Inventory

Regardless of the organization in which the inventory is carried out, there are its main types and rules for conducting it. The main types of inventory include:

- planned;

- unscheduled.

Planned organization should be carried out by all companies at the end of the year, before drawing up annual responsibilities. Unscheduled inventory is carried out in cases where there is an urgent need for it. For example, when a fact of theft is revealed, when a financially responsible person is changed, or when a company is liquidated. Based on the results of the inventory of material assets, shortages or surpluses may be identified.

What is shortage

Important! Shortage is understood as the difference between accounting data and the actual balance at the current time, identified during a full or partial recalculation of any group of goods.

The main document regulating the procedure for taking inventory is Order No. 49 of the Ministry of Finance. According to this document, the initial actions of the inventory commission when receiving results are:

- Establish the degree of responsibility of each person involved.

- Reclaim receivables that are in doubt, transfer unfinished barter and existing debts.

- Make an inventory of valuables deemed unsuitable or unrecoverable.

- Identify the reasons for surpluses or shortages.

- Receive an explanation of the shortage.

Identifying shortages at a point of sale

If a shortage is detected at a retail outlet, the following actions are possible with respect to the seller:

- Demand from him an explanation regarding the identified shortage.

- If the seller is found to be at fault, or there is liability under a collective agreement on financial responsibility, then the shortage, which cannot be written off, can also be deducted from wages. In the first case in the full amount, in the second - in a certain percentage. Interest deductions exceeding 20% are established only in court.

Amounts collected from employees should not exceed their official salary. However, if necessary, by court decision, it is possible to exceed it.

How is the shortage identified?

The inventory is regulated by Order of the Ministry of Finance No. 49 dated June 13, 1995. Initially, when conducting an inventory, its results are documented in inventory lists.

Question: Based on the results of the inventory, how can we deduct the shortfall from the employee’s wages and reflect this operation in accounting? View answer

If a shortage is detected, the following documents are drawn up:

- comparison sheet;

- statement of discrepancies;

- protocol of the inventory commission;

- explanatory notes from financially responsible persons.

On a note! Comparison statements and acts have unified forms: INV-18, INV-19, TORG-2, however, organizations can also use independently developed forms enshrined in the LNA (Federal Law No. 402 of 6/12/11, Art. 9- 4).

The reasons for the shortage may be the following:

- within the limits of attrition rates;

- incompetence of responsible persons, incorrect maintenance of primary records of values;

- theft, natural disasters, other force majeure circumstances.

Question: How to reflect in the organization’s accounting the offset of the shortage of materials with surpluses due to re-grading identified during the inventory? View answer

The protocol records one of the reasons, and then the accountant reflects the shortage with postings, guided by this document.

IMPORTANT! A sample order for writing off shortages based on inventory results in the absence of culprits from ConsultantPlus is available at the link

Incompetent completion of documents and careless storage of inventory items can also lead to shortages. In this case, it is necessary to give the person in charge time and the opportunity to put the documents in order, recalculate the values and compare them with the accounting data to detect errors.

If even after these actions the missing values are not found, the organization’s material losses are attributed to the guilty person. This is an employee who signed a liability agreement and violated its terms by his actions (storekeeper, salesman, cashier).

If a case of theft is discovered, inventory materials are usually sent to the court and write-off occurs depending on its decision: to the guilty person or to the company’s costs, if this person is not identified by the court.

Actions of the employer upon detection of a shortage

If a shortage is detected, the seller’s actions will be as follows:

- Require employees to write an explanatory note regarding the lack of valuables. If an employee refuses to give explanations, then it is necessary to draw up an appropriate act of refusal, in accordance with the requirements of the Labor Code of the Russian Federation.

- Collect shortfalls from workers. This can only be done within a month from the date of the inventory results. After this period, recovery can only be applied in court. The employer can give an order for recovery in an amount not exceeding the average monthly salary. If it is necessary to recover a large amount, then this can only be done through the court.

Attribution of the amount of the shortfall to the guilty party

Regulatory regulation

The procedure for holding an employee financially liable for damage caused to the employer is established by Chapter 39 of the Labor Code of the Russian Federation. The employee is obliged to compensate the employer for direct actual damage caused to him (Article 238 of the Labor Code of the Russian Federation).

An employee's financial liability may be:

- limited (Article 241 of the Labor Code of the Russian Federation) - within the limits of the employee’s average earnings;

- full (Article 243 of the Labor Code of the Russian Federation) - in the following cases: the employee is charged with full financial responsibility for damage caused to the employer during the performance of his job duties;

- a shortage of valuables entrusted to the employee on the basis of a special written agreement or received by him under a one-time document was discovered;

- the damage was caused intentionally;

- the damage was caused while under the influence of alcohol, drugs or other toxic substances;

- the damage was caused as a result of the employee’s criminal actions established by a court verdict;

- the damage was caused as a result of an administrative offense established by the relevant government body;

- information constituting a secret protected by law was disclosed;

- the damage was caused while the employee was not performing his job duties;

- responsibility is established by the employment contract concluded with the deputy heads of the organization and the chief accountant.

Financial liability occurs when simultaneously present (Letter of Rostrud dated 10/19/2006 N 1746-6-1):

- unlawful behavior (actions or inactions) of an employee;

- causal connection between the unlawful act and material damage;

- presence of guilt in committing an unlawful act (inaction).

Before making a decision on compensation for damage by a specific employee, the employer is obliged to conduct a check to determine (clause 4 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated November 16, 2006 N 52):

- the amount of damage caused;

- the reasons for its occurrence;

- employee's fault.

It is also necessary to request a written explanation from the employee to establish the cause of the damage (Article 247 of the Labor Code of the Russian Federation). In case of refusal or evasion of the employee from providing the specified explanation, an appropriate act must be drawn up.

Collection of the deficiency from the guilty person is carried out by order of the employer, which he must issue no later than one month from the date the amount of damage is established (Article 248 of the Labor Code of the Russian Federation).

The employer, taking into account the specific circumstances under which the damage was caused, may fully or partially refuse to recover damages (Article 240 of the Labor Code of the Russian Federation).

Debt can only be collected through legal proceedings if:

- the month period has expired;

- the employee does not agree to voluntarily compensate for the damage caused to the employer;

- the amount of damage caused to be recovered from the employee exceeds his average monthly earnings;

- the employee undertook to compensate the damage voluntarily, but quit before the debt was fully repaid and refused to pay the debt.

To account for settlements with employees, account 73.02 “Calculations for compensation of material damage” is used (chart of accounts 1C).

If the guilty person is identified, the shortage is assigned to him on the date (clause 8, clause 7, article 272 of the Tax Code of the Russian Federation):

- recognition of damage by the guilty party;

- the entry into force of a court decision to recover the amount of damage.

The amount of damage is calculated based on market prices, but cannot be lower than the value of the property according to accounting data (Article 246 of the Labor Code of the Russian Federation).

The difference between actual and market value is taken into account in:

- BU - as part of other income (clause 16 of PBU 9/99);

- NU - as part of non-operating income (clause 3 of article 250 of the Tax Code of the Russian Federation, clause 4 of clause 4 of article 271 of the Tax Code of the Russian Federation).

Accounting in 1C

Attribute the shortfall at the expense of the guilty person using the document Transaction entered manually, transaction type Transaction through the section Transactions – Accounting – Transactions entered manually.

In the document please indicate:

- from - the date of written recognition of the damage by the guilty party;

Write-off of the shortage to the guilty party at the actual (book) cost of the goods:

- Debit - 73.02 “Calculations for compensation of material damage”; Subconto - Ivanov Alexander Pavlovich , the MOL is indicated from the directory Individuals , from whom the amount of the deficiency is subject to recovery;

Writing off the difference between the actual and market value of the goods to the guilty party:

- Debit - 73.02 “Calculations for compensation of material damage”; subconto - Ivanov Alexander Pavlovich , the MOL is indicated from the directory Individuals , from whom the amount of the deficiency is subject to recovery;

Income tax return

In the income tax return, the difference between book value and market value is reflected in non-operating income: PDF

- Sheet 02 Appendix No. 1 page 100.

Inventory shortage: what should the financially responsible person do?

The warehouse manager, administrator, senior cashier, etc. can act as a financially responsible person. According to them, the legislation provides for the following:

- After the deficiency report is issued, the responsibility of the person who, according to the documents, bears this responsibility begins.

- Liability may arise both in accordance with the provisions of the law and in accordance with the terms of the signed agreement on liability.

- If the deficiency of the responsible person is not related to the performance of his job duties, then bringing him to justice is possible only by a court decision.

How to apply

When, as a result of the inventory, a shortage is identified, a special statement will be required, which contains information about the identified discrepancies according to accounting data and actual balances. This statement contains the following:

- the amount of the shortage in monetary terms;

- natural loss acceptable to the company;

- market and book value of the product, as well as the difference derived between them.

After registration, the statement is signed by all members of the inventory commission. After this, all reports are sent to the accounting department, which already carries out the final reconciliation of accounting and actual data. In order to register a shortage, special unified forms are used:

- act of inventory of goods in transit;

- an inventory of the received goods, which are stored on the sales floor or in the warehouse;

- collation statement.

Write-off of shortage

Write-off of the shortage is possible subject to the following conditions:

- write-off is carried out for the calendar year in which the inventory took place;

- the shortage has a clear quantitative expression;

- The product being written off must correspond to its name.

If the above factors are met, you can proceed directly to write-off. The order will be as follows:

| Procedure | What does it include |

| Issuance of an order | The manager issues a corresponding order (unless the internal documents of the company provide otherwise) |

| Write-off | Write-off is made from credit to debit to the account provided for by the accounting procedure |

| Coverage of expenses | If transportation costs are required to be covered, as well as payment for the persons who carried out the inventory, then the required amount should also be added to the same debit account |

| Data Mapping | The accounting department receives calculations based on natural loss rates, which are compared with the actual shortage. If the shortage exceeds, then a write-off is carried out. |

| VAT recovery | VAT may or may not be reinstated. In case of recovery, it is reflected in debit. |

Customer Reviews

Gratitude from Truk N.N. I would like to express my gratitude to Vasily Anatolyevich Kavalyauskus, Alexander Viktorovich Pavlyuchenko and Maxim Andreevich Lobur for providing qualified legal assistance, with the help of which my problem was resolved quickly and clearly. When contacted, I always found understanding and attention. It’s good that the “Society for the Protection of Consumer Rights” employs such lawyers and advocates. I wish you success in your future work and defending the interests of consumers.

Sincerely, Truk N.N.

07.05.2018

Gratitude from Antonov Arkady I, Antonov Arkady Shanobich, turned to the Legal Agency of St. Petersburg for help due to the fact that when concluding an agreement for spinal treatment with Medstar, I was actually deceived in the cost of treatment and more. During the process of drawing up a treatment contract with me, no one explained to me that the treatment would be carried out using credit funds; the amount of treatment was constantly changing. My requests to be given longer time to familiarize myself with the procedures and consultations at their price list were refused. That is, there was actually pressure on the client. At home, when I carefully read the entire document, I realized that I had actually been deceived about money and treatment time. On October 30, 2018, I applied for legal assistance from the Legal Agency of St. Petersburg regarding the termination of the contract for treatment at Medstar and the termination of the loan agreement from Alfa-Bank. My case was handled by Denis Yurievich Stepanov, all issues were resolved very quickly and I was informed about all situations. I would like to thank Stepanov D.Yu. and all lawyers who work in this agency.

November 21, 2022

Gratitude from Plisetsky V.V. I would like to express my gratitude to Sergei Vyacheslavovich Mavrichev for his sensitive attitude and understanding towards clients. The issue was resolved within one day. I am very grateful to Sergei Vyacheslavovich.

Plisetsky V.V. October 19, 2018

Review by B.I. Goreky Gratitude to Yuri Vladimirovich from B.I. Goreky for the consultation on family rights.

Gratitude to Kavalyauskas V.A. from Astafieva A.S. I express my gratitude to the Legal Agency and in particular to lawyer Vasily Anatolyevich Kavaliauskas for the skillfully done work. Vasily Anatolyevich advised and prepared all the documents necessary for court proceedings. As a result of the consideration of the consumer rights case, the result and the high amount exceeded all my expectations. Thank you very much for your qualified work and professionalism.

Sincerely, Astafieva A.S., 03/01/2019

Gratitude from Busygin A.I. I express my gratitude to Vasily Anatolyevich Kavalyauskas for the qualified management of my case, competent advice and justification for the decision, which led to compensation of the stated claims.

Sincerely, Busygin Alexander Ivanovich

26.12.2017

Gratitude from Vraveevsky S.A. Sergey Vyacheslavovich! Thank you very much for the consultation! All the details were disclosed to me in detail, all questions were answered comprehensively. I am very glad to receive help from a qualified specialist!

Vraveevsky S.A. 12/18/2018

Review by Rychnikova G.V. I express my gratitude to your employee Andrey Valerievich Ermakov for providing me with legal assistance.

I also express my gratitude to Diana Sumarokova for her polite and tactful customer service and the very pleasant atmosphere in your office.

Gratitude from gr. Kolesnikova A.N. Let me express my deep gratitude to the Legal Agency of St. Petersburg, located at Spassky Lane, 12. For their professional and friendly assistance in resolving my issue! I wish to continue working, bringing benefit to all residents of St. Petersburg. And not only.

Kolesnikov Alexander Nikolaevich.

Position: Head of the Metro Implementation Sector

PS: Before your company, I contacted 5 companies on this issue and received unclear answers.

Gratitude from N.A. Uvarova I express my deep gratitude to lawyer Sergei Vyacheslavovich for his attitude towards me and my question. There are no words to describe the feelings of gratitude for the professionalism shown and the greatest human sympathy and understanding! All the best to you! Health, success in work and long life!

Thank you very much! Sincerely, Nadezhda Anatolyevna Uvarova, 07/25/2019

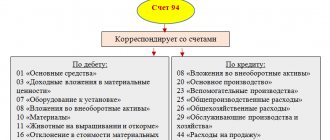

Inventory shortage: postings

Important! As a result of the inventory, not only a shortage of valuables, but also a surplus can be identified. In addition, a result such as misgrading is also possible. It means that it is necessary to remove some items from the balance and capitalize others.

The accounting treatment will be as follows:

- If a surplus is identified, the valuables arrive at the time of the inventory. They are paid at the market price, unless a different order is provided for by the company’s internal rules. Monetary indicators are included in financial results along with other expenses, or as income in non-profit organizations.

- If the shortage falls under natural loss, then the amounts are written off as expenses or as expenses. If the shortage exceeds the natural loss, then the write-off occurs at the expense of the guilty parties. If the culprits cannot be identified, then the write-off is made to the financial results.

Basic entries when writing off shortages:

| Write-off | Postings | |

| D | TO | |

| By goods and materials | 94 | 10 |

| By fixed assets | 94 | 01 |

| For finished products | 94 | 41 (43) |

| By natural decline | 20 (25,44) | 94 |

| At the expense of the perpetrators | 73 | 94 |

| For other expenses | 91.2 | 94 |

Reflection of shortfalls in expenses

Due to the fact that the guilty person has not been identified, and there is a document from government authorities, the shortage will be reflected in:

- Accounting - as part of other expenses (clause 30 of the Methodological guidelines for accounting of oil and gas production, approved by Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n);

- NU - as part of non-operating expenses equated to losses (clause 5, clause 2, article 265 of the Tax Code of the Russian Federation).

To reflect the shortage of goods as an expense, create a document Transaction entered manually, transaction type Transaction through the section Transactions - Accounting - Transactions entered manually.

from field indicates the date of the decision, which confirms the absence of the perpetrators.

- Debit - 91.02 “Other expenses”; subconto - Write-off of losses from shortages and thefts in the absence of perpetrators , item of other expenses, filled out from the directory Other income and expenses, Type of item - Other losses equated to non-operating expenses ;

- Credit - “Shortages and losses from damage to valuables.”

Income tax return

In the tax return, the amount of losses from shortages of goods is reflected as part of losses equated to non-operating expenses: PDF

- Sheet 02 Appendix No. 2 page 300 “Losses equated to non-operating expenses.”

See also:

- Inventory procedure

- Inventory of goods and materials: 1C

- Guide Write-off of goods

- Shortage of goods and materials. The culprit has been identified

- Restoration of VAT when writing off inventory items

- Surplus of goods as a result of inventory

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Inventory shortage. The culprit has been identified. When conducting an inventory, a shortage of inventory items may be identified. IN…

- Illegal use of this software product in 1C has been detected: how to remove it When working with the 1C program, the user may encounter a message...

- Error 1C: Object field not detected When updating the 1C database, installing a new Platform, making changes to...

- Can another person receive a salary for an employee? - clarifications of Rostrud Labor legislation does not contain a direct ban on paying wages to third parties...