What needs to be done before switching from UTII to simplified tax system in 2022

Simplified taxation is essentially close to imputed tax. The checklist of what needs to be done before the transition is as follows:

- Decide on the object of taxation. An individual entrepreneur must calculate the tax burden based on income and expenses and choose from what he will pay the state: from income or from the difference between income and expenses. For calculations, you can use the current year's indicators.

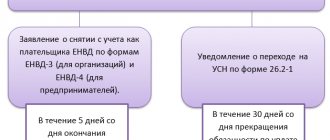

- You must submit an application to switch to a simplified regime before December 31, 2022, otherwise, from January 1, the entrepreneur will be transferred to the OSN. Form 26.2-1 should be used.

- Provide a return for the fourth quarter of 2022, and also pay tax. The procedure has not changed: the declaration must be submitted by January 20, 2022, and UTII must be paid by January 25, 2022.

Main responsibilities of the simplified tax system payer

Let's compare UTII and simplified tax system in terms of reporting and frequency of tax payments:

| Duty | simplified tax system | UTII |

| Submitting a declaration | Once a year (at the end of the year) | 4 times a year (based on the results of each quarter) |

| Payment of taxes and advances | 4 times a year | |

| Additional reporting | Book of income and expenses | No |

Along with reducing the number of submitted declarations, the simplification requires maintaining a new register - a book of income and expenses, approved. By Order of the Ministry of Finance dated October 22, 2012 No. 135n. Additionally, organizations are required to maintain accounting records and submit financial statements.

Who is not entitled to use the simplified tax system?

Not all organizations and businessmen can switch from UTII to the simplified tax system. The simplified system cannot be used:

- enterprises that do not meet the requirements of the simplified tax system;

- businessmen who have not submitted an application for transfer;

- organizations with branches. At the same time, enterprises with divisions and representative offices can “simplify”;

- organizations in which the share of other LLCs is no more than 25 percent. In rare cases, the Federal Tax Service may make exceptions;

- pawnshops;

- businessmen operating in the field of gambling;

- entrepreneurs providing notary and lawyer services privately;

- government organizations;

- foreign enterprises;

- agencies providing private job search services.

Application for transition from UTII to simplified tax system: how to fill out

To understand how to fill out an application, you can consider a sample application for transition from UTII to simplified tax system:

- If the application is submitted along with documents for registration:

- An example for those who apply within 30 days after registration or for those who want to send an application to switch from UTII to the simplified tax system:

What taxes does the simplified tax system exempt from?

The simplified system, similar to imputation, gives the right not to pay such taxes (Article 346.11 of the Tax Code of the Russian Federation):

Additionally, all payers of the simplified tax system are exempt from VAT, except for cases of importing products and performing the duties of a tax agent.

If you still have questions about the transition from UTII to other modes, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Conditions for an organization's transition to the simplified tax system

To transfer an individual entrepreneur or LLC from UTII to the simplified tax system, it is important to meet a number of conditions:

- cost and income of the organization up to 150 million rubles;

- staff up to 100 people.

Even if the limits are exceeded, business can be conducted at a simplified rate, but with an increased rate. However, revenue cannot exceed 200 million per year, and the number of employees must be below 130.

Notification of the transition from UTII to simplified tax system

should be sent by December 31, 2022. It must indicate the characteristics of the business that are important for the transition to the simplified system, as of October 1, 2022. However, there is no need to write down the income and cost of the operating system.

Let's sum it up

- From January 1, 2022, organizations and individual entrepreneurs whose annual income and residual value of fixed assets do not exceed 150 million rubles have the right to switch to the simplified tax system.

- The amount of “simplified” tax directly depends on the actual income of the payer.

- Taxpayers notify their Federal Tax Service of the application of the simplified tax system in 2022 by December 31, 2020 and indicate the selected object of taxation: income or income reduced by the amount of expenses. Otherwise, there will be an automatic transition to OSNO.

- An individual entrepreneur has the right to combine the simplified tax system with a patent.

Restrictions on the use of simplified taxation system

| Criterion | simplified tax system | UTII (for comparison) |

| Number of employees | No more than 100 people | — |

| Share of participation of other organizations in the authorized capital (not taken into account in relation to non-profit organizations; organizations created with contributions from public organizations of disabled people and scientific institutions) | No more than 25% | — |

| Income per year | No more than 150 million rubles. | — |

| Residual value of fixed assets | No more than 150 million rubles. (does not apply to individual entrepreneurs) | No restrictions set |

| Prohibition on the use of special regime | Enterprises with branches cannot switch to the simplified tax system. Otherwise, types of imputation activities may well be transferred to the simplified tax system, because they do not coincide with those for which the simplification cannot be applied | A list of specific types of activities for which UTII is allowed to be applied has been introduced |

How is the simplified tax system and advance payments calculated?

There are two objects in the simplified taxation system. Let's look at them separately:

- Income. The tax rate may be reduced by regional legislation. The maximum is 6 percent. In this case, it is possible to reduce the amount due to insurance premiums, benefits for the first three days of sick leave for employees, as well as contributions under voluntary insurance contracts. The tax can be reduced by no more than 50 percent. If an individual entrepreneur does not have employees, he can use it to reduce his own contributions.

- Income minus expenses. Tax rate 15 percent. The amount cannot be changed. If the enterprise was unprofitable, the businessman can pay a minimum tax of 1 percent of income.

How to switch to the simplified tax system from 2022: step-by-step instructions

For some entrepreneurs, the process of switching to simplification can be difficult. The algorithm of actions is as follows:

- Selecting an object of taxation. In order to determine which will be profitable, you can use existing statistics or plans for the next year. The tax is calculated as follows:

- the “income” object is taxed at 6 percent. But the government of some regions took into account the abolition of UTII and reduced the rate;

- the object “income minus expenses” is taxed at 15 percent. However, the list of possible expenses is limited.

- We draw up an application in form 26.2-1 and send it to the Tax Office. You can see a sample above. The submission deadline is limited: this must be done before December 31, 2022, otherwise the business will be transferred to OSN, and you will have to spend a whole year with it.

- We carry out an inventory to properly account for expenses.

We have accounting on the simplified tax system “Income” at a rate of 6%, we want to work with the company on VAT. Is this possible?

This may be a problem for your partners, since they will not have “input” VAT. It appears only to those who purchase goods from VAT payers, provided that the transaction itself is subject to value added tax. The amount of “input” VAT can then be deducted when paying taxes.

It turns out that it is not profitable for companies using the general taxation system to cooperate with companies using the simplified tax system. To retain such clients you can:

- To reduce the price. Agree with the client that you will sell the goods without VAT, but will give a discount on the amount of tax. In this case, your partner, working on a common tax system, will not lose anything.

- Become a mediator. Find a supplier who, like the buyer, works for OSNO. Draw up an agreement that you will buy goods from one organization for another and receive a reward. Then your client will be able to equate the “input” VAT to a deduction and save on taxes.

New rules of the simplified tax system from 2022

In 2022, if an entrepreneur has violated the restrictions of the simplified tax system (more than 100 employees or more than 150 million in profit), he can continue to use the simplified tax system. Let's talk in more detail.

What will change in terms of limits

The profit can be exceeded by 50 million, and the staff can be increased to 130. If these numbers are exceeded, the business will be transferred to OSN.

New tax rates

If the limits are exceeded, the rate will be increased: eight percent for the “income” object and twenty for “income minus expenses.”

Which type of simplified tax system to choose

There are two types of simplified taxation system: simplified taxation system “income” and simplified taxation system “income minus expenses”. In the first case, the object of taxation is the received income, in the second - the received income reduced by expenses.

When choosing between the simplified tax system “income” and the simplified tax system “income minus expenses”, you need to analyze your revenue and understand what share of it is occupied by expenses. If your expenses account for less than 60% of your revenue, then it makes sense to choose the simplified tax system “income” with a tax rate of 6%. If expenses occupy a share of more than 60% of revenue, then it is more advisable to choose the simplified tax system “income minus expenses”, where the tax rate is 15%. In Art. 324.16 of the Tax Code of the Russian Federation provides a list of possible expenses.

Answers to popular questions:

What does a retail store need to consider when choosing a replacement UTII?

An entrepreneur should take into account what he is selling. Some taxation systems are incompatible with the sale of excisable and marked goods. For example, on PSN a businessman cannot distribute medicines, shoes and fur products. Other labeled products can be sold.

Who in retail can switch to simplified?

The simplified tax system can be used by both individual entrepreneurs and organizations. There are no restrictions on the size of the retail space, but the following indicators must be taken into account:

- Revenue: up to 150 million rubles per year. It is possible up to 200 million, but the rate will be increased: for the “income” object from six to eight percent and for the “income minus expenses” object from 15 to 20.

- Staff: up to 100 people. It is possible up to 130, but the rate will be increased.

- Residual value up to 150 million.

The main thing to do is to choose an object. You can pay tax on income (six or eight percent, if the limits are exceeded) or on the difference between income and expenses (15 or 20 percent, if the limits are exceeded). If expenses account for up to 60 percent of revenue, it will be profitable to choose the “income” object; otherwise, you should prefer “income minus expenses.”

What should stores do that combined UTII with the simplified tax system?

After the abolition of UTII, such stores will be automatically transferred to a simplified system. If an entrepreneur plans to change the object of taxation, an application must be submitted before December 31.

How to transfer a cash register from UTII to simplified tax system

There is no need to re-register the cash register. But you will have to change the information on the check. The required details are in tag 1055, where you need to select a new tax system. More details can be found at the link.

What are the benefits when switching from UTII to simplified tax system?

For entrepreneurs switching to a simplified tax system after the abolition of UTII, in some regions a reduced tax rate is provided for the “income” object. Sometimes it is reduced to a minimum of 1 percent.

How to transfer goods from UTII to simplified tax system

Income cannot take into account revenue for goods purchased during UTII, but sold under simplified conditions. Also, advances that were received on imputation are not taken into account, even if the goods were sent to the simplified tax system.

The expenses do not take into account the costs incurred before the simplification, as well as the cost of goods and raw materials that were paid for imputation, but used for the simplified tax system.

Which mode should I choose if the store sells labeled goods (medicines, shoes, fur)?

UTII and PSN are not suitable in this case. If the revenue is small, a simplified approach will do, otherwise it’s worth switching to OSN.

Which mode should I choose if the store sells excisable goods (alcohol, tobacco)?

Entrepreneurs can choose the simplified tax system, PSN or OSN. At the same time, the sale of strong alcohol is not available to individual entrepreneurs. For organizations, a simplified or general regime is suitable.

What regime should a furniture store choose after canceling UTII?

For a small business, PSN or simplified tax system is suitable. If sales volumes are large, you will have to choose OSNO. It is worth taking into account: revenue, the size of the staff, the area of the retail premises and the size of the payroll.

What regime should a jewelry store choose after canceling UTII?

If the store is small, you can choose a patent. In cases where the production of products is also planned, you can switch to the simplified tax system. Both simplified and OSN are available for LLCs.

After the abolition of UTII, what mode should a grocery store choose when selling excisable goods (alcohol) and labeled goods (tobacco)?

When selling mild alcohol and tobacco products, you can use a patent or simplified tax system.

What happens if you do not submit a notice of transition to a simplified tax regime by March 31?

The Federal Tax Service itself will transfer the entrepreneur to the taxation system that he chose as the main one when registering the enterprise. For example, those who initially planned to use the simplified tax system, and then began to use UTII, will automatically end up on the simplified tax system.

If, during registration, the entrepreneur did not submit a notification about the simplified tax system, after the deadline he will be transferred to the OSNO.

According to the Federal Tax Service, by mid-January, of the 1.3 million entrepreneurs who paid UTII at the end of 2022, 96.2% chose a different tax regime. Of these, 57.5% switched to a simplified version, and 40% to a patent. Another 2.5% chose a tax for the self-employed.