In the article we will describe in detail how, when switching to online cash registers, to account for online cash register expenses for companies in 2022 that use such special regimes as the simplified tax system, UTII and Unified Agricultural Tax.

Registration of old cash registers with tax authorities has been canceled since February 2017. However, if a cash register is registered before February of this year, it can continue to be used either until July 2022 or until July 2022.

You can use CCP before July 1, 2017 if the organization works on the simplified tax system or pays agricultural tax. Until July 2, 2022, those organizations that pay a patent or UTII have the right to use CCP.

At the same time, if the electronic cash register tape ends before the specified period, then the old machines will no longer be used (

Costs for purchasing an online cash register

Based on the letter from the Ministry of Finance, a new cash register costs approximately 25,000 rubles. This amount includes expenses for: (click to expand)

- A new cash register that lasts for 36 months;

- Services of fiscal data operators;

- Telecom operator services.

Organizations do not have to buy a new cash register; they have the right to upgrade the old one. Such expenses will cost the company 4,000–6,000 rubles.

Costs for the next two years are about 4,000 rubles. This amount includes fiscal data and telecom operator services. The next drive will be needed only in three years, it will cost around 6,000 rubles, services for replacing it cost 3,000 rubles. In this case, organizations can replace them independently.

Those organizations that combine “imputation” with OSN cannot use the drive for 36 months. They have to change it every 13 months. The same service life of the drive is provided for farms with seasonal work, or if the cash register does not transmit data to the tax office.

Now, when using new cash registers, a maintenance contract is not mandatory. However, it is still possible for the cash register to break down. Organizations may enter into such maintenance contracts voluntarily. Such an agreement will be required if the organization needs to document expenses (

How much does an online cash register cost?

There are several types of online cash registers. The choice of an entrepreneur depends on the specifics of the activity, working conditions, and trafficability of the enterprise. Each type of cash register has its own price segmentation. Let's take a closer look at how much it will cost to purchase a cash register.

| Autonomous cash register The cheapest type of online cash register. Functionality is limited. Works autonomously, without the need to connect to a PC. It has a small screen and a mechanical keyboard. Price: 5,000 - 12,000 rub. Go to catalog |

| Smart terminal The most popular type of CCP. In appearance it resembles a tablet: it has a large touch screen that occupies most of the front panel. Equipped with a built-in receipt printer. Typically runs on Android and supports downloading various applications. Price: 9,000 - 25,000 rub. Go to catalog |

| Fiscal registrar Online cash register with built-in receipt printer. It does not work autonomously, but only when connected to a control device (often a PC). Price: 8,000 - 30,000 rub. Go to catalog |

| POS system The most expensive type of online cash register. It consists of several interconnected devices (PC, barcode scanner, fiscal recorder, etc.). Typically used by large companies. Price: 15,000 - 90,000 rub. Go to catalog |

Go to the online cash register catalog

Why pay more when you can save? The fact is that autonomous cash registers are becoming less and less suitable for modern business every year. Take, for example, the requirement to reflect items on receipts. If the product base consists of hundreds of items, constantly entering names using mechanical buttons, each of which is programmed with several letters, is not a pleasant or quick task. Autonomous cash registers are the best option for micro-businesses, enterprises that print up to 5 receipts a day and use a cash register only because it is required by law.

In general, the price of a cash register depends on many factors: type of cash register, manufacturer, equipment, and so on. For example, the presence of a built-in battery or acquiring increases the cost.

Patent and UTII

With such special regimes, expenses for an online cash register do not affect tax. But for entrepreneurs the right to deduction is provided. Such a deduction is equal to no more than 18,000 rubles. for the purchase of one cash register. If an entrepreneur needs two cash registers, then the tax can be reduced by an amount that is a multiple of this deduction, that is, for two cash registers - no more than 36,000 rubles, for three - no more than 54,000 rubles, etc. The deduction can be applied both in 2022 and later. But not before the moment when the entrepreneur registered the cash register.

Important! The tax deduction can be received no earlier than the entrepreneur registers the cash register.

If the deduction is greater than the amount of imputed income for the quarter, then the remainder can be taken into account in the next quarter. The same rule is established for the patent taxation system.

Let's assume that an entrepreneur has several patents. At the same time, cash costs exceed the payment for one patent. In this case, the entrepreneur can take into account the remaining costs when calculating payments for other patents.

You might also be interested in:

Online cash registers Atol Sigma - how to earn more

How to make a return to a buyer at an online checkout: step-by-step instructions

MTS cash desk: review of online cash register models

Scanners for product labeling

Shoe marking for retail 2022

Online cash register for dummies

Did you like the article? Share it on social networks.

Add a comment Cancel reply

Also read:

Inexpensive online cash register for individual entrepreneurs and LLCs

An inexpensive online cash register is the dream of every entrepreneur and for good reason.

With the introduction of amendments to Federal Law 54, even those who have not worked with them before are required to establish cash registers. And all those who previously used cash registers with EKLZ switched to online cash registers. Many entrepreneurs cannot afford expensive equipment, so manufacturers have developed budget solutions that you should know about... 669 Find out more

The cheapest online cash registers for LLCs and individual entrepreneurs

Cheap online cash registers, despite their low cost, are able to provide high-quality work in accordance with the requirements of Federal legislation.

After the approval of 54-FZ, a shortage arose in the cash register market, the main reasons for which were not only the inability of manufacturers to quickly provide customers with the required number of terminals with a fiscal drive, but also the unpreparedness of individual entrepreneurs and organizations for unexpected and sometimes unaffordable financial expenses. So how to choose... 754 Find out more

How to register in EGAIS - step-by-step instructions

On the territory of the Russian Federation, retail sales of alcoholic beverages require individual entrepreneurs and organizations to work with the EGAIS program.

How to register with EGAIS? A unified state automated information system controls the alcoholic beverages market from the moment of bottle production to final consumption. In this way, the state successfully combats counterfeit alcohol and prevents thousands of deaths from low-quality products. Retailers need registration with EGAIS in order to legally… 1036 Find out more

Accounting expenses in an online class

Let's consider accounting for the costs of acquiring a cash register, as well as related expenses.

Let’s assume that Continent LLC purchased an online cash register for 25,000 rubles. Setting up a service center cost the company 5,000 rubles. In this case, the initial cost must be taken into account in the amount of 30,000 rubles. Using a simplified method of accounting, Continent LLC immediately writes off the cash register at the moment it begins to be used.

The postings will be as follows: (click to expand)

D10 K 60 – cash received, amount 25,000 rubles;

D26(44) K60(76) – expenses for setting up the cash register are written off, the amount is 5,000 rubles;

D26(44) K10 – the cash register has been put into operation, the amount is 25,000 rubles.

Those organizations that use simplified accounting have the right not to include additional expenses in the initial cost of the cash register. They can only take into account the price of the online checkout.

The legislative framework

| Legislative act | Content |

| Letter of the Ministry of Finance No. 03-01-15/76891 dated December 21, 2016 | “On the acquisition and use of cash registers that ensure the transfer of fiscal documents to tax authorities through a fiscal data operator” |

| Law No. 54-FZ of May 25, 2003 | “On the use of cash register systems when making cash payments and (or) settlements using electronic means of payment” |

| Letter of the Ministry of Finance No. 03-11-06/2/73772 dated 12/09/2016 | “On accounting for tax purposes under the simplified tax system of expenses for the purchase of cash registers and for payment for the services of a fiscal data operator” |

| Article 346.5 of the Tax Code of the Russian Federation | “The procedure for determining and recognizing expenses and income” |

Is it possible to receive a deduction of 18 thousand rubles? other taxpayers using online cash registers?

Business entities using the OSNO or simplified tax system cannot apply a deduction of 18 thousand rubles. for the purchase of online cash registers. But they have the right to take into account the costs of purchasing a cash register and all related costs when determining the taxable base for income tax or the simplified tax system “income minus expenses” (subclause 35, clause 1, article 346.16 of the Tax Code of the Russian Federation).

It is important to take into account that the expenses of simplifiers reduce the amount of income only after their actual payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

If the taxpayer took into account the costs of purchasing a cash register as expenses during the period of application of OSNO or the simplified tax system of 15%, and subsequently switched to UTII or PSN, then he does not have the right to reduce the amount of tax by the amount of the deduction.

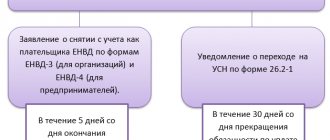

Another situation is possible when the deduction can be lost. For example, a taxpayer purchased a cash register using UTII in 2022, and from January 2022 switched to the simplified tax system. The deduction cannot be applied, because It is not yet possible to reduce the amount of UTII for the tax periods of 2022, and in 2018 a regime is applied in which no deduction is provided. It is also impossible to recognize costs using a simplified approach, because they were incurred even before the transition to the simplified tax system (letter of the Federal Tax Service dated February 21, 2018 No. SD-3-3/ [email protected] ).

And we talked about how to transfer deductions in a similar situation when switching from UTII to PSN in this material.