Why do you need KUDiR IP?

KUDiR is recognized as a tax accounting register, although it combines accounting and tax accounting. The document reflects the following data:

- information about fixed assets and depreciation;

- calculation of wages and taxation;

- utilities and other expenses;

- taxation of business transactions with identification of the difference, which is ultimately subject to personal income tax.

KUDiR IP is needed to form the tax base for personal income tax (NDFL) for the tax period, which is considered a calendar year. Individual entrepreneurs pay 13% of the calculated difference between income and expenses to the budget.

If at the end of the tax period the financial result is negative, i.e. There is a loss, then no tax is paid. Also, the loss is not carried forward to a future tax period and is not covered by the profits of subsequent years.

Form of reference

Features of compilation depend on the chosen form. There are two options available in 2022:

- In the paper version, the title page is filled out, after which the pages are stitched and numbered. At the end, a signature and seal (if available) are placed.

- Electronic maintenance of a ledger of income and expenses implies mandatory printing of the document at the end of the tax period with page numbering and an indication of their number. As in the paper version, the document is signed and stamped.

The form of maintaining KUDiR is determined by order and is fixed by the accounting policy of the individual entrepreneur / LLC. Most services involve maintaining documentation in electronic form, but at the request of the Federal Tax Service, a printout may be required. Number of copies - one. If the organization has several divisions, the main office handles the registration.

Maintaining KUDiR on OSNO

KUDiR on OSNO is formed from the beginning of the tax period. The accounting book is kept either by the entrepreneur himself or by an accounting employee; it is kept for 4 years. Individual entrepreneurs provide an accounting book along with 3-NDFL reporting. Thus, KUDiR is submitted to the tax office at the place of registration until April 30.

The magazine has a unified form. However, the entrepreneur has the right to independently create the form of the document. Coordinate all changes with the tax authority. If the developed version of the register is not approved, the tax office may not count the bookkeeping.

KUDiR is maintained in paper or electronic form. The book, issued in electronic form, is printed at the end of the calendar year. It is also laced, numbered and signed. Do all this with the book, which was kept in paper form. Previously, KUDiR had to be certified by the tax office, and the paper book was certified before filling out, and the electronic book after printing. Now the law does not require a certification procedure.

Common IP errors on OSNO when filling out KUDiR

Error 1. The data in KUDiR should be corrected correctly, using the norms of the established Procedure.

You should know that all corrections in the accounting book are made only manually. Therefore, if you need to correct an error or make changes to the KUDiR, all necessary entries should be made by hand. As established, the date of editing must be indicated next to it and everything must be certified with the signature of the individual entrepreneur. It is prohibited to use corrective means, paint over, or “mask” errors, entries, letters, or words.

Error 2. You can make changes to the primary accounting documentation, but only by agreeing on these corrections directly with the originator of the document. Moreover, the amendment made is recognized as valid if it is certified by the signature of this compiler indicating the date of its entry.

The exception is bank and cash documents - changes are not allowed in them.

Contents of KUDiR

KUDiR reflects information about the individual entrepreneur, the contents of the document, as well as six sections. The type of tables and sections of the book depends on the type of activity of the organization. The document reflects all income and expense procedures. Here are the requirements for the responsible person when maintaining the book:

- checking the receipt of cash and non-cash funds;

- control over payment to the supplier for each type of product sold during the work shift;

- correct write-off of product costs as expenses, which is carried out using the FIFO method or the average unit cost.

Entries in the accounting book are made continuously on the basis of primary documents at the time of the transaction, i.e. on a cash basis. Business transactions are reflected in chronological order in ruble equivalent. For transactions in foreign currency, their value is translated at the rate of the Central Bank of the Russian Federation into rubles on the day of receipt or disposal of funds.

If errors occur in KUDiR OSNO, they are corrected: the incorrect information is carefully crossed out, substantiated by the correct entry, certified with the signature of the individual entrepreneur and the date of the correction is indicated. The tax office may not accept KUDiR when submitting reports due to serious filling errors.

Rules of conduct

General requirements for KUDiR

- The frequency of establishment for OSNO, simplified tax system and unified agricultural tax is once every 12 months, for a patent - for the entire period of its validity.

- Data is entered in chronological order.

- All entered information is confirmed by primary documentation. These can be acts of work performed / services provided, invoice, receipt, payment order, etc.

- Filling out the KUDiR is mandatory even if there are no operations during the year. If there is no activity, a document with zero data is generated.

- Amounts are written in rubles, excluding kopecks.

- Corrections are allowed, but subject to mandatory certification by the manager. A stamp is required, if available.

There is no need to transfer the book to the Federal Tax Service, but authorized employees can request it for control, and if it is missing or filled out incorrectly, it has the right to impose a fine.

Procedure for filling out KUDiR IP OSNO

Each section of KUDiR IP OSNO includes many subparagraphs, the completion of which is mandatory.

The title page includes information about the individual entrepreneur: full name, INN, address, information about the tax authority at the place of registration of the individual entrepreneur, data from the registration certificate, bank details, as well as the individual entrepreneur’s signature, date and other data.

Section 1 displays all income that was actually received in the tax period, including advances, as well as expenses actually incurred in this period. This reflects raw materials, semi-finished products and other inventory items acquired by the individual entrepreneur for subsequent financial gain. Moreover, costs during the manufacture of products are written off as expenses only in relation to the products sold. They can also be written off according to the standards established by the legislation of the Russian Federation.

Sections 2 - 4 include information on depreciation of fixed assets, low-value wear-and-tear items (IBP) and intangible assets. The initial cost of fixed assets and intangible assets is determined based on the cost of acquisition, delivery costs and putting the property into operation. Depreciation is written off as expenses only in the amount accrued for the tax period. Depreciation deductions are made only in relation to the individual entrepreneur’s own property, i.e. which was purchased for a fee. Income from the sale of fixed assets and intangible assets is the difference between the sale price of the property and its residual value.

Section 5 covers payroll and taxes. The table in this section resembles a payroll sheet; it is generated for each month. The table displays the following information:

- the amount of calculated and paid wages;

- incentive and compensation payments;

- the cost of goods that are issued as remuneration in kind;

- payments under copyright and civil law contracts;

- other payments;

- calculated personal income tax;

- other deductions;

- date of payment;

- signature on receipt.

Section 6 calculates the tax base for personal income tax, which is formed based on the results of the calendar year. On its basis, 3-NDFL reporting is completed.

Book of accounting of income and expenses for individual entrepreneurs on the General Taxation System (GTS)

Content:

1. Filling out KUDiR

2. KUDiR in 1C

3. Zero Book

Filling out KUDiR

For individual entrepreneurs in the General Taxation System, there is an obligation to keep records of the amount of expenses incurred and income received from business activities. The formation of a special tax form in the form of a book of income and expenses for individual entrepreneurs under the general taxation regime is a mandatory requirement by law.

A book of accounting for income and expenses is necessary to calculate the taxable profit base of an individual entrepreneur, on the basis of which the calculation of tax deductions for the reporting period will be made. Today, KUDiR for individual entrepreneurs is printed once a year. And this is the best case scenario. Some people don't lead at all. Is it possible not to lead? Of course not. Not only we and accountants talk about this, but also the legislators of the Russian Federation.

Filling out KUDiR exists in two versions: · on paper; · electronic.

If the book is kept in electronic form, after the expiration of the accounting period (year), it should be printed, the sheets numbered and stitched using thick thread. The final page is stamped with the individual entrepreneur (if any) and signature, and the number of pages is also indicated. Then the accounting book is registered with the local tax authority.

The accounting book, as well as the entire so-called “primary record” confirming income and expenses, must be retained by the individual entrepreneur for 4 years.

What actions do we need to perform in order to correctly formulate the accounting book? A detailed guide is in this publication.

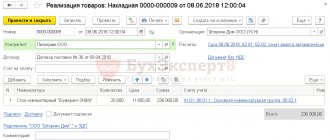

Let's look at a specific example of how to create a book of income and expenses in the 1C: Accounting 8 program.

KUDiR in 1C

To create and print KUDiR approved by current legislation in 1C, the report “Book of Income and Expenses of Individual Entrepreneurs” (section “Reports”) is intended.

Rice. 1

Book of accounting of income and expenses and household items. operations of an individual entrepreneur, as a regulated report, is generated for the calendar year, however, for management needs, it is possible to generate it for any other period you need.

If an individual entrepreneur carries out several types of activities, it will be necessary to indicate exactly the type by which the book is formed.

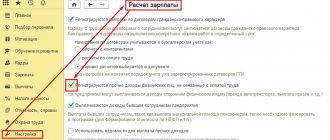

By clicking the "Show Settings" button, you can specify additional settings. In order to generate not all, but one or several tables of the Accounting Book, in the form that opens, check the boxes for the required tables. If the type of activity is subject to VAT, then in the report form you should check the “Generate for transactions subject to VAT” checkbox. You can additionally display the details of receipt documents in the report. To do this, you need to check the “Output details of receipt documents” checkbox. To print the required sheet, go to the appropriate section and start the process by clicking the “Print” button.

Rice. 2

So simply we figured out how to create and how to print a book of income and expenses in the 1C: Accounting 8 program. All that remains is to flash it and store it for the required number of years.

Zero book

If during the reporting period the individual entrepreneur did not have any movements of funds, this does not mean that there is no need to maintain KUDiR. In such a situation, the entrepreneur must submit, along with other reports, the so-called “zero” Book to the tax office. It must be completed in accordance with the usual requirements, but in the columns showing the actual movement of funds, enter zeros.

If you have any questions, feel free to write or call us. We are always in touch and happy to help!

Specialist

Natalia Mitnitskaya

Responsibility for violation of the procedure for maintaining KUDIR

Gross violations of the requirements for accounting for income, expenses, as well as the object of taxation are regulated by Article 120 of the Tax Code of the Russian Federation. The following types of fines have been established: 10,000 rubles - a fine for a gross violation committed during one tax period; 30,000 rubles - a fine for the same act committed during more than one tax period; 20% of the amount of unpaid tax, but not less than 40,000 rubles - a fine for a violation that resulted in an underestimation of the tax base.

Author of the article: Ekaterina Moguchaya

Work in the cloud service for small businesses Kontur.Accounting: there is simple accounting, payroll, taxes and reporting via the Internet. Work for free for the first 14 days and learn about all the capabilities of the service.

Section V. Calculation of wages and taxes

Table 5 is filled out for each month separately when paying wages or payments under contracts. The table includes:

- Amounts of accrued and paid wages.

- Compensation and incentive payments.

- The cost of goods issued in kind.

- Payments under civil law contracts and copyright agreements.

- Other payments in accordance with the concluded agreement.

Table 5 is actually a payroll statement, as it includes calculated income tax, other deductions, payment date and signature on receipt.

Instructions and samples for filling out KUDiR

Below are instructions and samples of KUDiR for the simplified tax system (also suitable for PSN and Unified Agricultural Tax, since they are very similar and easier to fill out).

Samples of filling out KUDiR on the simplified tax system

You can view the completed KUDIR sample on the simplified tax system using this link.

You can view a completed example of zero KUDIR on the simplified tax system using this link.

Instructions for filling out KUDiR on the simplified tax system

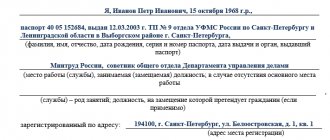

Title page

Field " OKUD Form"

" is not filled in.

In the " Date

» the year, month and date of the start of maintaining the book are recorded (i.e. the date of the first entry in KUDIR).

Field " OKPO"

» is filled out if you have an information letter from Rosstat that contains this number.

In the field “ Object of taxation”

“Income” or “Income reduced by expenses” is indicated.

In addition, do not forget to indicate:

- the year for which KUDIR is filled out;

- name of LLC or full name of individual entrepreneur;

- TIN and KPP for an LLC or TIN for an individual entrepreneur (two different fields are provided);

- legal address of the LLC or residence address of the individual entrepreneur;

- current account numbers and names of banks in which they are opened (if any).

Section I. Income and expenses

Contains four tables (one for each quarter). Each table consists of 5 columns (columns).

COUNT No. 1

. Serial number of the record.

COUNT No. 2

. Date and number of the primary document confirming income or expenses.

On income:

- If funds are received at the cash desk

, then the date of receipt and the number of the cash report, which is compiled at the end of each shift (formerly Z-report), are recorded.

For example, 01/15/2022, FD No. 54 (report on shift closure)

. - If the funds arrived in the current account

, then the date of arrival and the number of the payment order or bank statement are recorded.

For example, 01/15/2022 payment order No. 100

or

01/15/2022 bank statement No. 100

. - If the funds received on paper BSO

(strict reporting form) (if, by law, the cash register can not be used), then for each such form issued it is not necessary to make a separate line in the KUDIR. Instead, you can write down the date of the working day and issue a PKO, which lists the numbers of all issued BSOs for that day (in this case, the amount of funds for these BSOs is entered in column 4). For example,

01/15/2022 PKO No. 100

. You can group BSOs only if they were discharged within one day.Note!

to use

paper strict reporting forms

instead of cash receipts. BSO should be formed using CCP. However, if a business is exempt from CCP, then paper BSO can be used as a document confirming the calculation. - a refund

was made for a product or service, then in column 4 the refund amount is entered with a minus sign, and in column 1 the date of the actual return and the number of the payment order or cash receipt for the refund (FD number) are recorded.

Note!

The point of indicating the document number in column 2 of KUDiR is to identify the operation and, if necessary, find it at any time. Previously, the shift closure report (Z-report) had a number. Now, instead of it, you can use the “fiscal document number” attribute - FD. However, each cash register has its own FD numbering. Therefore, if you have several cash registers, it is recommended that in addition to the FD, you indicate the FN (fiscal drive) details or the cash register number.

When an expense is incurred (only for the simplified tax system “Income minus expenses”), the date of the expense and the number of the primary document are recorded, which can be: an invoice, a payment order, a cash report, a sales receipt (if work without a cash register is allowed), etc. For example, 01/15/2022 FD No. 53 (return check)

,

01/15/2022 delivery note No. 55

,

01/15/2022 item No. 55

,

01/15/2022 FD No. 55 (shift closing report)

, etc.

note

that expenses for the purchase of goods for their subsequent resale are entered only after their sale.

COUNT No. 3

. Contents of operation.

This column is not too important.

Examples of filling in income:

- Receipt at the cash register. Payment under agreement No. 100/AA dated January 10, 2022 for the provision of advertising services

. - An advance was received from the buyer LLC Firma for the upcoming delivery of goods under contract No. 100/AA

. - Income received. Trading revenue for 01/15/2022

. - Refund to the buyer under agreement No. 100/AA dated 10/15/2021.

Examples of filling in expenses (only for the simplified tax system “Income minus expenses”):

- Advance paid to employees.

- Wages listed.

- Personal income tax is transferred from wages.

COUNT No. 4

. Income taken into account when calculating the tax base.

note

, that when returning funds to the buyer, the amount is written in this column with a minus sign. Those. not in expenses (column No. 5), but in income (column No. 4).

COUNT No. 5

. Expenses taken into account when calculating the tax base. Filled out only by individual entrepreneurs and organizations using the simplified tax system “Income minus expenses.”

In the “Help for Section I” fill in:

- on the simplified tax system “Income” only line 010 for the entire year;

- on the simplified tax system “Income minus expenses” lines 010, 020 for the whole year and lines 040, 041 (if the amounts are not negative).

Entrust reporting to specialists

Section II. Calculation of expenses for the acquisition of fixed assets and intangible assets

Filled out only on the simplified tax system “Income minus expenses”, if in the tax period there were expenses for the acquisition (construction, production) of fixed assets

and for the acquisition (creation by the taxpayer himself)

of intangible assets

.

Fixed assets

– these are objects of property that individual entrepreneurs and LLCs use for a long time (more than 12 months) in the production of products, performance of work and provision of services. For example, buildings, land, machinery, equipment, tools, etc.

Intangible assets

Unlike fixed assets, they do not have a material form and are the result of intellectual activity. For example, invention rights, trademarks, copyrights, etc.

Section III. Calculation of the amount of loss that reduces the tax base for tax

Filled out only on the simplified tax system “Income minus expenses” if there were losses in the past or current tax period that can be carried forward to the next period.

Section IV. Expenses that reduce the amount of tax (advance tax payments)

Filled out only for the simplified tax system “Income”.

At first glance, this section may seem very difficult to fill out, but in fact everything is very simple. It indicates insurance premiums in the amount of amounts paid. Individual entrepreneurs indicate paid

insurance premiums for yourself, based on the cost of the insurance year.

LLCs and individual entrepreneurs also indicate paid

insurance premiums for individuals.

To fill out this section, it is convenient to use an individual entrepreneur’s insurance premium calculator, which will help you calculate fixed individual entrepreneur premiums for any period (for example, quarterly).

Completed samples of this section are available via the links above.

Section V. Amount of trade fee that reduces the amount of tax (advance tax payments)

Filled out only on the simplified tax system “Income”, if the individual entrepreneur is a payer of the trade tax.