In this article we will figure out whether an online cash register is needed for various individual entrepreneurs on a valid patent. This is a special tax regime in which the possibility of using it depends on the number of employees, the level of income and the types of activities used. Some entrepreneurs will receive a deferment in 2022, but not all. Most large and medium-sized businesses have already switched to the changed conditions, now it’s up to the small ones. Let's figure out who will have to implement this and how.

What the law says

There is a basic regulatory act that is designed to regulate the use of cash registers. This is Federal Law No. 54, adopted back in 2003. But this does not mean that it is the only one in this area designed to monitor the use of technology. In 2022, equipment reform was carried out, as a result of which the main law changed.

There are 2 fundamental changes:

- Individual entrepreneurs should use online cash registers when interacting with individuals in cash and by bank transfer. These devices have a memory module installed - a fiscal drive, which is designed to store transactions electronically. In this case, the cash register must be connected to the Internet, since the equipment is required to transmit data to the Federal Tax Service. The device will have to be changed every 1-3 years, depending on the area of activity and the system used.

- The cash register should be used both when accepting and issuing cash. This applies to any payments, including cards and virtual funds. The updated rules apply to purchases and refunds, to mutual settlements with prepayment, loans, and installments. This also applies to the issuance of money for the delivery of scrap or metals.

New requirements were introduced little by little, in parts. First of all, this affected subjects who work for UTII. Later - for the rest.

Then we identified and approved a list of areas of activity that can exist without an online cash register. They were allocated in 2 paragraphs of Law 54.

It included:

- trade that is carried out by delivery or distribution;

- sales of products at fairs;

- sale of certain types of goods.

You will not need a CCT for individual entrepreneurs on any patent for nannies, home-schoolers, caregivers and other types. This applies to those who rent out property they own.

Does an entrepreneur need an online cash register?

In Art. 2 54-FZ states whether a cash register is needed for a patent - yes, you cannot work without a cash register. Individual entrepreneurs need to purchase an online cash register for trade, catering, and services.

IMPORTANT!

From 01.02.2021, individual entrepreneurs under special taxation regimes, including patents, are required to detail the name of goods and services in receipts (Part 17 of Article 7 290-FZ of 07/03/2016). Before purchasing a cash register, you should check whether the cash register model is suitable for printing receipts with the names of goods and services. In addition, it is necessary to connect the goods accounting system, create a product catalog, and then integrate it into the online cash register.

There are exceptions for patent entrepreneurs. Individual entrepreneurs on PSN have the right not to use an online cash register if they are engaged in activities from paragraphs. 1, 2, 4, 5, 7, 8, 12-17, 19-27, 29-31, 34-36, 39, 41-44, 49-52, 54, 55, 57-62, 64, 66- 80 clause 2 art. 346.43 Tax Code of the Russian Federation

There are other exceptions when an online cash register for an individual entrepreneur on a patent is not required in 2021 if:

- Individual entrepreneurs rent out their own housing, housing with parking in an apartment building (Clause 2, Article 2 54-FZ);

- Individual entrepreneurs sell ice cream at kiosks and do not pay using automatic devices (clause 2, 8, article 2);

- Individual entrepreneurs sell entrance tickets to the theater from hand or from a tray (clause 14, article 2);

- IP is calculated exclusively using coins from the Central Bank of the Russian Federation through machines that are not powered by electricity (clause 1.1, article 2).

Previously, entrepreneurs without employees were allowed to work without cash registers. But the tax authorities explained whether an online cash register is needed for an individual entrepreneur without employees now - yes, from 07/01/2021, individual entrepreneurs without employees are required to use cash register equipment, even if they produce goods (work, services) of their own production. This rule was introduced by Part 1 of Art. 2 129-FZ.

Principles for PSN

This type of taxation is usually used by small businesses. Special benefits were provided for them. Which of them can be used by a particular business depends on the direction and people under its command. Deciding whether you need to use a cash register is required separately for each case.

Nuances of legislation:

- Paragraph 2 of paragraph 54 of the law lists the areas in which there is a need to use cash register systems. All other subspecies are temporarily not subject to the requirement.

- Before July 1, 2018, all individual entrepreneurs who are engaged in catering or resale, and also hired employees, should have purchased and set up online cash registers.

- All other patent users needed to acquire equipment before July 1, 2019. This applies to those to whom the exceptions did not apply.

But later, on June 6, 2022, Law 129 was signed, which introduced a delay until July 2022. These amendments applied to those who sold goods or services of their own making. Moreover, this affected not only those who are on PSN, but also on other regimes.

But when an entrepreneur hires at least one employee, he can no longer use this deferment. From the moment the employee is hired, he will have to purchase and install a cash register within 30 days.

Rating of online cash registers for individual entrepreneurs in 2022

The rating of cash registers for individual entrepreneurs in 2022 includes the following models:

| Evotor 5i Mobile online cash register with built-in acquiring. Designed for courier services, small retail, taxis, small-scale catering. Touch screen, free cash register program, wide compatibility with cash register equipment and programs. Suitable for working with labeled goods. Model features:

Go |

| Evotor 7.2 Stationary smart terminal (without battery). It does not have an acquiring module, but is equipped with a large display and high printing speed. Designed for convenience stores, small and medium catering, repair shops, dry cleaners, flower shops. The universal cash register allows you to make payments, work with EGAIS and labeling. A personal account is supported for remote cash management and employee monitoring. Model features:

Go |

| MSPOS-K Mobile smart terminal with built-in 2D barcode photo scanner. Used by small retail stores, service and catering enterprises, couriers and taxi drivers. Model features:

Go |

| MSPOS-T-F Stationary online cash register with increased power with a large touch display and a built-in printer for printing receipts. Designed for small retail, service enterprises, cafes and fast food chains. Model features:

Go |

| ATOL 30F A popular fiscal recorder for creating a cashier’s workplace with a small budget for automation. The model has a customizable print format and uses a narrow format cash register tape. Widely compatible with cash register programs and hardware. Model features:

Go |

It is difficult to say which cash register is the best for entrepreneurs in 2022 - everything is individual and depends on the specifics of the business.

="text-align:>

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Who is required to use CCP and CRM when purchasing any patent?

The main characteristics of the production where it is necessary to install a cash register:

- there are subordinates;

- a businessman simply resells products, does not create them himself.

Some types of businesses will need to acquire software before the summer of 2022:

- hairdressers and cosmetologists;

- repair and maintenance of household appliances;

- computer and communications masters;

- maintenance and restoration of cars and motorcycles;

- transportation of people and goods;

- veterinary services;

- medicine and pharmacology, provided there is a license;

- retail trade;

- rental of any property;

- sports direction;

- public catering;

- milk - production and sales.

Other varieties have the right not to purchase equipment for now.

Who doesn't need to install cash registers in 2022?

The law generally exempts some types of activities from issuing any documents to buyers. Individual entrepreneurs and organizations using any taxation system may not use a cash register if:

- trade in newspapers and magazines on paper, as well as when selling related products at newsstands, provided that the share of newspapers and magazines in their turnover is at least 50%, and the range of related products is approved by the executive authority of the constituent entity of the Russian Federation, and accounting for proceeds from sales newspapers and sales of related products are kept separately,

- providing meals to students and employees of educational organizations implementing basic general education programs during classes,

- trade in retail markets, fairs, exhibition complexes, except for the shops, pavilions, kiosks, tents, auto shops, auto shops, vans, containers and other trading places (premises and vehicles, including trailers and semi-trailers), open counters located in them inside indoor market premises when selling non-food products other than those listed in the order of the Government of the Russian Federation dated April 14, 2017 N 698-r,

- peddling (outside a fixed network) of food and non-food products (except for technically complex and food products that require certain conditions of storage and sale, and are subject to mandatory marking by means of identification) from hands, from carts, baskets and other devices for displaying, carrying and selling goods, including in passenger cars and air transport,

- selling ice cream kiosks,

- bottling trade in soft drinks, milk and drinking water,

- trade from tank trucks in kvass, milk, vegetable oil, live fish, kerosene,

- seasonal trade in vegetables, including potatoes, fruits and melons,

- sales by the manufacturer of folk arts and crafts products,

- sale of objects of religious worship and religious literature in religious buildings and structures and on the territories related to them or in other places provided to religious organizations for these purposes,

- trading using mechanical vending machines that are not connected to power and accept coins,

- retail sale of shoe covers,

- Individual entrepreneurs when renting out housing along with parking spaces, if the latter are located in an apartment building and belong to the individual entrepreneur by right of ownership.

Among the entrepreneurs who do not have to install a cash register both in 2022 and in the future, there are those who provide services:

- for the acceptance of glassware and waste materials, except scrap metal, precious metals and stones,

- shoe repair and painting,

- for the production and repair of metal haberdashery and keys,

- for the supervision and care of children, the sick, the elderly and disabled,

- plowing gardens and sawing firewood,

- porters at railway stations, bus stations, air terminals, airports, sea and river ports,

- for an individual entrepreneur to lease (hire) residential premises belonging to this individual entrepreneur by right of ownership,

- provision of services for conducting religious rites and ceremonies in places of worship and other places provided to religious organizations for these purposes.

In addition, pharmacy and paramedic stations in villages, as well as libraries, are exempt from using CCT.

54-FZ in detail:

- review of the latest changes in law 54-FZ “On the use of cash register equipment”;

- how to return money for a cash register: tax deduction for an online cash register;

- detailed analysis of 54-FZ in questions and answers.

Where can you cut costs?

To support small businesses, tax incentives have been prepared. For example, for individual entrepreneurs on a patent, such benefits are available only in cases where the equipment was delivered before July 1, 2022.

The principles by which funds are provided:

- Up to 18 thousand rubles for each copy, but no more than the costs incurred by the owner of the establishment during installation. It is allowed to include here the amount of the fiscal registrar, implementation and training, software and related expenses.

- You can take into account the money spent on the contract.

Those who delayed the purchase are not entitled to this deduction.

What is the patent tax system and who can use it

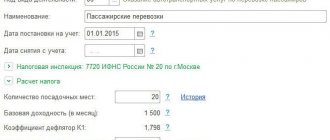

The tax patent is based on the elementary principle of cut-off. Each subject of the Russian Federation independently determines the amount of the highest possible income for each type of business activity. Based on this possible income, a fixed tax amount is established. The entrepreneur pays it in advance to the tax authorities without submitting a tax return.

The patent system facilitates paperwork and eliminates some of the paperwork, including maintaining a cash book. It also allows an entrepreneur to quickly get rich and develop if the income from his activities significantly exceeds the value established in his region. So sometimes an individual entrepreneur on a patent can simply open a business in the right place to successfully run a business.

Important! In Russia, the right to use a tax patent is assigned to specific types of activities of individual entrepreneurs, which are listed in Art. 346.43 Tax Code of the Russian Federation. That is, not every entrepreneur will be able to apply a patent.

Who has benefits this year?

To make it easier to understand who may not use calculation technology until the summer of 2022, we have prepared a table.

| Who received a deferment | Availability of employees | Until what point is the relaxation |

| Offering from own production | No | Until 07/01/2021 |

| Personal services | ||

| Handmade works |

At the moment, by the end of 2022, all individual entrepreneurs must have what they need. Whether there will be additional extensions may change due to changes in legislation.

Online cash register for individual entrepreneurs: deferments are over

Back in 2022, the government revised its decision regarding certain categories of entrepreneurs. They were given a deferment from installing a cash register until 07/01/2021 if their activities meet the following conditions:

- the entrepreneur works alone (without employees and employer);

- trades in goods of its own production, provides services or performs work.

If you hire an employee, install the cash register within 30 days. Otherwise - a fine.

What should entrepreneurs expect? Due to the provision of a deferment, to date, few small businesses have installed an online cash register. A proposal has been put forward to compensate payment costs for the purchase of CCPs to these least vulnerable categories. The proposal is currently under consideration and no response from the government has been published. Let us recall that in 2017-2019 a tax deduction was applied for the purchase of cash register devices in the amount of 18,000 rubles.

According to experts, compensation for the purchase of an online cash register for individual entrepreneurs in 2022 will become a serious financial support and will help keep businessmen from leaving for the shadow sector.

But for now the reality is this: the deferment of cash payments for entrepreneurs in 2021 is ending and there are unlikely to be further concessions. There is an option to switch to the self-employed category, but subject to meeting certain requirements.

What to do with labeled products

It is worth figuring out whether a certain individual entrepreneur operating on the basis of a patent needs a cash register if you plan to sell items with markings.

You cannot work for PSN only if you intend to sell medicines or shoes, as well as fur clothing. Excise products remain prohibited.

For example, it is allowed to sell:

- textiles;

- food;

- cigarettes and beer;

- lumber, subject to recommendations for the size of the sales area;

- jewelry products;

- outerwear.

To select equipment that will help you work with marked products, contact Cleverence. Our specialists will highlight the tasks that the software should handle, select the right models and tell you how to use the new equipment. It is worth optimizing the enterprise so as not to waste a lot of time on routine tasks.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Will such a cash register be needed if the individual entrepreneur operates on the PNS?

With the PNS, you do not have to send declarations, and taxes are paid according to a pre-thought-out and defined algorithm. Only those entrepreneurs who are engaged in certain subtypes of activity have the right to use the patent system. What does this include:

- some types of retail trade;

- public catering;

- private courses;

- repair of shoes, furniture, equipment;

- tutors, nannies;

- carriers.

These types may not set up online cash registers and limit themselves to issuing customers a sales receipt or a document that can fully replace it.

Let's summarize

- An individual entrepreneur on a patent needs an online cash register from July 1, 2019.

- Catering and retail trade with hired workers will move from July 1, 2018.

- Until you buy an online cash register, issue BSO, sales receipts or receipts.

- Tax deduction for individual entrepreneurs on PSN is a maximum of 18,000 rubles.

- You can indicate the name and quantity of goods in a receipt from February 1, 2022.

- Use a drive with a 36 month lifespan.

Technical support of equipment. We will solve any problems!

Leave a request and receive a consultation within 5 minutes.

Will equipment be needed if there is no staff?

For most retail entrepreneurs on a patent, the use of cash registers and varieties of online cash registers remains a difficult issue if they operate without hired workers. This point became controversial, since initially they were obliged to use CCP, even if they did not use someone else’s work. But later, in June 2022, changes were adopted that delayed the IP. You may not install the equipment if:

- sell products of your production;

- personally provide services;

- do the work yourself.

The laws contain information that such companies will not even have to send customers forms related to strict reporting. But all this is only if the client is given a sales receipt or its equivalent, which contains all the necessary details.

As soon as such a businessman hires staff, he is recommended to acquire a cash register within 30 days and register it in accordance with all the rules. Without registration, people should also not be in the enterprise.

If the company’s activities are not related to the options listed above, then it needs to buy an online cash register, even if it has no employees.

Do self-employed people need an online cash register?

From January 1, 2022, entrepreneurs from Moscow, Moscow region, Kaluga region, Tatarstan and 19 other regions can switch to the experimental tax regime “Professional Income Tax” or, in other words, register as self-employed.

The self-employed include those who are not individual entrepreneurs and provide services without hiring employees, for example, nannies and tutors. But those who have an annual income of more than 2.4 million rubles per year, or have hired workers, or sell excisable and labeled goods, cannot switch to this regime.

What does a self-employed person get:

- no need to submit tax reports - just register in the “My Tax” application,

- income tax is 4% when working with individuals and 6% when working with legal entities and individual entrepreneurs,

- no need to pay insurance premiums and VAT.

A self-employed person can make payments both in cash and in non-cash form. The sale or provision of a service is recorded by a receipt, which is created in the My Tax application. Thus, the self-employed do not need an online cash register. But without it, you won’t be able to accept card payments.

Penalties for lack of cash register

Working as an individual entrepreneur on a patent without a cash register (cash register) is only possible in the cases that we discussed above.

In all other situations, you will have to bear responsibility for failure to comply with the law. It all depends on what exactly is broken. What sanctions may there be:

- absence or refusal to use cash register equipment - from 1/4 to 1/2 of the purchase amount, the release of which was made without equipment, but not less than 10,000 rubles;

- repeat offense of the above - suspension of work for up to 90 days;

- use of broken, unregistered, with violations of the cash register - 1,500-3,000 ₽;

- failure to issue a check to a client - 2,000 rubles or an administrative warning.

For legal entities, the sanctions are much higher. There is no point in arguing with inspectors; it will be quite difficult to prove your case even in court.