According to the new rules, benefits are paid to employees not by the employer, but directly by the Social Insurance Fund (see Decrees of the Government of the Russian Federation dated April 21, 2011 No. 294 and dated December 1, 2018 No. 1459). The employer is only required to submit the relevant documents to the fund's branch. The procedure for sending documents to the FSS is described in the video.

In the pilot regions, benefits are paid to employees not by the employer, but directly by the Social Insurance Fund (see Decrees of the Government of the Russian Federation dated April 21, 2011 No. 294 and dated December 1, 2018 No. 1459). The employer is only required to submit the relevant documents to the fund’s branch. The procedure for sending documents to the FSS is described in the video.

A pilot project for sending sick leave to the Social Insurance Fund is taking place in the following regions

- 01 - Republic of Adygea;

- 02 - Bashkortostan;

- 03 - Republic of Buryatia;

- 04 - Altai Republic;

- 05 - Dagestan;

- 06 - Republic of Ingushetia;

- 07 - Kabardino-Balkarian Republic;

- 08 - Republic of Kalmykia;

- 09 - Karachay-Cherkess Republic;

- 10 - Republic of Karelia;

- 11 - Komi Republic;

- 12 - Republic of Mari El;

- 13 - Republic of Mordovia;

- 14 - Republic of Sakha (Yakutia);

- 15 - Republic of North Ossetia - Alania;

- 16 - Republic of Tatarstan;

- 17 - Republic of Tyva;

- 18 - Udmurt Republic;

- 19 - Republic of Khakassia;

- 20 - Chechen Republic;

- 21 - Chuvash Republic;

- 22 - Altai region;

- 23 - Krasnodar region;

- 24 - Krasnoyarsk region;

- 25 - Primorsky Krai;

- 26 - Stavropol Territory;

- 27 - Khabarovsk Territory;

- 28 - Amur region;

- 29 - Arkhangelsk region;

- 30 - Astrakhan region;

- 31 - Belgorod region;

- 32 - Bryansk region;

- 33 - Vladimir region;

- 34 - Volgograd region;

- 35 - Vologda region;

- 36 - Voronezh region;

- 37 - Ivanovo region;

- 38 - Irkutsk region;

- 39 - Kaliningrad region;

- 40 - Kaluga region;

- 41 - Kamchatka region;

- 42 - Kemerovo region;

- 43 - Kirov region;

- 44 - Kostroma region;

- 45 - Kurgan region;

- 46 - Kursk region;

- 47 - Leningrad region;

- 48 - Lipetsk region;

- 49 - Magadan region;

- 50 - Moscow region;

- 51 - Murmansk region;

- 52 - Nizhny Novgorod region;

- 53 - Novgorod region;

- 54 - Novosibirsk region;

- 55 - Omsk region;

- 56 - Orenburg region;

- 57 - Oryol region;

- 58 - Penza region;

- 59 - Perm region;

- 60 - Pskov region;

- 61 - Rostov region;

- 62 - Ryazan region;

- 63 - Samara region;

- 64 - Saratov region;

- 65 - Sakhalin region;

- 66 - Sverdlovsk region;

- 67 - Smolensk region;

- 68 - Tambov region;

- 69 - Tver region;

- 70 - Tomsk region;

- 71 - Tula region;

- 72 - Tyumen region;

- 73 - Ulyanovsk region;

- 74 - Chelyabinsk region;

- 75 - Transbaikal region;

- 76 - Yaroslavl region;

- 77 - Moscow;

- 78 - St. Petersburg;

- 79 - Jewish Autonomous Region;

- 80 - Transbaikal region;

- 81 - Perm region;

- 83 - Nenets Autonomous Okrug;

- 84 - Krasnoyarsk region;

- 85 - Irkutsk region;

- 86 - Khanty-Mansiysk Autonomous Okrug - Ugra;

- 87 - Chukotka Autonomous Okrug;

- 88 - Krasnoyarsk region;

- 89 - Yamalo-Nenets Autonomous Okrug;

- 90 - Moscow region;

- 91 - Crimea;

- 92 - Sevastopol;

- 93 - Krasnodar region;

- 95 - Chechen Republic;

- 96 - Sverdlovsk region;

- 97 - Moscow;

- 98 - St. Petersburg;

- 99 - Moscow.

Registers of sick leave (disability certificates) are transferred by policyholders or insured persons to the Social Insurance Fund for the calculation of disability benefits to insured persons.

The following types of benefits are available at Extern:

Insured events and conditions for payment of benefits are established by Federal Law No. 255-FZ dated December 29, 2006.

| Insurance case | Conditions for payment of benefits |

| Temporary disability | Paid in the following cases: - illness, injury; - caring for a sick family member; — quarantine of the insured person or child under 7 years of age; — after-care in sanatorium-resort institutions |

| Occupational diseases and injuries | Paid in case of loss of ability to work due to an accident at work or occupational disease (detailed conditions are described in Federal Law No. 125-FZ of July 24, 1998) |

| Pregnancy and childbirth | It is paid to the woman in total for the entire period of leave (in the absence of complications and the birth of one child, the period is 70 days before and after childbirth). Features of benefit payment are described in Chapter. 3, art. 10 255-ФЗ |

| Early pregnancy | Paid as a lump sum to women who registered with medical institutions in the early stages of pregnancy |

| birth of a child | One-time benefit for the birth of a child |

| Baby care | Monthly child care allowance until the child reaches the age of one and a half years |

| Burial | Social benefits for funerals are paid in accordance with Federal Law No. 8 of January 12, 1996 |

| Payment of 4 additional days off for one of the parents to care for disabled children | Four additional paid days off per month are provided to one of the working parents (guardian, trustee) to care for disabled children and people with disabilities from childhood to 18 years (Article 262 of the Labor Code of the Russian Federation) |

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Direct benefit payments

The system of paying benefits to employees directly from the Social Insurance Fund of the Russian Federation was launched back in 2011. The features of direct payments of benefits for compulsory social insurance in case of temporary disability and in connection with maternity in the constituent entities of the Russian Federation are approved by Decree of the Government of the Russian Federation of April 21, 2011 No. 294.

The Nizhny Novgorod region and the Karachay-Cherkess Republic joined the FSS pilot project in 2011. As of the end of 2019, the direct procedure for paying benefits from the Social Insurance Fund is already successfully working in more than 50 constituent entities of the Russian Federation.

Since 01/01/2020, the Komi Republic, the Sakha (Yakutia) Republic, the Udmurt Republic, the Kirov, Kemerovo, Orenburg, Saratov and Tver regions, and the Yamalo-Nenets Autonomous Okrug have been participating in the project.

The Irkutsk region was supposed to join the project from 07/01/2020, but the deadline was postponed to 01/01/2020 (Resolution of the Government of the Russian Federation of November 13, 2019 No. 1444).

From July 1, 2020, the project will expand to other regions: the Republic of Bashkortostan, the Republic of Dagestan, the Krasnoyarsk and Stavropol Territories, the Volgograd, Leningrad, Tyumen and Yaroslavl regions. It is planned that in 2022 the whole country will join the direct payments project.

The direct payments project implies that amounts from the Social Insurance Fund are transferred directly to employees for the following types of benefits:

- temporary disability benefits due to illness;

- temporary disability benefits due to an accident at work or occupational disease;

- maternity benefits;

- a one-time benefit for women registered in medical institutions in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly allowance for child care up to 1.5 years;

- payment for additional leave for the entire period of treatment and travel to and from the place of treatment.

A number of types of benefits are still paid by the employer, and then reimbursed upon application from the funds of the Social Insurance Fund of the Russian Federation:

- social benefit for funeral;

- payment of four additional days off to one of the parents (guardian, trustee) to care for disabled children;

- expenses for preventive measures to reduce industrial injuries and occupational diseases of workers.

Advantages of the direct payment mechanism

By participating in the FSS project “Direct Payments”, from the point of view of calculating benefits, the policyholder still:

- calculates average earnings;

- pays the employee part of the benefit - payment for the first three days of illness;

- provides the necessary data for calculating the portion from the Social Insurance Fund.

Advantages of the Social Insurance Fund project “Direct Payments”:

- improving the situation of insured citizens when receiving benefits under compulsory social insurance;

- benefits at the expense of the Social Insurance Fund are paid within the strictly established deadlines;

- payment of benefits does not depend on the financial situation of the employer;

- improving the position of policyholders when paying benefits under compulsory social insurance;

- transfer of obligations to pay part of the benefit directly to the Social Insurance Fund.

Simplifying the work of an accountant is not so obvious: storage, preparation and responsibility for identifying falsification of certificates of incapacity for work do not reduce the workload.

Additional responsibilities for accountants when making direct payments include preparing and sending to the Social Insurance Fund:

- a register containing complete information about the organization that issued the certificate of incapacity for work to verify its accuracy;

- data on the employee’s average earnings to enable the fund to calculate amounts to be paid;

- applications containing the employee’s bank details to provide the Social Insurance Fund with the opportunity to transfer benefits to the insured.

Interaction scheme for the project of direct payments of benefits from the Social Insurance Fund

The interaction between the employee of the insured person, the employer - the policyholder, the Social Insurance Fund - the insurer and the medical institution in the Social Insurance Fund project “Direct Payments” is as follows (Fig. 3):

- The employee goes to a medical facility.

- The employee receives a document “certificate of incapacity for work” at the medical institution.

- Upon completion of the illness, the employee submits to the accounting department of the organization in which he works a “closed” and partially completed “certificate of incapacity for work.” In this case, the employee fills out an application to the Social Insurance Fund with a request to pay the benefit, indicating the details for transferring funds. The employer fills out his part of the “sick leave certificate” with information about the employee’s insurance record and data on average earnings and makes a calculation.

- The employer pays the employee (if necessary) for the first 3 days of illness.

- The employer submits to the Social Insurance Fund a register of information for calculating benefits and an application for the transfer of funds to the account of the insured person within no more than 5 days.

- The FSS checks the information received and informs the employer of either an error log or confirmation of receipt of the register and application.

- Having confirmed receipt of the register and application, the Social Insurance Fund calculates the amount to be paid from the fund and makes the transfer to the employee in accordance with the application.

Rice. 3. Scheme of interaction on the project of direct payments of benefits from the Social Insurance Fund

Direct payments in “1C: Salary and HR Management 8” (rev. 3)

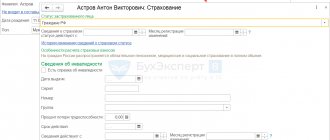

To confirm the region’s participation in the direct payments project in “1C: Salaries and Personnel Management 8” edition 3, in setting up the organization’s Accounting Policy on the FSS Benefits tab, you should set the flag I confirm that the organization is registered in the region with direct payment of benefits through the FSS

and in the field Payment of benefits transferred to the Social Insurance Fund from: indicate the date of entry into the pilot project (Fig. 4).

Rice. 4. Setting up accounting policies

As a result of setting up the Accounting Policy in the Sick Leave document, the FSS Pilot Project tab becomes available (Fig. 5).

Rice. 5. Document “Sick leave”

Clicking the link Fill in the data for the register of information transmitted to the Social Insurance Fund opens a form for filling out data about the medical organization and the doctor who issued the certificate of incapacity for work. The employee’s application for payment of benefits must be submitted to the Social Insurance Fund office. It can be generated right there using the link Enter an employee’s application for payment of benefits. Data that is already in the program is inserted into the application automatically.

In the Reporting, certificates menu, there is a specialized workplace Benefits at the expense of the Social Insurance Fund, where you can create documents for payment of benefits, and then, using the 1C-Reporting service, immediately send the necessary information in the required format via electronic communication channels to the Social Insurance Fund.

| 1C:ITS For more information on preparing in 1C and sending to the FSS a register of information for direct payments, see the section “Instructions for accounting in 1C programs.” |

The procedure for generating and sending benefits

To start working with FSS benefits, on the main page of the system, select the desired organization at the top of the page and go to the “FSS” section > in the “Benefits and ELN” section, click on the “All documents” button.

If the item “FSS benefits and certificates of incapacity for work” is missing, make sure that the organization of one of the regions participating in the pilot project is indicated at the top of the page.

Creating documents in Extern

You must click on the “Create a new document” button.

In the window that opens, select the type of benefit, mark the desired employee in the list and click “Create document”.

The list of employees in the “FSS Benefits” service is common with the service for preparing reports to the pension fund Kontur-Otchet PF.

If the required employee is not in the list, then click the “Add new employee” button.

In the window that appears, fill in your full name and SNILS and click “Add employee.” The added employee will appear in the list and will be selected by default, and will also appear in the PF Contour-Report service.

Next, you should start filling out the form in the window that opens.

Uploading a finished file into the system

Click the “Load from file” button.

In the window that opens, select a file and click “Open”. The file accepted into the system must be generated in the format established by the FSS and have an xml extension.

The uploaded documents will appear in the list. To check a document and send it to the FSS, click on the line with the required document. A form for editing and submitting will open.

Filling out the document

There are three sections that must be completed in the benefit payment document. Depending on the selected type of manual, the following sections will be displayed:

- "General information".

- "Certificate of incapacity for work" . The section is displayed in disability benefits, maternity benefits, occupational injury benefits, and illness benefits.

- "Calculation of benefits."

- "Additional documents". The section is displayed in the maternity benefit (if the “Registered in the early stages of pregnancy (up to 12 weeks)” checkbox is checked in the disability benefit), early pregnancy benefit, childbirth benefit and child care benefit.

All required fields will be highlighted in red.

List of documents for the Social Insurance Fund currently in force

The employer prepares documents for payment of benefits. According to the current procedure, first the employee writes an application for benefits (according to the appropriate form from the FSS order No. 578 dated November 24, 2017), attaching to it the necessary supporting documents (sick leave, certificates from previous places of work, copies of children’s birth certificates, certificates from Registry office, etc.). Then the employer creates a package to transfer it to Social Security.

What documents does the FSS need now:

- if information is sent electronically - a register filled with information necessary for the assignment and payment of benefits (approved by order of the Social Insurance Fund dated November 24, 2017 No. 579);

- if the data is transmitted in paper format - copies of documents confirming the legality of the assignment of benefits and an inventory (from the Social Insurance Fund order No. 578 dated November 24, 2017).

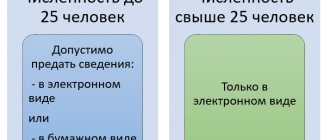

The electronic format is mandatory for policyholders whose average number of employees in the previous billing period was more than 25 people (clause 4 of the Regulations, approved by Government Resolution No. 2375 of December 30, 2020). Other employers can choose a convenient option for submitting information, incl. on paper.

Section "General information"

In this section, information about the employee, the employing organization and the method of payment of benefits is filled out. The completed data is saved within the employee; when creating a new sheet, this section will be filled in automatically.

1. «Applicant” - it should be noted who is the recipient of the benefit:

- “Benefit recipient” - the benefit is received by the applicant himself.

- “Authorized representative” - the benefit is received by the applicant’s representative.

When you select the latter, a block opens in which you should enter information about the authorized representative - full name and passport details.

2. “Information about the benefit recipient” - you must fill in the details of the benefit recipient, such as full name, SNILS, date of birth, address, gender, registration status and identification document.

Information about employees is available simultaneously both in the “FSS Benefits” service and in the PF Contour-Report. If you change information about an employee in one service, it will change or be deleted in the other.

3. “Information about the employer (organization)” This section is filled in automatically from the payer’s details. All lines except the TIN can be changed manually. If you change the details of the employing organization here, they will also change in the details.

4. “Benefit payment method” - you must choose one of two payment methods:

- Transfer through a bank;

- To the “WORLD” card;

- Postal transfer;

- Through another organization.

5. The “General Information” section is completed, you need to move on to the next section. The “Save changes to the document?” window will appear, click the “Save” button and proceed to filling out the next section.

Section “Certificate of incapacity for work”

The section is present in the following types of benefits:

- disability benefits;

- maternity benefits;

- benefits for occupational injury, illness.

Filled out based on the certificate of incapacity for work submitted by the employee. The layout of the fields corresponds to the paper form that is issued at the medical institution.

1. “Incapacity sheet No.” - the number of the incapacity sheet should be indicated in the cell: a 12-digit code under the barcode in the upper right corner of the incapacity sheet form.

2. Indicate whether the sheet is primary or continuation; duplicate or original.

- If the disability sheet being generated is not a continuation of another sheet, check the “Primary” box.

- If a certificate of incapacity for work is issued to replace a lost one, Fr.

- If the sheet is a continuation of another sheet, the number of the primary sheet should be indicated in the “Continuation of disability sheet No.” field. There is no need to check the “Primary” box.

3. Fill out all the required fields below (they will be highlighted in red), just like on a paper form issued by a medical facility.

Some filling features:

- Depending on which reason for disability code is selected, the required fields will be highlighted in red frames below.

- The code book does not contain the values 04 (work accident or its consequences) and 07 (occupational disease or its exacerbation). A document containing these reasons for disability cannot be sent electronically. These data should be submitted to the Social Insurance Fund on paper.

- If you have chosen a part-time job, then in the “No.” field you should indicate the number of the certificate of incapacity for work presented at the main place of work.

- If another sheet was issued, which is a continuation of the one being filled out, then its number should be indicated at the very bottom of the section.

4. The “Sheet of Incapacity for Work” section is completed, click the “Save” button and move on to the next one.

Electronic certificate of incapacity for work

A certificate of incapacity for work can be issued both in paper and digital form in accordance with paragraph 5 of Article 13 of the Federal Law of December 29, 2006 No. 255-FZ. Both options have equal legal force starting from 01.07.2017 in accordance with the amendments made by Federal Law dated 01.05.2017 No. 86-FZ. Drawing up a document in a digital version is possible if the medical organization and the insurer (employer) are participants in the information interaction system.

Advantages of electronic certificates of incapacity for work

The undeniable advantages of electronic sick leave certificates over paper versions ensure their widespread use.

Among the advantages:

- lack of expensive production of sick leave forms - strict reporting documents with special protection;

- there is no need to issue a duplicate if the paper form is lost or damaged;

- It’s easy to correct errors/typos;

- there is no need to verify the authenticity and validity of the sick leave certificate;

- there is no need to ensure secure storage of paper documents and their timely transfer to the Social Insurance Fund;

- Filling is not affected by the color of ink and legibility of handwriting;

- The processing time and receipt of documentation is reduced.

Interaction scheme for the ELN project

The interaction of the employee (insured person), employer (policyholder), Social Insurance Fund (insurer) and medical institution in the “ELN” project is as follows (Fig. 1):

- The employee contacts the medical institution, where he expresses written consent to receive an electronic health insurance.

- The medical institution registers an electronic certificate of incapacity for work in the federal state information system - the unified integrated information system “Sotsstrakh”.

- The medical institution receives an ELN number from the FSIS UIIS “Sotsstrakh”.

- The medical institution provides the employee with the ELN number.

- At the end of the period of illness, the employee transfers the personal identification number to the accounting department of the organization in which he works.

- The employer downloads the ENL using the number from the FSIS UIIS “Sotsstrakh”. ELN is filled out in the part supplied from the medical institution. The employer fills out its part of the ENL with information about the employee’s insurance experience and data on average earnings and makes the calculation.

- The employer pays the employee the entire benefit amount.

- The employer submits to the Social Insurance Fund a register of information about personal income tax, downloaded from the FSIS UIIS "Sotsstrakh", supplemented by information about the length of service of employees and data for calculating benefits.

- FSS receives ELN from FSIS UIIS "Sotsstrakh".

- The FSS checks the information received from the employer and sends the employer either an error report or confirmation of receipt of the register within no more than 10 days.

- Having confirmed receipt of the register, the FSS reimburses the employer for part of the benefit in excess of the payment for the first three days.

Rice. 1. Interaction diagram for the ELN project

| 1C:ITS For information about the electronic certificate of incapacity for work and interaction with the Social Insurance Fund, see the section “Instructions for accounting in 1C programs.” |

Support for the ELN project in 1C: Salaries and Personnel Management 8 (rev. 3)

In the program “1C: Salary and Personnel Management 8”, edition 3, a request from the FSIS UIIS “Sotsstrakh” for an electronic certificate of incapacity for work is made by clicking the Receive data from the Social Insurance Fund button when entering the Sick Leave document (Fig. 2). In this case, it is enough to select an employee and indicate the number of the certificate of incapacity received by the employee at the medical institution.

Rice. 2. Document “Sick leave”

All data on the electronic certificate of incapacity for work, including information about the medical organization and special causes of incapacity, are automatically downloaded from the FSIS UIIS “Sotsstrakh”. You can view the download results by following the hyperlink Filled in LN data. The data in the Sick Leave document is automatically supplemented with information from the 1C: Salary and Personnel Management 8 program about the employee’s length of service, his average earnings, previous sick leaves for care, conditions for calculating personal income tax, etc.

Having received the ELN from the FSIS UIIS “Sotsstrakh” and calculated it, the employer pays the employee benefits in the usual manner, and transfers to the FSS a register of electronic certificates of incapacity for work. It is convenient to create a register, send it immediately or upload it to a file in the 1C-Reporting service. The transcript of the ELN registry entry contains detailed information about the certificate of incapacity for work.

If, when sending the ELN register, some of the certificates of incapacity for work are not accepted by the FSS due to any errors, then the corrections of these errors will be taken into account the next time the specified register is sent. To do this, starting from version 3.1.10 of the program, its state is saved separately for each electronic device:

- Accepted by FSS;

- Not accepted by FSS

.

The ENL status is automatically updated when the FSS response is downloaded.

Section "Calculation of benefits"

In this section, fill in the data necessary to assign benefits to an employee by the regional branch of the Social Insurance Fund. All required fields will be highlighted in red.

1. “Information attribute” - you should select the “Primary information” item if the benefit is sent to the Social Insurance Fund for the first time. The “Recalculation” item is selected if the benefit has been sent and adjustments need to be made.

2. “Date of submission of documents to the policyholder” - the date when the benefit recipient submitted the application and additional documents to the employer should be indicated.

3. Indicate the regional coefficient, rate, insurance period, year and amount of earnings.

If you need to specify information about replacing billing years, you should check the “Fill in information about replacing years” checkbox. Additional fields will appear to indicate the years to be replaced.

4. “Benefit payment period” - you should select whether the benefit is paid entirely at the expense of the employer or whether there is a period for which the benefit is paid at the expense of the Social Insurance Fund. In the second case, in the field “Benefit at the expense of the Social Insurance Fund for the period”, be sure to indicate the beginning and end of the period for which the benefit is accrued at the expense of the Social Insurance Fund.

5. The “Benefit Calculation” section is completed; click the “Check and Submit” button.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Electronic certificate of incapacity for work for direct payments

Advantages of electronic sick leave certificates in the direct payments project

The simultaneous participation of the policyholder in both FSS projects provides the organization with ample opportunities to automate the processing of benefits. The accountant is relieved of the responsibility for monitoring the falsification of sick leave certificates. The employer pays for the first three days of sick leave already registered with the Social Insurance Fund. However, the policyholder receives not only the benefits of two projects, but also the need to generate and submit reports separately for each of the projects.

Scheme of interaction with the participation of the policyholder in two projects

The interaction between the employee of the insured person, the employer - the policyholder, the Social Insurance Fund - the insurer and the medical institution in the case of the employer’s participation in the Social Insurance Fund ELN and direct payments projects is as follows (Fig. 6):

- The employee goes to a medical facility.

- The medical institution registers the ELN in the FSIS UIIS “Sotsstrakh”.

- The medical institution receives an ELN number from the FSIS UIIS “Sotsstrakh”.

- The medical institution provides the employee with the ELN number.

- Upon completion of the illness, the employee transfers the personal identification number to the accounting department of the organization in which he works. In this case, the employee fills out an application to the Social Insurance Fund with a request to pay the benefit, indicating the details for transferring funds.

- The employer downloads the ENL by number from the FSIS UIIS "Sotsstrakh" (ELN is filled in in the part supplied from the medical institution), fills out its part of the ENL with information about the employee's insurance experience and data on average earnings and makes the calculation.

- The employer pays the employee (if necessary) for the first three days of illness.

- The employer submits to the FSS a register of information about ELN downloaded from the FSIS UIIS “Sotsstrakh”, supplemented by information about the employees’ length of service and data for calculating benefits, a register of information for calculating benefits for direct payments and an employee’s application to transfer funds to the account of the insured person.

- FSS receives ELN from FSIS UIIS "Sotsstrakh".

- The FSS checks the information received and informs the employer of either an error log or confirmation of receipt of the register and application.

- Having confirmed receipt of the register, the Social Insurance Fund transfers to the employee part of the benefit in addition to the payment for the first three days.

Rice. 6. Scheme of interaction with the participation of the policyholder in the ELN project and direct payments

ELN for direct payments in “1C: Salary and Personnel Management 8” (rev. 3)

In the 1C: Salaries and Personnel Management 8 program, edition 3, in the Sick Leave document, you can download an electronic certificate of incapacity for work by its number. In this case, on the Pilot Project tab, all required information will be automatically filled in in detail. And in the 1C-Reporting service, users are given the opportunity to create registers for direct payments and for electronic tax payments.

From the editor. More information about payments from the Social Insurance Fund, direct payments, electronic sick leave, as well as about the capabilities of the 1C: Salary and Personnel Management 8 program, edition 3, for interaction with the Social Insurance Fund within the framework of the ELN project and a pilot project for direct payments from Social Insurance Fund representatives and experts 1C was discussed at the lecture on November 14, 2019. The video is available for viewing on the 1C:ITS website on the 1C:Lecture page.

Section "Additional Documents"

The section is present in the following types of benefits:

- maternity benefit (if the disability benefit checkbox “Registered in the early stages of pregnancy (up to 12 weeks)”);

- early pregnancy benefits;

- childbirth benefit;

- child care allowance.

Some filling features:

- It is mandatory to fill in the data from the child’s birth document - type of document, series and number, date of issue, full name, date of birth.

- If necessary, you can fill in information about a certificate from the other parent about non-receipt of benefits, information about an adoption or guardianship document, and information about an agreement on transfer to a foster family.

After filling out the section, click the “Save” button.

What is needed to pay social insurance benefits to employees in 2022?

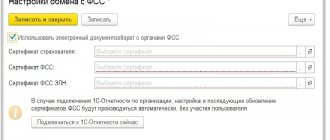

The employer needs to organize work with electronic sick leave (ELN) by connecting to the FSS information system - EIIS "Sotsstrakh", through which all relevant information is now exchanged with the fund.

Important! Recommendations from ConsultantPlus To transfer information, you can use one of the following methods. Submit the information via (clause “a”, clause 10 of the Rules for information interaction when generating an electronic sick leave, Information from the Federal Social Insurance Fund of the Russian Federation): the policyholder’s personal account on the website https://cabinets.fss.ru/. To access it, you must use a verified account on the government services portal; electronic interaction service “Social Electronic Document Management” (SEDO) (https://sedo.fss.ru/sedo.html); AWP program “Preparation of calculations for Social Insurance Fund”. It can be downloaded from the foundation’s website; accounting programs that have the ability to work with electronic sick leave; EDF operator. Read more about how to organize work with ELN in K+. Trial access is free.

You also need to collect from employees and send to the Social Insurance Fund information about insured persons in the form approved. social insurance. This way, you will also inform the fund of the payment details of the employees for which it must pay benefits.

Payment of sick leave and maternity benefits is carried out without any applications from employees on the basis of the Eln, posted in the Unified Social Insurance Information System by medical institutions.

Is the register of information for the assignment and payment of benefits transferred to the Federal Social Insurance Fund of the Russian Federation? See K+ for the answer. Trial access is available for free.

The Social Insurance Fund will also pay for the child's birth benefit; no applications or certificates of non-receipt of benefits by the second parent are now required. An application will only be required when applying for child care benefits: in a free form for leave and in a form approved by the Social Insurance Fund for payment of benefits.

A typical situation from K+ will help you fill out all the documents for a “children’s” vacation and pay for it. Trial access to the system is free.

Checking and sending

1. To send, you must first open the document, then click the “Check and Send” button.

If you need to send several documents at the same time, you should open the “Details and Settings” menu and click the “Enable bulk sending mode” button.

After this, you will be able to send several documents.

2. The scan will begin.

- If the verification is successful, you should select a certificate to sign the document and click “Send document to the FSS.”

The list will display only qualified certificates whose TIN matches the organization’s TIN from the document.

The registration number of the policyholder in the certificate must match the registration number of the organization indicated in the document.

If the document is sent for a separate unit (in this case, the subordination code ends with 2), then the registration number of the policyholder in the certificate must match the additional FSS code specified in the document.

After sending, the document will appear first in the list with the status “Queue for sending”.

- If errors are found during the check, you should click the “Close and proceed to correct errors” button. Fields with errors will be highlighted in red; you should correct them and resend.

Processing statuses

- “Created” - the document was created, but not sent to the FSS. The date and time the document was last modified is indicated.

- “Queued for sending” - the document is queued for sending to the Social Insurance Fund.

- “Submit Error”—errors occurred during the document sending process. You need to send the document to the FSS again. To do this, click on the line with the document and click “Send again”.

- “Not accepted by the FSS” - as a result of checking the document in the FSS, errors were identified. You should correct the errors indicated in the FSS protocol and resend the document.

- “Accepted by the FSS” - the document is sent for consideration to the regional office of the FSS. The receipt can be viewed and printed.

If errors are found during the check at the regional office of the FSS, the notification should be received by Russian Post. In this case, you should make the required changes to the document and send it to the FSS.

View scan results

If the document is accepted for consideration

If the document was submitted for consideration to the regional office of the FSS, the status “Accepted by the FSS” will be displayed. This is the final status.

To view a receipt, you need to click on the line with the document and follow the “View receipt” link.

A window with a receipt will appear on the screen.

The document for which the receipt was received can be edited and sent again to the FSS. To do this, click on the line with the document and click the “Correct errors and resend” or “Create recalculation” button. These functions will also be available if you hover your mouse over the line with the document and click on .

- “Correct errors and send again” - this item should be used if the document passed checks at the FSS gateway and was submitted for consideration to the regional office of the FSS, but during its review, shortcomings were discovered and the FSS sent a notice of errors to the employer (for example, by Russian Post "). You should correct the errors indicated in the notice and resend the document.

- “Create recalculation” - this item should be used if the document passed checks at the FSS gateway and was submitted for review to the regional FSS office, but after receiving the receipt the employer realized that an error was made in the calculation data. When creating a recalculation in the “Benefit Calculation” section, you will need to indicate the reason for the recalculation, correct the necessary data and resend the document.

If the document is not accepted

If the document was not accepted by the FSS, the status “Not accepted by the FSS” will be displayed. To view the log, you need to click on the line with the document and follow the “View error log” link.

A window with the protocol will appear on the screen.

The document for which the protocol was received must be corrected and sent again to the FSS. To do this, click on the line with the document and click the “Correct errors and resend” button. This function will also be available if you hover your mouse over the line with the document and click on .

After selecting “Correct errors and resend”, the document status will change to “Created”. If necessary, you can always view the protocol by clicking on and selecting “ View document flow”.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

View sent documents

To view the sending status, select the line with the desired document and click on it. After this, a window with data on the last shipment will become available.

- Document status – read the meaning of statuses in the section “List of documents and statuses” .

- Report number in the FSS - the number is used to search for the transferred document on the FSS portal in the section “Information about transferred documents” .

- Error log – displays a list of errors detected by the Social Insurance Fund during control of the transmitted document.

- View receipt – the ability to open a receipt confirming receipt of the document by the Foundation.

- View document – allows you to display the information contained in the sent document.

- Download file – downloads the transferred document.

If you want to see the entire history of sendings, you should click “Show history” .