Through what payments and in what amount can the cost of a patent be reduced?

New edition of Art. 346.51 of the Tax Code of the Russian Federation gives entrepreneurs the right to reduce the cost of a patent by the following types of payments:

- Mandatory insurance contributions for employees to the following funds: pension, medical and social.

- Contributions for voluntary personal insurance of employees in case of temporary disability.

- Sick leave for the first days of illness, which is paid by the employer.

- Insurance premiums that an entrepreneur pays for himself.

Since most of the listed types of payments relate to various types of insurance, we will further call them insurance premiums for brevity.

An individual entrepreneur with employees can reduce the cost of a patent by paying insurance premiums for themselves and their employees by no more than 50%. An entrepreneur who works alone has the right, without restrictions, to deduct contributions paid for himself from the cost of the patent.

A situation is possible when an individual entrepreneur simultaneously uses two or more patents for different types of activities, and employees are involved in only one of the areas.

According to tax authorities, the 50% limitation on reduction in value applies to all patents that were valid during the period when the individual entrepreneur had employees (clause 3 of the letter of the Federal Tax Service of the Russian Federation dated 06/02/2021 No. SD-4-3 / [email protected] ).

Example 1

IP Yakovlev received three patents for 2022:

- Patent No. 1 for the period from January 1 to December 31.

- Patent No. 2 for the period from January 1 to July 31.

- Patent No. 3 for the period from October 1 to December 31.

For activities under patent No. 3, Yakovlev hired two employees on October 10, 2022. Therefore, Yakovlev has the right:

- Reduce the cost of patent No. 2 by contributions for yourself without restrictions, since during the period of validity of this patent there were no employees.

- Reduce the cost of patent No. 1 for contributions for oneself and patent No. 3 for contributions for oneself and employees within 50%. The fact that no workers were involved in the activities under patent No. 1, according to the tax authorities, does not matter. It is important that during the period of validity of this patent, the individual entrepreneur had employees in principle.

Results

To reduce the cost of a patent by contributions, you need to send a notification to the tax office with the details of the patent and the amount of contributions paid.

The notification is sent to the Federal Tax Service with which the individual entrepreneur is registered under the patent and with which he paid or must pay its cost.

If the notification was submitted after part or all of the cost of the patent was paid, the overpayment can be returned upon application.

The procedure is new and has not yet been tested in practice, so most likely there will be questions and clarifications from tax authorities. We will monitor developments and report on the blog. Subscribe so you don't miss anything!

Under what conditions can an individual entrepreneur reduce the cost of a patent for insurance premiums?

To receive a deduction from a patent for insurance premiums, a number of conditions must be met:

- The fees must actually be paid during the period during which the patent is in force. For example, an individual entrepreneur has the right to pay fixed contributions for himself on any day during the year. If the patent was received in January-February, and the individual entrepreneur paid the fees in March, then the cost of the specified patent cannot be reduced by these fees.

- Contributions that were paid during the validity period of the patent for past billing periods can be deducted from its value on a general basis. This also applies to 1% contributions to the Pension Fund of the Russian Federation on revenue exceeding 300 thousand rubles. per year (clause 4 of the letter of the Federal Tax Service of the Russian Federation No. SD-4-3/ [email protected] ).

- If an individual entrepreneur uses contributions paid for employees to deduct, then these employees must be engaged in “patent” activities. Consequently, those entrepreneurs who combine a patent with a simplified patent or OSNO must keep separate records of the fees paid.

- If the individual entrepreneur has already used contributions to reduce the taxable base for other taxes, then they cannot be reused to reduce the cost of the patent.

Real income exceeds potential

With the introduction of online cash registers, it has become easier for tax authorities to monitor the actual income of taxpayers. What to do with the accrual of an additional contribution to pension insurance in the amount of 1% on the amount of real annual income exceeding 300,000 rubles, if the amount of potential income does not exceed 300,000 rubles?

Let us turn to the Tax Code of the Russian Federation, in paragraph 1 of Article 346.48. which says:

“The tax base is defined as the monetary expression of the annual income potentially received by an individual entrepreneur for the type of business activity in respect of which the patent tax system is applied...”

From paragraph 1 of Article 346.48. The Tax Code of the Russian Federation states that the tax base is equal exclusively to the monetary expression of potential income.

For further confirmation of this idea, let us turn to the Letter of the Ministry of Finance dated January 28, 2019 No. 03-15-05/4703. Reading the last paragraph:

“If the potentially receivable annual income of an individual entrepreneur for the relevant type of business activity exceeds 300,000 rubles, then such an individual entrepreneur pays an additional 1% in addition to insurance contributions for compulsory pension insurance in a fixed amount, calculated from the amount exceeding 300,000 rubles. potential annual income, regardless of the actual annual income of an individual entrepreneur..."

From all of the above it follows that, regardless of the amount of real income of an individual entrepreneur applying the patent taxation system, the calculation of an additional contribution to pension insurance in the amount of 1% on an amount exceeding 300,000 rubles is based only on potential income.

Example The potential income of an entrepreneur for the reporting year was 200,000 rubles, and the actual income was 500,000 rubles. In this case, the additional contribution to pension insurance in the amount of 1% is not paid, since the potential income does not exceed 300,000 rubles.

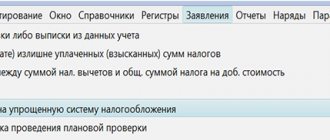

How to fill out and submit a notice of reduction in the value of a patent for insurance premiums

Notification of a decrease in the cost of a patent for insurance premiums must be submitted in the form attached to the order of the Federal Tax Service of the Russian Federation dated March 26, 2021 N ED-7-3/ [email protected] . The document consists of a title page with general information about the taxpayer and two sections:

- Section A includes information about patents the value of which the taxpayer wants to reduce:

— number and validity period (lines 010, 020, 025);

— taxpayer’s attribute: whether he has payments to individuals or not (line 030);

— total amount of tax on the patent (line 040);

— the amount of contributions to be reduced according to the current notification (line 050);

- the amount of contributions that was used to reduce payments under this patent for previously issued notifications (line 060).

The Tax Code of the Russian Federation allows you to distribute the deduction between several patents. In this case, information on each of them should be reflected in a separate block of lines 010 - 060.

- In section B you need to indicate the amounts for the business as a whole:

— total insurance premiums paid (line 110);

— insurance premiums were used to reduce the cost of patents under the current notification (line 120);

— insurance premiums were used to reduce payments for patents under previous notifications (line 130);

— the balance of paid insurance premiums not used to reduce the cost of patents (p. 140).

The notification can be sent either on paper or electronically. There is no deadline for submitting it.

The application should be submitted to the Federal Tax Service where the entrepreneur is registered as a taxpayer on the PSN. An individual entrepreneur can operate using a patent in several regions. In this case, he can send an application to the tax office at the place of his registration in any of these regions (clause 1 of the letter of the Federal Tax Service of the Russian Federation No. SD-4-3 / [email protected] ).

The Federal Tax Service has the right to consider the notification within 20 working days, i.e. about a month. Tax authorities will send the entrepreneur a document refusing to reduce the value of the patent in the following cases:

- The amount of insurance premiums indicated in the notification has not actually been paid.

- The amount of contributions paid is less. Here the tax authorities will refuse to reduce the cost of the patent partially - in the amount of excess over the actually paid contributions (clause 5 of the letter of the Federal Tax Service of the Russian Federation No. SD-4-3 / [email protected] ). An individual entrepreneur can pay additional fees and re-submit a notification for the difference. But you need to make an additional payment while the patent has not yet expired.

- The amount of contributions in the notification is greater than the cost of the patent for an individual entrepreneur without employees or 50% of this cost for an individual entrepreneur with employees. Here the tax authorities will also partially refuse the deduction, but nothing can be changed - the limitation on the value of the patent is used in any case.

Potential income exceeds actual

Let’s say the potential annual income of an individual entrepreneur under a patent is 400,000 rubles. What to do with the accrual of an additional contribution to pension insurance in the amount of 1% on the amount of potential income exceeding 300,000 rubles, if the real annual income according to the taxpayer was 200,000 rubles?

In this case, as in the previous one, the basis for calculating the additional contribution to pension insurance is potential income, which, according to the condition, is equal to 400,000 rubles. An individual entrepreneur is obliged to pay, together with the amount of a fixed contribution and 1% of 400,000 - 300,000 = 100,000 rubles in the amount of 1,000 rubles.

Other topics: Reduction of patent on insurance premiums from 2022

Example 2

IP Petrov acquired a patent worth 25 thousand rubles for the 1st half of 2022. Petrov has no hired workers.

In April 2022, Petrov filed a notice to reduce the value of the patent by the entire amount - 25 thousand rubles. However, by this time he had paid only 20 thousand rubles. insurance premiums. Therefore, the tax authorities partially refused to apply a deduction to Petrov in the amount of 5 thousand rubles.

But if Petrov pays an additional 5 thousand rubles. until June 30, 2022, then he can submit a second notification for this amount and take advantage of the deduction in full.

If within a month after the notification was submitted, the tax authorities did not react to it in any way, then “by default” we can assume that the application to reduce the value of the patent was accepted without comments.

We will tell you how to more conveniently use the deduction of insurance premiums from a patent in the next section.

Example 3

IP Kirillov filed an application for a patent for the 1st quarter of 2022, which costs 30 thousand rubles. Kirillov has no hired employees. In February 2022, Kirillov paid part of the insurance premiums “for himself” in the amount of 25 thousand rubles. He can fully deduct the fees paid from the cost of the patent, i.e. pay instead of 30 thousand rubles. only 5 thousand rubles.

If more contributions have been paid than the cost of the patent (or half of it for individual entrepreneurs with employees), then the application should include only the amount that is allowed to be used to reduce the cost of the patent.

The unused balance of contributions can then be deducted from the cost of other patents, but only within the calendar year (clause 6 of the letter of the Federal Tax Service of the Russian Federation No. SD-4-3 / [email protected] ).

Example 4

IP Smirnov’s patent for the 1st quarter of 2022 costs 100 thousand rubles. Smirnov has hired employees. For January - February 2022, he paid insurance premiums for himself and for his employees in the amount of 70 thousand rubles. But Smirnov has the right to deduct only half the cost of the patent, i.e. 50 thousand rubles. It is this amount that Smirnov must indicate in line 050 of section A of the notification.

Thus, he will pay half the cost for the patent for the 1st quarter - 50 thousand rubles. If Smirnov continues to acquire patents in 2022, he can use the remaining 20 thousand rubles. contributions to reduce their cost.

It is also important to consider the patent payment period. It is much more convenient to immediately pay a smaller amount than to later fill out an application for offset or refund of money from the budget.

Therefore, it is best to postpone payment for the patent to the latest possible date, taking into account the requirements of the law. It will be easiest for those who bought patents for six months or less - they can pay until the last day of their validity period.

For example, if a patent was purchased for January-March, then it is advisable to transfer all fees as much as possible in January-February and then submit a notification at the beginning of March. Within a month, tax officials will check the application and if there is no refusal, the taxpayer can safely pay the reduced cost of the patent on March 31.

In this case, you can submit the notification at the end of March, including the March contributions, but then the entrepreneur must be completely sure that the document is filled out without errors.

But if the patent is purchased for a long period (from 6 months to a year), then a third of its cost must be paid in the first 90 days of work. In this case, after the deduction is processed, an overpayment may occur. Also, overpayment may occur for “short” patents if the individual entrepreneur paid the tax ahead of schedule or submitted the notification later.

The overpayment for a patent can be offset against future payments or returned to the current account upon application (Article 78 of the Tax Code of the Russian Federation). The offset is more convenient if the individual entrepreneur intends to acquire patents in the near future.

Contributions to pension and health insurance in 2022

Let us recall that fixed contributions for compulsory pension insurance until 2022 were calculated using the following formula:

Minimum wage at the beginning of the year X Insurance premium rate (26%) X 12.

Starting from 2022, the Russian government decided to increase the minimum wage to the subsistence level and set the minimum wage from January 1, 2022 at 9,489 rubles. With such a minimum wage, fixed contributions calculated according to the previous rules (Article 430 of the Tax Code of the Russian Federation) should have increased significantly. In order not to radically increase the tax burden on entrepreneurs, the country's leadership determined that:

From 2022, fixed contributions are no longer tied to the minimum wage set on January 1. The decision of the Government of the Russian Federation established not a calculated, but a strictly fixed amount for the payment of mandatory pension insurance contributions in 2022 - 29,354 rubles, in 2022 - 32,448 rubles, in 2022 - 32,448 rubles. For 2021, the government decided not to increase the burden on individual entrepreneurs in terms of fixed contributions and their amount remained at the level of last 2020. However, despite the difficulties that entrepreneurs currently have to overcome, the Government of the Russian Federation has decided to increase the amount of fixed contributions for 2022. 34,445 rubles will be a fixed payment to the individual entrepreneur for himself in 2022.

In addition to fixed contributions in a strictly defined amount, until July 1, 2022 for 2022, individual entrepreneurs whose annual income exceeded 300,000 rubles had to pay 1% of the excess amount. For 2022, the deadline for paying the additional pension insurance contribution for 2022 remains the same - until July 1, 2022.

The deadline for paying 1 percent on pension insurance for 2022 is until July 1, 2022. They need to be listed in the INFS. Moreover, the contribution can be paid in installments, evenly distributing the financial burden. Such payment of contributions is optimal when applying the simplified tax system. Paying contributions in installments allows you to avoid paying an advance payment to the simplified tax system and, accordingly, overpaying at the end of the year.

The deadline for paying 1 percent on pension insurance for 2022 is until July 1, 2021 . They need to be listed in the INFS. Moreover, the contribution can be paid in installments, evenly distributing the financial burden.

BCC for this payment: 182 1 02 02140 06 1110 160.

All current KBK 2022 are published on this page.

For health insurance in 2022, premiums will only be paid in a fixed amount. Health insurance premiums for incomes over 300,000 rubles do not need to be calculated and paid.

To pay fixed medical contributions to individual entrepreneurs in 2022, as in the case of pension contributions, it is not necessary to take into account the minimum wage. The government has determined the specific amount of medical contributions. In 2022 it is 6,884 rubles; in 2022 - 8,426 rubles, in 2022 - 8,426 rubles. There was no increase in the amount of medical contributions, as well as pension contributions, in 2022 compared to 2022. For 2022, in addition to the increase in compulsory pension insurance, the amount of contributions for health insurance has also been increased. In 2022, individual entrepreneurs will have to pay 8,766 rubles to the health insurance fund, which is 340 rubles more than in 2022.

Let us remind you that the minimum wage in 2022 is 12,792 rubles. In 2022, the federal minimum wage will be 13,890 rubles.

But, as stated above, it does not affect the amount of mandatory fixed insurance premiums for the periods 2022 and 2022, 2022 and 2022.

Fixed contributions for 2022

| Recipient of contributions | KBK (2020) | Amount of fixed payments for 2022 |

| Inspectorate of the Federal Tax Service for compulsory pension insurance in a fixed amount | 182 1 0210 160 | 32,448 rubles |

| Inspectorate of the Federal Tax Service for compulsory medical insurance | 182 1 0213 160 | 8,426 rubles |

| Total: 40,874 rubles |

Fixed contributions for 2022

| Recipient of contributions | KBK (2021) | Amount of fixed payments for 2022 |

| Inspectorate of the Federal Tax Service for compulsory pension insurance in a fixed amount | 182 1 0210 160 | 32,448 rubles |

| Inspectorate of the Federal Tax Service for compulsory medical insurance | 182 1 0213 160 | 8,426 rubles |

| Total: 40,874 rubles |

Fixed contributions for 2022

| Recipient of contributions | KBK (2022) | Amount of fixed payments for 2022 |

| Inspectorate of the Federal Tax Service for compulsory pension insurance in a fixed amount | 182 1 0210 160 | 34,445 rubles |

| Inspectorate of the Federal Tax Service for compulsory medical insurance | 182 1 0213 160 | 8,766 rubles |

| Total for 2022: 43,211 rubles |

You will find more information about fixed payments for pension and health insurance in 2022 in this material.

Conclusion

Starting from 2022, entrepreneurs can reduce the cost of a patent by insurance premiums actually paid during its validity period.

If the individual entrepreneur does not have employees, then he can reduce the payment for the patent without restrictions, down to zero. An individual entrepreneur with employees has the right to deduct no more than half the cost of the patent. Unused contributions in excess of these limits can be carried forward to reduce payments for future patents, but only within a calendar year.

To apply the deduction, you must submit a special notification to your tax office using a form developed by the Federal Tax Service.

If the patent has already been paid, then after the tax authorities check the deduction notice, the entrepreneur can offset the overpayment against the cost of future patents or return it to the current account.

What to pay attention to

- Contributions and benefits must be actually remitted during the period of validity of the patent(s). For example, if you have a patent valid from January 1 to March 31, 2022, then the cost of the patent can only be reduced by the fees transferred in this period.

- Only contributions and benefits for employees engaged in patent activities can be taken into account.

- If the individual entrepreneur does not have employees, he can reduce the cost of the patent to zero. If an individual entrepreneur has employees, he has no right to credit more than 50%. On February 25, 2022, the Ministry of Finance of the Russian Federation explained in letter No. 03-11-11/13087 that if an individual entrepreneur has employees, but they are all engaged in activities that are taxed under a different taxation system (USN or OSNO), and the entrepreneur is engaged in activities under a patent one, he has the right to reduce the value of the patent down to zero. That is, without applying the 50% limit.

- If an individual entrepreneur has several patents, and for at least one of them he attracts workers (under employment contracts or civil process agreements), in this case the entrepreneur is an employer within the framework of the patent taxation system. Therefore, he has the right to reduce the cost of all patents by no more than 50%.

- You cannot deduct contributions from the cost of the patent if you reduced taxes on them under a different taxation system.

- If the amount of contributions is greater than the cost of the patent, in line 120 of sheet B you must indicate an amount equal to the amount of the patent (for individual entrepreneurs without employees) or an amount equal to half the cost of the patent (for individual entrepreneurs-employers). For example, you have one patent for a year worth 27,000 rubles. There are no other patents and no other patents are expected. You work without assistants and have the right to reduce the cost of the patent to zero. In this case, you need to indicate the following data on Sheet B: line 001 - “2”; line 110 - 27000; line 120 - 27000. With the same data, an individual entrepreneur with hired employees will indicate only 13500 in line 120.

- If the amount of contributions and benefits is greater than the cost of the patent, it can be distributed among several patents within one calendar year. In this case, two options are possible:

- All patents were purchased from one Federal Tax Service . In Sheet A you need to fill out several lines 010, 020 and 030 with data on all patents. Then on sheet B in line 110 indicate the sum of lines 030 of sheet A, that is, the total cost of all patents.

- Patents were purchased from different Federal Tax Service Inspectors . In this case, the notification must be completed and sent for each Federal Tax Service separately . And indicate only those patents that were acquired by the relevant tax authorities.