What is OS

The concept of fixed assets is disclosed in FAS 6/2020 “Fixed Assets”, effective from 2022, and in PBU 6/01 “Accounting for Fixed Assets”, valid until the end of 2022, as well as in the Tax Code of the Russian Federation.

Since 2022, PBU 6/01 “Accounting for fixed assets” has lost force, it was replaced by two new FSBU 6/2020 “Fixed assets” and FSBU 26/2020 “Capital investments”. ConsultantPlus experts explained in detail what the new standards have changed in asset accounting compared to PBU 6/01. Get trial access to the system for free and go to the Ready-made solution.

OS is the property of an enterprise, repeatedly used in production and economic activity, meeting the conditions:

- intended for long-term use (more than a year);

- not for sale;

- not processed during the production process (like raw materials);

- it is expected to make a profit.

In other words, OS are buildings, equipment, machines, machines, computers, office equipment, household supplies, etc. OS also include animals, fruit-bearing perennial plants, capital communication and transport facilities (communication centers, roads, power grids).

The operating system criteria also include the initial cost.

- From 2022, the limit on the cost of the operating system is set by the organization independently. For example, you can make it the same as for income tax - 100,000 rubles. Objects with private investment for more than a year and a cost below the limit can be immediately written off as expenses (clause 5 of FSBU 6/2020 “Fixed Assets”).

- Until the end of 2022, in accounting (BU) (clause 5 of PBU 6/01), the maximum cost of classifying property as MPZ was 40,000 rubles. (accounting policy could have established a smaller amount). Such property is written off as expenses as soon as it is put into production. Anything that exceeds this limit, but meets the above criteria, is taken into account as OS.

Find out how to set a limit on the cost of fixed assets in accounting in accordance with FSBU 6/2020 “Fixed Assets” in the Ready-made solution from ConsultantPlus. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

In tax accounting (TA) objects worth up to 100,000 rubles. inclusive, are not considered fixed assets (Article 257 of the Tax Code of the Russian Federation). The assignment of an asset to fixed assets affects the procedure for accounting for its value as part of expenses (fixed assets are subject to depreciation, i.e., they are written off gradually according to the accounting policy of the enterprise, and inventories are written off at a time), as well as the procedure for document flow, inventory and write-off.

Postings upon receipt of fixed assets

Fixed assets are taken into account at their original cost. FSBU 6/2020 “Fixed Assets” does not contain an approximate list of expenses that form this cost. According to the standard, the initial cost is the total amount of capital investments related to the object that the organization made before recognizing fixed assets in accounting. But after recognizing an object, you can choose how to evaluate it: at its original or revalued cost. Moreover, the selected method applies to the entire OS group.

It is understood as the sum of the cost of purchasing the OS and other expenses associated with this purchase (installation, delivery, customs duties, intermediary commission, etc.).

IMPORTANT! The initial cost of an asset does not include VAT if this tax is recoverable for the company. Non-payers of VAT (for example, simplifiers) take this tax into account in the initial cost of property (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

The OS is accepted for accounting on the date when it is fully formed, and for NU - when the OS is put into operation.

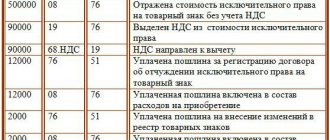

When an asset is received, accounting records are generated:

- Dt 08 Kt 60 (10, 70, 69) - expenses for the acquisition or creation of fixed assets are taken into account;

- Dt 19 Kt 60 - input VAT is allocated;

- Dt 01 Kt 08 - PS OS was formed.

For information on how to account for VAT on fixed assets, read the article “How to claim VAT on fixed assets or equipment for deduction.”

If the OS requires installation, then account 07 “Equipment for installation” will be included in the postings. As a rule, it is used by construction organizations. The account accumulates information about equipment that requires technological installation, connection to networks and communications and is intended for installation in premises under construction. After the costs are fully collected on the account, the amount of the installed OS is written off to Dt account 08 (Dt 08 Kt 07). Next, the same algorithm is applied: amounts from account 08 are written off to account 01, thus forming the initial cost of the asset.

More detailed information is provided in the Guide to the purchase and sale of real estate from ConsultantPlus. Get free trial access to the system and proceed to the materials.

04.03.2022Creation of the Social Fund. What will change for business?

The Ministry of Labor proposed merging the Pension Fund and the Social Insurance Fund. The reform is planned to be completed within this year. The new structure, which received the short name “Social Fund,” could begin work as early as 2023. The details of the reform were studied by the editors of the magazine “Calculation”.

04.03.2022How to distinguish between repair and reconstruction costs and why this is important

In practice, disagreements with tax authorities arise due to the fact that inspectors try to subsume certain repair work under reconstruction. And the accountant’s task is to prove the opposite. The fact is that the costs of any repairs - current, medium or major - can be immediately and completely included in expenses. And reconstruction costs are written off only through depreciation.

04.03.2022Fourth capital amnesty

The government has submitted to the State Duma a bill on holding a capital amnesty from March 14, 2022 to February 28, 2023. This will be the fourth amnesty under which Russian businessmen will be able to legalize their savings, real estate, foreign accounts, etc.

04.03.2022A simplified taxation system company must pay VAT if it purchases services from a foreign company

Firms using the simplified tax system are exempt from paying value added tax. But, if a Russian company uses the simplified tax system to purchase services from a foreign entity, it has the responsibilities of a tax agent for VAT.

04.03.2022New form 4-FSS from the report for the 1st quarter of 2022. Project overview

The Federal Social Insurance Fund of Russia has developed and published a draft of a new form of calculation for accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases.

04.03.2022What documents need to be used to justify transport costs?

To write off expenses for official transport in the tax base for profits, you can use any document that complies with the law, contains all the required details and justifies the costs. The name and form of the document do not matter.

04.03.2022Workers want their salary in cash, not on a card: how to prepare the documents?

Many banks came under sanctions. There are queues at ATMs after working hours. Employees who have cards from such banks want to receive their salaries in cash, which is what they asked their employer to do. Can he accommodate his employees if the money has always been transferred through the bank to the card?

04.03.2022I was sick. Have worked. How will they be punished? And who?

The general director, a creative, spontaneous and not very predictable person, issued an order in which the responsibility for monitoring execution was assigned to the person who was on sick leave. Could this cause problems? From the point of view of regulating labor relations, it is important for an employer in such a situation to pay attention to 2 aspects. The first is how exactly the employee controlled the execution of the order, for example, whether he gave written instructions during illness, or whether he drew up any other papers with his signature. The second is how the work time sheet for the same period is filled out (whether a period of temporary disability is noted there or not).

03.03.2022How long does a desk audit of a VAT return have?

If for most taxes a desk audit lasts 3 months, then for VAT there can be as many as three such periods. Official - 2 months. It can be extended up to 3 months. There is also a shortened period - 1 month. It is associated with the acceleration of tax refunds and requires the fulfillment of a number of conditions.

03.03.2022Central Bank of the Russian Federation on restrictions on foreign exchange transactions: clarifications, March 2022

The Central Bank clarified a number of issues regarding the ban on the sale of currency and the restrictions imposed on foreign exchange transactions for Russian companies.

03.03.2022VAT on advertising expenses is included in the profit base

The company has the right to take into account VAT on advertising expenses in the tax base for profits. The Ministry of Finance was reminded of this.

03.03.2022Measures to support the IT industry have come into force

The President signed a Decree on support measures for companies in the IT industry. Only accredited IT industries can take advantage of the benefits.

03.03.2022Wage delays: what threatens the employer in 2022?

If an employer delays wages, he may be fined from 10 to 50 thousand rubles. In addition to administrative liability, criminal and material liability is possible. The head of an organization, branch or separate unit may also be imprisoned for up to three years.

03.03.2022“My home is my... store.” Whose consent is needed to transfer premises from residential to non-residential?

The owner wants to turn his apartment on the ground floor of an apartment building into a store with a separate entrance. To do this, he must first enlist the support of other owners. But how many yes votes are needed? Will it be necessary to obtain the approval of all owners or is 2/3 of their total votes sufficient? The Supreme Court answered this question in one of its recent rulings.

02.03.2022The deadline for refunding the overpayment has passed. What to do?

The company missed the period for refunding overpaid taxes. Does this mean that she will no longer be able to receive funds? Not at all, but restoration of the period will have to be sought through the courts. The editors of the magazine "Raschet" studied the explanations of the Federal Tax Service.

02.03.2022What does the buyer risk if there is no delivery agreement?

If there is no delivery agreement and you received the goods according to the act, this does not mean that if you delay payment, the supplier will not impose sanctions on you, since there was nowhere to register them. Liability is provided for in Article 395 of the Civil Code of the Russian Federation, and it occurs faster than it could be written in the contract, and the amount of the fine may be higher.

02.03.2022When do you need to withhold personal income tax when making payments to individual entrepreneurs?

When paying an individual entrepreneur for services or work under OKVED that are not specified in his registration data, the company must withhold personal income tax.

02.03.2022Distribution of net profit at the end of the year

The net profit received by the organization can be paid to shareholders (founders) or participants.

02.03.2022Additional economic measures introduced from March 2

On February 28, 2022, the President signed a Decree on the introduction of special economic measures. Yesterday, a new Decree No. 81 dated March 1, 2022 was adopted on additional measures to ensure the financial stability of Russia.

02.03.2022From March 1, computers can only be disposed of through special companies.

From March 1, 2022, an obligation has been introduced for organizations and individual entrepreneurs to recycle computers only through companies that will recycle old, broken electronic equipment.

1 Next page >>

Accounting for depreciation of fixed assets: postings

Unlike materials and inventories consumed in production, fixed assets transfer their cost to company expenses gradually. This process is called depreciation. However, it is not accrued for certain types of fixed assets. Such objects include assets that do not change production qualities during the operation of the enterprise: land plots, cultural heritage sites, art collections, etc.

In accounting, three methods of calculating depreciation are used (linear, reducing balance method, proportional to the volume of production), however, for the purposes of accounting, only linear and non-linear methods are used.

Until the end of 2022, the cost write-off method was used based on the sum of the useful life numbers. Since 2022, this method has become invalid.

IMPORTANT! As a rule, an organization uses one method of calculating depreciation for accounting and financial accounting, since different methods create tax differences that require additional attention of an accountant. Therefore, the linear calculation method is usually used.

Linear depreciation is calculated using the formula:

A = PS / SPS,

Where:

A is the monthly depreciation amount;

PS - initial cost of fixed assets (account balance 01);

SPS is the useful life of the OS.

To calculate it, you need to know the useful life of the asset, established by the Decree of the Government of the Russian Federation “On the classification of fixed assets included in depreciation groups” dated January 1, 2002 No. 1. In accounting, fixed assets can be written off faster than in tax accounting, using other calculation methods and a shorter period of use, but then tax differences are formed, since accounting and tax amounts will differ.

An example of calculating depreciation using the straight-line method was prepared by ConsultantPlus experts. Get trial access to the system for free and proceed to the example.

To account for depreciation, records are kept in account 02 “Depreciation of fixed assets.” Its amounts are debited from the accounts of production and commercial costs (20, 23, 25, 26, 29, 44), forming a credit balance on account 02.

The accountant creates monthly records:

Dt 20 (23, 25, 26, 29, 44) Kt 02 - depreciation has been accrued for fixed assets.

ATTENTION! According to PBU 6/01, applied until the end of 2021, depreciation began to accrue from the first day of the month following the month of registration of the fixed assets, and stopped from the first day of the month following the month of disposal of the object. According to FAS 6/2020 “Fixed Assets,” which will be introduced in 2022, this procedure becomes optional: an organization can apply it if it makes such a decision. As a general rule, depreciation begins from the date the object is recognized in accounting, and stops from the moment it is written off.

Depreciation is...

All companies using the simplified tax system are required to maintain accounting records (Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

Accounting for fixed assets (fixed assets) is also mandatory because if the residual value of fixed assets exceeds 150 million rubles. the organization loses the right to apply the special regime. In this case, only depreciable property is taken into account (subclause 16, clause 3, article 346.12 of the Tax Code of the Russian Federation). Depreciation is the write-off of the initial value of an asset over its expected period of use. Calculation of depreciation in accounting begins in the month following the commissioning of the asset. Depreciation can be calculated in several ways:

- linear;

- reducing balance method;

- by the sum of the numbers of years of useful use;

- proportional to the volume of finished products.

Learn about methods for calculating depreciation in the article “Methods of calculating depreciation in accounting .

The results of the calculations are displayed in the depreciation statement, which the company develops independently, taking into account the rules for preparing primary documentation approved in Art. 9 of Law No. 402-FZ. Depreciation is calculated monthly, with the exception of companies that are allowed to conduct simplified accounting. Such organizations have the right to write off depreciation charges once a year, on December 31, or independently set the frequency (clause 19 of PBU 6/01).

For information on who can conduct accounting according to a simplified scheme, see the material “Features of accounting in small enterprises” .

IMPORTANT! Individual entrepreneurs using the simplified tax system are not required to keep accounting records, and therefore they also do not have the obligation to calculate depreciation.

The algorithm for calculating depreciation in accounting is the same for all organizations in any taxation system and is regulated by PBU 6/01.

Read about the nuances of accounting for fixed assets under the simplified tax system in a standard consultation from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

Accounting entries for the restoration of fixed assets

The initial cost may increase if work is carried out to restore the OS (modernization, reconstruction and retrofitting). The accounting procedure for such operations differs depending on whose forces this modernization is carried out: a third-party organization or independently. If the modernization is carried out by a third-party contractor, then the costs of such work are reflected in Dt account 08 in correspondence with account 60 “Settlements with suppliers and contractors”. In this case, the postings are generated:

- Dt 08 Kt 60 - reflects the cost of the contractor’s work;

- Dt 19 Kt 60 - VAT allocated.

If the work is carried out independently, then the costs of additional equipment are taken into account on account 08 in correspondence with the cost accounts (10, 70, 69, etc.). This creates the following records:

Dt 08 Kt 10 (70, 69, etc.) - reflects the costs of upgrading the OS.

Upon completion of the work, the amounts accumulated on account 08 are written off to account 01 Dt, thus increasing the initial cost of the asset.

Read more about the features of accounting and NU OS in the article “Modernization of fixed assets - accounting and tax accounting.”

Postings to account “02.02”

By loan

| Debit | Credit | Content | Document |

| 08.03 | 02.02 | Calculation of depreciation on a fixed asset item, which is accounted for on account 03 and used in capital construction | Regular operation |

| 20.01 | 02.02 | Calculation of depreciation on a fixed asset item, which is accounted for on account 03 and is used in the main production | Regular operation |

| 23 | 02.02 | Calculation of depreciation on a fixed asset item, which is accounted for on account 03 and used in auxiliary production | Regular operation |

| 23 | 02.02 | Calculation of depreciation on a fixed asset item, which is accounted for on account 03 and used in auxiliary production | Regular operation |

| 25 | 02.02 | Accrual of depreciation on an object of fixed assets for general production purposes, which is accounted for on account 03 | Regular operation |

| 26 | 02.02 | Accrual of depreciation on an object of fixed assets for general economic purposes, which is accounted for on account 03 | Regular operation |

| 29 | 02.02 | Calculation of depreciation on a fixed asset item, which is accounted for on account 03 and is used in service industries and farms | Regular operation |

| 44.01 | 02.02 | Calculation of depreciation on an item of fixed assets, which is accounted for on account 03 and used in organizations engaged in trading activities | Regular operation |

| 44.02 | 02.02 | Calculation of depreciation on an item of fixed assets, which is accounted for on account 03 and is used in organizations engaged in industrial and other production activities | Regular operation |

| 91.02 | 02.02 | Additional accrual of the amount of depreciation for previous periods for an item of fixed assets, which is accounted for on account 03 | Regular operation |

OS sales

In the case when an organization sells fixed assets, it is obliged to record the cost of sale of the asset and the original cost minus depreciation (residual value). Records are generated:

- Dt 62 Kt 91 - income from sale is recognized;

- Dt 91 Kt 68 - VAT reflected;

- Dt 02 Kt 01 - depreciation written off;

- Dt 91 Kt 01—residual value written off.

Ownership of the asset is transferred on the basis of a deed (Form No. OS-1). If the object of sale is real estate, then the date of transfer of rights is the date of state registration.

An example of reflecting the sale of fixed assets at a loss from ConsultantPlus: An organization sells an asset at a price of RUB 1,200,000, including VAT of RUB 200,000. The costs of delivering the property to the buyer are assigned to the organization by the contract. Get trial demo access to the K+ system and study the example for free.

Results

Thus, asset accounting is quite diverse, as it accompanies many situations related to the acquisition, use, write-off, and modernization. Acceptance of an asset for accounting (account 01) occurs through accounts 07 and 08, which accumulate expenses associated with acquisition, installation, delivery, etc. Disposal of fixed assets occurs by writing off the residual value for other expenses of the organization.

Sources:

Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reflection of depreciation in company accounting

To reflect standard transactions in accordance with the norms of Order No. 94n, the account is intended. 02, on which transactions for accumulated depreciation of fixed assets are generated. This account is passive - with depreciation on credit and write-off on debit. Accordingly, the corresponding account will depend on the area of activity of the organization and the type of asset.

Note! If the cost of an asset does not exceed 40,000 rubles, such an object can be immediately included in the inventory (inventory) and does not require depreciation as fixed assets (clause 5 of PBU 6/01).

Depreciation accrued - posting

When calculating depreciation amounts, the posting is made to the credit account. 02 in correspondence with account. 08, 44, 23, 20, 25, 26, 79, 29, 97, 91, 83. The duration of depreciation depends on the useful life of the asset. This period is established taking into account the requirements of the OS Classifier (Resolution of the Government of the Russian Federation No. 1 of 01.01.02). The amount of depreciation is affected by the chosen calculation method. When calculating depreciation, transactions can be recorded in different ways:

- Depreciation was accrued on production equipment - posting D 20 K 02.

- The amount of depreciation on auxiliary equipment has been accrued - posting D 23 K 02.

- When calculating depreciation amounts for equipment of general production or general economic importance - posting D 25 (26) K 02.

- If the fixed assets are leased, the following entry is made - the amount of accrued depreciation is credited to the account. 02, corresponding with account. 91.

Write-off of depreciation - posting

When an asset is removed from the balance sheet of an enterprise, it is necessary to write off the asset. To do this, the amount of accumulated depreciation is transferred from the debit of the account. 02 on credit account 01. As a result, the account is closed. 02. The operation is reflected as follows:

- The amount of accrued depreciation is written off - posting D 02 K 01.

Let's look at how in practice depreciation is calculated and depreciation is written off when disposing of fixed assets.

Suppose a manufacturing enterprise purchased a machine at a price of 1,400,000 rubles. The accountant assigned the object to group 3 according to the Classifier, and the SPI was set at 40 months. The depreciation calculation method is linear, the amount of monthly depreciation is 35,000 rubles. (1/40 month x RUB 1,400,000.00). In accounting, depreciation transactions are reflected as follows:

- Monthly depreciation charge - posting D 20 K 02 for RUB 35,000.00.

Let’s assume that after 3 years, that is, after 36 months, management decided to sell the machine at a price of 250,000 rubles. without VAT. The amount of depreciation accrued by this time is 1,260,000 rubles. (36 months x RUB 35,000.00). Let's reflect the operation in accounting:

- The object was sold to the buyer - D 62 K 91.1 for RUB 295,000.00. (RUB 250,000.00 + RUB 45,000.00).

- VAT allocated from the transaction - D 91.2 K 68.2 for 45,000.00 rubles.

- Accumulated depreciation is written off - D 02 K 01 by RUB 1,260,000.00.

- The value (residual) of the object was written off - D 91.2 K 01 for RUB 140,000.00. (RUB 1,400,000.00 – RUB 1,260,000.00).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.