Regulatory basis for the application of the new standard

In our article we will consider the new accounting standard FSBU 27/2021 “Documents and document flow in accounting” (FSBU 27/2021 approved by Order of the Ministry of Finance dated 04/16/2021 No. 62n). From the name it is clear that it is dedicated to the compilation, storage, and movement of documents within an organization, that is, the procedure for working with documents. The FSBU 27/2021 project has already ceased to be - it will come into force in 2022 and will replace the existing ones:

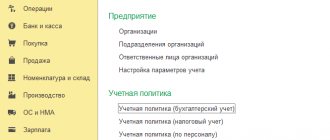

The text of the FSBU 27/2021 standard indicates the date when its application becomes mandatory. This is January 1, 2022. Before this date, the standard can be applied, but then this should be reflected in the accounting policies of the organization.

This step is reasonable and justified; it will allow us to gradually prepare for innovations and enter 2022 fully armed, when the application of FSB 27/2021 “Documents and document flow” will become mandatory.

Next, we’ll tell you what’s new in FSBU 27/2021 and whether everyone is required to apply it.

Our articles about other new standards:

- "New PBU "Arenda";

- “We take into account reserves in a new way: transition to FSBU 5/2019”;

- “Procedure for accounting for capital investments in accordance with FSBU 26/2020”.

Scope of application of the FSBU on documents

FSBU 27-21 is used by almost all economic entities with a few exceptions.

IMPORTANT! FSBU 27/2021 is not applied by public sector organizations.

Some points of the FSBU 27/2021 standard are also not applied by financial credit and non-credit organizations. These include paragraphs 5, 6, 7, 22. Below, as the rules established by the new standard are described, it will be separately indicated what exactly these points are, that is, an explanation will be given that the rule does not apply to financial organizations.

What does the FSBU “Documents and Document Flow” mean by these concepts? What can be classified as documents in the context of applying the new standard and what should be understood by document flow? See the diagram for answers:

Read more about primary accounting documents in the article “Primary accounting documents - list” .

Further, the standard describes the requirements for accounting documents, accounting registers, the procedure for their correction and the creation of an archive.

The essence of the standard

FSBU 27 repeals outdated principles and rules contained in previous regulations on regulating document flow at enterprises. The document also clarifies current standards and introduces new concepts. There are not many changes compared to previous instructions. But they still exist and require attention.

Basic Concepts

FSBU 27 2022 “Documents and document flow” contains definitions of two basic concepts:

- document - primary accounting acts and accounting registers;

- document flow - the movement of accounting documents within a business entity from the date of their registration until the end of execution (i.e. until the moment of reporting or filing of acts in the archive).

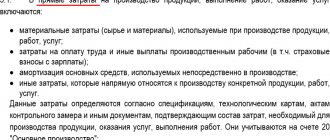

Requirements for primary documents

So, the rules for drawing up primary documents are now defined by FSBU 27 2022. What new does this standard prescribe? There aren't really too many changes.

The basic requirements for the “primary” are as follows:

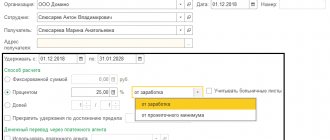

- documents are drawn up in Russian (if it is necessary to use a foreign language, the acts must have a line-by-line translation);

- monetary values are expressed in rubles (in some cases, both in rubles and in foreign currency, but the presence of a ruble meter is required).

The primary document must contain the required details:

- name of the act;

- date of registration;

- name of the compiling entity;

- Contents of operation;

- the value of the natural and/or monetary dimension of the transaction;

- the title of the position of the employee completing the transaction and/or responsible for its implementation, as well as his (or their) full name and signature.

FSBU 27 21 introduces a new concept - a supporting document. This is an independent act containing information about a transaction or a fact of the economic life of the organization, which is documented in the primary document. Information allowing to identify such an act must be included in the text of the “primary report”. The supporting document itself does not belong to the “primary document”, but is only used for its registration. It may not contain mandatory details.

FSBU “Documents and Document Flow” defines some assumptions regarding primary documents:

- several interconnected events in the economic life of an enterprise can be formalized in a single primary act;

- ongoing or recurring events of economic life (for example, the accrual of interest or the delivery of goods in batches on different dates under one contract) can be processed not immediately after their completion, but at a certain frequency, the most optimal for each specific case;

- Several transactions made by a participant in exchange trading with different partners can now be executed in a single document;

- as a “primary” standard, FAS 27 2022 allows the use of documents obtained during the functioning of the organization; a necessary condition is the presence of mandatory details in them: these are checks, contracts, payment receipts, etc.

Primary documents can be in either paper or electronic form. In the second case, it is necessary to have an electronic signature and the ability to provide a copy of the act on paper.

About accounting registers

FSBU 27 21 imposes special requirements on the accounting register system. It should provide:

- completeness of data;

- chronological order of reflection of objects and transactions on accounts;

- systematic accumulation of information about the facts of economic life in accounting;

- maintaining synthetic and analytical accounting;

- systematic accumulation, chronology and reflection in accounts of information relating to the economic life of the organization;

- reliability of information, that is, its correspondence to “primary” data;

- timeliness of information reflection;

- legal significance of reflected acts.

What should an accounting document be?

Please note that the rules of this standard do not cancel the rules established for primary accounting by federal law dated December 6, 2011 No. 402-FZ “On Accounting,” but supplement them.

The FSBU “Documents and Document Flow” has the following requirements for the accounting document in 2022:

Financial institutions do not apply these requirements.

The primary accounting document must contain the required details (Article 9 of Law No. 402-FZ):

The new standard clarifies some details:

In addition to the mandatory details, the primary document may contain additional ones. The accounting document can be either paper or electronic. An electronic document is signed with an electronic digital signature. If federal legislation does not establish a specific type of digital signature for signing a document, then it can be any type of digital signature agreed upon by the economic entities signing the document. An electronic document must provide for the possibility of making a paper copy.

We wrote about the organization of electronic document management in the articles:

- “Electronic document flow in an organization”;

- “Electronic document flow between organizations”.

We show in the diagram what assumptions you can make when compiling primary accounting documents:

The standard imposes the following requirements for accounting registers:

Where does the primary come from?

The organization's primary accounting documents are created for each individual transaction at the time of its completion, in extreme cases - immediately after its completion. For example, contracts, deeds, acts, etc.

Primary documents are divided into two large groups: internal documents and external ones.

- Internal documents are created to reflect internal operations. Compiled at the enterprise. These include cash receipts and expenditure orders, invoices, acts, payroll statements, etc.

- External documents arrive at the enterprise already completed. Compiled outside the organization. These include invoices, bank statements, waybills, etc.

Three stages of documentation:

- Establishment of primary documentation.

- Transfer of information from primary documents to accounting registers.

- Preparation of reports based on accounting register data.

Is it possible to correct the document and if so, how?

Accounting documents must be drawn up in such a way that their long-term preservation can be ensured. Therefore, filling out the primary form, for example, with a simple pencil is unacceptable. Thus, such an option for correcting a document as erasing the inscription and re-entering the correct data is not suitable. Also, you cannot use mechanical correction tools - correction pencils, erasers, putty, etc. How can you correct a document if necessary?

IMPORTANT! Not every document can be corrected! It is not allowed to make adjustments to cash and bank documents.

Amendments may be made to other accounting documents.

Below is the procedure for making corrections to a paper accounting document, an electronic document and an accounting register:

Requirements for accounting registers

The system of accounting registers must be organized in such a way that the basic principles of accounting are observed.

- Completeness. All users should be able to obtain the information they need from accounting data. These are, first of all, business owners and managers, as well as external users: investors, banks, counterparties, government agencies.

- Chronological and systematic recording. Accounting objects must be reflected in documents sequentially and grouped in accordance with their economic meaning.

- Analytical and synthetic accounting. All accounting data must be reflected both in the context of individual objects and in general, based on the economic meaning of the operation. For example, when calculating salaries, analytical accounting must be carried out on the credit of account 70 in the context of employees. And the total amount of accrued wages should then be distributed between cost accounting accounts depending on the category of employees.

- Systematicity. All accounting data must be interconnected. Analytical accounting data must correspond to the final records for synthetic accounts, and the accounting register data must correspond to the lines of the accounting statements.

- Validity and reliability. All accounting records must correspond exactly to the primary documents and reflect accounting objects without omissions.

- Timeliness. Data must be reflected in accounting in a timely manner in order to promptly provide current information to users and generate reports on time.

- Legal significance. Accounting documents must act as evidence of business transactions. To do this, they must contain the necessary details provided for in Art. 9 and 10 of Law No. 402-FZ: information about the company, date, essence of the transaction, monetary measurement and signatures of responsible persons. And certain types of documents, for example, cash and bank documents, must strictly comply with established forms.

All stages of document flow: from preparation to storage

The document flow procedure in the organization is approved by the head.

The basic requirements for document flow in an enterprise are as follows:

According to FSBU 27/2021, the accounting archive is maintained by the organization in the form in which the accounting documents were originally compiled. Electronic documents are stored in electronic form, paper documents are stored in paper form. Converting paper documents into electronic form for storage purposes is not permitted.

Documents must be stored on the territory of the Russian Federation. If activities are carried out in other territories and the legislation of those countries requires documents to be stored there, then such storage should be ensured.

The loss (damage, destruction) of an accounting document obliges the organization to make every effort to restore it.

How to organize document flow taking into account new requirements? Sign up for a free trial access to ConsultantPlus and get acquainted with the algorithm of actions from scratch for organizing document flow, compiled by experts taking into account the new standard.

All changes introduced by the new standard are presented in the final diagram:

Results

The new standard on documents and document flow will have to be applied without fail from 2022. Not too many changes have been made compared to the previous rules. Many of them concern the abolition of outdated rules, others clarify existing ones.

Sources: Order of the Ministry of Finance dated April 16, 2021 No. 62n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.