An employer can help employees by reimbursing their costs of paying interest on loans and credits for the purchase and construction of housing. It should be borne in mind that such compensation is precisely the right, and not the obligation of the employer.

First of all, it is worth understanding what legislators mean by housing. To do this, you need to refer to the Housing Code. Thus, an isolated premises in the form of real estate is considered residential. It must be suitable for permanent residence, that is, meet established sanitary and technical rules and regulations and other legal requirements. Residential premises, in particular, include a residential building or part thereof, an apartment (part thereof), and a room. Grounds – paragraph 2 of Article 15, Article 16 of the Housing Code.

Accounting for income tax expenses

The amount of reimbursement of employee costs for paying interest on loans for the purchase and construction of housing can be taken into account in the income tax base. They relate to labor costs in a certain amount (clause 24.1 of Article 255 of the Tax Code of the Russian Federation). Namely, their amount should not exceed 3 percent of the amount of labor costs.

One of the conditions for recognizing compensation amounts in labor costs is precisely the compensation of employee expenses, which presupposes an initial payment by the employee at his own expense (Clause 24.1 of Article 255 of the Tax Code of the Russian Federation). It is important that the employee first pays the housing interest out of his own pocket, and only then the organization compensates him for it. Similar explanations are given in the letter of the Ministry of Finance of Russia dated November 16, 2009 No. 03-03-06/2/225.

Another condition is that it is the employee of the organization who must bear the cost of paying interest on the loan. After all, clause 24.1 of Article 255 of the Tax Code provides for reimbursement of expenses directly to the employee. This should be paid attention to when housing, for the purchase of which a loan or credit was taken, is registered as a common shared or joint property of an employee and his spouse (letter of the Ministry of Finance of Russia dated March 2, 2010 No. 03-03-06/ 1/102 ).

Opinion of the Ministry of Finance

If the employer itself pays interest on the employee's loan directly to the bank, there is no reimbursement. This means that it will not be possible to attribute such costs to income tax expenses. This was emphasized by the Russian Ministry of Finance in a letter dated December 29, 2010 No. 03-04-06/6-322.

We should not forget that for the purpose of calculating income tax, expenses are recognized as justified and documented expenses (clause 1 of Article 252 of the Tax Code of the Russian Federation). According to the clarifications of the Ministry of Finance of Russia in letter dated November 16, 2009 No. 03-03-06/2/225, documents confirming the employee’s expenses for paying interest and the organization’s expenses for reimbursement of these costs include:

- a copy of the loan agreement;

- copies of receipts confirming the employee’s payment of interest under the loan agreement;

- expense and cash orders, payment orders confirming the fact of reimbursement of interest by the employer;

- an agreement between an employee and an employer to reimburse expenses for paying interest under a loan agreement;

- a copy of a document confirming the intended use of borrowed funds (purchase of residential premises);

- an employment or collective agreement containing a provision for reimbursing the employee for these expenses. It is also important to have an order from the employer to pay a specific employee a specific amount of interest compensation and a corresponding statement from the employee.

Tax deduction for mortgage interest

A citizen receives from the state not the deduction amount itself in monetary terms, but a refund of the 13% income tax he pays. First, taxes included in the price of the property are refunded, after which the refund goes to the interest paid under the mortgage loan agreement. Good afternoon, the next question is, I can get a deduction of 260,000 or 13% of 2 million (for 16 years from 3x) when buying an apartment with a mortgage, and when I pay off the mortgage and when buying the next apartment, can I take the deduction again, if for the first one they paid me 260,000? I don’t understand the point: I only have 260,000 or 2 million for the rest of my life, but can I receive 13% of the purchase?

Please note => Low-income large families benefits 2019 Nizhny Novgorod

Limit value calculation

As already noted, the cost of reimbursing employees for the payment of “housing” interest is recognized in a certain amount: their amount should not exceed 3 percent of the amount of labor costs.

Let us remind you that labor costs, according to paragraph 1 of Article 255 of the Tax Code, include:

- any accruals to employees in cash and in kind;

- incentives and bonuses;

- compensation accruals related to work hours or working conditions;

- bonuses and one-time incentive accruals;

- expenses associated with the maintenance of these employees, provided for by the norms of the legislation of the Russian Federation, labor contracts or collective agreements. The first thing you should pay attention to here is that when calculating the limit, they use the amount of labor costs for the organization as a whole, and not separately for each employee.

Secondly, the amount of labor costs is determined on an accrual basis from the beginning of the calendar year.

The fact is that for profit tax purposes, labor costs are recognized as an expense on a monthly basis based on the amount of expenses accrued in accordance with Article 255 of the Tax Code. Taxable profit is determined on an accrual basis from the beginning of the tax period. The tax period for corporate income tax is the calendar year (clause 4 of article 272, clause 7 of article 274, clause 1 of article 285 of the Tax Code of the Russian Federation). Similar explanations are given in letters of the Ministry of Finance of Russia dated June 11, 2009 No. 03-03-06/1/395 and dated November 17, 2008 No. 03-04-06-01/336.

Note that under the cash method, labor costs are recognized as an expense as the debt to pay wages to employees is repaid (subclause 1, clause 3, article 273 of the Tax Code of the Russian Federation).

Then, in calculating the maximum amount, the amount of wages paid should be used. Example 1

The collective agreement of Delta LLC contains a provision for the organization to reimburse employees for the payment of interest on loans and credits received by them for the purchase and construction of residential premises. The organization provides assistance in the form of such compensation to the following employees: lawyer O.G. Somov, manager E.N. Ershov and storekeeper R.P. Udochkin. For January–March 2012, the expenses of Delta LLC for compensation of these costs amounted to only 30,000 rubles, including in relation to: – O.G. Somov - 15,000 rubles; – E.N. Ershova - 8000 rubles; – R.P. Udochkin - 7000 rubles. During the same period, the amount of labor costs for the organization as a whole amounted to 750,000 rubles. This means that she has the right to reduce the income tax base in February by an amount that does not exceed 22,500 rubles. (RUB 750,000 X 3%). Consequently, Delta LLC has the right to include in labor costs only part of the costs of reimbursing employees’ expenses for paying “housing” interest: instead of 30,000 rubles. only 22,500 rub. The excess amount is RUB 7,500. (30,000 – 22,500) Delta LLC has no right to take into account labor costs.

The maximum amount of expenses for reimbursing employees’ expenses for paying “housing” interest during a calendar year may change. After all, the income tax base is determined by the cumulative total from the beginning of the tax period, and the amount of labor costs increases.

For what years are tax refunds made on mortgage interest?

Your right to receive a tax deduction arose from the moment you signed the apartment transfer and acceptance certificate, that is, from May 2022. At the same time, you have the right to reimburse interest for previous periods (2015 - 2022) in accordance with paragraph. 4 pp. 6 clause 3 art. 220 Tax Code of the Russian Federation. In order to make a refund, you must have completed declarations in Form 3-NDFL for the entire expired period (2015 – 2022). The tax deduction and declaration in form 3-NDFL must be submitted from the moment the acceptance certificate is signed. In May 2022, you can submit a declaration for the three previous years - that is, from 2015. To do this, you need to provide the following package of documents: a share participation agreement, a transfer and acceptance certificate, a 2-NDFL certificate on income for the entire period, a copy of the loan agreement and a certificate from the bank on the interest paid during this time.

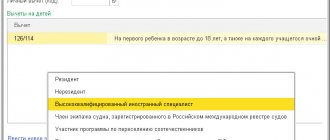

We calculate personal income tax

Reimbursement amounts for employee expenses related to payment of “housing” interest are not subject to personal income tax. But only in the amount in which these amounts are included in expenses that reduce the income tax base, that is, in an amount not exceeding the limit established in paragraph 24.1 of Article 255 of the Tax Code. Thus, the amount of compensation exceeding the mentioned limit is subject to personal income tax at a rate of 13 percent.

When applying the provisions of paragraph 40 of Article 217 of the Code, it should also be noted that this norm provides for the exemption from personal income tax for amounts reimbursed by an organization for expenses actually incurred by its employee. If the employee pays interest on the loan directly to the bank, this rule does not apply. After all, there is no reimbursement to the employee of the amounts of interest previously paid by him (letter of the Ministry of Finance of Russia dated December 29, 2010 No. 03-04-06/6-322).

Let's say an organization reimburses interest costs for several employees.

Then, if the maximum amount is exceeded, income subject to personal income tax must be distributed among the relevant employees. The procedure for such distribution of the organization should be fixed in the accounting policy. Example 2

Let's use the data from example 1. From the excess amount of 7,500 rubles. (30,000 – 22,500) Delta LLC must withhold personal income tax at a rate of 13 percent. For this purpose, the organization distributed the specified amount between lawyer O.G. Somov, manager E.N. Ershov and storekeeper R.P. Udochkin in proportion to the amounts of compensation they received. This is established in the accounting policy for tax purposes of Delta LLC. As a result, the taxable income of each employee for January–March 2012, in addition to the wages they received, amounted to: – for O.G. Somov – 3750 rub. (RUB 7,500 X RUB 15,000 : RUB 30,000 X 100%); – from E.N. Ershova - 2000 rubles. (RUB 7,500 X RUB 8,000 : RUB 30,000 X 100%); – from R.P. Udochkina – 1750 rub. (RUB 7,500 X RUB 7,000 : RUB 30,000 X 100%). The organization will withhold personal income tax from compensation paid to employees in the following amounts: – according to O.G. Somov – 488 rubles. (RUB 3,750 X 13%); – according to E.N. Ershov – 260 rubles. (RUB 2,000 X 13%); – according to R.P. Udochkin – 227 rubles. (RUB 1,750 X 13%).

How to return mortgage interest through the tax office: step-by-step instructions

- citizens who purchased or independently built housing on a plot of land using their own or borrowed funds;

- foreign citizens who stay on the territory of the Russian Federation for more than 183 days a year and pay personal income tax in the amount of 13%;

- Women on maternity leave can apply for a deduction immediately after leaving maternity leave if the property was purchased before maternity leave.

Many people who are already burdened with a mortgage are interested in the question of the time frame for filing an application for partial interest reimbursement. The conditions of the Tax Code of the Russian Federation are quite loyal and do not oblige the borrower to immediately collect all documents when applying for a mortgage.

24 Dec 2022 marketur 369

Share this post

- Related Posts

- Benefit for teachers in Khabarovsk region

- Sample interest-free loan agreement between legal entities

- Land benefits for veterans of military service in 2022 in the Rostov region

- How to determine which Pension Fund an organization belongs to

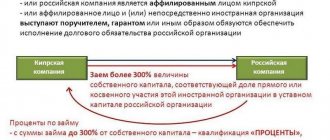

If the organization uses the simplified tax system

Employers using a simplified taxation system can also take into account compensation to employees for paying housing interest. This conclusion is contained in the letter of the Ministry of Finance of Russia dated April 11, 2011 No. 03-11-06/2/50.

The Ministry of Finance approves

The date employees paid interest on housing loans is not important for tax purposes. This remark was made by officials of the Russian Ministry of Finance in a letter dated April 6, 2009 No. 03-04-06-01/80.

The fact is that when determining the tax base, “simplified workers” can write off expenses for wages and temporary disability benefits in accordance with the legislation of the Russian Federation (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation). And labor costs for the purpose of determining the base for the “simplified” tax are written off in the manner established by Article 255 of the Tax Code.

Please note: only those employers who pay tax at a rate of 15 percent can write off such expenses. For those who preferred the “profitable” simplified tax system, such a maneuver is not allowed. This means that the personal income tax taxation procedure is in question.

In a letter dated October 7, 2010 No. 03-04-06/6-246, the Russian Ministry of Finance actually said that when applying the 6% simplified tax system, employee income will have to be taxed in the generally established manner. The preferential provisions of paragraph 40 of Article 217 of the Tax Code do not apply in this case. These amounts are subject to personal income tax in accordance with the established procedure.

Compensation by the state and employer for mortgage interest in 2019

Mortgage borrowers often have questions about whether it is possible to return mortgage interest and how to do this. Currently, there are three main ways to get back some of the money spent on a mortgage loan. However, each of them will differ both in return conditions and amounts. There are some nuances to getting back part of the money spent that you should know about in advance (especially if you work with a mortgage agency like YUGRA: details about the latter are in the article at the link).

- the birth of the first child gives a young family a subsidy to cover 18 square meters. meters of housing;

- the second child provides the same payment, but at the same time the young family gains access to maternal capital, which can also be used to repay the mortgage loan;

- upon the birth of the third child, the state fully repays the housing loan taken out.

Insurance premiums

Amounts paid to employees to reimburse housing interest are not subject to insurance contributions:

- to the Pension Fund for compulsory pension insurance;

- to the Social Insurance Fund for compulsory social insurance in case of temporary disability and in connection with maternity, as well as for compulsory social insurance against industrial accidents and occupational diseases;

- to the Federal Compulsory Medical Insurance Fund for compulsory medical insurance.

The legislation does not establish any restrictions on the amount withdrawn from the taxation of contributions.

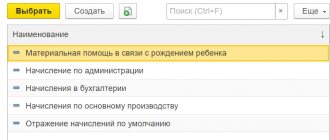

Accounting

In accounting, employers' expenses to help employees repay housing loans are recognized in full. They are reflected as expenses for ordinary activities (clause 7 of PBU 10/99 “Expenses of the organization”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

The amount of compensation is recorded in the debit of cost accounting accounts (20, 25, 26, 29 or 44) and the credit of account 73 “Settlements with personnel for other operations” subaccount “Calculations for reimbursement of interest costs” in the reporting period in which it was accrued (Clause 18 PBU 10/99).

V.A. Lyalin, tax consultant

Accounting

The reflection of compensation to an employee for interest costs on a loan (credit) for the purchase (construction) of housing depends on the procedure for paying such compensation. If compensation was paid to an employee, take it into account on account 73 “Settlements with personnel for other operations”:

Debit 20 (23, 25…) Credit 73

– compensation for interest costs on a loan (credit) for the purchase (construction) of housing has been accrued;

Debit 73 Credit 50 (51)

– compensation has been paid (transferred to a bank account).

If the organization reimbursed the costs of interest on a loan (credit) for the purchase (construction) of housing directly to the lender (creditor), take them into account on account 76 “Settlements with various debtors and creditors”:

Debit 20 (23, 25…) Credit 76

– compensation for interest costs on a loan (credit) for the purchase (construction) of housing has been accrued;

Debit 76 Credit 50 (51)

– compensation has been paid (transferred to a bank account).

This conclusion follows from the Instructions for the chart of accounts (accounts 73, 76).

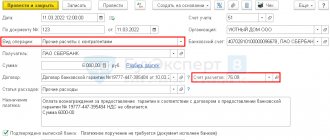

An example of reflecting in accounting compensation to an employee interest costs on a loan for the purchase of housing received from a bank

On February 1, the head of Alfa CJSC, in response to a statement by manager A.S. Kondratyev issued an order to pay the employee compensation for interest expenses on a loan received for the purchase of housing for January. A loan was received from a bank in the amount of RUB 4,000,000. In January, interest on the loan amounted to 28,055 rubles.

Alpha's accountant made the following entries in the accounting records:

Debit 26 Credit 73 – 28,055 rub. – compensation for interest costs on a loan for the purchase of housing has been accrued;

Debit 73 Credit 51 – 28,055 rub. – the amount of compensation is transferred to the employee’s bank account.