Before starting a business related to delivery trade, you, as an entrepreneur, need to study the features of running this business and the taxation scheme.

ATTENTION! Starting with reporting for the fourth quarter of 2022, a new tax return form for the single tax on imputed income will be used, approved by Order of the Federal Tax Service of Russia dated June 26, 2018 N ММВ-7-3/ [email protected] You can generate a UTII declaration without errors through this service , which has a free trial period.

What kind of trade is delivery?

In the Tax Code of the Russian Federation (part two) dated 05.08.2000 No. 117-FZ (as amended on 28.12.2016) Ch. 26.5. Art. 346.43. A fairly clear definition is given:

11) distribution trade - retail trade carried out outside a stationary retail network using specialized or specially equipped vehicles for trade, as well as mobile equipment used only with the vehicle. This type of trade includes trade using a car, a car shop, a car shop, a toner, a trailer, a mobile vending machine;

Thus, it becomes clear to us that delivery trade is mobile trade, not tied to a specific location. In other words, if you want, you can make a decision at any time and change your location, but at the same time you have the right to trade from a vehicle for a long time, remaining in the same place. But, suppose you are the owner of a mobile shop, devoid of signs of mobility (no wheels, towbar, etc.) - it rather resembles a kiosk, then trade from such a counter cannot be considered delivery trade.

In general, the Tax Code quite clearly defines the types of vehicles:

- automobile,

- auto shop,

- auto shop,

- tonar,

- caravan,

- mobile vending machine.

The legislator has a number of requirements for vehicles planned to be used for distribution trade:

- Your vehicle must meet the requirements of environmental class no lower than 4 (Euro 4);

- the vehicle must undergo technical inspection;

- the vehicle must be kept in proper sanitary and technical condition;

- according to modern requirements, you will have to equip the vehicle with a mobile geolocation system with the ability to track the vehicle via the Internet;

- the vehicle must be specially equipped for trading. What does this mean? Perhaps we are talking about a vehicle that was originally created for distribution trade, and, perhaps, converted for these purposes through a major overhaul. But in any case, the signs of trade should be obvious. You need to take care of the presence of a display case or counter, refrigeration, cash register and other technological equipment provided for by the requirements of regulations for the sale of products. Do not forget about the equipment of the seller’s workplace - it is necessary to install an umbrella or canopy, a chair, a table to be able to work with the client.

During operation, connection to utility networks may be required. You have the absolute opportunity to connect to energy and water supply networks on a temporary basis - this does not deprive your activity of the status of distribution trade.

After equipping the vehicle, it is very important to decide on the range of products sold. Here the All-Russian Product Classifier comes to our aid, according to which, and in accordance with the specialization of the vehicle, you can determine the list of goods:

| No. | Specialization |

| 1 | Fast food |

| 2 | Milk products |

| 3 | Meat products |

| 4 | Vegetables fruits |

| 5 | Fish, seafood |

| 6 | Bread, bakery products, confectionery |

| 7 | Products |

| 8 | Non-food products |

| 9 | Printed products |

| 10 | Flowers |

It is necessary to pay attention to the fact that you can work with the “Products” and “Non-Food Products” specializations only in cities with a population of less than 300 thousand people and in rural areas.

What can you trade?

OKVED code 52.63 allows you to trade any type of product. At the moment, some of the popular goods actively sold in this way are food, electrical equipment, fasteners, tools and even washing and detergents. But in addition to these goods, products such as baked goods, clothing and shoes can also be sold outside the store. The mobility of this type of business makes it possible to sell such types of goods as household goods, tools, elements used in lighting, and wiring.

By delivering certain types of goods to remote local populations, every businessman has the opportunity to make double profits. Unlike ordinary stores, this type of sales of goods is constantly subject to movement, which means that during the sale of their products, each time a businessman can simultaneously purchase agricultural products or various raw materials at a price that interests them.

Other products purchased in this way may be in demand in another locality, where mobile trade will subsequently move. Code 52.63, used for the sale of goods outside stores, also applies in the case of sales of goods through a machine.

>Taxation of traveling trade 2019

What kind of trade cannot be considered delivery trade?

Now let’s look at the mistakes that will help you avoid problems with the law when determining the type of trade as delivery:

- trade cannot be considered delivery if you deliver the goods in accordance with a previously completed application or purchase and sale agreement;

- if your vehicle is not properly equipped, then trade from this vehicle also cannot be considered a delivery trade;

- if you trade from a tray, table, box, drawer, etc., i.e. Your trade equipment does not have the characteristics of a vehicle, then such trade cannot be considered delivery trade either.

Business ideas from scratch

Important

By the way, this same administration every year develops a plan for the placement of non-stationary retail outlets, that is, places where you can trade without problems. And in general, to be honest, I advise you to maintain good relations with the administration, because some commission that a competitor has set on you will come to you and will begin to “sniff out” violations of trade rules, sanitary standards, and standing rules (in what position is it possible or not stand), and you once called the administration, asked what the problem was, and the commission disappeared (this happens in 90% of cases).

But don't think it's free. In return, the administration will ask you to go to trade in places where the population is less than 100 people and/or there is no store.

Is it possible to apply UTII for distribution trade?

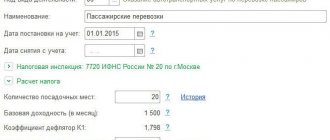

According to the Tax Code of the Russian Federation, entrepreneurs engaged in delivery trade have the right to apply a single tax on imputed income (UTII). To do this, you must submit an application to the tax office at the location of the organization or at the place of residence of the individual entrepreneur within five days from the date of commencement of business. Within five days from the date of receipt of the application, the tax office issues a notice of registration as a single tax payer on imputed income.

Calculation of UTII for distribution trade

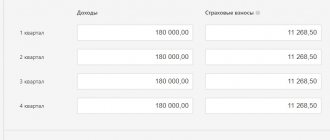

When calculating UTII, a physical indicator is used - the number of employees, including the entrepreneur, which is 4,500 rubles for each employee. In addition to the physical indicator, the following coefficients are used:

- K1 – deflator coefficient

- K2 – correction factor

K1 for the next calendar year is established by the Ministry of Economic Development of the Russian Federation.

K2 is determined by municipalities for an indefinite period.

If local authorities do not apply a reduced tax rate, then the amount of UTII must be calculated at a rate of 15% .

So, to calculate UTII, first of all, we determine the tax base for the reporting quarter:

| Tax base for UTII for the quarter | = | Basic profitability per month (4500.00) | * | (Average number of employees for 1 month of the quarter | + | Average number of employees for the 2nd month of the quarter | + | Average number of employees for the 3rd month of the quarter) | * | K1 | * | K2 |

Having determined the tax base for UTII for the quarter, you can calculate the amount of UTII using the formula:

UTII = Tax base for UTII for the quarter * 15%

Example:

IP Ivanov I.I. trades seedlings from its own vehicle in Yekaterinburg. In the region, the UTII rate is 15%.

Let's determine the tax base for the quarter:

4500 rub/person*(1+1+1)*1.798*0.64 = 15534.72

Let's calculate the amount of UTII:

15534,72 * 15% = 2330,21

UTII for the 1st quarter is equal to 2330.21 rubles.

If during the specified period there were payments of hospital benefits and insurance premiums, then the amount of UTII can be reduced.

Taxation due to the traveling nature of work (Savinova M

The purpose of the bill “On the legal regulation of the activities of social networks and on amendments to certain legislative acts of the Russian Federation” is the legislative regulation of the activities of social networks. The bill proposes to prohibit the use of social networks by persons under 14 years of age. In addition, it is proposed to legislate the procedure for registering a social network user.

The use of cash registers (PRO) in 2022: what is changing since then?

- Who should apply PPO in 2022 Read more>>

- Sellers of equipment and electronics will have to use PPO and issue fiscal receipts>> More details>>

1. The requirements to use PPO for group 2 units and self-service terminals (PTKS) have come into force.

2. The transition period for the transfer of EKKA (cash registers) to digital data transmission has ended. The main criterion for using PPO is not the type of enterprise, but the fact of accepting payment in cash (or by payment card through a POS terminal, tokens, coupons, etc.)

Common mistakes in maintaining UTII

Let's look at the most common mistakes in maintaining UTII.

| Common mistakes | Explanation |

| The start date of business activity is incorrectly determined | An application to the tax office must be submitted within 5 days from the date of commencement of activities falling under UTII. There is no need to submit an application in advance - you will be forced to pay tax for the period in which there was actually no activity. The date of commencement of business can be considered the date of the first economic fact. |

| The individual entrepreneur does not count himself as an employee | When calculating the tax base for UTII, the physical indicator is the number of employees. But often, when making calculations, an individual entrepreneur does not take himself into account as an employee, because in fact, he is not an employee, which is a mistake. The consequence of this error is an incorrect calculation of the tax base, and, consequently, the tax will be underestimated, which will certainly lead to the accrual of fines and penalties. |

| Incorrect calculation to reduce the amount of UTII | Individual entrepreneurs working independently have the right to reduce UTII by fixed contributions paid for themselves. But if an individual entrepreneur hires workers, then this right is lost, but the tax amount can be reduced due to insurance payments for employees. Please note that the tax amount cannot be reduced by more than half. |

| Lack of activity when applying UTII | UTII is a tax that does not depend on the income received, so even if there is no actual activity of the company or entrepreneur, the tax will still have to be paid. This explains the lack of point in switching to UTII in advance. If an activity falling under UTII is suspended for any reason, it is better to deregister with the tax office. In this case, the tax will be charged on the number of days of the quarter when the activity was carried out. |

Using online cash registers

Online cash registers will soon occupy a significant place in the trade sector. The new cash register equipment will differ in that it will send online tax information about completed sales in real time. The online cash register does not require ECLZ or fiscal memory, but a fiscal storage device is required. A fiscal drive is a removable unit used to store, protect and transmit information to the Federal Tax Service. As the drive fills up, it must be replaced, as well as the online cash register. Each copy is registered electronically with the tax authority.

When will the special regime be cancelled?

From July 1, 2022, all entrepreneurs engaged in delivery trade and falling under UTII will be required to start using online cash registers.

| Term | Explanation |

| Until July 01, 2022 | Voluntary use of the online cash register |

| From July 01, 2022 | Mandatory use of online cash register |

In order to start using the online cash register you need to:

- purchase cash register equipment;

- connect the cash register to the Internet;

- select a fiscal data operator and conclude an agreement (indicate the operator’s IP at the checkout);

- register an online cash register with the tax office and receive an online registration card;

- start using it!

For non-compliance with the law and the lack of an online cash register, significant fines are provided (for legal entities at least 30,000 rubles, for individuals at least 10,000 rubles).

Cost issues

The specificity of outbound trade and accounting of operations is such that the cost of goods is written off simultaneously with the accrual of revenue. The write-off procedure is determined by the method of accounting for goods by an individual entrepreneur or a company. Current legislation allows products for retail sale to be accounted for at purchase and sale prices.

Keeping records of the sales price involves the use of 42 accounts. It reflects the trade margin. The latter is installed when purchasing the product. When accounting using account 42, the following entries are made:

- write-off of the cost of products sold at sales prices;

- reflection of the reversal of the trade margin.

When working using this method, the accountant will have to determine the amount and the average percentage of the markup.

There are several methods for writing off goods, for example, by unit cost, by average cost. It is not necessary to use one method for all products. Each product group may provide its own optimal evaluation method. This decision needs to be fixed in the accounting policy.