Are you switching from UTII? Connect Kontur.Accounting

45% discount in November: RUR 7,590 instead of 13,800 rub. per year of work

Easy bookkeeping

The system itself will calculate taxes and remind you of the deadlines for payments and submission of reports.

Automatic calculation of salaries, vacation pay and sick leave

Technical support 24/7, tips inside the service, reference and legal database

Sending reports via the Internet

Reports and KUDiR are generated automatically based on accounting data

Electronic document management and quick verification of counterparties

Documents, transactions, analytical reports, VAT reconciliation

Why buy online cash registers

Representatives of the Federal Tax Service need the introduction of online cash register systems. Cash desks themselves transmit data on transactions to the tax office. Due to this, tax authorities receive more information about taxpayers and can reduce the number of audits. It will also become easier for entrepreneurs, because now they will not be checked without reason or suspicion. Businessmen will also be able to more easily control sales volumes, carry out inventory and pay clients.

Old cash registers are already outdated, and online cash registers reduce the risk of fraud and errors on the part of the seller, transmit information via the Internet, send checks by email and help grow the business.

Advantages and disadvantages of installing and implementing online cash registers in these cases

It is worth remembering that the transition to a new system is not only stressful and incomprehensible situations. This also brings with it a number of positive aspects that many are not aware of. Let's talk about this in more detail.

Pros:

- there will be fewer checks from the Federal Tax Service, since CCP constantly transmits information to them;

- registration is much simpler - you don’t even have to visit the tax office, you can do everything via the Internet;

- there is no need to be serviced at a service center, there is an opportunity to refuse this and save;

- using a smart cash register, you can collect a variety of statistics, simplify interaction with certain types of documents, and automate some operations;

- Some models that can operate in the cloud allow you to work remotely in your personal account; you can also monitor sales, purchases and the average bill.

But there are also a couple of disadvantages. These are mainly the costs of purchasing new equipment and the need to replace the FN approximately once every 5 years. If you are looking for options that will help you save money, then contact Cleverence. Our software can cope with such tasks, and its price is at a reasonable level.

How to switch to an online checkout

A businessman can buy a new online cash register or upgrade his own device for printing receipts in a specialized service. The online cash register must meet the requirements of the Federal Tax Service, set out in letter No. ММВ-20-20/33, otherwise you may be fined. The cash desk must:

- ensure the transfer of information to the tax office online;

- have a fiscal accumulator for a period of at least 3 years for UTII;

- print fiscal documents in compliance with all details and send them to the buyer by mail or telephone;

- print a two-dimensional QR code with a minimum size of 20x20 on a cash receipt or BSO;

- be able to work autonomously, and when the connection is restored, transfer all checks to the Federal Tax Service.

The list of cash register models that meet the requirements established by law is given in the cash register register posted on the official website of the Federal Tax Service.

Be sure to register the cash register with the tax office: you cannot work on an unregistered cash register, it will not be considered in use. Do not forget to enter into an agreement with an accredited fiscal data operator and check that the information is transferred correctly.

The transition of small businesses to online cash registers is facilitated by delays. The gradual transition gives entrepreneurs time to prepare for the new operating procedure and costs for cash register systems. In addition, this will help avoid equipment shortages and price increases.

How to reduce CCP costs

Fiscal storage for 36 or 13 months

To reduce the cost of cash register equipment for entrepreneurs on UTII, the state allowed them to change fiscal drives every three years, and not once a year, as they do on OSNO. However, not everyone will be able to save. In some cases, a storage device for 13 months is needed even on a “imputed” basis:

- when combining UTII and OSNO;

- for companies in areas without communications, mentioned above;

- for seasonal or temporary work. The law does not specify what kind of work is considered seasonal, so the Federal Tax Service allows taxpayers to decide this themselves.

Special bank promotions

A number of large banks offer small and medium-sized businesses to reimburse the costs of purchasing cash register equipment when purchasing a package of their services. Those who are just planning to purchase a cash register and those who have already purchased it can take advantage of the offer.

Who doesn't switch to online checkout?

At the request of the legislator, almost all entrepreneurs in 2022 must switch to working with an online cash register. All individual entrepreneurs who are not required to switch to online cash registers use sales receipts and strict reporting forms that are issued to customers. Special conditions are exempt from using online cash registers:

- The individual entrepreneur operates in a remote area where there is no Internet. The Ministry of Communications is forming a list of hard-to-reach territories. If the place of business of the enterprise is included in the list, it is not necessary to use an online cash register. The exception is the sale of excisable goods.

- Organizations and individual entrepreneurs whose activities are included in the list of clauses 1.1, 2, 3, 5-7, 9 of Art. 2 Federal Law No. 54. Kiosks selling soft drinks, shoe repair shops, sales of periodicals, school and university canteens, and securities exchanges are exempt.

- Individual entrepreneurs selling tickets and theater subscriptions from hands or trays. You can't sell it over the Internet like that.

- Individual entrepreneurs on a patent, carrying out preferential activities (clause 2.1 of Article 2 of Law No. 54-FZ). For example, repair of keys, shoes, furniture, cleaning services, carrying things, photography, security, excursions, etc.

- Self-employed individual entrepreneurs. All they need to do is generate receipts in the “My Tax” application.

Application of online cash registers under the new law for individual entrepreneurs on UTII in retail

Some areas are now subject to a moratorium on penalties until July 2022, as some of them were not ready for such global changes. That is, violations will be recorded, but so far no one will apply sanctions. For example, this will affect conductors and bus drivers who issue tickets.

It is worth remembering that the adopted rules will not apply to all organizations. Let's figure out who may not be in a hurry to make the transition yet, and who will not need updates at all.

Who uses online cash registers from July 1, 2022

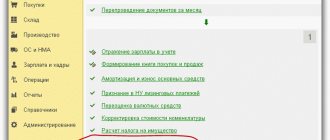

The cloud service Kontur.Accounting will help in conducting activities on UTII; it accepts reports from cash desks at the end of the shift. Keep records together with Kontur.Accounting. Get free access for 14 days

The first stage of deferment took place in 2022. The following companies started using online cash registers:

- organizations on UTII in the field of retail trade and catering;

- entrepreneurs on UTII and patent who trade in retail or provide catering services, but only if they have hired employees;

- Organizations and individual entrepreneurs with hired workers in catering;

- Organizations and individual entrepreneurs using vending machines, except for entrepreneurs without employees. Machines that only accept coins and are not powered are exempt from cash register machines.

New generation cash register systems when combining tax regimes

Entrepreneurs are required to begin using online cash registers when combining the simplified tax system and UTII from July 1, 2022. This is stated in Article 7 of Federal Law No. 290-FZ dated July 3, 2016, and this requirement applies only to those activities that a businessman conducts on a simplified tax basis. If the objects are different, then he must definitely start using CCP in 2022, for example, in a restaurant where the simplified tax system is used and alcoholic beverages are sold. If we are talking, for example, about a hairdressing salon, for which he pays a single tax, the owner can install a new generation cash register as early as 2018. This will not constitute a violation.

Individual entrepreneurs on UTII who received a deferment until July 1, 2019

The second stage of deferment lasted until July 1, 2022. Until this time, the following were exempted from the obligation to use CCP:

- Individual entrepreneurs with employees and organizations outside of retail trade and catering working on UTII;

- Individual entrepreneur on a patent without employees who are engaged in retail trade;

- Individual entrepreneurs on a patent, except for entrepreneurs without employees, providing personal services, including hairdressing salons, equipment repair, cargo transportation, veterinary services, rental services, etc.

- Individual entrepreneurs and LLCs on UTII that do not hire employees and work in the catering or retail sector;

- Individual entrepreneurs and LLCs that issue strict reporting forms;

- Individual entrepreneurs without employees who own vending machines.

If during this period hired employees appeared on the staff of an individual entrepreneur or LLC, then an obligation arose to install an online cash register system. They were given 30 calendar days for this.

Until the entrepreneur starts using the online cash register, he must present the buyer with checks, receipts and other documents confirming the fact of payment for the transaction. From July 1, 2022, it was necessary to start using the cash register for non-cash payments to individuals. From the date of payment, 1 working day is given for generating a cash document.

IP UTII services and online cash register

Individual entrepreneurs providing the following services are also required to install an online cash register before July 1, 2019:

| household; | transportation of goods; |

| veterinary; | transportation of passengers; |

| for repairs, technical car maintenance and washing; | other types of activities provided for in Article 346.29 of the Tax Code of the Russian Federation. |

| rental of parking spaces and protection of vehicles in paid parking lots; |

Tire fitters, auto electricians, tailoring or shoe repair specialists, nannies, caregivers, tutors, etc. can work without a cash register in 2022. Individual entrepreneurs working on their own without registering as auxiliary workers.

Who is exempt from online cash registers for UTII in 2020

At the end of the last deferment, in July 2022, almost all taxpayers were supposed to switch to online cash registers. The following categories of payments received exemption:

- Services for conducting religious ceremonies and rituals;

- Sale of religious items;

- Work in remote or inaccessible areas;

- Pharmacies and medical units in villages and villages;

- Non-cash payments between individual entrepreneurs and organizations;

- Repayment or issuance of a loan;

- Work in protected military facilities, military intelligence, security facilities and similar protected areas;

- Providing paid parking spaces;

- Paid library services;

- Credit organizations;

- Activities of the self-employed;

- Entrepreneurs on a patent, if they issue a BSO;

- Kiosks with soft drinks, shoe and clothing repair stations, sale of periodicals, school and university canteens, securities exchanges.

Also, all settlements with employees are exempt from the use of cash register systems: payment of wages and benefits under contracts, issuance of financial aid, and accountable funds.

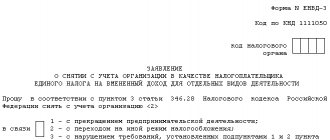

Fines for late transfer from UTII

There is no need to manually change the type of taxation: after canceling UTII, the entrepreneur will automatically be transferred to the mode selected as the main one: OSN or simplified tax system. If none of these options are suitable, you should use one of the special modes. There will be no fines, but an unprofitable system can bring big losses.

How to work in retail after the abolition of UTII

After the imputation is cancelled, the entrepreneur has two options: automatically remain on OSN/STS or choose another mode. You can select the type of taxation using the calculator on the Federal Tax Service website. Let's talk about the pros and cons of switching to current tax regimes: simplified tax system, NPD, PSN, unified agricultural tax.

How to switch from UTII to simplified taxation (USN)

The simplified taxation system is one of the most suitable for entrepreneurs who were on UTII. The list of restrictions for the simplified tax system is almost the same as for imputation, with a few exceptions: annual revenue up to 150 million, and the residual value of the enterprise up to 150 million. The regime has the following advantages:

- Large selection of activities. In simplified terms, in addition to retail and services, you can conduct: wholesale trade, production, educational and medical activities. The full list can be found at the link.

- You can select the object of taxation: “Income” or “Income minus expenses”. It is believed that the second option is worth choosing if the company’s expenses reach 65 percent of revenue.

- Compared to OSNO, the tax rate is quite low: 6 percent for “Income” and 15 percent for “Income minus expenses.”

- Up to 100 people on staff on average per year.

- Up to 150 million rubles of income per year.

LLCs in which other organizations have a share of more than 25 percent will not be able to operate on the simplified system.

How to switch from UTII to NAP

The professional income tax was designed for the self-employed, but even individual entrepreneurs can switch to it after the imputation is abolished. The regime can only be used by businessmen working in the service sector or selling goods of their own production. At the same time, there should be no staff, and annual income is limited to 2.4 million rubles.

NAP has the following advantages:

- Tax rate from 4 to 6 percent.

- Insurance premiums are paid voluntarily.

- There is a tax deduction and tax capital.

- There is no need to keep records or submit a tax return.

In order to switch to NAP, you need to register in the Tax Service application “My Tax” or on the Nalog.ru website. It is also necessary to renounce the simplified tax system or OSNO by submitting an application. Forms to fill out can be found on the Federal Tax Service website here.

How to switch from UTII to a patent (PSN)

The connection between the Patent system and UTII is obvious: both regimes do not take into account real income and are calculated based on potential annual revenue. Another similarity is that you cannot sell labeled goods on PSN.

The latest news suggests that the list of activities available under patent will be expanded, and the limit on retail space will be increased to 150 square meters. There are other restrictions on PSN:

- Staff of up to 15 people.

- Tighter restrictions on activities. The full list should be looked at in the law on the application of the PNS of the region in which the business is conducted.

- Income no more than 60 million per year.

- One patent in the territory of one municipality.

Application forms for the transition can be found on the Nalog.ru website.

How to switch from UTII to Unified Agricultural Tax

The single agricultural tax applies to producers of goods in the agricultural sector and to fishing enterprises. The Unified Agricultural Tax exempts individuals from income tax and property tax.

In addition, in accordance with the second paragraph of the first paragraph 145 of Article of the Tax Code, businessmen on the Unified Agricultural Tax may be exempt from paying VAT. You can read more on the Federal Tax Service website. The features of this mode are as follows:

- The organization's income from agricultural activities must be more than 70 percent.

- Object of taxation “Income minus expenses”.

- The tax rate is 6 percent. In some constituent entities of the Russian Federation, in accordance with regional legislation, it can be completely reduced to 0.

Forms and procedures for filling out applications can be found here.

How to combine special modes

One of the most striking features of UTII is the ability to combine this system with most others. After the abolition of imputation, only four special regimes will remain: simplified taxation system, NPD, unified agricultural tax and PSN.

The simplified tax system and the OSNO cannot be used simultaneously; the tax on professional income is also incompatible with the others. OSNO/USN and PSN are the most common combination. In this case, the simplified and basic system is the basis to which all enterprises are subject, and certain types of activities are transferred to special modes.

Online cash register for individual entrepreneurs deferred until July 1, 2022

Until July 1, 2022, entrepreneurs without employees who accept payment for work performed, services provided and goods sold of their own production can work without an online cash register (Clause 1, Article 2 of the Federal Law dated 06.06.2019 No. 129-FZ). The benefit is valid for any payment: cash, by card, by receipt, through a bank, via the Internet, etc.

Attention ! Resale of goods does not receive a deferment.

The right to exemption will be lost if the entrepreneur enters into an employment contract with at least one employee. In this case, the individual entrepreneur will have 30 days from the date of conclusion of the agreement to register the cash register.

How to choose among the variety of cash registers

Now let’s get down to the most interesting question – which model is better to take. We advise you to pay attention to several parameters:

- Autonomy. If the work of your individual entrepreneur involves traveling or delivery, then it is critical to choose the right device. He must provide the courier with a cash register with a battery for a certain period of time.

- Display size, presence and number of buttons. A simple one in appearance is suitable for a small assortment, while a screen with a large touch diagonal is larger for large stores, restaurants and other establishments.

- Print speed. An important factor if queues often form. The faster the document is printed, the less people will accumulate in the room. The presence of an auto-cut also has a positive effect on the quality of customer service.

- Width of receipt tape. If most of the titles in the assortment are long, then you should choose a printer that will fit more into one line.

- Internet connection. You can choose among those that work via a SIM card, cable or wi-fi. If the connection does not work well indoors, it is better to use a SIM card.

- Dimensions. Here it is worth considering the place where the device will be located after purchase. Some are quite bulky. For courier delivery, we recommend looking for a more compact option.

Among the popular models:

- Atol Sigma 7. Check 57 mm. The display is touchscreen, occupies 7 inches. Can be used for goods with markings and EGAIS.

- Evotor 7.2. Directories, cloud database, integration with various commodity accounting systems.

- Atol Sigma 10. Screen 10 inches. Prints at a speed of 100 mm/sec. There is an auto-cut. Supports all possible methods of connecting to the Internet.

We looked at how to choose an online cash register for UTII payers in retail trade, took into account the nuances and provided a list of those who currently have the right not to change anything in their work.

We remind you that there are no sanctions if you prepare in advance, and for being late, serious fines can be imposed, including restriction of activities for a period of 3 months. We advise you to start rebuilding at least 30 days in advance in order to have time to complete all operations and comply with the law now. Number of impressions: 1106

Fines for violating the rules of working with cash register systems for individual entrepreneurs

The cloud service Kontur.Accounting will help in conducting activities on UTII; it accepts reports from cash desks at the end of the shift. Keep records together with Kontur.Accounting. Get free access for 14 days

While the deferment is in effect, no fines will be imposed on entrepreneurs. There is still time to purchase, install and register a cash register. But those who already work with online cash registers receive serious fines for violations:

- Trading without an online cash register upon first detection is punishable by a fine of 10,000 rubles, and if after this the individual entrepreneur does not purchase a cash register, he will be disqualified for up to 90 days;

- Using an online cash register in violation of the rules for registration, reflecting details on receipts, or lack of a fiscal storage device - a fine of 3,000 rubles;

- For failure to issue a check at the request of the client - a warning or fines - 2,000 rubles;

- For failure to submit documents on cash transactions to the tax office - a warning or a fine of 1,500 to 3,000 rubles.

The cloud service Kontur.Accounting will help in conducting activities on UTII and other special modes; it accepts reports from cash desks at the end of the shift. Keep records together with your colleagues, calculate salaries, generate and send reports online.

Try for free

FAQ. Answers to popular questions

How to choose a fiscal data operator and connect to it?

Information about your fiscal data operator (FDO) will be needed when registering a cash register. Therefore, an agreement with him must be concluded in advance. The OFD must be accredited by the Federal Tax Service. The list of accredited OFDs is on the website of the Federal Tax Service of the Russian Federation. Approach the choice of OFD responsibly - study the offers and tariffs. Some operators, in addition to standard tariffs, offer daily and check rates - perhaps this will be more convenient for you. An important point is that when switching from one operator to another, you will need to re-register all cash register equipment. This can be done online on the tax website.

What features do online cash register receipts have?

The receipt must contain the name of the product or service, quantity and price, taking into account all discounts. To do this, you will need a commodity accounting system, for example, SBIS Retail. There is a relaxation for individual entrepreneurs - until February 1, 2022, it is not necessary to indicate the name on the check. But if you sell labeled products, you will have to print all new items. Here we told you what a check looks like, what details it contains and what the requirements are for it.

Can I move a cash register from one point of sale to another?

You can transport cash register equipment, but it will need to be re-registered at a new address. Otherwise, the organization will be fined 5,000–10,000 rubles, and the individual entrepreneur 1,500–3,000 rubles.