must indicate how many employees of the enterprise are exposed to dangerous and/or harmful factors at the enterprise. All employees of the enterprise are accepted for registration. Rosstat's instructions indicate which persons are not taken into account when preparing indicators for all sections of Form No. 1-T (working conditions) - women on maternity leave and persons on maternity leave.

Line 01 contains data on the total number of employees at the enterprise without taking into account the factors affecting them.

In line 02, fill in the indicator for the total number of “employed in work with hazardous working conditions.” These data are filled in based on a special assessment. The number of workplaces that are recognized as harmful or hazardous to health is taken into account. If an employee is exposed to several risk factors, then it should be taken into account only once, without taking into account the number of factors in force.

Lines 03–13 - decoding of line 02 for individual harmful factors affecting humans. If a workplace is exposed to several risk factors, then such an employee must be taken into account for each factor separately.

Line 12 describes the employee's physical activity.

Line 13 characterizes the intensity of the mental process.

All data in the first section is provided without taking into account the availability of guarantees and compensation for employees.

Second section

The second section of the 1-T statistical reporting form is intended to indicate information about employees for whom certain compensations are established. Only workers in conditions with an unfavorable climate and in areas contaminated with radiation are not taken into account. As the example of filling out the table of indicators on labor protection shows, data on women and workers under 18 years of age are reflected in this section separately.

Lines 20, 21 and 24 indicate information about the number of employees who are entitled to annual additional paid leave, reduced working hours and increased wages. Such regulations must be coordinated with the local regulations of the enterprise and the Labor Code of the Russian Federation.

Page 22 provides data on the number of workers receiving free food for medical and preventive purposes.

On page 23 there is information about employees who are entitled to free milk and other healthy products.

On page 25 - the number of workers employed in hazardous and/or hazardous work and who are required to undergo regular medical examinations.

Page 26–28 contain information about persons who have the right to receive an early pension for having worked in difficult and harmful working conditions. Page 28 also takes into account employees with other old-age insurance pensions for unfavorable working conditions.

On page 29 there is information about workers who, working in unfavorable conditions, received at least one compensation or guarantee (increased wages, for example).

On page 30 - workers who, for working in difficult conditions, receive free special clothing, special-purpose footwear and other personal protective equipment.

Page 31 provides information on obtaining such funds to protect against the influence of adverse factors.

Column 5 of each line of the second section indicates the actual amounts excluding VAT that were spent on paying for additional allowances, free food and personal protective equipment, which is included in the wage fund in this area. Expenses are indicated for the year, and data on the number of employees in column 3 is at the end of the year. In this regard, if workers have enjoyed certain benefits and/or compensation for some time, but at the end of the year the employment contract with them has already been terminated, the information in the third column is not indicated. Or, conversely, when filling out the number of workers, the absence of data on payments is allowed, since there might be no money for them.

Please note that the form is filled out by an employee who has all the necessary information or access to it. He has the right to sign the report if the employee has such authority by order of the manager. If there are none, then the document is signed by the head of the organization.

At the end of the section, when submitting a report on Form No. 1-T (working conditions), indicate an e-mail and telephone number for contact, and enter the date the form was compiled.

New instructions for filling out labor indicators in statistical reporting

Belstat approved new Instructions No. 1 on filling out the following labor indicators in state statistical observation forms (hereinafter referred to as the forms):

— number of employees in the organization;

— movement of workers;

— use of the calendar fund of time;

— wage fund and average wages of employees;

- other payments and expenses that are not reflected in the payroll.

Previously, the procedure for filling out the listed indicators was regulated by Instructions No. 92, which are currently no longer in force.

Instructions No. 1 came into force on February 19, 2020, but they should be taken into account when filling out labor indicators from February 2022 inclusive <*>.

Taking into account Instructions No. 1, changes were also made, for example, to Form 12 “Labor Report” and Instructions No. 163.

Number of employees, movement of workers. Calendar time fund

What changed? Let's figure it out.

1. Indicators of the number of employees. A general rule has been highlighted according to which indicators of the number of employees in the forms are reflected in whole numbers. An exception is cases when indicators can be reflected with one decimal place, but this must be established in the forms themselves and (or) instructions for filling them out <*>.

2. Number of employees . New categories of workers have appeared that are included in the payroll:

— workers performing remote work <*> ;

- unemployed people who are registered as such with the labor, employment and social security authorities and hired for work in the direction of these authorities <*>.

3. The number of employees temporarily absent from work. Workers aimed at preventing accidents will now also be included in the payroll of workers temporarily absent from work <*>. At the same time, the category of employees who are on leave in connection with the adoption of a child under the age of three months is excluded <*>.

On a note! An employee who has adopted a child under the age of three months or has been appointed as his guardian is granted maternity leave for a period of 70 calendar days from the date of adoption or establishment of guardianship. In the future, at the request of such employees, they are granted parental leave until the child reaches the age of 3 years <*>. Thus, employees on leave in connection with the adoption of a child under the age of three months are now included in the category of employees on maternity leave, to care for a child until he reaches the age of 3 years, and are still taken into account in the payroll <*>.

It has been established that the payroll now also includes workers who did not show up for work because they were given a day of rest that day for working overtime <*> . Previously, these were only workers with overtime working hours when accounting for it in aggregate <*>. Thus, the payroll now includes employees who:

— a day of rest was provided for working overtime;

— any procedure for recording working time has been established in accordance with the Labor Code: daily, weekly, summarized <*>.

4. Workers who are not included in the payroll. Employees who are not included in the payroll include persons recruited to work in the organization on the basis of a contract for the provision of labor. These persons no longer include military personnel <*>. At the same time, workers who are not included in the payroll now include persons with drug addiction or substance abuse, placed in labor treatment centers and brought to work in the prescribed manner <*>. Previously, contracts for the provision of labor could only be concluded with government organizations. In accordance with Directions No. 1, contracts are concluded with organizations . Thus, the parties to the contract for the provision of labor can now be both commercial and non-profit organizations.

5. List of employees as of date. The list of employees for each calendar day also includes employees who were absent from work. At the same time, it was clarified that these were absent employees not for any reasons, but specifically for those listed in paragraph 5 of Instructions No. 1 <*>.

6. Average number of employees for the period. It is clarified that the procedure for calculating the average number of employees on the payroll for a quarter, if the organization worked for an incomplete quarter , is carried out by summing up the average number of employees on the payroll for all months of work in a given quarter and dividing the resulting amount by 3 <*> .

7. Calculation of the average number of employees. It has been added that when calculating the average number of employees, employees raising a disabled child under 18 years of age are also excluded from the number of employees, who, upon application, are granted one additional day off from work every month with payment in the amount of the average daily earnings at the expense of state social funds. insurance in accordance with the law, on the day of absence from work <*>.

In the average payroll, not only workers in agricultural organizations are now taken into account as whole units, but also workers in crop production , for whom a summarized accounting of working time for the annual accounting period is established <*>.

8. Employees hired for additionally introduced jobs (blue and white collar workers). The list of employees who are not included in the number of employees hired for additionally introduced jobs has been expanded. In particular, they now include those hired for work that, more than 6 months before the conclusion of the employment agreement (contract), was performed in this organization by an individual under the GAP <*>.

9. Employees who stand out in forms from the number of laid-off workers.

In the forms, from the number of dismissed workers, it is no longer necessary to single out workers dismissed at their request and by agreement of the parties <*>.

10. Indicators of use of the calendar fund . The list of man-days of absence for valid reasons has been expanded to include employee absences:

in connection with training for military service with separation from work, conscription for military and special training <*>;

attributable to the period of leave granted to the father (stepfather) at the birth of a child <*>;

aimed at preventing accidents <*>.

It has been established that the use of calendar time for employees performing remote work is reflected similarly to homeworkers <*>.

11. Filling examples . In the example of filling out the indicators, the indicator for part-time workers has been changed: instead of the average number of man-days of “absence permitted by law”, it is now necessary to take into account the average number of man-days of “absence for good reasons” <*>.

Also in the text of Guidelines No. 1, the following terms have been replaced:

- “holidays”, “holidays (non-working) days” for the term “non-working holidays”;

On a note! A non-working holiday is a holiday established and declared a non-working day by the President of the Republic of Belarus <*>.

— “failure to appear due to illness” to the term “temporary incapacity for work, issued by certificates of incapacity for work or certificates of temporary incapacity for work.” This term is also changed in the footnote <***> to Appendix 4 to Instructions No. 1 <*>.

Salary fund

To reflect the indicators in the forms of state statistical reporting, the following payments are still included in the wage fund <*>:

— wages for work performed and time worked;

— incentive payments;

— compensatory payments;

— payment for unworked time;

- other payments.

Instructions No. 1 detail the payments for each of these groups. At the same time, the wording of many positions has been clarified or supplemented in comparison with Directive No. 92.

In particular, wages for work performed and time worked include:

- wages accrued to citizens registered with the labor, employment and social protection authorities as unemployed, sent to organizations to gain practical work experience in their acquired profession, specialty (specialty area, specialization), qualifications, including wages compensated to the employer for budget account <*>;

- remuneration to a civil servant for performing the functions of a state representative in the management bodies of business companies, paid in accordance with the procedure established by law by the state body in which the civil servant works <*>.

It is clarified that bonuses (of a systematic nature, one-time, annual bonus) are taken into account as part of incentive payments, regardless of the sources of their payment <*>. Additional payments (allowances) to young specialists with higher and secondary specialized education, established in accordance with the law, are reflected as incentive payments. Previously, these payments were taken into account for young specialists with higher and secondary specialized education employed in organizations of the agro-industrial complex <*>.

According to the new procedure, compensation payments should include additional payments to employees when combining the positions of employees (professions of workers), expanding service areas (increasing the volume of work), performing the duties of a temporarily absent employee without exemption from work determined by the employment contract or job description. Previously, these payments were classified as payments for time worked <*>.

The list of types of payment for unworked time now also includes the wages of donor employees, retained for them at the expense of the employer in the manner established by law, for the days they perform the donor function <*>.

Instructions No. 1 also contain an updated list of other payments and expenses that are not reflected in the wage fund. Now such payments include compensation for the mobile and traveling nature of work, work performed on a rotational basis, for constant work on the road, work outside the place of residence (field allowance) within and in excess of the norms established by law. Previously, such payments made in accordance with the law were included in the wage fund as compensatory payments <*>.

It is also determined that the following are not included in the wage fund:

- bonus, compensation for unused labor leave, financial assistance and other payments to employees on maternity leave, to care for a child until he reaches the age of three years and who are not taken into account in the average payroll <*>. Let us note that this provision was previously contained in the Instructions for filling out a report, Form 12 “Labor Report”;

— cost of purchased bottled water <*>;

— expenses for holding presentations, meetings, seminars, entertainment events, including expenses for catering for them <*>;

- material assistance and other payments for the Day of Disabled Persons of the Republic of Belarus, the Day of Remembrance of Internationalist Soldiers, the Day of the Chernobyl Tragedy (previously these payments were named only for the Day of Disabled Persons of the Republic of Belarus) <*>;

— wages accrued to employees for the day of the republican cleanup day and transferred by the employer in the prescribed manner (subclause 53.41 of Instructions No. 1);

- payments to employees made by the employer and compensated in accordance with the law from budget funds intended to reimburse the costs of eliminating the consequences of the disaster at the Chernobyl nuclear power plant <*>;

— income from shares and other income from the employee’s participation in the organization’s property (dividends, interest) <*>;

- payments provided to persons who do not work in this organization (pensioners, disabled people, families of the deceased and other persons) <*>.

Resolution of the National Statistical Committee of the Republic of Belarus January 20, 2022 N 1

Normative base

Order of Rosstat dated July 30, 2021 No. 457 “On approval of forms of federal statistical observation for organizing federal statistical observation of the number, conditions and remuneration of workers, the need of organizations for workers by professional groups, composition of personnel of the state civil and municipal service”

Order of Rosstat dated 24.07. 2020 No. 412 “On approval of forms of federal statistical observation for the organization of federal statistical observation of the number, conditions and remuneration of workers, the need of organizations for workers by professional groups”