What are the ratios?

Immediately after sending the calculation of insurance premiums, the 2022 DAM report is checked online to ensure that logical controls are performed.

And after the Federal Tax Service accepts the calculation, it will begin to be checked for errors and violations of reporting indicators. To do this, Federal Tax Service specialists use control ratios - mathematical reconciliation of the entered data. This method helps to check the accuracy and correctness by comparing certain groups of indicators. For logical control, use the new version of the Tester program. It must be downloaded from the Federal Tax Service website and installed on your work PC.

IMPORTANT!

Starting with reporting for the 1st quarter of 2022, a new DAM form is in effect from Federal Tax Service Order No. ED-7-11 / [email protected] dated 10/06/2021. But the new CS have not yet been approved. To check, use the ratios that are given in letter No. BS-4-11 / [email protected] dated 02/19/202.

Insurance premium payments must be submitted no later than 30 calendar days from the end of the billing period. If it is a weekend, the deadline is extended to the first working day. For example, for the 1st quarter of 2022, you must report by 05/04/2022, since 04/30/2022 falls on a Saturday, and then the long May holidays begin.

ConsultantPlus experts discussed how to check the CS in the RSV. Use these instructions for free.

to read.

Control ratios allow you to check the correctness of filling out the DAM not only for tax authorities, but also for policyholders - as self-control. This mathematical check is a table that contains:

- calculation formulas indicating fields, rows, cells and sheets;

- references to the norms of current legislation that are violated in the calculations of contributions;

- comments on the violation of fiscal legislation;

- actions of a representative of the tax inspectorate when a violation is detected.

The new table presents not only methods for checking data within the report, but also the control ratios of 6-NDFL and DAM in 2022 - inter-document controls. A mandatory condition applies: an economic entity that has submitted a report in form 6-NDFL is required to report in the DAM form. If the payment for contributions is not provided on time, the tax authorities will send a request to provide a report in a unified form.

IMPORTANT!

To check discrepancies between 6-NDFL and DAM, not only control ratios for DAM are used, but also formulas developed for 6-NDFL. They were approved in the letter of the Federal Tax Service No. BS-4-11 / [email protected] dated 03/23/2021.

What contribution ratios have been clarified?

Next, in the left column we present the text of the ratio, and in the right column - the violation of the Tax Code of the Russian Federation.

Between the indicators for calculating insurance premiums:

| 1.84 | |

| (gr. 2 p. 060 subdivision 1.2 appendix 1 R.1 gr. 3 p. 060 subdivision 1.2 appendix 1 P.1 gr. 4 p. 060 subdivision 1.2 appendix 1 P.1) = (( gr. 001 appendix 1 R.1 tariff of insurance premiums) ≤ (gr. 2 p. 020 subdr. 1.2 appendix 1 R.1 gr. 3 p. 020 subdr. 1.2 appendix 1 R.1 gr. 4 p. 020 subdr. 1.2 appendix 1 R.1) / 3 × 0.5 kopecks | SV for compulsory medical insurance for the last 3 months of the reporting period ≠ base for calculating SV, multiplied by the tariff corresponding to the payer code greater than the number of f.l., cat. beginning SV for compulsory medical insurance for the last 3 months of the reporting period × 0.5 kopecks. |

| 1.138 Payer tariff code "01" | |

| if gr. 2 pp. 055 adj. 2 R. 1 gr. 3 pp. 055 adj. 2 R. 1 gr. 4 pp. 055 adj. 2 R.1 = 0, then ((gr. 2 p. 060 app. 2 R.1 gr. 3 p. 060 app. 2 R.1 gr. 4 p. 060 app. 2 R.1) = (gr 2 page 050 appendix 2 R.1 group 3 page 050 appendix 2 R.1 group 4 page 050 appendix 2 R.1) × corresponding to the value of field 001 appendix 2 R.1 insurance premium rate ) ≤ (gr. 2 p. 015 appendix 2 R.1 gr. 3 p. 015 appendix 2 R.1 gr. 4 p. 015 appendix 2 R.1) / 3 × 0.5 kop. | In the absence of payments in favor of foreign citizens, SV on OSS for the last 3 months of the reporting period ≠ base for calculating SV multiplied by the tariff corresponding to the payer's tariff code greater than the number of f.l., cat. beginning SV on OSS for the last 3 months of the reporting period × 0.5 kopecks. |

| 1.140 Payer tariff code other than “01” | |

| ((gr. 2 p. 060 app. 2 R.1 gr. 3 p. 060 app. 2 R.1 gr. 4 p. 060 app. 2 R.1) = (gr. 2 p. 050 app. 2 R.1 gr. 015 appendix 2 R.1 group 3 page 015 appendix 2 R.1 group 4 page 015 appendix 2 R.1) / 3 × 0.5 kopecks | SV on OSS for the last 3 months of the reporting period ≠ base for calculating SV, multiplied by the tariff corresponding to the payer's tariff code greater than the number of fl., cat. beginning SV on OSS for the last 3 months of the reporting period × 0.5 kopecks. |

How control ratios are used for DAM

The Federal Tax Service regulations explain that this, the left part of the KS and the right part of the KS in the DAM, is a comparison of two different sections of the calculation in one formula. There are two options for checking RSV:

- intraform control is a check of indicators within the calculation itself. That is, whether the accountant performed the arithmetic calculations correctly;

- Inter-document control is a form of control that involves comparing the indicators of different reporting forms.

For each control category, special control ratios are provided. We offer verification instructions:

- Control inside the report:

- if you fill out reports using specialized accounting programs, then this type of control is carried out automatically;

- when filling out the form manually, check that the taxable base is calculated correctly - this is the sum of all charges minus non-taxable amounts;

- check the correctness of calculation of contributions according to the approved insurance tariffs (base multiplied by the tariff);

- when filling out the third section, control the arithmetic operations (the amount of accrued earnings for the reporting three months);

- deposit amounts in rubles and kopecks;

- the total amount of the third section for all employees of the organization must correspond to the amount of accruals in the second section.

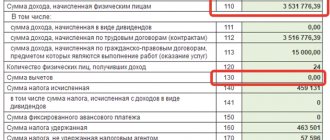

- We compare the indicators with other forms. Control ratios with 6-NDFL are applied as follows: the sum of lines 112 and 113 is greater than or equal to line 050 of Appendix 1 to Section 1 of the RSV. If equality is not met, then the payer has underestimated the amount of the tax base.

Another control ratio with 6-personal income tax: p. 110 rub. 2 6-NDFL – page 111 rub. 2 6-NDFL greater than or equal to p. 050 gr. 1 other 1.1 rub. 1 RSV. This ratio is applied from the report for the 1st quarter of 2021 and only for payers without separate divisions. The formula does not apply to individual entrepreneurs who use PSN.

For clarity, let us present in the table the control ratios of the DAM and 6-NDFL in 2022 for taxpayers:

| Reporting form | Identifier | KS |

| Letter No. BS-4-11/ [email protected] dated 03/23/2021 | ||

| 6-NDFL, RSV | 3.1 | line 112 + line 113 >= line 050 of appendix 1 to section 1 of the DAM (the ratio applies to the reporting period for the tax agent as a whole, taking into account separate divisions) |

| Letter No. BS-4-11/ [email protected] dated 02/19/2021 | ||

| RSV, 6-NDFL | 2.2 | Art. 110 rub. 2 6-NDFL - art. 111 rub. 2 6-NDFL >= art. 050 gr. 1 other 1.1 rub. 1 RSV |

IMPORTANT!

The relationship between 6-personal income tax and the total amount of payments under the DAM is not always met. The exception is completely non-taxable payments: daily allowances within the standard and child benefits are not indicated in 6-NDFL, but are included in the total amount of payments in the DAM. In this case, the Federal Tax Service will require clarification.

Now let’s look at what the KS 2.06 identifier in the RSV is and how to answer the tax authorities’ question about the discrepancies. Until 2022, the form for calculating insurance premiums from the Order of the Federal Tax Service No. ММВ-7-11/470 of September 18, 2019 was in force. And the control ratios from letter No. BS-4-11 / [email protected] dated 02/07/2020 were applied to it. After Order No. ММВ-7-11/470 lost force, the old Constitutional Courts also ceased to be valid.

Previously, tax authorities monitored payments to insured persons using KS 2.6 and 2.7 identifiers; now these codes are not in the list of verification indicators. And it will not be possible to provide an explanation for the identifier KS 2.06 in the RSV. These codes are given in letter No. BS-4-11/ [email protected] , which is no longer used. But the Federal Tax Service still controls the level of payment within the framework of labor relations and compares them with the minimum wage and the average salary for the industry in the region for the previous year. We remind you that the minimum wage in 2022 is 13,890 rubles.

Control ratios allow tax authorities to identify understatement of the base for calculating insurance premiums. To check, the inspector compares:

- Minimum wage with payments separately for each employee;

- the regional industry average salary for the past year with the average amount of payments per employee per month.

If payments to employees are less than these indicators, the inspector will request an explanation.

Why do we need new KS on contributions?

New control ratios are needed by small and medium-sized businesses (SMEs) to check the correctness of filling out the DAM in terms of payments to individuals over 1 minimum wage, which are subject to reduced insurance premiums from April 1, 2022.

Earlier, in a letter dated 04/07/2020 No. BS-4-11/5850, the Federal Tax Service provided temporary tariff codes and categories of the insured person. It is for these codes that new control relations have been introduced.

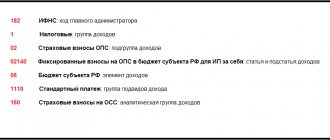

For reduced contributions from the part of payments that is above 1 minimum wage, the tariff code is 20.

For insured persons, for part of payments from 1 minimum wage, the category codes are as follows:

- MS - individual;

- VZHMS - foreigners and stateless persons insured in the OPS system who temporarily reside in Russia, as well as foreigners or stateless persons temporarily residing in the Russian Federation who have been granted temporary asylum;

- VPMS - foreigners and stateless persons who temporarily stay in the Russian Federation (with the exception of highly qualified specialists).

Please note that all listed codes may become permanent.

For these codes, additional formulas have been added to the control ratios for contributions:

FOR PAYER RATE CODE

FOR INSURED PERSON CATEGORY CODE

If there are other 1.1 adj. 1 rub. 1 SV according to field value 001 adj. 1 rub. 1 SV = 20 obligation to find information about the payer in the SME register at the beginning of each month in which gr. 2, 3, 4 along lines etc. 1.1 adj. 1 rub. 1 CB > 0

If in other 3.2.1 rub. 3 SV according to FL (according to SNILS full name indicators) field value 130 = MS, then in other. 3.2.1 rub. 3 SV for this FL with a value in field 130 = NR line 150 for each field value 120 = minimum wage

Online services and verification programs

In practice, it is quite difficult to manually check benchmark ratios for insurance premiums. Representatives of the Federal Tax Service recommend drawing up the form electronically rather than on paper. Let us remind you that only those insurers whose average number of employees does not exceed 10 people report to the regulatory authorities (FTS, FSS and PRF) on paper. Insurers with 11 or more employees are required to report electronically.

To prepare reports, use specialized accounting programs that must be installed on your work computer, or online services. All programs already have a valid online check of DAM control ratios, which greatly simplifies the work of an accountant.

What are control ratios

The Federal Tax Service of Russia regularly develops and sends to territorial inspectorates the results of control ratios for the DAM: the left part of the KS and the right part of the KS are formula indicators that correspond to the sections of the calculation of insurance premiums (letter of the Federal Tax Service No. BS-4-11/ dated 02/19/2021). Control ratios (CRs) are a tool for checking the correctness of data in the DAM. Verification is performed by comparing interrelated indicators. They allow inspectors of territorial tax authorities accepting the calculation to check it for compliance with current legislation in terms of regimes, tariffs and benefits applied by payers, and for the presence of arithmetic, logical errors, etc. Organizations and individual entrepreneurs use control ratios for self-checking before send a report to the tax authorities.

How to work with online resources

The report verification algorithm depends on the selected software type. In general, checking the DAM online for free in 2022 will be as follows:

- Prepare the report electronically. For example, use specialized accounting programs or applications from the official website of the Federal Tax Service.

- Check the finished report using internal control. Such actions provide standard settings for accounting programs.

- If the program does not support intra-form control, then check the RSV like this:

- upload the report in xml format - this is a special reporting format;

- upload the report file to the application for verification or upload the reports to the website;

- follow the recommended software actions;

- correct errors identified by the check;

- submit reports to the Federal Tax Service.

IMPORTANT!

Advice! If you submit reports via secure communication channels and use specialized software, such a reporting program provides for mandatory forms of control. For example, PP "SBIS" will check the report for arithmetic errors and indicate discrepancies with 6-NDFL.

Current reference ratios

IMPORTANT!

Despite the fact that the form for calculating insurance premiums has been updated, the CS has not yet been changed. And although after changing the DAM form, the letter of the Federal Tax Service No. BS-4-11/ dated 02/07/2020 actually lost force (the CS checked the DAM from Order No. ММВ-7-11/ dated 09.18.2019), the new indicators have not yet been approved. When checking the current calculation form, use the KS from letter No. BS-4-11/, but take into account changes in the contents of the report and the new line numbering.

Let's give an example. Previously, the KS 2.06 identifier was used for verification. Currently this indicator is not in the list of CS.

The indicators of control ratios are communicated to lower tax authorities as an appendix, which is a table consisting of six main columns:

- Source documents.

- KS included in the indicators: No.

- Description of the CS.

- In case of non-compliance with the CC - as part of the indicators: possible violation of the legislation of the Russian Federation (with links to the relevant regulations).

- Formulation of the violation.

- Actions of the inspector.

IMPORTANT!

The control ratios of 6-NDFL and RSV are given in another standard - letter of the Federal Tax Service No. BS-4-11/ dated 03.23.2021. An organization or individual entrepreneur that reports in Form 6-NDFL is required to report in the DAM form. If the calculation is not provided on time, tax authorities will send a demand and apply sanctions within the framework of the Tax Code of the Russian Federation.

Not all services are equally “free”

When using the new online service for reconciling insurance premium reports, be vigilant. Some sites offer a free test - a one-time reporting reconciliation. Further control of forms is paid.

For example, if the site requires you to enter a phone number or card, then money will be debited from your accounts. But reporting control services are not always provided. Fraudsters have come up with a number of tricks. For example, during an online check, the site produces a new error that the accountant has not encountered before. But the service does not provide explanations for the shortcomings, but requires payment. Be carefull!

We recommend working with official services and applications. For example, download software for reporting insurance premiums on the Federal Tax Service website.

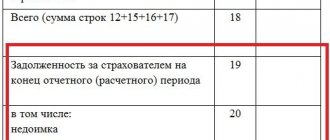

Rules for submitting RSV

Employers submit this calculation to the Federal Tax Service at the end of the year and quarterly. The new reporting form was approved by Federal Tax Service Order No. ED-7-11/ [email protected] dated 10/06/2021. Policyholders will submit the updated DAM for the first quarter of 2022 for the first time. Order No. ED-7-11/ [email protected] sets out the procedure for filling out the DAM and the tariff codes of the insurance premium payer. See all codes in Appendix No. 5. For example, tariff codes 01 and 20 in the DAM in 2022 are used for different payers:

- 01 - payers with the basic tariff;

- 20 - small and medium-sized businesses (209-FZ dated July 24, 2007).

Report on insurance premiums no later than the 30th day of the month following the reporting (calculation) period. In 2022, the deadlines for submitting this form look like this:

- for the 1st quarter - until 05/04/2022 (postponement from Saturday 04/30/2022);

- 6 months - until 08/01/2022 (postponement from Saturday 07/30/2022);

- 9 months - until 10/31/2022 (postponement from Sunday 10/30/2022);

- for 2022 – until 01/30/2023.