About legal entities

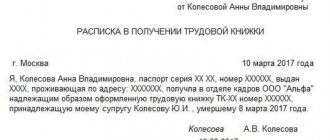

When is an insert in the work book completed? The new form of the insert in the work book has been approved

Every day, the organization itself issues and accepts dozens, or even hundreds of primary accounting documents.

Job description of a customer service manager: general provisions 1. Manager providing customer service,

The deputy chief accountant is accepted for this position upon the recommendation of the chief accountant, to whom he subsequently

Payment of taxes, contributions ESSENCE OF THE CHANGES EXPLANATION RULE OF THE RF Tax Code/ACT OF TAX LEGISLATION A unified tax

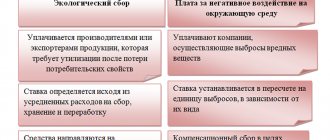

Environmental tax: who should pay, when and how much? The Ministry of Finance published draft amendments to the Tax Code of the Russian Federation,

Typical mistakes If we talk about typical mistakes when abbreviating, these include:

Regulatory framework Order of the Federal Tax Service of the Russian Federation dated September 23, 2019 N ММВ-7-3/ [email protected] “On approval of the tax return form

From the beginning of 2022 for all persons working under employment contracts to the Pension Fund

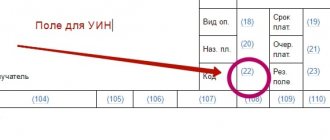

In what cases should the UIN be indicated? The UIN in 2022 must be indicated only in payment documents.