Economic calculation of the benefits of the patent system

Deadlines for obtaining and procedure of the patent system

How to obtain a patent for a taxi in Moscow

Cost of a taxi license

Every driver working in a taxi asks himself the question: should he acquire a license to operate a taxi or not?

If you seriously intend to earn money by transporting passengers and luggage by passenger taxi, and at the same time save the money you earn on taxes and reporting, then the answer is obvious: of course, you need to acquire a license to operate a taxi.

Advantages of purchasing a patent:

- no need to pay 6% of your turnover (money earned);

- reporting for individual entrepreneurs is reduced;

- you don’t need to follow the lead of companies trying to make money from you.

Now let's look at these advantages in more detail. Each driver working in a taxi, in addition to cash orders, also carries out non-cash orders from companies that enter into contracts with him directly, or he undertakes to fulfill the orders provided by dispatch services, taxi companies, which, in addition to their cars, also attract individual entrepreneurs to fulfill orders.

PSN: essence and types of activities

The meaning of this special regime is that the entrepreneur receives a special document from the tax authorities - a patent.

It acts as a permit to conduct any type of commercial activity. A patent is a kind of payment for carrying out an activity. You can receive (or better yet, buy) it for any period, but not more than 12 months (clause 5 of Article 346.45 of the Tax Code of the Russian Federation) and only for one type of activity (clause 1 of Article 346.45 of the Tax Code of the Russian Federation). Different patents must be acquired for several types of business activities. The patent taxation system can only be used by individual entrepreneurs; it has nothing to do with enterprises. For entrepreneurs, the patent tax system is an excellent chance to try themselves in a small business, because a document can be purchased for at least 1 or 2 calendar months. The patent tax system does not require the preparation and submission of a tax return on it, which is another argument in favor of starting entrepreneurs switching to it.

ATTENTION! A bill has been submitted to the State Duma, according to which SMEs will be able to apply PSN. Officials also propose to set new limits for the special regime. See details here.

The types of activities that are subject to taxation using the patent method are prescribed in Art. 346.43 Tax Code of the Russian Federation. The list contains 80 types of permitted activities. At the same time, local authorities have the right to supplement it at the regional level, but not to reduce it. If we compare the types of activities of the patent tax system with UTII, we cannot help but dwell on the obvious similarities. Basically, the application of these two tax systems involves the provision of certain services and retail trade.

Production within the framework of the patent taxation system is not provided for, but it is possible to provide so-called production services that are directly related to the manufacture of something. For example, these include the production of tableware, carpets, agricultural implements, eyewear, etc.

IMPORTANT! From 2022, it is no longer possible to use PSN when selling goods that are not related to retail trade. And labeled drugs cannot be sold even within the framework of medical and pharmaceutical activities. Read more here.

Transition to a patent tax system

In order to obtain a patent, an entrepreneur must submit an application of his intention to the tax office at least 10 days before the start of application of the PSN.

The application form can be downloaded for free by clicking on the image below:

To switch to PSN from 01/01/2022, submit the form no later than 12/16/2021. See details here.

In turn, the tax authorities are ordered to issue a patent within 5 days from the date of acceptance of such an application, provided that the payer has the right to apply this tax regime (clause 3 of Article 346.45 of the Tax Code of the Russian Federation). In this case, the entrepreneur receives the patent itself (or a notice of refusal to issue it) against receipt from tax specialists.

ATTENTION! If an entrepreneur has submitted an application for a patent through the “Individual Entrepreneur’s Personal Account” or via telecommunication channels, he will receive it electronically. In this case, it is no longer necessary to obtain a paper patent from the tax authorities.

Find out what happens if an individual entrepreneur delays filing a patent application here .

Since 2014, an entrepreneur can declare his desire to switch to a patent tax regime simultaneously with the registration of an individual entrepreneur, which is another advantage of a patent for beginning entrepreneurs.

As mentioned earlier, the patent tax system can only be used by individual entrepreneurs. But there are certain restrictions for them:

- The number of personnel - no more than 15 people engaged in activities for which the PSN is applied, for the tax period does not exceed 15 people.

When calculating the average number of employees for PSN, take into account the people who are employed by you in all types of “patent” activities, since the number limit is general, regardless of how many patents you have received (clause 5 of Article 346.43 of the Tax Code of the Russian Federation, Letter from the Ministry of Finance of Russia dated March 20, 2015 N 03-11-11/15437). Employees who are employed in your activities under other taxation regimes do not need to be taken into account. For example, if you combine PSN and simplified tax system, do not take into account workers in “simplified” activities when calculating the number for PSN (Letters of the Ministry of Finance of Russia dated March 13, 2020 N 03-11-11/19389, dated October 29, 2018 N 03-11-09/77379 ).

See also: “PSN + OSNO: how many workers can an individual entrepreneur hire without losing a patent?”; “Are maternity women included in the average number for PSN? ”

- Income exceeding 60,000,000 rubles.

It is determined incrementally from the 1st day of the calendar year in which the entrepreneur began patenting activities. In practice, situations often arise when the payer combines several tax regimes. Income is considered in aggregate for all activities. If an individual entrepreneur combines a PSN, for example, with a simplified tax system, then for the purposes of the income limit on the PSN, income from sales is taken into account both from activities transferred to the “patent” and from activities on the simplified tax system (clause 6 of Article 346.45 of the Tax Code of the Russian Federation, Letter from the Ministry of Finance of Russia dated 04/13/2021 No. 03-11-11/27580). Otherwise, the individual entrepreneur will lose the right to use the patent taxation system.

Read about the combination of PSN and simplified tax system here.

The tax authorities are not required to issue a patent to the applicant. They can issue a refusal based on several reasons (clause 4 of Article 346.45 of the Tax Code of the Russian Federation):

- The application indicates the type of activity that has nothing to do with the patent tax system.

- Submission of an application not on a standardized form or with irregularities in filling out the required elements.

- Indication in the application of an incorrect validity period of the document, for example, 18 months, which contradicts the requirements of the patent regime.

- Violation of the condition for re-transition to the patent tax regime in case of loss of the right to use it (paragraph 2, paragraph 8, article 346.45 of the Tax Code of the Russian Federation). An application for the use of a patent in relation to an activity for which it was previously used can be filed by an entrepreneur no earlier than the next calendar year.

- Failure to pay arrears that must be transferred in connection with the transition to a patent tax system.

If an entrepreneur has lost the right to use a patent, for example, if his income exceeds his income, then he must notify his tax office about this by filing an application within 10 calendar days from the date of occurrence of these circumstances. A similar application is submitted in the event of termination of activities for which the patent tax system was applied. Deregistration is carried out by tax inspectorate specialists no later than 5 days from the date of filing the application. The official date of deregistration is the day when the entrepreneur was transferred to the general tax regime.

Subject to certain conditions, entrepreneurs have the right not to pay a patent, since they are subject to a zero rate for a certain period. Check if you can avoid paying tax with the help of advice from ConsultantPlus. If you do not have access to the K+ system, get a trial demo access for free.

What taxes does the patent tax system replace?

The patent taxation system involves replacing the single tax with the payment of taxes only in relation to activities for which this tax regime is applied. The single tax that an entrepreneur pays for obtaining a patent replaces 3 taxes: VAT, personal income tax and personal property tax. However, if an entrepreneur imports products into the territory of the Russian Federation, then such an operation will be subject to VAT in the general manner, regardless of whether he applies a patent or not.

An entrepreneur with a patent must pay insurance premiums for himself.

Read more about them here. See also: “The individual entrepreneur was closed before the patent expired: how to calculate the percentage in the Pension Fund of Russia.”

In addition, he charges insurance premiums to the wage fund of his employees. Moreover, starting from 2022, he must do this on a general basis and at general tariffs. Until 2022, there was a benefit for individual entrepreneurs on PSN: the tariff for compulsory pension insurance was 20%, and there was no need to transfer social and health insurance contributions at all, with the exception of activities related to retail trade, public catering and leasing of premises (subclause 9 clause 1, subclause 3 clause 2 of article 427 of the Tax Code of the Russian Federation).

Read about insurance premium rates in the article “Insurance premium rates in the table.”

From 2022, individual entrepreneurs have the right to reduce the amount of PSN tax by the amount of insurance premiums paid for themselves in the amount of 100%, or paid for employees, but not more than 50% of the tax amount.

See here for details.

Russian laws allow the combination of several tax regimes. In this case, the individual entrepreneur must keep records separately for each type of activity (tax regime).

UTII system for taxis

Important:

from 2022, UTII taxi is no longer relevant! Those who previously operated under this tax system must now consider other options.

Until this point, many taxi companies had been using the UTII system, since it was profitable to a certain extent: it was suitable for small taxi services (up to 20 cars and up to 100 drivers employed directly in the taxi service). The tax was calculated differently for one region or another and could be reduced due to insurance payments. And even the fact that UTII as a system did not operate in Moscow did not deprive it of its popularity.

In 2022, UTII will be abolished not only in taxis, but also in all other areas of activity, since with all the above advantages there were also no less significant disadvantages:

- For a business with a small income, the system was unprofitable;

- When applying UTII, the final financial result was difficult to predict;

- This system was often used when splitting up a business in order to avoid larger tax payments.

The abandonment of UTII, according to legislators, will have to contribute to the development of healthy competition and the creation of equal conditions for doing business. Meanwhile, taxi companies are being offered to switch to one of the following tax payment schemes.

Tax accounting under the patent tax system

As noted earlier, the patent tax system gives an entrepreneur the opportunity not to submit tax reports, but it does not exempt him from maintaining tax records. After all, with its help, tax authorities track income received on an accrual basis from the beginning of the calendar year. The amount of income received is important in determining the right of an entrepreneur to obtain a patent or its further use.

An individual entrepreneur must keep records of his actual income (and not possible) in the income book under the patent tax regime. If a person uses hired labor, then records of wages of his staff and insurance contributions must be organized. He can keep records himself, use hired labor (have a full-time accountant or accounting department), or contact specialized companies that carry out record keeping.

ConsultantPlus experts explained in detail how individual entrepreneurs keep records of income and expenses when combining simplified taxation system and PSN. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Although an individual entrepreneur on a PSN does not have to submit reports under the patent taxation system, he is not exempt from generating and submitting other reports. Read more about this in the article “Individual entrepreneur reporting on PSN - pros and cons.”

simplified tax system

The simplified taxation system for entrepreneurs has a number of advantages:

- The individual entrepreneur independently chooses the subject of taxation: income or income minus expenses;

- accounting documentation does not require special knowledge and does not take much time;

- Individual entrepreneurs are exempt from paying personal income tax and personal property tax. persons and VAT.

Payment modes of the simplified tax system

The percentage tax rate is 6% of income or 15% of the difference between income and expenses. The simplified tax system is paid in advance payments quarterly until the 25th day of the month following the quarter. At the end of the year, a declaration of annual income is submitted, payment is made until April 30 for individual entrepreneurs (March 31 for organizations). You can change the simplified tax system to another system only at the end of the tax year.

Taxi at the object "STS income"

When choosing the tax object “Income”, the rate will be 6%. Regional authorities can reduce the rate down to 1%. The amount for calculating tax is taken for the reporting period. For example, if reporting is for a quarter, then income for 3 months is summed up.

When can an entrepreneur lose the right to use a patent?

An entrepreneur may be deprived of the right to use a patent in the following cases:

- the number of personnel increased to more than 15 people;

- the income received from sales exceeded 60,000,000 rubles;

- from 2022 - if, within the framework of the retail patent, the sale of goods not related to retail trade was carried out.

Read about which sales are not retail and may result in invalidation of the patent, and about other changes in the PSN from 2022 in this publication.

If an entrepreneur bought a patent, for example, for 5 months, and then, after conducting business for 3 months, decided to stop it, then he can submit an application to the tax office for reimbursement of the paid cost of the purchased patent for the remaining 2 months.

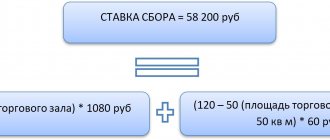

Example of calculating the cost of a patent

The valuation of a patent is fixed. The tax rate is 6%. For Crimea and Sevastopol it can be set at 4%.

Potential income for the year is used as the tax base. It is established by local authorities at the regional level. You can find out the price of a patent at the tax office or in the articles of regional laws.

The upper limit of potential income in 2022 is established by the laws of the constituent entities of the Russian Federation.

ATTENTION! The deflator coefficient is not determined, since from January 1, 2022 from clause 7 of Art. 346.43 of the Tax Code of the Russian Federation, the provision that established the maximum amount of potential income, which was previously subject to indexation by the deflator coefficient, was excluded.

In some cases, when calculating the price of a patent, the area of the rental premises, sales area, and the number of employees can also be taken into account. If during the year the number of employees decreased, for example, from 10 to 8 people, then the tax is not recalculated downward, but if it is upward, it is subject to recalculation (a new patent is purchased according to the letter of the Ministry of Finance of the Russian Federation dated April 29, 2013 No. 03-11-11/ 14921).

The tax period is considered to be the year or the number of months for which the patent was purchased.

To understand the meaning of calculating the value of a patent, consider a simple example.

Individual entrepreneur P. A. Menovshchikov decided to start providing hairdressing services in 2022 and acquire a patent for 5 months. Regional authorities of a constituent entity of the Russian Federation have established a potential income of 325,000 rubles. Let's calculate the annual cost of a patent.

It will be equal to 325,000 rubles × 6% = 19,500 rubles. The cost of a patent per month will be 19,500 rubles / 12 = 1,625 rubles. Accordingly, the cost of a patent for individual entrepreneur P. A. Menovshchikov for 5 months of 2022 will be 1,625 rubles × 5 months = 8,125 rubles.

According to local legislation, the amount of potential income increases as the number of employees increases. If the individual entrepreneur Menovshchikov has a staff of no more than 5 people, then the possible income according to the law of the subject in our example will be equal to 600,000 rubles. Then the cost of a patent for a year will be recalculated upward: 600,000 rubles × 6% = 36,000 rubles. The price of a patent per month will be 36,000 rubles / 12 months = 3,000 rubles. In total, the entrepreneur must pay for 5 months of using the patent: 3,000 rubles × 5 months = 15,000 rubles.

Consider an example where the number of employees increased in the middle of the patent.

The same individual entrepreneur P.A. Menovshchikov, having worked independently for 4 full months, decided to hire 3 people for the remaining 5th month of the patent tax system. For 3 new employees, he must additionally buy a patent for the remaining 1 month of the patent's validity period. Since he hired up to 5 employees, the price of the patent will be calculated based on our estimated 600,000 rubles.

We get the price of a patent for the 5th month of an entrepreneur’s activity: 600,000 rubles × 6% / 12 months = 3,000 rubles. It is for this amount that the individual entrepreneur Menovshchikov must purchase a new patent for 3 of his new employees.

After the expiration of 2 patents, IP Menovshchikov P.A. can purchase a new patent for the desired period, but based on a different amount of potential income accepted by the authorities of his region, for example, 900,000 rubles. The amount of this income will change due to an increase in the number of working personnel from 5 to 8 people.

The tax must be transferred in one amount if the patent term does not exceed 6 months or in two amounts if the patent is issued for 6-12 months. ConsultantPlus experts explained in detail how much tax should be transferred under PSN and what deferment entrepreneurs working in the affected industries can receive. Get trial access to the K+ system and upgrade to the Ready Solution for free.

Find out more about calculating the cost of a patent here.

Economic calculation of the benefits of the patent system

With an average net income of 92,000 rubles per month, there are up to 50,000 non-cash orders. There are much more such orders from companies in need of transportation in reputable taxi companies, moreover, if you are a normal driver, then the company will order you personally, and the taxi company will always meets the client halfway, and this is additional income.

But how can a taxi company officially give you cashless money?

There are several options, but we will look at the most used:

Conclude an agreement with you as an individual (while paying all taxes for you) and pay you a salary. But taxi companies won’t just do this. This is only possible for an increased percentage, i.e. not 20% interest like individual entrepreneurs with their own accounts, but at 25-30% or simply pay you a fixed salary per month, without compensating you for gasoline, repairs, maintenance, wear and tear, etc.;

To conclude an agreement with you as an individual entrepreneur, then the taxi company has the opportunity, after you have issued an invoice for the work done, to officially pay you the invoice for the transport services you provided. But you should be prepared to pay the minimum tax on each transferred amount, for example 6%.

It is not difficult to calculate that per month, with net earnings from non-cash orders of at least 50,000 rubles, you are required to pay income tax in the amount of: 3,000 rubles. This is twice the cost of a patent per month. And keep in mind that in our calculations we took the minimum (50,000 rubles per month). Your overpayment per year will be at least 18,000 rubles (just like that).

I would like to note that non-cash orders include payment in the car using a terminal, payment by card in the application (in cooperation with online applications. There are more and more such orders and it is up to you to decide whether to refuse the number of orders that taxi service users need or to acquire a patent and forget about unnecessary reporting and tax payments.

Pros and cons of PSN

Let us consider and summarize the pros and cons of using the patent tax system.

The advantages of the patent taxation regime include the following aspects:

- An entrepreneur can independently determine the validity period of a special tax regime (patent). This gives an aspiring businessman an excellent opportunity to assess the potential of the market in which he plans to operate and the income from business activities.

- There is no need to submit tax returns, which makes the life of entrepreneurs much easier. However, this does not exempt them from maintaining tax records of their income.

- Regional authorities have the right to expand the list of activities for which patents can be issued, which also provides additional opportunities for small businesses.

- A simple tax transfer scheme that does not depend on the results of final activities. The price of a patent is determined by the tax office based on potential income for the year. It is established by local authorities at the regional level.

- Possibility of acquiring patents for several types of activities and in several regions of the country.

- The price of a patent is reduced by the amount of the transferred insurance premiums, as is done under the simplified tax system “income”.

Of course, the patent tax regime is not without its drawbacks:

- The mode can only be used by individual entrepreneurs. Businesses do not fall into this category.

- Basically, patent commercial activities involve household services and retail trade.

- There is a strict limitation on the number of employees - only 15 people. All employees of the entrepreneur are subject to registration.

- The area of the service room should be no more than 150 square meters. m. (this restriction applies to retail and catering, because the area is not specified for other services).

Results

Each entrepreneur must independently assess the risks, opportunities and potential income under different taxation regimes and make a choice in favor of the most profitable one. The patent tax regime is especially suitable for entrepreneurs starting their own business, as it frees them from calculating taxes and filing tax returns.

You can find out which BCC the cost of the patent should be credited to in the article “KBK for a patent for individual entrepreneurs (nuances)” .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Taxi tax according to OSNO

If, when answering the question: “Which taxation should I choose for an individual taxi?”, an entrepreneur leans towards the basic system, then he will have to pay VAT, personal property tax and personal income tax. This system is complex and expensive; it requires a complete accounting workflow. It is necessary to correctly process all financial transactions and observe all the nuances when submitting reports. Therefore, there is a need to hire an accountant and oblige drivers to fill out primary cash documents every time.